- Home

- »

- Pharmaceuticals

- »

-

Acromegaly Treatment Market Size And Share Report, 2030GVR Report cover

![Acromegaly Treatment Market Size, Share & Trends Report]()

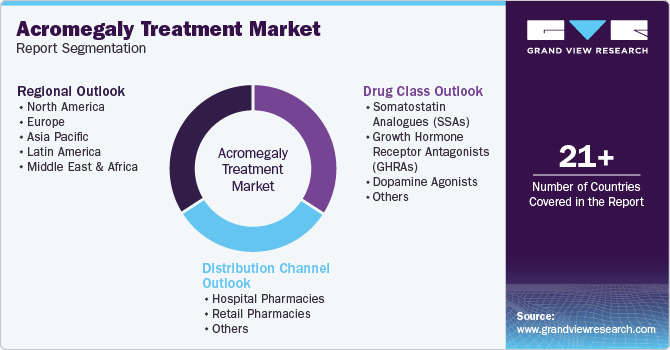

Acromegaly Treatment Market Size, Share & Trends Analysis Report By Drug Type (Somatostatin Analogs, GHRA), By End-use (Hospitals & Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-053-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Acromegaly Treatment Market Size & Trends

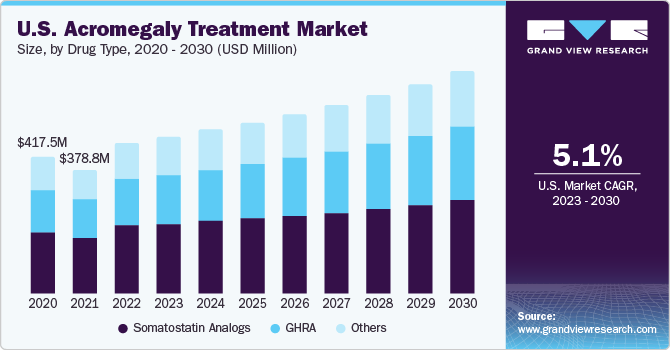

The global acromegaly treatment market size was valued at USD 1.26 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. The increasing incidence of acromegaly is contributing to the high demand for advanced treatment options, which further boosts the development of newer molecules. Pharmaceutical companies are constantly investing in R&D to develop new formulations and newer routes of administration of existing drugs.

The prevalence of genetic diseases and changing lifestyles are expected to lead to rising market demand in the forthcoming years. The rising incidence of hormonal diseases, such as hypopituitarism and endocrine diseases, is projected to support the growth further. Technological advancements and government support are anticipated to create growth opportunities for the market players. As per the National Organization for Rare Disorders (NORD), in 2021, Acromegaly is detected in 50 to 70 people in a million approximately. Each year 3 to 11 people per million are diagnosed with it. Due to a high probability of slow development, Acromegaly can remain unrecognized

A strong pipeline of drugs is the key factor driving the acromegaly treatment market. For instance, seven somatostatin analogs and two growth hormone receptor antagonists are expected to receive FDA approval by 2027. Moreover, the advent of technologically advanced detection techniques such as radiosurgery and radio-labeled imaging technologies providing cost efficiency coupled with minimum side effects are expected to provide a growth platform to this market.

Favorable government insurance policies and schemes for patients with rare diseases are another key contributing factor to the market growth. For instance, multiple government healthcare organizations in the U.S. and Europe, such as the National Institutes of Health (NIH) and the National Center for Advancing Translational Sciences (NCATS), offer subsidized medicines for rare diseases. In Japan, acromegaly has been listed as an intractable disease, and the whole treatment cost is covered under insurance. The aforementioned initiatives are anticipated to boost growth in the near future.

Drug Type Insights

The somatostatin analogs segment accounted for the largest market share of 44.5% in terms of revenue in 2022. Somatostatin analogs have been prescribed as the first-line treatment option by healthcare physicians over the past few decades, owing to the wide availability of drugs and cost efficiency. The marketed drugs available are Sandostatin LAR & Signifor LAR from Novartis, and Somatuline Depot from Ipsen Pharma.

The patent expiry of Sandostatin LAR in 2014 has not impacted its market much, owing to the absence of generic drugs. In June 2020, Chiasma received approval from the U.S. Food and Drug Administration for the oral SSA octreotide acromegaly pill MYCAPSSA after four years of filing.

Moreover, a strong pipeline of drugs is expected to propel growth in the near future. For instance, Somatuline Autogel by Ipsen Pharma, CRN00808 by Crinetics Pharmaceuticals, and MYCAPSSA oral by Chiasma Inc. are under clinical trial and are expected to receive approval in the coming years. The only Growth Hormone Receptor Antagonist (GHRI) currently available is SOMAVERT (Pegvisomant) from Pfizer Inc. The drug patent expired in the U.S. and five European countries in 2017. But it will not significantly impact the market as there is no major generic competition.

