- Home

- »

- Advanced Interior Materials

- »

-

Advanced Ceramics Market Size, Share, Growth Report 2030GVR Report cover

![Advanced Ceramics Market Size, Share & Trends Report]()

Advanced Ceramics Market Size, Share & Trends Analysis Report By Material (Alumina, Titanate), By Product (Monolithic, CMCs), By Application (Bioceramics, Filters), By End-use (Automotive, Medical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-914-2

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Advanced Ceramics Market Size & Trends

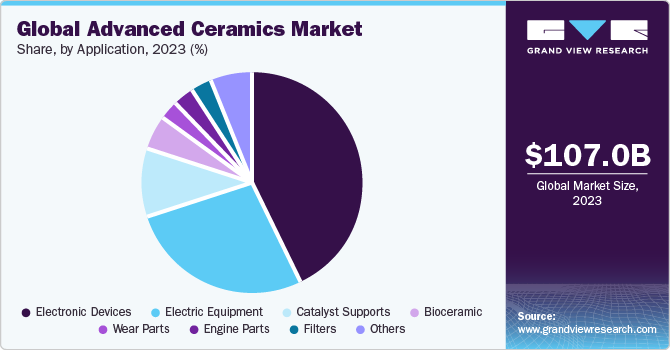

The global advanced ceramics market size was estimated at USD 107.00 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. Increasing demand for advanced ceramics in various industries, coupled with growth in the medical and telecom sectors, is expected to drive market expansion. Advanced ceramics, also known as technical ceramics, possess improved magnetic, optical, thermal, and electrical conductivity. End-users can reduce their production and energy costs by utilizing advanced ceramics that provide high efficiency to end products. Asia Pacific is a leading market for advanced ceramics in the world in terms of their consumption.

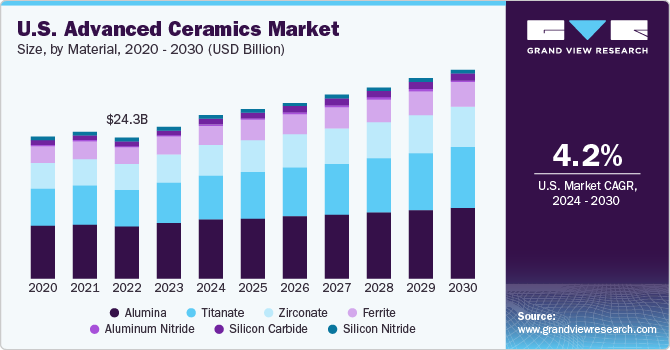

The rise in demand for advanced ceramics in the U.S. can be attributed to an increasing preference for lightweight materials across various industries. The production and consumption of these materials and components for the electrical and electronics sectors have been on the rise due to the growing need for uninterrupted connectivity. Furthermore, flourishing electric vehicle (EVs) and defense sectors have also contributed to market growth.

For instance, in 2023, under the National Defense Authorization Act of the U.S., the country authorized USD 32.6 billion for Navy shipbuilding, an increase of USD 4.70 billion. Also, in April 2023, the EPA announced new and stricter environmental rules for light- and medium-duty vehicles. The rules are expected to apply to vehicles manufactured from 2027 to 2032, covering greenhouse gases (GHG) and other pollutants, including ozone, nitrogen oxides, particulate matter, and carbon monoxide.

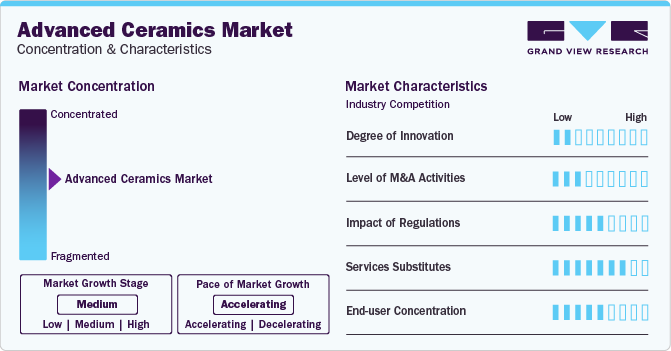

Market Concentration & Characteristics

The global advanced ceramics market is highly competitive owing to the presence of multiple manufacturers. The market players at different stages of the value chain observe integration. To gain a competitive edge, they pursue initiatives, such as mergers & acquisitions and capacity expansions worldwide.

