- Home

- »

- Medical Devices

- »

-

Active Wound Care Market Size & Share Report, 2030GVR Report cover

![Active Wound Care Market Size, Share & Trends Report]()

Active Wound Care Market Size, Share & Trends Analysis By Product (Biomaterials, Skin-substitute), By Application (Chronic Wounds, Acute Wounds), By End Use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-935-4

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

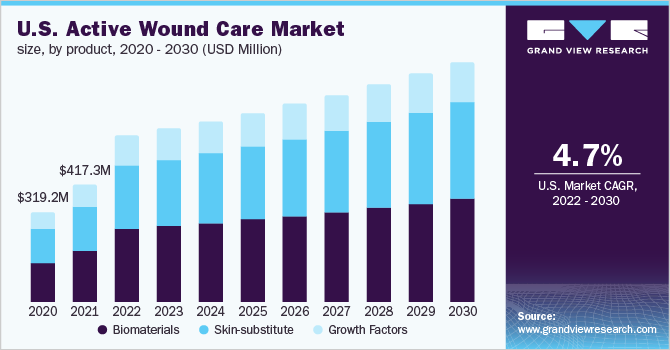

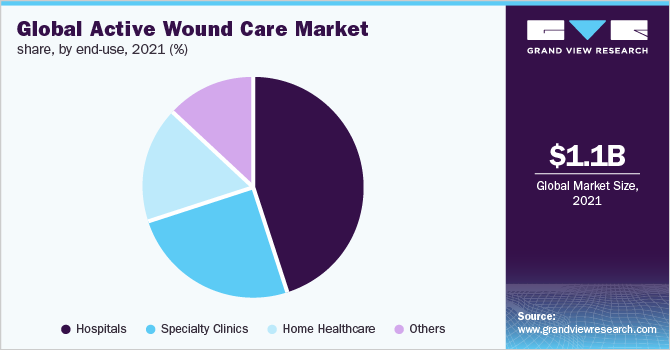

The global active wound care market size was valued at USD 1,077.9 million in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030. The market is primarily driven by technology advancements, an ageing population, difficulties associated with inadequate traditional wound healing procedures, government initiatives, and an urgent need for faster and safer chronic wound treatment. Moreover, rising prevalence of several lifestyle conditions that lead to chronic wounds, such as diabetic foot ulcer, venous leg ulcer, and pressure ulcer, is expected to drive the expansion of the market in the coming years.

For instance, chronic wounds impact around 5.7 million people in the U.S., according to recent estimates published in NCBI. Besides, some chronic lesions, such as diabetic ulcers, can necessitate amputation. The Independent Diabetes Trust in the United Kingdom claimed in its report (2019) that each year, around 115,000 people get diabetic foot ulcers and 278,000 people are treated for venous leg ulcers in the U.K. As a result, these ulcers take an average of 200 days to cure. Thus, the rising prevalence of chronic and acute wounds is expected to increase the demand for active wound care products.

Furthermore, benefits such as reducing the length of hospital stay to minimize surgical healthcare costs, as well as a growing preference for products that improve therapeutic results, are boosting demand for active wound care products. In addition, the rising economic cost burden of chronic wounds, as well as prolonged treatment duration and the inefficiency of wound dressings and devices in treating chronic wounds, might have resulted in increased unmet needs. This presents a huge opportunity for players to enter the market for active wound care by launching new products based on regenerative technologies, to reduce overall treatment duration and cost. This, combined with effective treatment outcomes for chronic wound patients, will drive demand for innovative active wound care treatment options.

Advanced growth factors and biological skin substitutes are well-known and scientifically established in the treatment of both acute and chronic wounds. Key players are currently attempting to strengthen their global presence by introducing new bioactive products to the market for active wound care. For instance, in July 2019, Angelini ACRAF S.p.A., introduced a new active wound cleanser. Similarly, in February 2019, Axio Biosolutions released MaxioCel which contains chitosan and is intended to treat chronic wounds. Further, in January 2019, the US FDA approved Platform Wound Dressing (PWD) by Applied Tissue Technologies LLC. Besides, in April 2018, MTF Biologics (previously known as Musculoskeletal Transplant Foundation) launched AminoBand Viable Membrane at the Wound Healing Society (WHS) meeting in the U.S. As a result of such launches coupled with rising spending on research and development activities and by key players, the market is expected to witness significant growth in the near term.

The COVID-19, had a negative impact on the market for active wound care, mainly owing to the cancellation or delay of elective surgeries. However, the rising adoption of telehealth and virtual consultations has helped the market regain post-COVID-19 pandemic. For instance, the Wound Pros provides a telemedicine platform that allows wound care teams and patients to communicate securely. It has also recently introduced "RITA," a new diagnostic and wound assessment application. Furthermore, according to several research studies, telemedicine options are a cost-effective way to improve wound care outcomes, growing patient compliance, and satisfaction. In addition to this, insurance policies have also started covering telehealth. Thus, owing to the aforementioned factors, the market for active wound care is anticipated to gain a significant growth rate in the post-pandemic period.

