- Home

- »

- Automotive & Transportation

- »

-

Aerospace Engineering Services Outsourcing Market Size Report, 2025GVR Report cover

![Aerospace Engineering Services Outsourcing Market Size, Share & Trends Report]()

Aerospace Engineering Services Outsourcing Market Size, Share & Trends Analysis Report By Service (Design & Engineering, Manufacturing Support, Security & Certification, After-market Services), By Location, By Component, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-643-1

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Technology

Industry Insights

The global aerospace engineering services outsourcing market size was valued at USD 37.79 billion in 2018 and is expected to exhibit a CAGR of 25.9% from 2019 to 2025. ESO, short for engineering services outsourcing, continues to acquire a larger share in the world’s total demand for aerospace engineering services as the aerospace industry struggles with challenges such as cost pressures, shortage of skilled resources, and an aging workforce. Soon, aerospace companies are expected to outsource an increasing number and volume of designing- and manufacturing-related services to reduce their operational costs, among other factors. The increasing demand for aircraft and their reduced half-lives are likely to lead to a notable rise in aerospace ESO activities over the forecast period.

The aerospace industry has significantly progressed in terms of the increased use of innovative technologies and digital devices over the years. The consecutive rise in the need for specialized engineering skills and expertise, which can be difficult to acquire, retain, and internally develop, is expected to drive a growing need for ESO activities. The growth of the aerospace ESO industry is also facilitated by partnerships between OEMs and service providers for leveraging cost-effective access to domain-specific technical expertise and higher production capacities. For instance, in February 2019, Diehl Aviation signed a multi-year agreement with Altair Engineering, Inc., establishing the company as Diehl Aviation’s strategic computer-aided engineering supplier.

The need for specialized IT and core engineering services has witnessed a surge in the past decade. Thus, apart from traditional engineering proficiencies like drafting, modeling, and MRO of airplane parts, service providers are also focusing on other offerings such as designing, prototyping, simulation, testing, and system engineering for aerostructures and avionics. The trend is likely to remain strong soon as well.

Growth in the military and civil aviation sectors is anticipated to drive the market for aerospace ESO, attributed to the rise in air travel in emerging economies and heightened emphasis given on military expenditure. Favorable government initiatives and investments into R&D activities in this sector are driving the demand for aerospace ESO. Moreover, growing global competition, coupled with post-recession pressure, compel manufacturers to focus on ways of reducing production costs.

The aerospace domain also faces a shortage of appropriate skills, which require OEMs to avail the services of specialized Engineering Service Providers (ESPs) catering to the aviation sector. The aerospace manufacturing industry seeks to harness the expertise of specialized ESPs for improved product & process innovation, better design & development solutions, and flexible technical capacity. The total cost of training, which often constitutes a large portion of opportunity costs for a company, along with trainer and material costs, can prove to be prohibitive for companies. Since ESPs employ experienced, well-trained professionals, and take care of their training costs, aerospace OEMs can attain their objective of cost-cutting whilst ensuring that the desired engineering tasks are dealt with professionally.

Service Insights

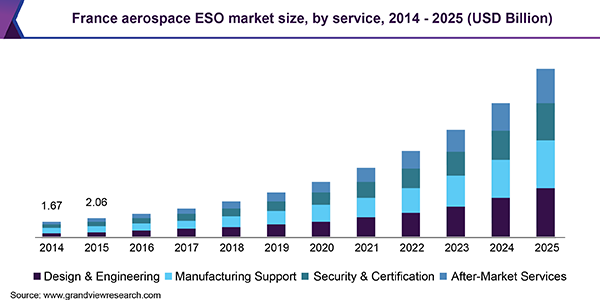

The four primary aerospace ESO services evaluated in the report comprise design & engineering, manufacturing support, security & certification, and after-market services. Of these, the manufacturing support ESO service segment accounted for the largest revenue share of more than 30% in 2018 and is anticipated to observe significant growth over the forecast period as well. Manufacturing support forms a vital element of the industry, providing digital manufacturing, component engineering, and tooling & fixture designing services to OEMs. The after-market ESO segment is also likely to demonstrate strong growth over the forecast period. The demand for ESO for after-market services is on the rise for various functionalities, the most important ones being maintenance, repair and overhaul services (MROs), augmented reality-based or virtual reality-based training, and asset tracking & management.

Vendors across the globe are increasingly focusing their efforts on capturing a larger revenue share by introducing new state-of-the-art processes and products. As a consequence of this, the design & engineering ESO segment is anticipated to witness the highest growth during the forecast period. Security & certification services are also expected to observe considerable growth from 2019 to 2025, with a projected CAGR of slightly over 25%. The upsurge in the growth prospects of this segment can be attributed to the rapidly changing safety regulations and airworthiness norms. Cyber resilience is an essential aspect in the aerospace industry to withstand and recover from any data breach or a cyber-attack.

