- Home

- »

- Alcohol & Tobacco

- »

-

Global Alcoholic Drinks Market Share Report, 2028GVR Report cover

![Alcoholic Drinks Market Size, Share & Trends Report]()

Alcoholic Drinks Market Size, Share & Trends Analysis Report By Type (Beer, Spirits, Wine, Cider, Perry & Rice Wine, Hard Seltzer), By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-925-3

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global alcoholic drinks market size was valued at USD 1,448.2 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2022 to 2028. This can be credited to the growing consumption of premium beer from developed economies such as the U.S. and the U.K. The growing demand for beer, wine, and dark spirits is enhancing the sales of alcoholic beverages. Moreover, the rising popularity of pubs, bars, and restaurants is further anticipated to boost market growth during the forecast period. The growing acceptance of the striking flavors of beers to aid the digestive system is the major factor driving the industry.

Moreover, the rising demand for artisanal spirits in developing economies such as China and India is anticipated to boost the growth of the market for alcoholic drinks. Rising demand to procure value-added hard seltzer products at an affordable cost is the upcoming opportunity for the market. However, the rising inclination to consume non-alcoholic beverages is hindering the market growth. At present, key players are focusing to launch cordials and liquors with lower alcoholic content to maintain human health.

During the financial year 2020 - 2021, the coronavirus disease had affected the globe to a larger extent. The supply chain of the market had slightly hindered during the COVID-19 era. The distribution channels such as liquor stores, grocery shops, and supermarkets were hampered due to the lockdown imposed by several governments across the globe. During the COVID-19 pandemic, the demand for beer and dark spirits increased. The key players in the market for alcoholic drinks are evaluating internet retailing from the e-commerce platform to improve the sales statistics of the market. This kind of process was expanding the commercial opportunity of the alcoholic beverages product, which, in turn, can propel market growth.

Growing investment from the U.K.-based prime players to procure high-quality Scotch whisky products is refueling market growth. The major key players are procuring superior quality cider, perry, and rice wine. The rapidly growing demand for lower calorie-based beer supplements from U.S. consumers is further driving industry growth. Moreover, the rising demand to procure value-added hard seltzer products at an affordable cost is an upcoming opportunity for the market. Hence, the market for alcoholic drinks is expected to perform well during the forecast period.

The rising inclination to consume non-alcoholic beverages is hindering market growth. Moreover, to start any new business in the alcoholic drinks industry vendors need to invest a huge amount of capital and resources, and take legal certifications from the government. Therefore, all the above factors may take a huge amount of processing time which is further limiting the growth of the market for alcoholic drinks. In addition, increasing health-conscious consumers are going to restrict the overall market growth during the forecast period. At present, key players are focusing to launch cordials and liquors with lower alcoholic content to maintain human health; this is an ongoing trend to increase the consumer base in the market. Moreover, key players such as the Asahi brand use the strategy of giving beer for every twenty-bottle order by asking liquor stores, known as the "Quarter Strategy", to spread their market share as much as possible.

Type Insights

The beer segment accounted for the highest revenue share of over 37.0% in 2021. The segment offers a great variety of ale, German-style altbier, and the ordinary bitter special type of beer. The growing adoption of California common beer is expected to escalate the market growth in the forthcoming years. The rising demand for Belgian-style Flanders to provide B-group vitamins will further enhance the sales of the beer segment during the forecast period.

The wine segment accounted for the 2nd highest revenue share of more than 23.0% in 2021. Wine has multiple health benefits; it provides antioxidants to promote longevity, which is a major factor surging segment growth. Also, wine can help protect against harmful inflammation and heart disease to promote health. Furthermore, red wine has a higher level of antioxidants to lower the risk of heart disease and prevent coronary artery disease; these are the factors contributing to the growth of the wine segment during the forecast period.

The hard seltzer segment is expected to witness register the highest growth rate in the market for alcoholic drinks during the forecast period. This can be credited to the growing demand for arctic chill ginger-lime hard seltzer in Europe. The bud light seltzer strawberry is one of the rising trends in the U.S. to fulfill the demand for fruit-flavored alcoholic beverages. The orange guava hard seltzer will raise the sales of the spirits segment during the assessment period.

Distribution Channel Insights

The liquor stores segment accounted for a revenue share of more than 28.0% in 2021. The rapid urbanization in the emerging economies will build the interconnecting channel of liquor stores. The growing drift of the consumers to adopt western culture is expected to boost the growth of the market for alcoholic drinks. The domestic liquor stores are supplying a diversified portfolio of alcoholic beverages at a lower cost which will turn to boost the segmental growth. Supportive measures taken by several governments across the world to minimize the complexity of liquor licenses will propel market growth.

The pub, bars, and restaurants segment accounted for a revenue share of more than 18.0% in 2021. The increasing trend among the young population to spend more time in pubs, bars, and restaurants is one of the major factors increasing the sales of alcoholic drinks in this segment. Further, the growing development of restaurants and bars in developed countries is accelerating the growth of alcoholic drinks sales in pubs, bars, and restaurants segment during the forecast period.

The internet retailing segment is projected to register the fastest growth during the forecast timeline. This can be credited to the increased focus of suppliers to implement the advanced e-commerce trade technology. Internet retailing is providing a door-step liquor delivery. The market growth is owing to the increasing demand for super-premium wine products through an e-commerce portal. The compassionate measures taken by private firms in the U.S. to accomplish the demand for alcoholic beverages through an e-commerce portal are propelling the market growth.

