- Home

- »

- Advanced Interior Materials

- »

-

Aircraft Mounts Market Size, Share & Growth Report, 2020-2027GVR Report cover

![Aircraft Mounts Market Size, Share & Trends Report]()

Aircraft Mounts Market Size, Share & Trends Analysis Report By Aircraft Type (Military, Commercial, General Aviation), By Mount Type (External, Internal), By Application, By End Use, By Region, And Segment Forecast, 2020 - 2027

- Report ID: GVR-4-68038-498-7

- Number of Pages: 143

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

The global aircraft mounts market size was valued at USD 606.0 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2020 to 2027. Increasing demand for safety and comfort in airplanes is anticipated to drive the demand over the forecast period. Moreover, the increasing production of commercial aircraft and repair and maintenance of the same is likely to fuel market growth.

The rise in the number of military-grade aircraft including choppers, helicopters, jets, and specialty fighter aircraft to enhance the air forces is expected to create scope for the increasing demand for mounts. Installation of high-grade machinery in specialty aircraft is likely to positively influence the growth of the market.

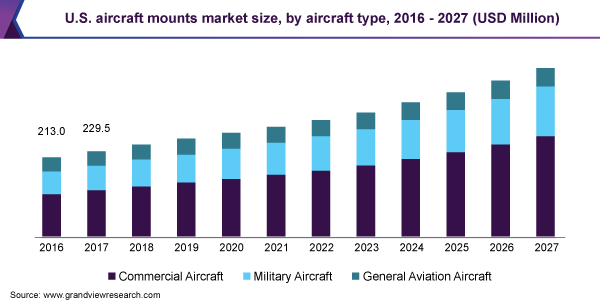

In the U.S., the commercial aircraft segment emerged as the leading type for mount installation. The well-established aviation industry in the country coupled with the rise in the number of passengers traveling domestic and international are likely to increase the demand for commercial flights, thus supporting the market growth.

Growing military services across the globe in light of strengthening the defense system are expected to fuel the demand for specialty fighter jets, choppers, and military-grade air careers. Furthermore, innovation in specialty war equipment installed in war aircraft needs customized mounts, thus they are expected to influence the market positively.

An increasing number of international travelers across the globe owing to the rise in the tourism industry has surged the aviation sector. Moreover, passengers’ preference for comfort and safety during flights has compelled the airlines to provide enhanced services, thus are supporting the market growth.

The ongoing COVID-19 pandemic has severely impacted the world economy and has affected the tourism and aviation industry. The aerospace manufacturing industry has halted the production of most of its orders and is expected to resume the operations by the 2nd quarter of the year. Thus, the market is anticipated to regain momentum in the upcoming period.

Application Insights

The engine mounts application segment in the aircraft mounts market accounted for the largest revenue share of 52.4% in 2019 and is likely to ascend at a CAGR of 7.9% until 2027. Increasing production of commercial and military-grade aircraft in light of a rise in air traffic for and defense activities across the major economies is expected to support the demand in the estimated time.

Timely maintenance and scheduled services and replacement of the aircraft components are expected to augment the demand for these mounts. Moreover, the engine mounts lose their stability over a period owing to high vibrations in the compartments, thus needing a periodic replacement of the mounts.

Suspensions are the essential components installed in the aircraft to absorb the shocks created by the moving parts. These suspensions also bear a high load of the components along with the shock-absorbing mechanisms, thus losing some durability over a particular span of usage. Thereby, is anticipated to witness high demand in replacement operations of the aircraft.

Vibration and shock isolation components are installed along with the suspensions in aircraft for the smooth functioning of the movable components. The rise in the demand for the shockproof mechanism coupled with the introduction of advanced components for shock absorption is expected to support the market growth during the forecast period.

Aircraft Type Insights

In 2019, the commercial aircraft segment accounted for the largest consumption of mounts with a revenue share of over 60% 2019 and is anticipated to ascend at the highest CAGR of 8.8% over the forecast period. The rise in the number of international passengers along with a growing need for comfort and safety is likely to fuel the growth of the segment in the forthcoming years.

Prominent airline service providers across the globe are focusing on offering comfortable flights with enhanced storage and modern equipment, thus, the aerospace manufacturers are engaged in providing enhanced mounts. Major manufacturers including Airbus and Boeing are covering up the pending orders for commercial aircraft, which in turn is likely to affect the market positively.

The strengthening of defense systems in major economies has flourished the air force divisions and has raised the demand for specialty fighter planes, choppers, jets, and others. The growing need for specialty and customized mounts in military aircraft is expected to support the market growth in the projected duration.

General aviation type accounted for a substantial share in the consumption of the amounts owing to the installation of specialty and premium components. The segment is inclusive of chartered planes, private jets, and premium aircraft & helicopters. The rise in the number of private jets is likely to ascend the market in near future.

Mount Type Insights

External mounts accounted for the largest revenue share of 85.8% in 2019 and the segment is expected to dominate the market over the forecast period. The external mounts are installed for enhancement in the passenger cabins and storage space along with enhancements in seating structures in the commercial and general aviation.

