- Home

- »

- Healthcare IT

- »

-

Global Accountable Care Solutions Market Size Report, 2030GVR Report cover

![Accountable Care Solutions Market Size, Share & Trends Report]()

Accountable Care Solutions Market Size, Share & Trends Analysis Report By Component (Software, Services), By End-user (Healthcare Providers, Healthcare Payers), By Solution (PHM, RCM), By Delivery Mode, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-982-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2020

- Industry: Healthcare

Report Overview

The global accountable care solutions market size was valued at USD 18.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.5% from 2022 to 2030. These solutions aid in reducing hospital stays, eliminating duplication of services, and preventing medical errors. Furthermore, they play a significant role in the transition of the healthcare industry from a patient-centered healthcare model to a data-driven model, thereby driving the industry. The Accountable Care Organizations (ACOs) consist of a group of doctors that work together to improve patient experience and the quality of care that a patient receives.

The doctors understand the health history of patients and communicate about the patient’s needs while saving time and costs associated with treatment by eliminating unnecessary appointments and tests. Increasing adoption of these solutions by several healthcare institutions, self-insuring employers and insurance companies, etc. is anticipated to increase awareness levels among patients. The rising adoption of accountable care solutions to offer high-quality services is anticipated to be a key driver for the industry. For instance, according to industry reports, as of January 2022, the number of physicians and non-physicians participating in the MSSP in the U.S. were 528,966.

This number is expected to witness a considerable increase with the higher adoption of accountable care organizations. Furthermore, an increased number of initiatives undertaken by the government to promote accountable care solutions is also anticipated to contribute to industry growth. For instance, the Affordable Care Act (ACA), which was enacted in 2010, has introduced ACOs to support the ambient goals of the healthcare industry to improve care, enhance the patient experience, and reduce healthcare costs. The rising number of security breaches in healthcare institutions and the high investments required to support the infrastructure of the services are some of the restraints to industry growth.

For instance, according to an article by Fierce Healthcare, dated February 2021, the total number of breaches in healthcare facilities increased to 679 in 2021 as compared to 663 in 2020 exposing data of more than 45 million individuals. The COVID-19 pandemic had a positive impact on the industry. Hospitals and healthcare institutions collaborated to share data to optimize healthcare delivery to patients. Cross collaborations between insurance providers, government agencies, and healthcare systems helped improve cost containment, resource allocation, improve financial outcomes, and data prevention. These factors aided the growth of the industry during the pandemic.

Component Insights

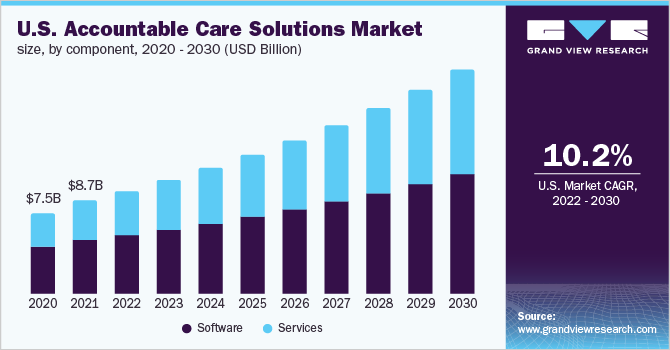

Based on component, the global industry has been further categorized into software and services. The software component segment dominated the global industry in 2021 and accounted for the maximum share of more than 57.65%of the overall revenue. Accountable care software helps streamline workflows in healthcare institutions, reduce expenses, offer better patient care, and enhanced patient safety. These are some of the major factors driving the growth of the segment. Moreover, an increased number of initiatives undertaken by key players, such as Aetna Inc., Epic Systems Corp., and IBM Corp., is anticipated to boost the adoption of these services.

For instance, in March 2022, Signify Health acquired Caravan Health with the intent of helping the company in improving its population health management and value-based program. The services segment is anticipated to grow at a lucrative CAGR during the forecast period. Various services offered by companies, such as hosting, revenue cycle management, optimization, and consulting, help manage the information systems in healthcare. This is anticipated to drive segment growth. Revenue cycle management helps manage clinical and administrative functions for the patients, which is expected to boost the adoption of these services.

Solution Insights

Based on solutions, the global industry has been further categorized into electronic health records, healthcare analytics, Revenue Cycle Management (RCM) solutions, patient engagement solutions, Population Health Management (PHM) solutions, claims management solutions, Healthcare Information Exchange (HIE), and others. The Population Health Management (PHM) solutions segment dominated the global industry in 2021 and accounted for the maximum share of more than 19.15% of the overall revenue. The PHM solutions help in integrating care management, EHR, patient management, and payment solutions, which further help in billing.

The PHM solutions also help in reducing healthcare costs by providing patient-centric care and reducing readmissions to hospitals. The healthcare analytics solution segment, on the other hand, is anticipated to witness the fastest growth rate during the forecast period. Healthcare analytics provide actionable insights to the users to make data-driven decisions. Moreover, healthcare analytics also helps in improving patient outcomes and coordination between operating teams. These factors are anticipated to drive the adoption of healthcare analytics software by providers in the coming years.

End-user Insights

Based on end-user, the global industry has been further categorized into healthcare providers and healthcare payers. The healthcare providers end-user segment dominated the global industry in 2021 and accounted for the maximum share of more than 58.27% of the total revenue. Rising adoption of these solutions by healthcare providers, such as hospitals, healthcare institutions, and insurance providers, to provide affordable and improved healthcare solutions to patients are the key factors responsible for the segment’s high share. Furthermore, increased adoption of patient-centric solutions and software, such as electronic software, by providers is anticipated to boost segment growth.

