- Home

- »

- Advanced Interior Materials

- »

-

Air Conditioning Systems Market Size & Share Report, 2030GVR Report cover

![Air Conditioning Systems Market Size, Share & Trends Report]()

Air Conditioning Systems Market Size, Share & Trends Analysis Report By Type (Unitary, Rooftop, PTAC), By Technology (Inverter, Non-Inverter), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-528-1

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Air Conditioning Systems Market Trends

The global air conditioning systems market size was valued at USD 119.36 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The spread of the COVID-19 pandemic negatively impacted the demand for air conditioners in 2020 owing to decreased consumer spending. However, the market experienced a resurgence in 2021, achieving a steady and robust growth trajectory, propelled by shifting climate patterns and an increasing need within the realm of commercial construction. Additionally, consumers’ growing inclination toward convenience and comfort is expected to upkeep the demand for air conditioners over the forecast period.

Air conditioning systems are ubiquitous with applications ranging from homes, shopping centers, and commercial spaces to entertainment centers. In developing nations, AC is still a sought-after product; however, the affordability of environmentally optimized products is still a huge challenge. Air conditioning systems have played a pivotal role in transforming the indoor environment, particularly in hot and arid areas, becoming an important part of the infrastructure that supports modern spaces. Further, as economic growth in emerging markets continues to surge, the demand for AC is anticipated to witness bullish growth over the next few years.

The market is also expected to be driven by factors such as the promising growth of the construction and tourism industries. The increasing disposable incomes of individuals across the globe are also expected to encourage the uptake of a variety of air conditioning systems over the forecast period. Additionally, factors like the growing inclination of consumers toward energy-efficient systems and the growing popularity of portable systems are also expected to benefit the air conditioning systems market growth.

The rising population, which is anticipated to positively influence the residential and commercial constructions is also expected to increase demand for air conditioning systems. For instance, the rising population in Gulf countries is anticipated to contribute significantly to construction spending in GCC countries. The regional population is estimated to reach over 600 million by 2050 from 350 million in 2015. This is likely to propel growth in construction activities in the infrastructure and building sector, particularly education, housing, and healthcare infrastructure, to support communities.

Governments of various countries are focusing on efficient air conditioning. For instance, in February 2019, Energy Efficiency Services Limited (EESL), a joint venture of four Public Sector Enterprises under the administrative control of the Ministry of Power, Government of India, announced the launch of the Super-Efficient Air Conditioning program. The program is aimed at promoting the use of energy-efficient technologies and bringing about a reduction in energy consumption. Through this program, the Ministry of Power in India also aims to address India’s Hydrochlorofluro carbons Phase-out Management Plan and Cooling Action Plan by 2032.

Type Insights

The unitary segment accounted for the largest revenue share of 41.3.% in 2022 and is expected to grow at the fastest CAGR of 9.5% during the forecast period. Unitary air conditioners are predominantly used in households. Therefore, the increasing demand from the growing residential sector is expected to upkeep the demand for unitary air conditioning systems. Additionally, a unitary AC can be easily paired with the warm furnaces in the same ductwork in both commercial and residential buildings which is estimated to boost the segment growth.

Apart from unitary ACs, the type segment also includes Packaged Terminal Air conditioners (PTAC) and rooftop ACs. The PTAC segment is expected to witness a healthy CAGR of 5.6% from 2023 to 2030. The growth of package terminal air conditioners is attributed to their increasing adoption in the hospitality and residential sectors. PTACs are also gaining traction owing to technological advancements such as the use of inverter technology, energy-efficient systems, and wireless connectivity.

Technology Insights

The inverter segment accounted for the largest revenue share of around 67.6% in 2022 and is expected to grow at the fastest CAGR of 8.4% over the forecast period. This growth is attributable to inverter AC’s ability to control the speed of the compressor motor which helps in the continuous regulation of temperature. It also helps in saving energy and power with the help of a variable speed compressor. Additionally, other benefits such as no temperature fluctuations, longer durability, faster cooling, and reduced noise in comparison with non-inverter ACs are expected to fuel the demand for inverter technology.

The non-inverter segment is expected to witness moderate growth as compared to its counterpart. This can be attributed to various factors such as high energy consumption, fluctuating frequencies, and less lifespan. However, the low cost of these air conditioning systems could help the segment improve its hold on the market.