Some of the key manufacturers include 3M, CeramTec Group, CoorsTek, Ferrotec Corp., Morgan Advanced Materials, and Elan Technology, among others. In addition, many well-known market vendors, such as Anoop Ceramics and International Syalons Ltd., are vertically integrated across the value chain. They engage in the production of raw materials, manufacturing advanced ceramics, and distributing these goods to a range of end-use industries. These strategies help such companies in controlling the cost of production, which in turn, allows them to have control over the end prices of their products throughout the market.

The product has various applications in the aerospace industry as it is lighter than metals. This allows for longer space exploration, larger payloads, lower fuel consumption, and faster speeds. As a result, the use of advanced ceramics in the aerospace industry is expected to create significant growth opportunities for the market over the forecast period.

Material Insights

The alumina material segment held the largest revenue share of over 34.0% in 2023 and this trend is anticipated to continue over the forecast period. Alumina-based advanced ceramics are used for harsh applications that need characteristics, such as thermal stability and wear resistance. Some of the applications include high-voltage semiconductor parts, mechanical seals, insulators, and ballistic armor.

Titanate is projected to register the fastest growth rate over the forecast period. Titanate-based materials are widely used in antennas and resonators, especially in dielectric resonators for microwave communication systems. These materials have become essential components in our modern world. Increasing investment in wireless communication and 5G technologies is expected to propel product consumption over the coming years.

Application Insights

The electronic devices segment held the largest revenue share of over 47.0% in 2023 and this trend is expected to continue over the forecast period. The product is extensively used in computers, television sets, smartphones, and consumer appliances. Rising investments in the electronics sector are expected to drive growth in the segment over the forecast period.

The bioceramic segment is expected to register the fastest growth rate during the forecast years due to the increasing focus on the medical sector in different countries. Bioceramic materials are used in dental implants and as replacement parts in knee and hip surgeries. For instance, more than 2.0 million hip surgeries are done every year across the world, and this number is expected to increase further owing to the increasing affordability of these surgeries.

Product Insights

Monolithic held the largest revenue share of over 78.0% in 2023 and is expected to dominate the market throughout the forecast period. The product's high-temperature resistance, reliability, and durability make it a vital component in both electronic devices and vehicles. Its exceptional characteristics ensure the best performance and longevity, thereby enhancing the overall quality of end products.

The Ceramic Matrix Composites (CMCs) segment is anticipated to register the fastest growth rate over the forecast period. These composites combine ceramic reinforcement material with a ceramic matrix, resulting in improved properties, such as lightweight, high strength, and excellent thermal shock resistance.

End-use Insights

The electrical and electronics end-use segment held the largest revenue share of over 56.0% in 2023 and is anticipated to dominate the market over the forecast period. Advanced ceramics possess superconducting, semiconducting, piezoelectric, and magnetic properties. They have various applications in the electrical and electronics industry, including spark capacitors, plugs, inductors, resistors, and circuit protection devices.

The medical segment is expected to register the second-fastest CAGR from 2024 to 2030. The product possesses several properties, such as high compressive strength, low friction coefficient, high wear & chemical resistance, and non-toxicity, that make it ideal for medical applications. It can be used in a variety of implantable medical devices, diagnostic imaging equipment, therapeutic medical devices, and consumable medical devices.

Regional Insights

The advanced ceramics market in North America held a revenue share of over 28.0% in 2023 of the global market. Flourishing electronics, medical, and EV industries in the region are expected to stimulate market growth. Growing requirements for high-quality semiconductors that carry out ultra-high frequency signal transmission to ensure improved connectivity are further expected to boost the market growth.