On the other hand, the healthcare payers segment is estimated to witness the fastest growth rate during the forecast period. Increased initiatives undertaken by governments and private players across the globe are anticipated to bolster segment growth. For instance, in November 2020, Caravan Health and Blue Cross Blue Shield of North Carolina collaborated to launch a new Accountable Care Organization (ACO). Such initiatives are expected to increase awareness about accountable care solutions among the payers.

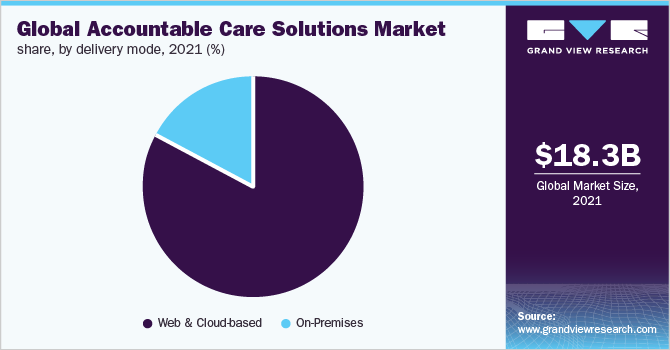

Delivery Mode Insights

Based on delivery modes, the global industry has been further categorized into web & cloud-based, and on-premise. The web & cloud-based delivery mode segment dominated the global industry in 2021 and accounted for the largest share of more than 83.20% of the overall revenue. The segment is anticipated to expand further at a steady growth rate and maintain its dominant industry position throughout the forecast period. Various advantages offered by the web and cloud-based solutions, such as better data management, cost efficiency, and accessibility of data, are some of the key factors driving the segment.

Furthermore, cloud-based technology helps host services and applications remotely, which can be used through the internet. On the other hand, the segment is also anticipated to witness the fastest growth rate during the forecast period. The fast-paced growth of this segment can be attributed to the higher adoption by hospitals and healthcare facilities on account of the increased security features, availability of cloud-based solutions, and low upfront investments.

Regional Insights

North America dominated the global industry in 2021 with the largest share of more than 52.50% of the overall revenue. Factors, such as the high rate of adoption of digital solutions and automation in healthcare facilities across the region, are driving the region’s growth. A rising number of initiatives and cross-partnerships between hospitals, insurance providers, and government institutions are anticipated to boost growth during the forecast period. For instance, Collaborative Health Systems, a population health management organization, and Community Care Alliance, an accountable care organization, announced a venture, which will provide value-based care in eastern Utah and Colorado.

The venture has the potential to reach 20,000 patients. On the other hand, the Asia Pacific region is estimated to register the fastest growth rate during the forecast period. The rising adoption of eHealth platforms and increased healthcare spending in the region is also expected to drive the region’s growth. For instance, the Australian government increased its healthcare spending from USD 94.5 billion in 2020-21 to USD 98.2 billion in 2021-2022. The increased spending is anticipated to boost the demand for accountable care solutions in the region.

Key Companies & Market Share Insights

High competition in the industry owing to innovative product offerings by key players and the entry of new players has led to rapid market growth. Various regulatory, quality, and pricing norms are also impacting cross-border trade. Some of the prominent players in the global accountable care solutions market include:

-

Cerner Corp. (Oracle)

-

IBM Corp.

-

UnitedHealth Group

-

Aetna, Inc.

-

Allscripts Healthcare Solutions, Inc.

-

Epic Systems Corp.

-

McKesson Corp.

-

Zeomega, Inc.,

-

Verisk Health, Inc.

-

Eclinicalworks, LLC

Accountable Care Solutions Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 20.5 billion

Revenue forecast in 2030

USD 49.3 billion

Growth rate

CAGR of 11.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2016 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, solution, delivery mode, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cerner Corp.; IBM Corp.; UnitedHealth Group; Aetna, Inc.; Allscripts Healthcare Solutions, Inc.; Epic Systems Corp.; McKesson Corp.; Zeomega Inc.; Verisk Health, Inc.; Eclinicalworks, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Accountable Care Solutions Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the global accountable care solutions market report based on component, solution, delivery mode, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2030)

-

Software

-

Services

-

-

Solution Outlook (Revenue, USD Million, 2016 - 2030)

-

Electronic Health/Medical Records

-

Healthcare Analytics

-

Revenue Cycle Management Solutions (RCM)

-

Patient Engagement Solutions

-

Population Health Management (PHM) Solutions

-

Claims Management Solutions

-

Healthcare Information Exchange (HIE)

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2016 - 2030)

-

Web & Cloud-based

-

On-Premise

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global accountable care solutions market was valued at USD 18.3 billion in 2021 and is expected to reach USD 20.5 Billion in 2022.

b. The global accountable care solutions market is expected to grow at a compound annual growth rate (CAGR) of 11.5% from 2022 to 2030 to reach USD 49.3 Billion by 2030.

b. North America dominated the accountable care solutions market in 2021 with a share of 52.5%. Factors such as high rate of adoption of digital solutions and automation in the healthcare facilities across the region are some of the key factors driving the market growth in the region

b. Some prominent players in the global accountable care solutions market include Cerner Corporation (Oracle), IBM Corporation, UnitedHealth Group, Aetna, Inc., Allscripts Healthcare Solutions, Inc., Epic Systems Corporation, McKesson Corporation, Zeomega Inc., Verisk Health, Inc., Eclinicalworks, LLC.

b. These solutions aid in reducing hospital stays, eliminating duplication of services, and preventing medical errors. Furthermore, they play a significant role in the transition of the healthcare industry from a patient-centered healthcare model to a data-driven model, thereby driving the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."