- Home

- »

- Next Generation Technologies

- »

-

Alternative Data Market Size, Share & Growth Report, 2030GVR Report cover

![Alternative Data Market Size, Share, & Trends Report]()

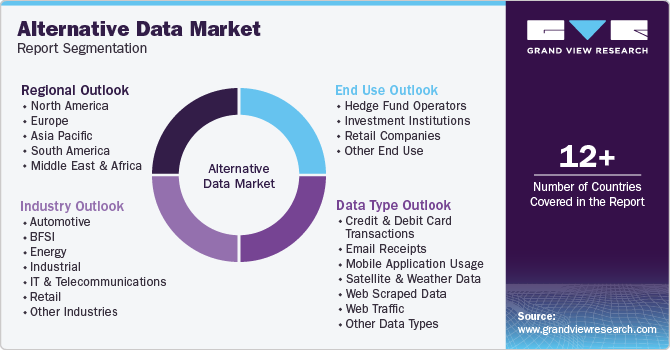

Alternative Data Market Size, Share, & Trends Analysis By Data Type (Credit & Debit Card Transactions, Mobile Application Usage, Social & Sentiment Data), By Industry, By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-025-9

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2017 - 2023

- Industry: Technology

Alternative Data Market Size & Trends

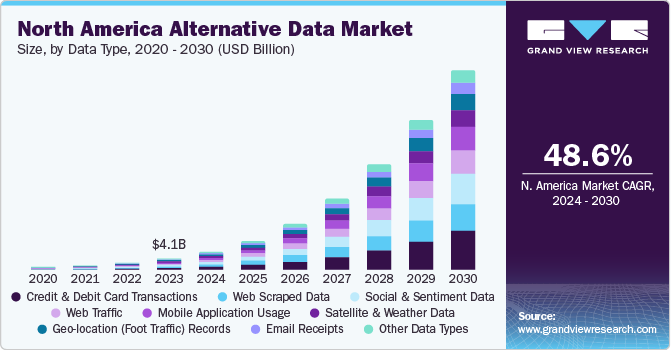

The global alternative data market size was valued at USD 7.20 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 50.6% from 2024 to 2030. The key drivers attributed to market expansion include the significant increase in the types of alternative information sources over the last decade. While web scraping and financial transactions are the most common sources, the emerging sources, including mobile devices, social media, satellites, sensors, IoT-enabled devices, and others, are gaining wider popularity. As such, the companies are actively expanding their offering by gathering information from all such sources.

The rising demand from hedge funds is expected to boost market growth significantly. More than half of hedge fund managers are now using it to gain a competitive edge by generating outperformance and supporting the risk management processes. More than 400 companies are engaged in selling alternative data to hedge funds, thereby contributing significantly to market revenue. Alternative data refers to the undiscovered which is not within the traditional sources such as SEC filings, financial statements, press releases, and management presentations. It is compiled from various sources such as e-commerce portals, public records, social media, financial transactions, web traffic, mobile devices, sensors, satellites, etc.

Applying specific analytics to this compiled set yields additional insights that were previously unknown, and are used by investors to evaluate investment opportunities. As this new information is a crucial differentiator that contributes to the alpha (market outperformance), the buy-side entities, such as hedge funds, mutual funds, private equity funds, pension funds, unit trusts, and life insurance companies, are actively using it to build fundamental investment models to outperform the market.

Alternative data, compared to the usual financials gathered from traditional sources, is difficult to utilize in strategic plans. It is often unstructured, lacks specific patterns, and is collected very frequently. Thus, the investors need expert personnel and various technologies, including analytics platforms, fluid data architecture, data science, and testing tools, to leverage the meaningful information from it. Further, Artificial Intelligence (AI) tools, such as machine learning and Natural Language Processing (NLP) are gaining popularity for analysis. AI-enabled processing increases information generation and helps to extract hidden patterns. As such, AI-based analytics tools are anticipated to boost the growth of the market for alternative data over the forecast period.

While most companies utilize various sources and tools to gain insights and predictive capabilities, regulatory constraints are expected to be the primary challenges for the market players. The increasing emphasis on regulations such as California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), along with other privacy regulations, pose threats to some of the alternative data sources. For instance, sources such as mobile devices, social media, and mobile application usage often conflict with consumer privacy issues. Any dataset that companies analyze needs to be completely free from Personal Identifiable Information (PII). Therefore, the providers’ compliance with privacy policies is a crucial factor for sustaining the market.

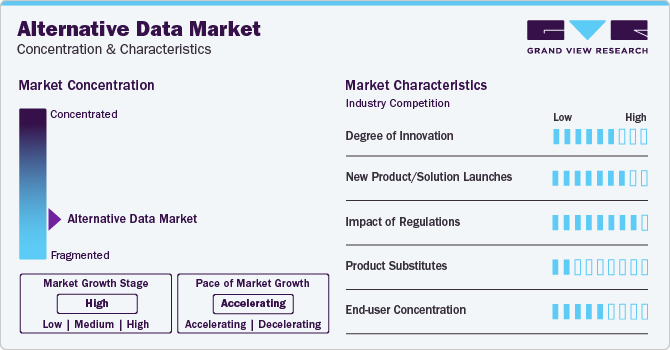

Market Concentration & Characteristics

The alternative data market growth stage is high, and the pace of the market growth is accelerating. The market is highly fragmented, with the presence of numerous small-scale companies and startups. The key market players, through Research and Development (R&D) efforts and continuous innovation, are also endeavoring to develop premium quality and high-value data sets with optimum accuracy to gain a competitive edge.