U.S. Advanced Ceramics Market Trends

The U.S. advanced ceramics market is anticipated to grow at a CAGR of 4.0% over the forecast period. Rapidly growing electronics, medical, and electric vehicle (EV) industries in the region are expected to stimulate market growth. Moreover, the market is expected to grow due to a surge in demand for high-quality semiconductors that enable ultra-high frequency signal transmission, resulting in improved connectivity.

Europe Advanced Ceramics Market Trends

The advanced ceramics market in Europe is expected to grow significantly in the future. Stringent environmental regulations are also pushing industries towards advanced ceramic materials known for their superior performance and sustainability. In addition, ongoing R&D activities focused on enhancing ceramic properties and manufacturing processes contribute to market expansion.

The Germany advanced ceramics market is a key player in the Europe regional sector due to a thriving manufacturing base and strong technological capabilities. Germany’s automotive industry, renowned for its innovation and quality, is a major consumer of advanced ceramics for applications, such as exhaust systems, engine components, and brake systems. Moreover, its emphasis on renewable energy sources and sustainability further drives the adoption of advanced ceramics in sectors like energy production and environmental technologies.

Asia Pacific Advanced Ceramics Market Trends

The advanced ceramics market in Asia Pacific held the largest revenue share of over 40.0% in 2023 and is projected to maintain its lead over the coming years. Growth in the EV, medical, and electronics industries is expected to boost market growth. For instance, in November 2023, Hyundai Motor began construction on a KRW 2 trillion (USD 1.52 billion) EV plant in South Korea. Moreover, increasing demand from end-use industries like electronics, automotive, aerospace, and healthcare, will support market growth. With rapid industrialization, urbanization, and infrastructural development, countries in the region are witnessing a surge in product demand due to its superior properties, including high-temperature resistance, hardness, and corrosion resistance.

The China advanced ceramics market is among the major markets in the APAC region owing to its extensive manufacturing capabilities, technological advancements, and supportive government policies

The advanced ceramics market in India is expected to witness steady growth on account of the rapidly growing end-use industries, such as healthcare, aerospace & defense, and electrical & electronics. The Indian government's initiatives like 'Make in India' along with R&D investments are further propelling the market growth in the country.

Central & South America Advanced Ceramics Market Trends

The advanced ceramics market in Central & South America is experiencing steady growth, fueled by factors, such as rapid industrialization, infrastructural development, and high adoption of advanced technologies, across various sectors. Countries in the region are witnessing rising product demand due to its superior properties like high strength, thermal stability, and chemical resistance, particularly in industries, such as electronics, automotive, healthcare, and energy.

The advanced ceramics market in Brazil will witness significant growth due to the country’s diverse industrial base, including manufacturing, aerospace, and oil & gas, which drives the demand for advanced ceramics. Moreover, its ambitious infrastructure projects and R&D investments further bolster growth prospects for the market.

Middle East & Africa Advanced Ceramics Market Trends

The advanced ceramics market in Middle East & Africais expected to witness significant growth over the forecast period. With the Middle East being a hub for oil & gas exploration and production activities, there is a growing demand for advanced ceramics in equipment and machinery due to their high-temperature resistance and wear properties. In addition, the healthcare sector in this region is experiencing rapid expansion, leading to increased demand for advanced ceramics in medical devices and implants.

The advanced ceramics market in Saudi Arabia is projected to have steady growth. Saudi Arabia stands out as a key player in the MEA advanced ceramics market, propelled by its significant investments in infrastructure projects, and initiatives like Vision 2030 aimed at diversifying the economy. Its thriving petrochemical industry, coupled with its focus on renewable energy projects, creates ample opportunities for the adoption of advanced ceramics in various applications.

Key Advanced Ceramics Company Insights

Some of the key players operating in the market include Kyocera Corp. and CoorsTek.