End-use Insights

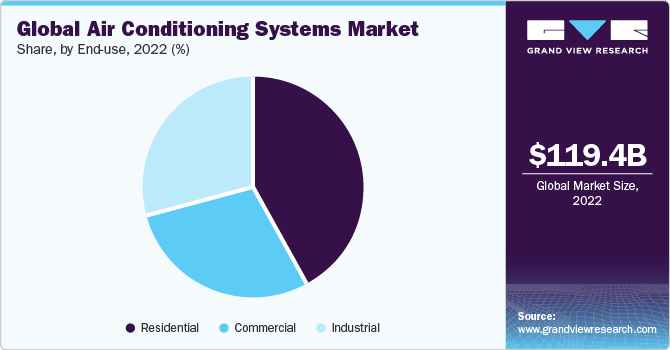

The residential segment held the largest revenue share of 42.0% in 2022 and is expected to grow at the fastest CAGR of 9.2% over the forecast period. Climate change has resulted in increased temperatures across several countries in recent years. Increasing temperatures have rendered air conditioning systems more of a necessity than a luxury. Therefore, customers across the globe are installing air conditioning systems in their homes; this trend is expected to grow as the earth’s temperature rises even more in the future. Owing to the changing climatic conditions, residential ACs are projected to record healthy growth over the forecast period.

The commercial segment is anticipated to register a CAGR of 5.7% over the forecast period owing to rapid urbanization and rising demand for commercial space. Commercial AC units require a significant amount of space and are generally located on the rooftops of buildings such as hotels, shopping malls, commercial offices, theaters, and big restaurants accounting for the optimum energy consumption. Hence, retrofitting and replacement of these units to minimize energy consumption is expected to elevate the adoption of AC across the commercial segment.

Regional Insights

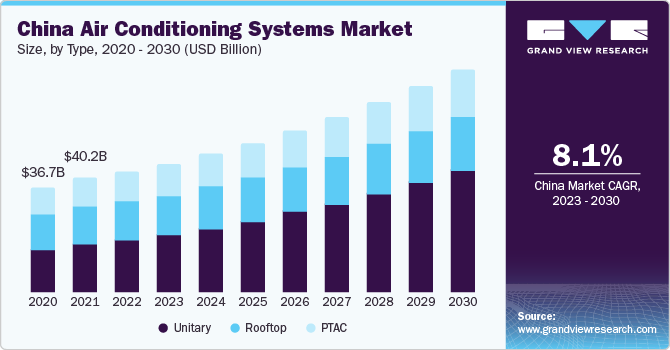

Asia Pacific dominated the market and accounted for the largest revenue share of 61.4% in 2022 and is expected to grow at the fastest CAGR of 7.7% during the forecast period. Rapid urbanization, infrastructure development, increasing disposable income and middle-class population are some of the major factors contributing to the positive outlook of the air conditioning systems market in the Asia Pacific region. The Asia Pacific region is experiencing rapid urbanization, leading to the construction of new residential and commercial buildings. The growing need for air conditioning systems in these buildings drives the demand for air conditioning units in the market.

North America accounted for over 19.8% of the overall revenue share of the market in 2022. The North American market along with other developed markets around the world is expected to witness growth primarily powered by replacement sales. Additionally, rising promotional activities from the government to increase the adoption of energy-efficient air conditioning systems to reduce energy consumption is also expected to fuel the growth of the regional market. Even though the overall market slumped due to the spread of the COVID-19 pandemic, North America and Europe recorded flat growth in 2020 and were not impacted as negatively as the rest of the world. This is attributed to the strong demand in the last quarter of 2020 in both regions.

Middle East & Africa is expected to grow at the second fastest CAGR of 6.2% during the forecast period. This notable surge can be attributed to significant global events like the Qatar FIFA World Cup 2022, prompting the development of numerous outdoor football stadiums equipped with air-conditioning facilities. The establishment of these cooled football arenas has in turn generated heightened demand for air conditioning across the region.

Key Companies & Market Share Insights

The market is characterized by intense competition due to the presence of numerous well-established global players. Some of the leading players in the market are DAIKIN INDUSTRIES, Ltd., Carrier, JOHNSON CONTROLS - HITACHI AIR CONDITIONING COMPANY, Whirlpool, Mitsubishi Electric Corporation, and Trane Technologies plc. These market players particularly focus on inorganic growth strategies such as mergers and acquisitions and joint ventures/collaborations to enhance their market presence. For instance, in June 2021, Carrier announced the acquisition of a controlling stake in Guangdong Giwee Group (Giwee Group). The acquisition was aimed at expanding Carrier’s geographic footprint to enhance its market position. In addition to acquisitions, major players in the market also indulge in collaborations with local players to increase their products’ reach. For instance, in June 2020, Daikin Industries, Ltd. announced the establishment of a joint venture with WASSHA Inc. The joint venture developed a new company, Baridi Inc., to provide air conditioning systems on a subscription basis for the people of the United Republic of Tanzania.