Location Insights

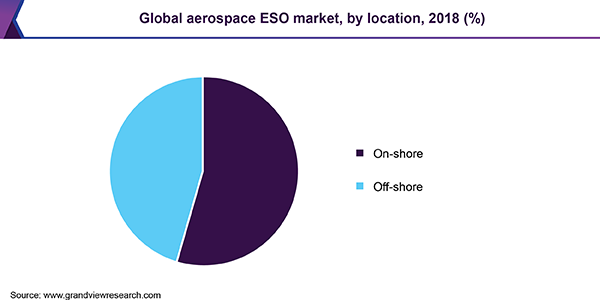

Based on location, the market for aerospace engineering services outsourcing has been segmented into on-shore and off-shore. The on-shore ESO segment dominated in 2018, accounting for close to 55% of the market. The segment is likely to retain its dominance and also expand at the fastest pace over the forecast period. On-shore engineering activities enable aerospace OEMs to collaborate with the service provider in their time zone and work within the same legal jurisdiction. This allows for easy and streamlined communication between the two firms, which, in turn, increases the efficiency of services outsourced.

Nevertheless, the off-shore ESO segment is also likely to witness strong growth opportunities. The demand for off-shore ESO has observed an increase due to the increasing confidence of aerospace OEMs in vendors based in developing nations such as India. Consequently, processes that involve an advanced level of technical know-how are gradually being outsourced to off-shore locations. Off-shoring of services leads to cost benefits, the fulfillment of offset obligations, and mitigation of currency risks.

Component Insights

Based on components, the market for aerospace ESO has been categorized into hardware and software. The hardware segment accounted for a larger revenue share in 2018 and is anticipated to assert its dominance over the forecast period. This can be attributed to the significant rise in the usage of electro-mechanical systems in the aerospace industry.

The software segment is anticipated to witness the highest growth from 2019 to 2025. This segment encompasses the software required for the Maintenance, Repair, and Overhaul (MRO) services; aviation software services; engineering software services; flight operation and schedule software services; and automation technology solutions. Software integration of contemporary technologies in the aviation sector plays a pivotal role in ensuring the smooth and efficient functioning of on-board aircraft systems, which is of utmost importance in this industry. Hence, the software segment is anticipated to witness a rapid growth to reduce the time spent on processes & vulnerabilities caused by a variety of processes in the aerospace ESO industry.

Regional Insights

The North America regional market for aerospace ESO accounted for the largest revenue share in 2018. A majority of well-established market players such as Honeywell International Inc. and Altair Engineering, Inc. are based in North America. The regional aerospace ESO market also has a higher revenue share owing to the early adoption of new technologies. The U.S. accounts for a substantial share of the software segment due to persistent developments in the IT sector and increasing deployment of IT services, data center systems, enterprise software, and communication systems in the region.

The European aerospace ESO market was valued at over USD 10 billion in 2018. The demand for outsourcing of aerospace engineering services in European countries is anticipated to be sluggish over the forecast period. This slow growth pace can be attributed to market saturation, fierce competition, and challenging economic conditions. Within Europe, Germany is expected to witness considerable growth from 2019 till 2025.

Asia Pacific is anticipated to emerge as the fastest-growing aerospace ESO regional market over the forecast period owing to the increasing number of collaborations between the OEMs and service providers. The number of such collaborations is likely to substantially grow soon due to the high availability of low-cost, high-skilled labor in the region. South America and Middle East & Africa regions are anticipated to register considerable growth from 2019 to 2025.

Aerospace Engineering Services Outsourcing Market Share Insights

Aerospace ESO is a dynamic market and faces several multi-faceted challenges such as growing operating costs, rising number of stringent environmental regulations, and a decrease in revenue-per-person. Intense competition among key players in the aerospace ESO industry has now shifted their focus to cost-effectiveness, innovation, and ESO. OEMs are focusing on green aviation, optimization of engine designs, and additive manufacturing. Advanced technologies such as structural health monitoring and blockchain infrastructure have also made their foray into the industry. The ensuing modernizations can improve the efficacy and security of the supply chain, enrich data integrity, and reduce risks.

To address the growing environmental concerns, manufacturing organizations are expected to focus more on investments in green technology. For instance, the U.K.-based technology start-up Samad Aerospace Ltd. is developing Starling Jet. This is a Vertical Take-Off and Landing (VTOL) hybrid-electric propulsion aircraft for commuting. Such trends are expected to increasingly encourage aerospace OEMs to invest in ESO. Some of the leading players in the market for aerospace ESO are Honeywell International Inc., LISI Group, ALTRAN, Bertrandt, AKKA, Altair Engineering, Inc., Alten Group, L&T Technology Services Limited, Safran, and QuEST Global Services Pte. Ltd.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Billion and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, South America, Middle East & Africa (MEA)

Country scope

U.S., Canada, Mexico, France, Germany, China, Japan, India, and Brazil

Report coverage

Revenue forecasts, company market share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the reportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global aerospace engineering services outsourcing market report based on service, location, component, and region:

-

Service Outlook (USD Billion, 2014 - 2025)

-

Design & Engineering

-

Manufacturing Support

-

Security & Certification

-

After-market Services

-

-

Location Outlook (USD Billion, 2014 - 2025)

-

On-shore

-

Off-shore

-

-

Component Outlook (USD Billion, 2014 - 2025)

-

Hardware

-

Software

-

-

Regional Outlook (USD Billion, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."