-

Kyocera Corp. is a multinational electronics and ceramics manufacturer based in Japan. Its advanced ceramics division offers a wide range of products, including cutting tools, industrial components, and electronic devices. Kyocera's advanced ceramics are known for their high quality, durability, and performance, making them a preferred choice in industries, such as automotive, aerospace, and medical

-

CoorsTek is a privately owned manufacturer of technical ceramics based in the U.S. It produces a diverse range of advanced ceramic products, including components for semiconductor manufacturing, medical devices, and industrial equipment

Nexceris and Admatec are some of the emerging market participants in the advanced ceramics market.

-

Nexceris is an advanced materials company dedicated to developing innovative ceramic technologies for energy, environmental, and industrial applications. Headquartered in the U.S., Nexceris specializes in the design and manufacture of ceramic-based products including solid oxide fuel cells, gas sensors, and catalysts. Leveraging its expertise in materials science and engineering, Nexceris aims to address critical challenges in clean energy and environmental sustainability

Key Advanced Ceramics Companies:

The following are the leading companies in the advanced ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AGC Ceramics Co., Ltd.

- CeramTec GmbH

- CoorsTek Inc.

- Elan Technology

- KYOCERA Corporation

- Morgan Advanced Materials

- Murata Manufacturing Co., Ltd.

- Nishimura Advanced Ceramics Co., Ltd.

- Ortech Advanced Ceramics

- Saint-Gobain

Recent Developments

-

In February 2023, MO SCI Corp., completed the acquisition of 3M's advanced materials business. This strategic move encompasses the transfer of more than 350 specialized pieces of equipment and associated intellectual property. By the fourth quarter of 2023, all acquired assets, including equipment and technology, will be fully integrated and operational at MO SCI Corp.'s headquarters in Rolla, Missouri

-

In June 2022, CoorsTek allocated more than USD 50 million towards the establishment of a cutting-edge advanced materials manufacturing campus spanning 230,000 square feet. This strategic investment aims to drive further innovation across multiple markets. The expansion represents a substantial commitment by CoorsTek to enhance its Benton facility, marking a pivotal milestone in the company's ongoing long-term investment strategy in Arkansas

Advanced Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 115.07 billion

Revenue forecast in 2030

USD 147.34 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; China; India; Brazil; Saudi Arabia

Key companies profiled

3M; AGC Ceramics Co., Ltd.; CeramTec GmbH; CoorsTek Inc.; Elan Technology; KYOCERA Corporation; Morgan Advanced Materials; Murata Manufacturing Co., Ltd.; Nishimura Advanced Ceramics Co., Ltd.; Ortech Advanced Ceramics; Saint-Gobain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Ceramics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global advanced ceramics market report based on material, product, application, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alumina

-

Titanate

-

Zirconate

-

Ferrite

-

Aluminum Nitride

-

Silicon Carbide

-

Silicon Nitride

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monolithic

-

Ceramic Coatings

-

Ceramic Matrix Composites (CMCs)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Equipment

-

Catalyst Supports

-

Electronic Devices

-

Wear Parts

-

Engine Parts

-

Filters

-

Bioceramic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric & Electronics

-

Automotive

-

Machinery

-

Environmental

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global advanced ceramics market size was estimated at USD 107.00 billion in 2023 and is expected to reach USD 115.07 billion in 2024.

b. The global advanced ceramics market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 147.34 billion by 2030.

b. Electronic devices was the key application segment of the market with a revenue share of above 47.0% in 2023. Increasing growth in wireless communication technologies is boosting segment growth.

b. Some of the key players operating in the advanced ceramics market are CoorsTek Inc., 3M, Saint-Gobain, KYOCERA Corporation, Nishimura Advanced Ceramics Co., Ltd, and CeramTec GmbH.

b. Growing inclination toward the adoption of lightweight materials that possess high-performance characteristics for applications in the semiconductors, medical, automotive, defense, and electronics industries is driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."