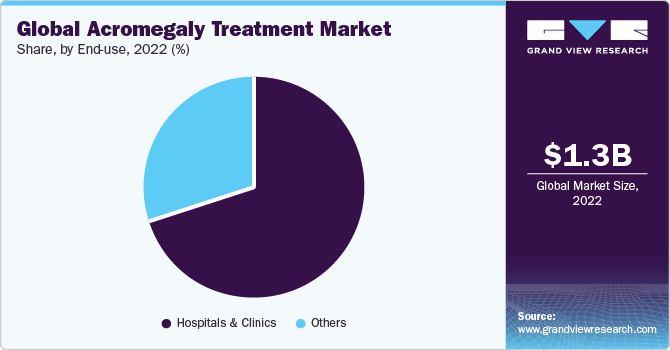

End-use Insights

The hospitals & clinics segment accounted for the largest revenue share of around 70.0% in 2022, which can be attributed to a large number of diagnostic procedures and surgeries performed in these facilities. In addition, advanced diagnostics facilities and the availability of surgeons are contributing to its dominant market share. On the contrary, a lack of awareness among people regarding the disease and late detection may restrain segment growth in the near future.

The others segment includes government and private organizations. In 2016, a research study was conducted in Chinese government hospitals, where 527 acromegaly patients were detected via facial photographs through machine learning. This initiative has further encouraged the early detection of the disease among the global population.

Regional Insights

North America accounted for the largest revenue share in 2022, owing to the increasing prevalence of the disease in the region, coupled with favorable government policies. According to a report by the U.S. Endocrine Society, the prevalence of acromegaly was estimated at 40 to 125 cases per million in 2016. Moreover, a rise in collective efforts by major players to develop new formulations and ensure high-quality products is projected to boost regional demand. For instance, BIM23B065 by Ipsen Pharma completed its phase 2 clinical trial in 2017 and preparing for the phase 3 trial.

The Asia Pacific region is projected to observe the fastest CAGR through the forecast period. Growing healthcare spending by countries such as China and India, coupled with increasing investments by pharmaceutical companies, is projected to present remunerative growth opportunities in the near future. For instance, Sun Pharma and WOCKHARDT are developing new formulations for octreotide molecules, which are currently in the pre-clinical phase.

Key Companies & Market Share Insights

The market is consolidated in nature and is marked by the presence of various small and large companies. It is led by Ipsen Pharma, Novartis AG, and Pfizer Inc., among others. Many new and key contributors have emerged in the last few years. Companies are focusing on implementing strategies, such as the development of new formulations, partnerships, distribution agreements, and regional expansions, to increase their revenue share.

For instance, Novartis launched Signifor LAR in a probe to retain its market share after the patent expiry of Sandostatin LAR in 2014. Furthermore, ISIS 766720 by Ionis Pharmaceuticals, Inc. is currently under phase 2 clinical trial and is still ongoing. In June 2019, Ipsen Biopharmaceuticals received FDA approval for a pre-filled syringe for Somatuline Depot (Lanreotide) for the treatment of acromegaly.

Key Acromegaly Treatment Companies:

- Novartis AG

- Ipsen Pharma

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- Chiasma, Inc.

- Peptron, Inc.

- WOCKHARDT

- Dauntless Pharmaceuticals

- Pfizer Inc.

- Ionis Pharmaceuticals, Inc.

Acromegaly Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.31 billion

Revenue forecast in 2030

USD 1.93 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novartis AG; Ipsen Pharma; SUN PHARMACEUTICAL INDUSTRIES LTD.; Chiasma, Inc.; Peptron, Inc.; WOCKHARDT; Dauntless Pharmaceuticals; Pfizer Inc.; Ionis Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acromegaly Treatment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global acromegaly treatment market report on the basis of drug type, end-use, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Somatostatin analogs

-

GHRA

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global acromegaly treatment market size was estimated at USD 1.26 billion in 2022 and is expected to reach USD 1.31 billion in 2023.

b. The global acromegaly treatment market is expected to witness a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 1.93 billion by 2030.

b. North America held the largest share of 39.750% in 2022 due to the increasing prevalence of the disease coupled with favorable government policies. Moreover, the rise in collective efforts by major players to develop new formulations and ensure high-quality products is projected to boost the regional demand.

b. Some key players operating in the acromegaly treatment market include Ipsen Pharma; Novartis AG; and Pfizer Inc. among others.

b. Constant investment in R&D for developing new formulations and newer routes of administration of the existing drugs coupled with the prevalence of genetic diseases and changing lifestyles are expected to boost the market growth in the forthcoming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."