Product Insights

The biomaterials segment accounted for the maximum share of 44.38% of the global revenue in 2021. The segment growth can be attributed to rapid technological advancements involving the usage of biomaterials for wound healing therapies. These wound care products comprise both synthetic and natural substances that help in both wound healing and tissue regeneration. Moreover, a surge in research and development activities and continual launches by key players is further contributing to the segment growth. For instance, in November 2020, UCLA researchers in collaboration with Duke University, developed a wound-healing biomaterial that could reduce scar formation and allow skin tissue to regenerate, resulting in healthier and stronger skin. Similarly, in February 2019, Axio Biosolutions launched MaxioCel, a next-generation wound care dressing made of chitosan. Thereby such developments are propelling the segment growth.

The skin-substitutes segment is expected to witness the fastest CAGR of 5.39%. Skin substitutes are tissue-engineered products that replace the form and function of the skin, either temporarily or permanently. Advanced skin substitutes are now used generally for deep and chronic wounds as they can prevent infection, limit bodily fluid loss, improve cytokine and growth factor production, reduced inflammatory response and subsequent scarring and protect the healing wound by acting as a covering. Moreover, tissue-engineered skin substitutes are an effective technique to address the scarcity of donor skin grafts. Advancements in technology for the development of skin substitutes such as collagen synthetic bilaminates and tissue culture-derived are among the factors expected to contribute to segment growth.

Moreover, with the advancement of biotechnology and tissue engineering, a wide range of skin substitutes for the treatment of chronic wounds are now available in the market for active wound care. Lately, a Tissue Biology Research Unit (TBRU) at the University of Zurich, Switzerland, and numerous laboratories have developed Dermo-epidermal Skin Substitutes (DESSs) comprising dermal and epidermal skin layers. Such laboratory-grown skin substitutes provide a novel and promising therapeutic alternative for patients with severe, full-thickness skin injuries.

The skin-substitute segment is further categorized into biological and synthetic. Biological substitutes dominated the market; however, the synthetic segment is anticipated to witness the fastest CAGR of 5.9% over the forecast period. The main advantage of biological tissue-created skin substitutes is that the patient's skin is easily available. More extracellular matrix is present in these substitutes, which aids in good re-epithelialization and speedier wound healing. On the other hand, the composition of the scaffold in synthetic tissue-designed skin substitutes may be controlled more precisely. Moreover, advances in technology for the production of tissue-engineered skin substitutes such as collagen-synthetic bilaminates and tissue culture-derived membranes are helping to drive segment expansion.

Application Insights

The chronic wounds segment dominated the market for active wound care and held the largest revenue share of 60.6% in 2021 and is anticipated to witness a considerable growth rate over the forecast period. The broad category of skin substitutes and biomaterials offers the ability to promote chronic wound healing and minimize the medical burden caused by these wounds. The increasing prevalence of diabetic foot ulcers, pressure ulcers, venous leg ulcers, and other chronic wounds, are likely to drive segment growth. For instance, according to ScienceDirect, diabetic foot ulcers may affect more than 25% of the diabetic population and may lead to amputation of the foot in 20% of patients. Moreover, according to American Diabetes Association, in 2018, an estimated 34.2 million people, i.e., 10.5% of the total U.S. population, had diabetes.

In addition, as per the data published in Mary Ann Liebert, Inc., in the U.S., a projected 500,000–600,000 people have venous leg ulcers resulting in an approximately USD 1 billion burden on health care. Thus, with the increasing number of patients suffering from chronic diseases is likely to spur the demand for active wound care products. Furthermore, the rising geriatric population is also a key factor driving the segment growth. According to the Administration for Community Living's profile on older Americans, the U.S. population aged 65 and above is estimated to be 54.1 million in 2019, accounting for approximately 19% of the total U.S. population. From 2009 to 2019, the population expanded by around 36%, and it is expected to reach 80.8 million by 2040, and 94.7 million by 2060. Older people are more susceptible and prone to injury, which may lead to an increase in the incidence of chronic wounds.

The acute wounds segment is expected to witness a considerable CAGR of 4.1% during the forecast period. The increasing cases of different traumatic wounds and burns are the major factor driving the segment. For instance, around 50.0% of people worldwide are exposed to fire-related traumas and among them, 90.0% of the cases occur in low to moderate-income countries. Similarly, as per the WHO, over 1,000,000 people are registered, annually, as moderately or severely burnt in India. Moreover, according to a study published by ScienceDirect in 2017, approximately 195,000 deaths occur in Indonesia annually due to burns. Such a rising prevalence of burn injuries is expected to create high demand for skin substitutes, thereby driving the segment growth.

End-use Insights

The hospital segment dominated the market for active wound care and held the largest revenue share of 45.2% in 2021, as a higher number of patients prefer to visit hospitals for different cases such as surgical wounds, burns, and ulcers. Moreover, the increasing number of surgical procedures and an increasing number of hospitals are among the major factors driving the segment. For instance, as per the latest survey by the American Hospital Association, the total number of hospitals in the U.S. was counted to be 6,093 in 2022. Hence, owing to the aforementioned factors, the segment is anticipated to propel during the forecast period.

