- Home

- »

- Next Generation Technologies

- »

-

5G Internet of Things Market Size And Share Report, 2030GVR Report cover

![5G Internet of Things (IoT) Market Size, Share & Trends Report]()

5G Internet of Things (IoT) Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By IoT Connectivity, By Network Architecture, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-063-6

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2020 - 2021

- Industry: Technology

5G Internet of Things Market Size & Trends

The global 5G internet of things (IoT) market size was valued at USD 3.53 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 50.2% from 2023 to 2030. The growth can be attributed to enhanced reliability, lower latency, increased capacity, and network speeds of 5G IoT. Additionally, it can automate business processes and provide end-to-end connectivity. 5G IoT-connected devices can be monitored in a single place, which increases their efficiency, thereby increasing productivity for the business while reducing costs. These benefits offered by 5G IoT are expected to contribute to the market’s growth over the forecast period. Numerous 5G IoT solution providers are focusing on developing products that are designed to assist enterprises in delivering 5G IoT services.

For instance, in July 2021, Nokia Corporation, a telecommunications technology company, launched its iSIM Secure Connect, a solution designed to assist CSPs and enterprises in delivering new IoT 5G and mobile services. The solution also enables more effective and secure management of consumer devices and machine-to-machine (M2M) subscriptions for devices supporting eSIM and iSIM technologies. Such product launches are expected to create lucrative growth opportunities for the market over the coming years.

The rising demand for connected devices and the use of 5G IoT in Industry 4.0 are the significant factors driving the market growth. 5G enables the most advanced network, designed to link nearly anything and everyone, including objects, machines, and gadgets. These devices are utilized in fleet management, smart buildings, logistics, capabilities networks, smart agriculture, tracking, remote healthcare, traffic safety & control, smart grid automation, and various other applications. Machine-to-machine connection is required for simple control and monitoring of these applications. The extensive applications enabled by 5G-linked devices are expected to accelerate the adoption of Machine-to-Machine (M2M) communications.

Growing investment in 5G IoT its application and use cases is also a significant factor contributing to the growth of the market. Worldwide IoT investments are expanding and are likely to continue throughout the forecast period. The possibility of IoT significantly boosting productivity as well as modifying and improving present business models is driving investments in the technology. Furthermore, IoT provides several benefits, such as big data for crucial data overview and management, IoT devices for cost optimization, smart device security, and improved machine/device efficiency. Because of these advantages, businesses, and investors worldwide are spending extensively in IoT, which bodes well for the growth.

The use of private 5G networks in 5G IoT is also expected to create growth opportunities for the market owing to the need for dedicated network areas for organizations. 5G IoT links smart devices and allows them to communicate with one another. Nevertheless, it needs reliable communication with higher bandwidth. Presently, 5G IoT and even 5G are in their early phases, with just a few individuals adopting 5G IoT. Yet, as 5G IoT use grows, the 5G public network spectrum is anticipated to become congested. Hence, Private 5G is planned to provide advanced network connections for companies and corporations in dedicated network zones. As a result, a private 5G network is likely to generate considerable growth prospects for 5G IoT adoption across sectors.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the 5G IoT market. The lockdowns caused a shortage of labor and materials worldwide, leading to a delay in deploying 5G networks. However, as the pandemic-induced demand for digitization organizations have been compelled to adopt 5G networks to provide better connectivity between their systems. Companies realized the potential of 5G and its transformative impact on their businesses, particularly when moving towards automation and a real-time feedback environment. Thus, the pandemic has accelerated the digitization of industries, leading to higher adoption.

Component Insights

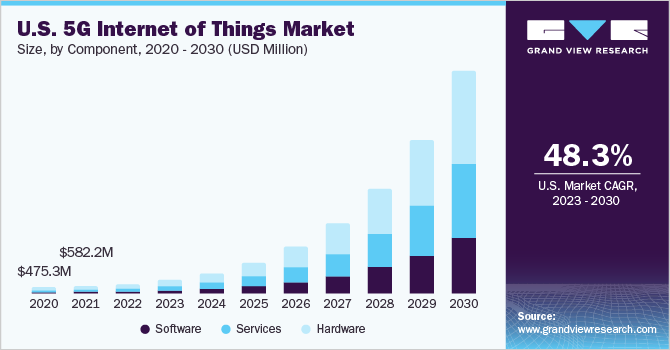

The hardware segment dominated the market in 2022 and accounted for more than 45.0% share of the global revenue. The segment growth can be attributed to significant innovation and investment in the coming years as companies seek to capitalize on the potential of this new technology. As 5G networks become more widely available, the cost of 5G IoT hardware will likely fall. This would make it cheaper for manufacturers to incorporate 5G IoT hardware into their business processes and utilize smart cities, industrial automation, and autonomous cars, among others. The combination of 5G technology with IoT has the potential to alter businesses and generate demand for 5G IoT hardware over the forecast period.

The services segment is projected to witness remarkable growth over the forecast period. The segment is expected to grow over the forecast period in line with the continued adoption of IoT devices in manufacturing, transportation, and automotive, among other industries and industry verticals. The support & maintenance segment is anticipated to witness the fastest growth over the forecast period.Businesses are increasingly depending on 5G IoT services to suit their demands as the number of IoT devices linked to the internet rises and the demand for a high-speed connection and real-time data processing rises.