Alternative data companies are involved in a high number of product launches. For instance, in July 2023, Earnest Analytics introduced Vela Velorum, an enhanced transaction alternative data panel. The Vela Velorum transaction dataset is presently available via Snowflake, S3, and BigQuery and is expected to become available in Earnest's proprietary web-based analytics platform, Dash, in the future.

Many countries have laws that regulate the collection, storage, and use of personal data. Companies that collect and use alternative data that includes personal data, such as social media profiles or online purchasing histories, may be subject to these laws. Examples of data protection laws include the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the U.S.

The threat of substitutes of alternative data is expected to be low as the direct alternative does not exist in the market for various data types, such as sentimental data, footprint data, transaction data, and others. Additionally, the web scraped data and public domain data, such as annual reports, financials, and others, are becoming obsolete for sound decision-making as strategy managers are moving towards alternative data to frame business strategies.

The various end-users of alternative data include hedge fund operators and investment institutions, among others. Asset management firms are developing their research tools, investing in automated data collection technology, and partnering with vendors to supply the tools and intelligence they need. Businesses are implementing alternative data services and solutions to enhance operations and evaluate their internal processes.

Data Type Insights

The credit and debit card transactions segment led the target market and accounted for more than 16% of the global revenue in 2023. This high share is attributable to the high demand for this type of data from investors, coupled with the presence of numerous providers of credit card transaction data. Alternative data for credit scoring, such as gig economy income, rent payment history, and utility bill payments, among others, can help lenders decide whether to approve loans. This segment is also expected to register the highest growth rate over the forecast period from 2024 to 2030 due to the advanced capabilities of the data providers, such as sorting customer expenditure based on gender, age, seller, geography, and other metrics. The companies are co-relating transaction data with different types of data to extract hidden insights on consumer expenditure patterns, thereby enabling investors to invest in profitable businesses.

The social and sentiment data and mobile application usage segments are estimated to witness a significant growth rate over the forecast period. The growth is attributed to the rising demand for smartphone usage from the retail industry. Retail companies utilize it to analyze the user’s e-commerce application usage patterns. Further, the retailers are increasingly using sentiment data from social media websites to understand user interests from various groups and regions. The geolocation (foot traffic) from satellite images is also gaining popularity to analyze the customer store visits on a particular time and days, thereby framing the operational strategies for operating the stores. Although these sources have low accuracy compared to transaction data, the companies are finding ways to connect the dots to derive insights.

End-user Insights

The hedge fund operators segment led the target market and accounted for about 68% of the global revenue in 2023. This high share is attributable to the high demand from hedge fund companies. The hedge fund operators, such as Blackrock Advisors, AQR Capital Management, Bridgewater Associates, among others, highly utilize alternative data to generate alpha. This segment is also expected to register a steady growth rate over the forecast period from 2024 to 2030 due to the increasing need for various sources to analyze the industries and find lucrative investment opportunities. Following this, the investment institutions segment also held a significant market share in 2022 due to institutional investors' increasing demand to gain a competitive edge.

The retail companies’ segment is expected to register the highest CAGR of 60.2% from 2024 to 2030. The growth is attributed to novel use cases of alternative data, such as geo-location, satellite, social media, and sentiment data by retail companies to take strategic decisions. E.g., Retail firms, such as Walmart, Target, Gap, and others, prominently procure geo-location data. In an environment where online shopping is rapidly capturing the market share, it helps major retail shops and malls co-relate foot traffic and actual sales. Further, it also supports the stores to decide locations for the new shops.

Industry Insights

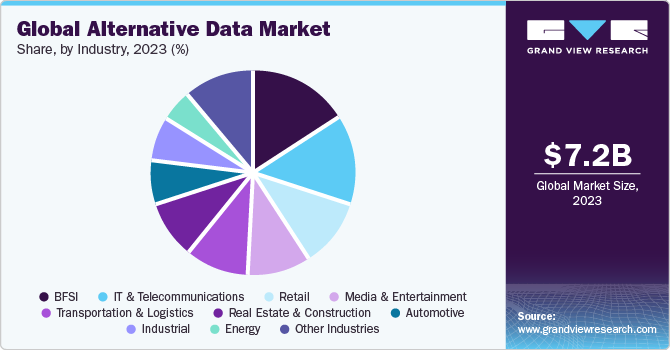

The Banking, Financial Services, and Insurance (BFSI) industry led the market and accounted for more than 16% of the global revenue in 2023. The growth can be attributed to the increasing demand for insightful data from various BFSI entities, including hedge funds, mutual funds, private equity funds, pension funds, unit trusts, and life insurance companies. These entities actively aim at gaining alpha by utilizing the hidden predictive capabilities of such sources. The retail industry segment is projected to exhibit a significant CAGR of more than 52.5% from 2024 to 2030. Some of the highest growing segments include energy, real estate, and construction, and transportation and logistics.