Key Air Conditioning Systems Companies:

- ALFA LAVAL

- BSH Hausgeräte GmbH

- Carrier

- DAIKIN INDUSTRIES, Ltd.

- Electrolux AB Corporation

- Haier Inc.

- Trane Technologies plc

- JOHNSON CONTROLS - HITACHI AIR CONDITIONING COMPANY

- Mitsubishi Electric Corporation

- Whirlpool

Recent Developments

-

In January 2022, LG Electronics U.S. unveiled its extensive range of commercial, light commercial, and residential HVAC solutions at the 2022 AHR Expo held in Las Vegas. This showcase demonstrated LG's strong and comprehensive lineup of HVAC offerings for various market segments

-

In March 2022, Voltas, Inc., a leading player in the HVAC industry, introduced its latest offering, the PureAir Inverter AC. This new range of air conditioners features advanced technologies such as HEPA Filter technology, PM 1.0 Sensor, and AQI Indicator, enhancing indoor air quality and comfort for consumers. The launch of the PureAir Inverter AC further strengthens Voltas' portfolio of cooling products and home appliances

-

In February 2023, Godrej Appliances, which is a division of Godrej & Boyce and holds the position of being the flagship company within the esteemed Godrej Group, unveiled India's inaugural leak-proof split air conditioner, showcasing an innovative inclusion of anti-leak technology. This strategic integration of anti-leak technology underscores the company's commitment to elevating user experience while establishing an unparalleled value proposition within the air conditioning domain

Air Conditioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 125.99 billion

Revenue forecast in 2030

USD 200.72 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion, Volume in thousand units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Brazil; Mexico

Key companies profiled

ALFA LAVAL; BSH Hausgeräte GmbH; Carrier; DAIKIN INDUSTRIES, Ltd.; Electrolux AB Corporation; Haier Inc.; Trane Technologies plc; JOHNSON CONTROLS - HITACHI AIR CONDITIONING COMPANY; Mitsubishi Electric Corporation; Whirlpool

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Conditioning Systems Market Report Segmentation

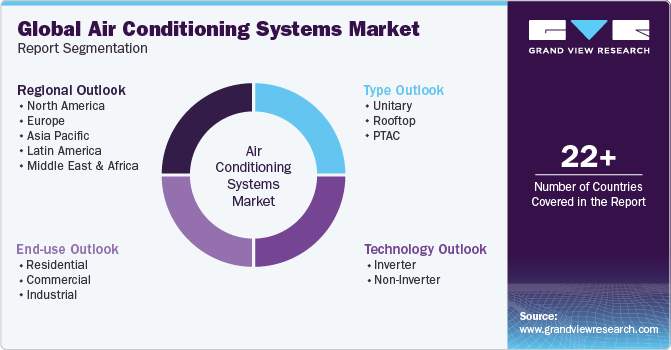

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global air conditioning systems market on the basis of type, technology, end-use, and region:

-

Type Outlook (Revenue, USD Billion; Volume, Thousand Units, 2018 - 2030)

-

Unitary

-

Rooftop

-

PTAC

-

-

Technology Outlook (Revenue, USD Billion; Volume, Thousand Units, 2018 - 2030)

-

Inverter

-

Non-Inverter

-

-

End-use Outlook (Revenue, USD Billion; Volume, Thousand Units, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion; Volume, Thousand Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global air conditioning systems market size was estimated at USD 119.36 billion in 2022 and is expected to reach USD 125.99 billion by 2023.

b. The air conditioning systems market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 200.72 billion by 2030.

b. Inverter segment dominated the air conditioning systems market with a share of 67.6% in 2022. This is attributable to rising awareness regarding the need to adopt energy-efficient air conditioning systems and the growing replacement of conventional air conditioners with inverter air conditioners.

b. Some key players operating in the air conditioning systems market include Carrier Corporation, BSH Hausgerate GmbH, Daikin Industries, Ltd., Haier Inc., Ingrasoll-Rand plc., Hitachi Ltd, Mitsubishi Electric, Whirlpool Corporation, and Haier Inc.

b. Key factors that are driving the air conditioning systems market growth include the rising demand from Asia-Pacific region; and rising number of hospitals, hotels, individual clinics, auditoriums, and multiplexes across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."