The home healthcare segment is expected to witness the fastest CAGR of 5.4% during the forecast period. Homecare is expected to witness the fastest growth over the forecast period. The onset of the COVID-19 pandemic mainly led to the promotion of home healthcare. Moreover, the geriatric population prefers homecare over hospital stay. Various conditions such as diabetic foot ulcers, venous leg ulcers, and surgical wounds generally require prolonged hospital stays, which often becomes challenging for elderly patients.

Furthermore, owing to the increasing healthcare costs, a large number of patients suffering from chronic diseases prefer to undergo treatments in-home care settings. This trend is likely to surge the demand for active wound care products, as they are used by patients to treat, diagnose, and monitor a variety of chronic and acute wounds in-home care settings. Hence, such factors are anticipated to boost segment growth over the forecast period.

Regional Insights

North America dominated the active wound care market and accounted for a revenue share of 45.2% in 2021 and is expected to witness a considerable growth rate over the forecast period. There is a rising demand for advanced treatment options, owing to the increasing prevalence of wounds, rising economic cost burden, and growing efforts by the government to reduce the overall treatment duration. These factors have led to the growing number of regulatory approvals for active wound care products including skin substitutes and growth factors in the U.S. This, along with suitable reimbursement policies in the region, are factors responsible for regional dominance.

In the Asia Pacific, the market for active wound care is estimated to witness the highest CAGR of 5.3% over the forecast period. This can be attributed to rising changing lifestyles leading to an increase in the incidence of chronic diseases and the presence of a large population base. For instance, in 2017, Diabetic Foot Ulcers (DFUs) account for roughly 80% of all non-traumatic amputations in India, according to a research paper published in Value in Health (the official journal of the International Society for Pharmacoeconomics and Outcomes Research, Inc.). Furthermore, patients with a history of DFU had a 40% higher 10-year mortality rate than those without. Such developments are projected to boost demand for active wound care products as an increasing number of patients uses these products to enhance patient treatment results. Furthermore, medical tourism in this region is increasing which is increasing the number of surgeries performed. Additionally, the increasing focus of the major players in the emerging Asian countries and government support is further driving the growth of the market for active wound care in this region.

Key Companies & Market Share Insights

The market for active wound care is highly fragmented in nature with the presence of several small and large manufacturers. Competitive rivalry and the degree of competition in the market are expected to intensify over the forecast period due to the presence of many players in the market. Furthermore, leading players are involved in collaborations, approvals, product launches, mergers & acquisitions to strengthen their product portfolios. For instance, in June 2021, Stratatech received FDA approval for its StrataGraft for treating adult patients with thermal burns. Thus, with various strategies acquired by leading players, the market is expected to impel during the forecast period. Some of the prominent players in the active wound care market include:

-

Smith & Nephew

-

MiMedx

-

Tissue Regenix

-

Organogenesis Inc.

-

Acell Inc.

-

Integra Life Sciences

-

Solsys Medical

-

Osiris Therapeutics Inc.

-

Cytori Therapeutics Inc.

-

Human BioSciences

-

Wright Medical Group N.V.

Active Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,536.8 million

Revenue forecast in 2030

USD 2.2 billion

Growth rate

CAGR of 4.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Smith & Nephew; MiMedx; Tissue Regenix; Organogenesis Inc.; Acell Inc.; Integra Life Sciences; Solsys Medical; Osiris Therapeutics Inc.; Cytori Therapeutics Inc.; Human BioSciences; Wright Medical Group N.V

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global active wound care market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomaterials

-

Skin-substitutes

-

Biological Skin-substitute

-

Allograft

-

Xenograft

-

Others

-

-

Synthetic Skin-substitute

-

-

Growth Factors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic foot ulcers

-

Pressure ulcers

-

Venous leg ulcers

-

Other chronic wounds

-

-

Acute Wounds

-

Surgical & traumatic wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The active wound care market size was estimated at USD 1,077.9 million in 2021 and is expected to reach USD 1,536.8 million in 2022.

b. The active wound care market is expected to grow at a compound annual growth rate of 4.7% from 2022 to 2030 to reach USD 2.2 billion by 2030.

b. North America dominated the active wound care market in 2021 during the forecast period and is expected to witness a growth rate of 4.75% over the forecast period. The rise in the patient pool in several countries and the growing aging population will boost the growth of the active wound care market in the region during the forecast period

b. Prominent key players operating in the active wound care market include Smith & Nephew, MiMedx, Tissue Regenix, Organogenesis Inc., Acell Inc., Integra Life Sciences, Solsys Medical, Osiris Therapeutics Inc., Cytori Therapeutics Inc., Human BioSciences and Wright Medical Group N.V.

b. Key factors that are driving the active wound care market growth include the increasing occurrence of acute, chronic, and surgical wounds, the aging population, and the increasing Incidence of various lifestyle disorders. In addition, the growing awareness of proper wound care management and rising potential in the advancing economies will further provide potential opportunities for the growth of the active wound care market in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."