Regional Insights

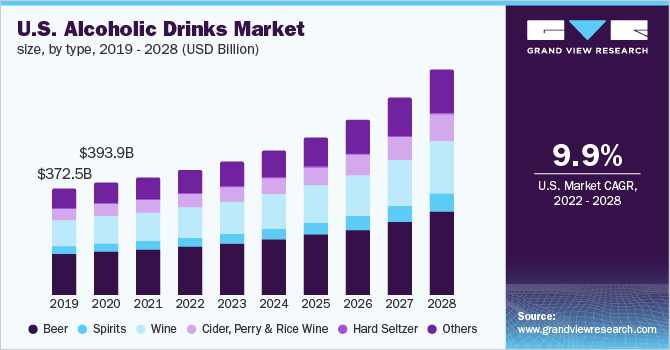

North America dominated the alcoholic drinks market and accounted for a revenue share of over 33.0% in 2021 due to the increasing demand for polished malt scotch whiskey in the U.S. and Canada. The rising trend in the U.S. to adopt classic brands of alcoholic beverages such as Arnold Palmer Spiked Half & Half, Bergenbier, and Burgasko will help to boost the market growth. Moreover, the funding provided by private firms in Canada to procure premium alcoholic beverages is anticipated to amplify the market growth.

In the Asia Pacific, the market for alcoholic drinks is projected to witness a CAGR of 11.1% from 2022 to 2028. This can be attributed to the increasing demand for agave-based spirits from emerging economies such as China and India to accomplish the demand for alcoholic beverages. The emerging trend in India to consume the local spirits such as black label, VAT69, and the McDowells whiskey is propelling the market growth. The growing adoption of beer, gin, and tequila flavors in China is estimated to showcase the fastest growth rate during the forecast period.

In Europe, the market for alcoholic drinks is projected to witness the 2nd fastest CAGR of 10.4% from 2022 to 2028. Europe is the major producer and consumer of alcoholic drinks in the world. The major key players namely Carlsberg A/S, Diageo Plc, and Anheuser-Busch InBev SA/NV are using various marketing strategies to remain competitive in the market. This majorly contributes to the growth of the market for alcoholic drinks in Europe.

Key Companies & Market Share Insights

Companies are mainly focused on launching old-aged rum products to meet the increasing demand for alcoholic drinks. The prime key players are focusing on maintaining the bizarre taste of alcoholic beverages. However, implementing e-commerce sales methodologies has its unique challenges and limitations. Multiple companies are targeting the expansion and launch of premium beer products in the market for alcoholic drinks. For instance, in June 2020, Asahi officially occupied the Carlton and United Breweries, Australia’s biggest brewer. The acquisition of Asahi and Carlton and United Breweries will now offer Asahi Beverages’ customers a range of wonderful tasting beverages with the addition of Australia’s most popular and highly enjoyed beer brands.

Furthermore, in May 2020, Pernod Ricard announced a partnership with the United Nations’ EducateAll platform, to provide free sustainable and affordable bartending training through online platforms. The online courses are available to all legal-drinking-aged adults through the mobile learning platform, namely EdApp. This mobile platform is an initiative of EducateAll in collaboration with the United Nations Institute for Training and Research (UNITAR). The joint initiative of UNITAR and EdApp has created a free global course library and is already hosting approximately 50,000 lessons daily. Some of the prominent players in the alcoholic drinks market include:

-

Anheuser-Busch InBev SA/NV

-

Bacardi Limited

-

Beam Suntory Inc.

-

Constellation Brands Inc.

-

Diageo Plc

-

Molson Coors Brewing Co.

-

Pernod Ricard SA

-

United Spirits Ltd.

-

Asahi Breweries Ltd.

-

Carlsberg A/S

Alcoholic Drinks Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1546.6 billion

Revenue forecast in 2028

USD 2877.2 billion

Growth Rate

CAGR of 10.3% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K; Germany; France; Italy; Russia; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Anheuser-Busch InBev SA/NV; Bacardi Limited; Beam Suntory Inc.; Constellation Brands Inc.; Diageo Plc; Molson Coors Brewing Co.; Pernod Ricard SA; United Spirits Ltd.; Asahi Breweries Ltd.; Carlsberg A/S

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global alcoholic drinks market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Beer

-

Spirits

-

Wine

-

Cider, Perry & Rice Wine

-

Hard Seltzer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Pub, Bars & Restaurants

-

Internet Retailing

-

Liquor Stores

-

Grocery Shops

-

Supermarkets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Italy

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Central & South America

-

Brazil

-

Argentina

-

Rest of Central & South America

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global alcoholic drinks market size was estimated at USD 1,448.18 billion in 2021 and is expected to reach USD 1,546.6 billion in 2022.

b. The global alcoholic drinks market is expected to grow at a compound annual growth rate of 10.3% from 2022 to 2028 to reach USD 2,877.2 billion by 2028.

b. North America dominated the alcoholic drinks market with a share of 33.8% in 2021. This is attributable to the growing consumption of premium beer, and the rising popularity of pubs, bars & restaurants in the tourism sector.

b. Some key players operating in the alcoholic drinks market include Anheuser-Busch InBev SA/NV; Bacardi Limited; Beam Suntory Inc; Constellation Brands Inc; Diageo Plc; Molson Coors Brewing Co.; Pernod Ricard SA; United Spirits Ltd; Asahi Breweries Ltd.; and Carlsberg A/S.

b. Key factors that are driving the alcoholic drinks market growth include the growing acceptance of the striking flavors of beers to aid the digestive system, the rising demand for artisanal spirits in developing economies, and the rising popularity of pubs, bars & restaurants in the tourism sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."