- Home

- »

- Medical Devices

- »

-

Active Wheelchair Market Size & Share Report, 2020-2027GVR Report cover

![Active Wheelchair Market Size, Share & Trends Report]()

Active Wheelchair Market Size, Share & Trends Analysis Report By Product Type, By Indication (Alzheimer's Disease, Amyotrophic Lateral Sclerosis (ALS), Cerebral Palsy), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-132-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

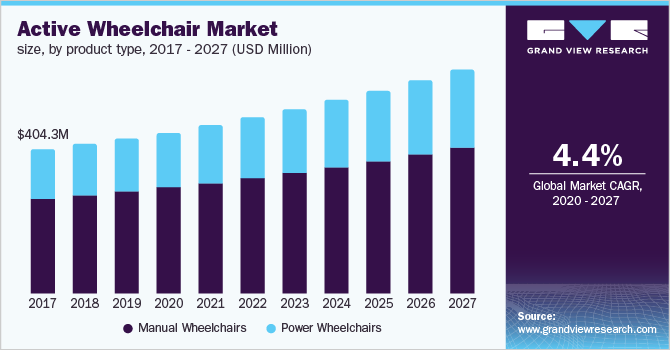

The global active wheelchair market size to be valued at USD 2.3 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% during the forecast period. Active wheelchairs are used daily and are generally more of an upscale product than standard wheelchairs. It includes wheelchairs for people that choose to remain physically active. Active wheelchairs constitute the majority of sports wheelchairs. These wheelchairs are easy to maneuver and are typically available in two varieties: folding and rigid. They can be adjusted to suit the user’s needs and their active lifestyle. The continuous improvement in active wheelchair efficiency, rising geriatric population with disability, increasing prevalence of chronic diseases, and increasing government initiatives to support the geriatric and disabled population are expected to drive the market over the forecast period.

According to the CDC, 54.4 million U.S. adults were affected by arthritis from 2013 to 2015. It is expected that 36.4 million adult arthritis patients are anticipated to report activity limitations by 2040. According to the WHO in 2018, the global geriatric population is expected to rise from 7.0% in 2000 to 16.0% in 2050.

Furthermore, rising product approvals, increasing global disposable income, and increasing adoption in emerging countries are projected to further fuel the product demand. In addition, favorable reimbursement policies are anticipated to further propel the market growth. For instance, active wheelchairs are provided by the NHS through grants, charities, or fundraising in the U.K. To avail active wheelchairs, the patients need a referral from a General Practitioner (GP), healthcare professional, such as a physiotherapist or occupational therapist, or hospital staff in the country.

Active Wheelchair Market Trends

The rise in the prevalence of chronic diseases is driving the growth of the market. The increasing rate of mobility-related disorders is observed to increase significantly. People with mobility difficulties develop a broad spectrum of health conditions and impairments including arthritis, cerebral palsy, muscular dystrophy, stroke, and other problems along with a growing geriatric population experiencing mobility problems or disabilities. This has raised the need for assistive technologies such as wheelchairs thereby, augmenting the market growth.

However, technologically advanced wheelchairs are associated with high prices which have arisen as a restraining factor for the adoption of the product. According to a report by the International Labour Organisation, the unemployment rates of people with disabilities in many developing countries have reached an estimate of 80% or more. This has thus made them less eligible to buy the product. In addition, the dearth of easily accessible skilled service providers required for active wheelchair maintenance is a challenging factor faced by the market.

Moreover, the increased government initiatives and funding for the provision of a wheelchair for disabled people are projected to boost the market growth. Additionally, rising awareness of assistive technologies coupled with the benefits offered by them is supporting the market growth. A wheelchair serves as a catalyst to increase the independence and social integration of the disabled. The utilization of wheelchairs by people with mobility issues helps them to prevent secondary complications such as progression of contractures or deformities, and conditions associated with poor postures.

Product Type Insights

The manual wheelchairs segment accounted for the largest revenue share of 66.8% in 2019 owing to its lightweight, less maintenance cost, non-dependability on charging, and low cost. In addition, the growing usage of manual wheelchairs in emerging countries is expected to propel segment growth over the forecast period.

However, the power wheelchairs segment is expected to register a higher CAGR of 4.6% over the forecast period owing to increasing adoption in the emerging countries and technological advancement over manual wheelchairs. In addition, an increase in the launch of powered wheelchairs by the key companies and growing awareness is further driving the market. Powered wheelchairs are also gaining popularity owing to their luxurious feel, self-reliance, and comfortability.