External mounts are inclusive of pedestal mounts, multiplane, shock, platform, sandwich mounts, and others. The provision of modern storage spaces in the aircraft cabin and seating comfort to passengers are the factors for the installation of the majority of the external mounts in the commercial segment.

The internal mounts segment is expected to witness growth in the estimated time on account of the provision of safeguarding the engine and other component installation. Moreover, the internal mounts are installed to the reduction in vibrations and shock in the aircraft while take-off and landing activities.

Safety measures for essential components in airplanes are likely to support the industry growth over the forecast period. The internal mounts need frequent services and replacement on fix intervals owing to the smooth functioning of the said components in planes. Furthermore, the segment is expected to ascend with an increase in the number of commercial flights.

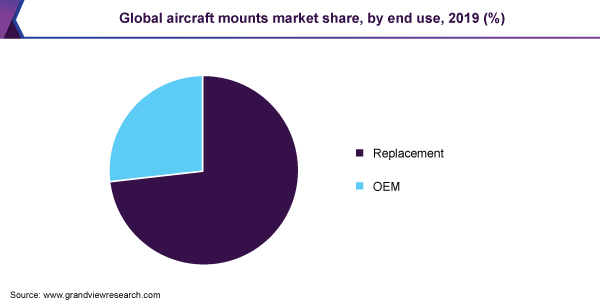

End-use Insights

In 2019, replacement end-use for the aircraft mounts accounted for the largest revenue share of 73.2% and is anticipated to ascend at a CAGR of 8.9% over the forecast period. Growing repair and maintenance of commercial aircraft to ensure passenger safety is anticipated to ascend the market over the forecast period.

Scheduled periodic maintenance of commercial planes and military-grade aircraft to ensure the components are intact with the respective operations are anticipated to upscale the market. Moreover, the engine mounts and suspension blocks in the aircraft need a fixed replacement over a certain period, thus influencing the replacement of such mounts.

Original Equipment Manufacturers (OEM) of mounting products engage in manufacturing applications as the mounts are pre-installed in the crafts. The rise in the production of aircraft of all sizes and categories is anticipated to accelerate the demand for the products in the estimated time until 2027.

Procurement orders for military-grade choppers, fighter jets, and large size commercial planes from major economies and airlines are likely to support the manufacturing of new aircraft, and thus are likely to influence the product demand from the original equipment manufacturer. Moreover, premium and private aircraft orders are expected to augment growth.

Regional Insights

North America dominated the market in 2019 with a revenue share of 45.3%. The well-established aviation industry coupled with cheap air travel and a wide presence of airline service providers in the region has flourished the growth. Furthermore, the growing defense sector in the region, prominently in the U.S. has surged the regional demand.

The U.S. was the largest consumer in the region in 2019 and is expected to maintain dominance over the forecast period. The rise in the number of foreign travelers along with the well-established tourism sector has supported the market. However, the ongoing COVID-19 outburst in the country has severely impacted aviation and tourism, thus hampering the market expansion.

The demand for external mounts in Europe accounted for a revenue share of 86.5% in 2019 and is expected to exhibit growth until 2027. The presence of prominent aircraft manufacturers in the region and enhanced manufacturing capabilities in Russia, France, Spain, the U.K., and Germany are likely to provide growth opportunities to the market.

Asia Pacific aerospace industry is projected to witness an upward trend in the estimated time owing to an increasing number of commercial flights for domestic and overseas travel. Moreover, the growing tourism industry in the region, specifically in South East Asia is projected to attract international visitors, this is anticipated to increase the demand for commercial planes and have a positive impact on the growth of the market.

Key Companies & Market Share Insights

Market competition among the players is based on product quality, durability, price, and resistance to shock. Moreover, players are focusing on the introduction of mounting components with high load-bearing capacity and enhanced durability. Players are focusing on the installation and design structure of the mounts. Moreover, these players are investing heavily in R&D activities for raw materials. Composites and alloys are gaining traction for mount production to reduce the overall weight of the aircraft. Moreover, mergers & acquisition and third-party manufacturing is considered for market competition. Some of the prominent players in the aircraft mounts market include:

-

Lord Corporation

-

AirLoc Ltd.

-

Hutchinson Aerospace GmbH

-

Trelleborg AB

-

GMT Rubber

-

Cadence Aerospace LLC

Aircraft Mounts Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 647.0 million

Revenue forecast in 2027

USD 1.1 billion

Growth Rate

CAGR of 7.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aircraft type, mount type; application; end use; region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Lord Corporation; AirLoc Ltd.; Hutchinson Aerospace GmbH; Trelleborg AB; GMT Rubber; Cadence Aerospace LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global aircraft mounts market report on the basis of aircraft type, mount type, application, end use, and region:

-

Aircraft Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Military

-

Commercial

-

General Aviation

-

-

Mount Type Outlook (Revenue, USD Million, 2016 - 2027)

-

External

-

Internal

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Suspension

-

Vibration/ Shock Isolation

-

Engine Mounts

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Replacement

-

OEM

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."