IoT Connectivity Insights

The massive IoT segment dominated the market in 2022 and accounted for more than 43.0% share of the global revenue. The growing number of massive IoT connections is expected to drive the growth of the segment. Massive IoT connects massive amounts of devices that require minimal connectivity and computing resources and are low-power, low-cost devices. Smart agriculture, asset tracking, supply chain management, smart energy, industrial monitoring, smart homes, and wearables are just a few industries where the combination of 5G with large IoT has applications. The advantages of Massive IoT propel its acceptance in the 5G IoT industry.

Industrial automation IoT is anticipated to emerge as the fastest-growing segment over the forecast period. Industrial automation IoT adds cellular connection into the wired industrial infrastructure needed for real-time sophisticated automation. This technology enables greater communication between industrial equipment and systems by merging 5G technologies with Ethernet-based industrial protocols and Time-Sensitive Networking. Industrial automation IoT is projected to alter the way organizations function by enabling seamless integration of cellular connection into the industrial infrastructure, resulting in increased cost savings, improved performance, and enhanced capabilities, consequently boosting the segment's growth.

Network Architecture Insights

The 5G non-standalone segment dominated the market in 2022 and accounted for more than 67.0% share of the global revenue. The growth can be attributed to the early deployment of 5G non-standalone networks throughout the world to provide 5G services to businesses and consumers. The 5G non-standalone network uses the existing 4G infrastructure to provide 5G connectivity.

During the first implementation of 5G networks, the non-standalone 5G network design will be critical in allowing users to experience faster data transfer speeds while still utilizing the current 4G/LTE infrastructure. Since they are built on existing infrastructure, they offer the most affordable and time-efficient way of upgrading to 5G, which is contributing to their dominant share in the market.

The 5G standalone segment is projected to grow at the highest CAGR over the forecast period. The ability of 5G standalone to maintain continuous machine-to-machine communication, which requires ultra-reliable, high-frequency, and low-latency connectivity is a major factor driving the segment growth.

5G standalone is a sort of 5G network architecture that is solely based on 5G infrastructure and is designed to deliver a more efficient and effective network for IoT devices. Globally, growing industrial digitization is creating new opportunities for service providers. The combination of these trends is expected to drive the growth of the segment in the 5G IoT market over the coming years.

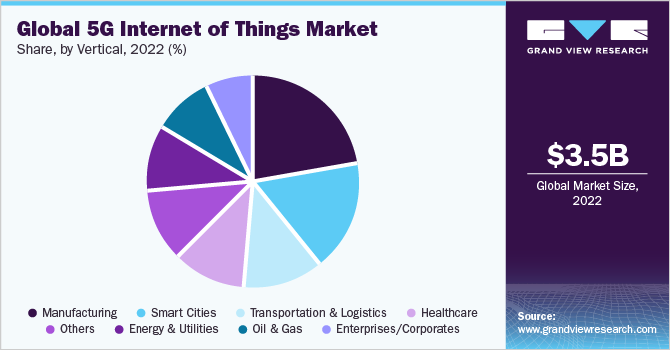

Vertical Insights

The manufacturing segment dominated the market in 2022 and accounted for more than 22.0% share of the global revenue. 5G IoT has the potential to revolutionize the manufacturing industry and fuel the growth of Industry 4.0 transformation. Its various applications in the manufacturing industry, including automation, autonomous vehicles, machine-to-machine connectivity, machine health monitoring, asset tracking, supply chain management, and predictive maintenance, are contributing to the segment’s growth.

Adoption of 5G IoT would be critical in assisting manufacturing entities in accelerating this transformation by providing enhanced visibility across the entire ecosystem and laying the groundwork for the implementation of cutting-edge technologies such as AI and ML, resulting in the creation of novel use cases and improved commercial outcomes.

The smart cities segment is expected to grow significantly over the forecast period. The rising deployment of connected sensors and devices, such as smart streetlights, traffic sensors, and waste management systems in smart cities are the major factors driving the growth opportunities for the segment. These devices collect and transmit data in real-time, allowing city managers to optimize operations and improve citizen services.

Additionally, with the rise of urbanization and population growth, cities worldwide are facing numerous challenges related to traffic management, energy consumption, and environmental sustainability. To address these challenges, smart cities are increasingly turning to 5G IoT technologies to enable real-time monitoring, analysis, and optimization of city services and infrastructure.