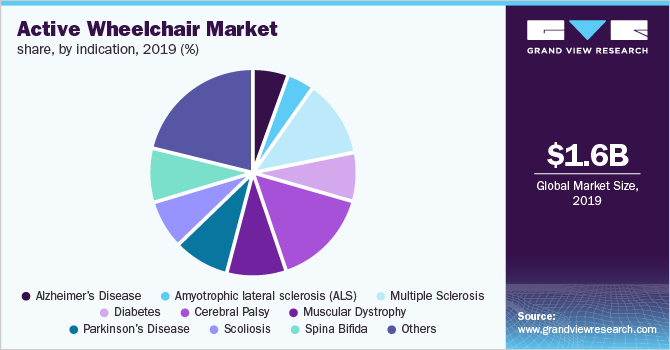

Indication Insights

The cerebral palsy segment held the largest revenue share of 15.5% in 2019 owing to the higher dependency of patients suffering from cerebral palsy on the active wheelchairs. In addition, the increasing prevalence of cerebral palsy is anticipated to drive the segment.

However, the spinal cord injury segment is anticipated to witness the fastest growth rate of 5.8% over the forecast period owing to the rising global prevalence of the condition. According to the WHO in 2019, about 250,000 to 500,000 people suffer a spinal cord injury every year due to road traffic crashes, falls, or violence.

Regional Insights

Europe accounted for the largest revenue share of 33.5% in 2019 owing to the increase in healthcare expenditure and the growing geriatric and disabled population in the region. In addition, increasing the adoption of powered wheelchairs is further driving the active wheelchairs market in the region.

However, Asia Pacific is expected to witness the fastest growth rate over the forecast period due to the rising awareness levels and increasing disposable income in the region. In addition, rising investments by companies for developing advanced active wheelchairs and the rising awareness about powered wheelchairs are some factors expected to propel market growth in the region.

Key Companies & Market Share Insights

To sustain in the highly competitive environment and to improve market share, the key companies are adopting new product launch as a key strategy. For instance, in March 2020, Invacare Corporation launched the new Invacare AVIVA FX Power Wheelchair, which is designed to meet the performance needs of active users.

Recent Developments

-

In July 2021, Numotion, a prominent provider of mobility services and equipment, acquired SpinLife.com, a global leader in online Durable Medical Equipment retail (DME). The acquisition will enable the company to serve more customers.

-

In May 2022, Sunrise Medical launched the new ZIPPIE Q300 M Mini and the QUICKIE Q200 R power wheelchair.

-

In July 2021, Sunrise Medical announced a partnership with LUCI. The collaboration is stated to bring LUCI’s smart wheelchair technology to Sunrise Medical's popular QUICKIE line of power wheelchairs.

Some of the prominent players in the active wheelchair market include:

-

Sunrise Medical

-

Mountain Trike

-

Numotion

-

Invictus Active

-

Karman Healthcare, Inc.

-

PER4MAX Medical

-

MEYRA GmbH

-

Spinlife

-

Sportaid

Active Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.7 billion

Revenue forecast in 2027

USD 2.3 billion

Growth Rate

CAGR of 4.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Netherlands; Belgium; Switzerland; Russia; Sweden; China; India; Japan; Australia; Malaysia; South Korea, Indonesia; Singapore; Philippines; Thailand; Brazil; Mexico; Argentina; Columbia; Chile; South Africa; Saudi Arabia; UAE; Israel; Egypt

Key companies profiled

Mountain Trike; Numotion; Invictus Active; Karman Healthcare, Inc.; Sunrise Medical; PER4MAX Medical; MEYRA GmbH; Spinlife; Sportaid

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country& segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Wheelchair Market SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global active wheelchair market report on the basis of product type, indication, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Manual Wheelchairs

-

Power Wheelchairs

-

-

Indication Outlook (Revenue, USD Million, 2016 - 2027)

-

Alzheimer’s Disease

-

Amyotrophic lateral sclerosis (ALS)

-

Multiple Sclerosis

-

Diabetes

-

Cerebral Palsy

-

Muscular Dystrophy

-

Parkinson’s Disease

-

Scoliosis

-

Spina Bifida

-

Spinal Cord Injury

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Belgium

-

Switzerland

-

Russia

-

Sweden

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Malaysia

-

Indonesia

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global active wheelchair market size was estimated at USD 1.6 billion in 2019 and is expected to reach USD 1.7 billion in 2020.

b. The global active wheelchair market is expected to grow at a compound annual growth rate of 4.4% from 2020 to 2027 to reach USD 2.3 billion by 2027.

b. Europe dominated the active wheelchair market with a share of 33.5% in 2019. This is attributable to rising healthcare awareness coupled with increasing geriatric and disabled populations in the region.

b. Some key players operating in the active wheelchair market include Sunrise Medical; Mountain Trike; Numotion; Invictus Active; Karman Healthcare, Inc.; PER4MAX Medical; MEYRA GmbH; Spinlife; and Sportaid.

b. Key factors that are driving the active wheelchair market growth include the increasing geriatric and disabled population, increasing prevalence of chronic diseases, and technological advancement in the active wheelchairs industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."