Regional Insights

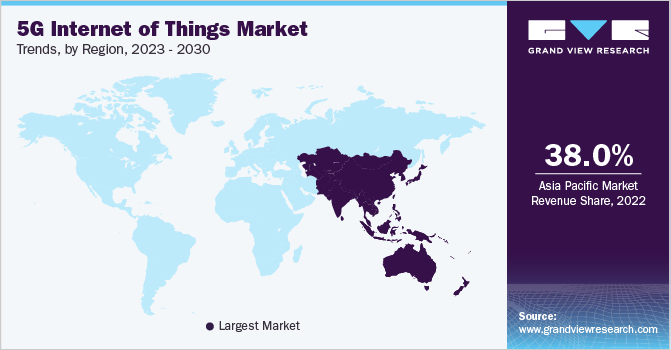

The Asia Pacific region dominated the market in 2022 and accounted for more than 38.0% share of the global revenue. The growth can be attributed to the increasing 5G IoT initiatives, such as smart cities, in nations like China and India. At the same time, favorable government measures for automation and technologically advanced start-ups in the country are propelling the regional market's growth.

Additionally, APAC is characterized by countries with large populations, emerging economies, and evolving businesses and startups, which offers a significant growth opportunity for 5G IoT network providers owing to the presence of a sizeable untapped consumer base in the region.

North America is expected to witness significant growth over the forecast period. Increasing 5G infrastructure investments are a key component fueling the region's expansion. Significant investments are made in 5G infrastructure, including the installation of fiber-optic cables, and other network elements. Moreover, the regional governments are encouraging the use of 5G technology through various programs and laws designed to enhance the network infrastructure. These elements are encouraging for the region's progress throughout the study period.

Key Companies & Market Share Insights

The 5G IoT industry can be described as fragmented, characterized by the presence of many prominent players, which are driving the competition in the market by adopting several strategies focused on the long-term sustainability of the market position, thereby making it challenging for new players to enter the market. These strategies include geographical expansions, product innovations, and a strong focus on.

Several companies are creating partnerships and collaborations with other industry participants. This allows them to use each other's capabilities and resources, allowing them to provide more complete and integrated solutions to clients. Businesses are also growing their presence in new geographic locations and launching new products to develop IoT applications for healthcare, retail, and other 5G-connected industries.

For instance, in March 2023, Qualcomm Technologies, Inc., a semiconductor company, launched QCM6490 and QCS6490, two integrated 5G IoT processors that support Ubuntu, Linux, Microsoft Windows, Android, and IoT Enterprise operating systems. As per the company, it assists customers in developing and deploying IoT applications for use in healthcare, retail, and other 5G-connected industries. Qualcomm's SoC processors include geolocation capabilities, allowing them to detect a device's exact location and notify the central server when it travels outside of a designated region. Some prominent players in the global 5G internet of things (IoT) market include:

-

Nokia Corporation

-

TELEFONAKTIEBOLAGET LM ERICSSON

-

ZTE Corporation

-

AT&T INC.

-

Huawei Technologies Co., Ltd.

-

Verizon Communications Inc.

-

Thales Group

-

Vodafone Group Plc.

-

China Mobile Limited

-

Microsoft Corporation

5G Internet of Things (IoT) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.18 billion

Revenue forecast in 2030

USD 89.42 billion

Growth rate

CAGR of 50.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2020 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, IoT connectivity, network architecture, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Nokia Corporation; TELEFONAKTIEBOLAGET LM ERICSSON; ZTE Corporation; AT&T INC.; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Thales Group; Vodafone Group Plc.; China Mobile Limited; Microsoft Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Internet of Things (IoT) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global 5G internet of things (IoT) market report based on component, IoT connectivity, network architecture, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2020 - 2030)

-

Hardware

-

Software

-

Services

-

Integration & Installation

-

Network Connectivity Services

-

Training & Consulting

-

Support & Maintenance

-

-

-

IoT Connectivity Outlook (Revenue, USD Billion, 2020 - 2030)

-

Sub-Massive IoT

-

Broadband IoT

-

Critical IoT

-

Industrial Automation IoT

-

-

Network Architecture Outlook (Revenue, USD Billion, 2020 - 2030)

-

5G Non-standalone

-

5G Standalone

-

-

Vertical Outlook (Revenue, USD Billion, 2020 - 2030)

-

Manufacturing

-

Smart Cities

-

Energy & Utilities

-

Transportation & Logistics

-

Enterprises/Corporates

-

Healthcare

-

Oil & Gas

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G internet of things (IoT) market size was estimated at USD 3.53 billion in 2022 and is expected to reach USD 5.18 billion in 2023.

b. The global 5G internet of things market is expected to grow at a compound annual growth rate of 50.2% from 2023 to 2030 to reach USD 89.42 billion by 2030.

b. Asia Pacific dominated the 5G IoT market with a share of 38.7% in 2022.This is attributed to the increasing number of 5G IoT initiatives, such as smart cities, in nations like as China and India. At the same time, favorable government measures for automation and technologically advanced start-ups in the country are propelling the regional market's growth.

b. Some key players operating in the 5G internet of things (IoT) market include Nokia Corporation, TELEFONAKTIEBOLAGET LM ERICSSON, ZTE Corporation, AT&T INC., Huawei Technologies Co., Ltd., Verizon Communications Inc., Thales Group, Vodafone Group Plc., China Mobile Limited, and Microsoft Corporation.

b. The rising demand for connected devices and the use of 5G IoT in industry 4.0 is a significant factor driving the market growth. 5G enables the most advanced network, designed to link nearly anything and everyone, including objects, machines, and gadgets.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."