Based on industry, the market has been further segmented into automotive, industrial, IT and telecommunications, media and entertainment, and others. The IT and telecommunications industry also held a significant revenue share of the market in 2023. Low bandwidth, dropped calls, and poor network are crucial issues for telecom companies. Therefore, operators increasingly emphasize optimizing their services with equipment monitoring, capacity planning, and preventive maintenance by using alternative data. Further, these companies are using demographic, social and sentiment, and browsing behavior data for targeted ads and region-specific marketing strategies.

Regional Insights

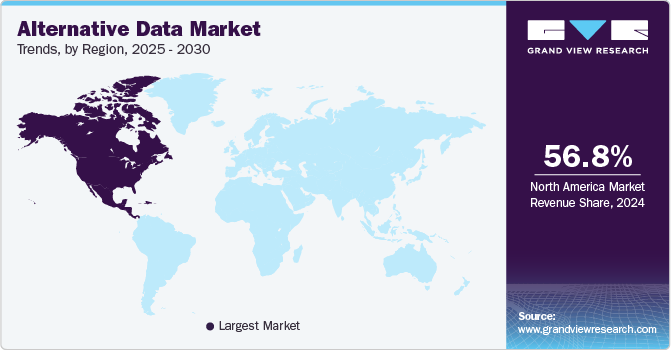

North America dominated the market and accounted for about 57% share of global revenue in 2023 and is anticipated to maintain its dominance over the forecast period. The high share of the region is attributed to the presence of numerous players in the market, such as Advan Research Corporation Eagle Alpha, M Science LLC, and UBS. The early adoption of alternative data from different industry verticals in the country also results in a high market share. Currently, more than 70% of the asset managers in the U.S. are inclined towards the use of alternative data in their investment process.

The European market also held a significant revenue share in 2023, owing to substantial alternative Assets under Management (AUM). These assets are primarily distributed across various classes, including private equity, hedge funds, real estate, and natural resources. The asset management companies are increasingly leveraging alternative data to frame profitable strategies to gain alpha. The Asia Pacific region is expected to emerge as one of the fastest-growing regional market because of the increasing use of data-driven research by investors. The regional market is anticipated to open significant growth opportunities for companies from emerging economies, such as India, Singapore, Thailand, and China. Presence of alternative data providers in India, a growing economy in the region, such as U.S.-based TransUnion LLC and Switzerland-based UBS, are likely to create significant growth opportunities in the region.

Presence of alternative data providers in India, a growing economy in the region, such as U.S.-based TransUnion LLC and Switzerland-based UBS, are likely to create significant growth opportunities in the region.

U.K. Alternative Data Market Trends

The alternative data market in the U.K. accounted for over 46.0% share of the European market in 2023. The alternative data market has witnessed significant growth in the U.K. owing to several factors, such as wide data availability, technological advancements, and increased demand from investors. Alternative data providers in the U.K. offer a wide range of data sets, including satellite imagery, social media sentiment, web scraping, and credit card transaction data.

Germany Alternative Data Market Trends

The alternative data market in Germany is expected to grow at a CAGR of 51.1% from 2024 to 2030. The alternative data market in Germany is expected to continue growing as more investors and companies recognize the value of non-traditional sources of information in decision-making. With the availability of high-quality data and the increasing demand for insights, the alternative data market in Germany is poised for significant growth over the coming years.

France Alternative Data Market Trends

The alternative data market in France has witnessed significant growth in recent years. Alternative data is widely used in France in areas such as risk management and compliance. For instance, credit card transaction data can be used to identify fraud or money laundering instances, and satellite imagery can be used to monitor environmental hazards.

The alternative data market in Asia Pacific was valued at USD 1.16 billion in 2023. Factors such as technological advancements, increasing demand from investors, and the growing awareness of the value of non-traditional data sources in the investment process are driving the growth of the alternative data market in the Asia Pacific. The region's increasing focus on technology and innovation and the rapid adoption of digital technologies, particularly in countries such as China and India, are the key contributors to the market growth.

China Alternative Data Market Trends

The alternative data market in China is projected to grow at a CAGR of 52.3% from 2024 to 2030. China has emerged as a significant player in the alternative data market in recent years. The market growth is driven by the country's large and rapidly growing economy, a rising middle class, and a government-led push toward innovation and technological development.

Japan Alternative Data Market Trends

The alternative data market in Japan is witnessing significant growth owing to several factors, such as a highly developed economy, a large and aging population, and a growing focus on innovation and technology. The aging population's increased use of digital services, such as e-commerce, social media, and online banking, has created a substantial amount of data that can be analyzed to gain valuable insights into market trends and consumer behavior.

India Alternative Data Market Trends

The alternative data market in India is expected to grow significantly over the forecast period, driven by factors such as the country's expanding economy, young and technical enthusiast population, and the government's efforts to drive innovation and technological development. One area where alternative data has gained significant traction in India is the financial sector. Financial institutions increasingly use alternative data to assess the creditworthiness of individuals and businesses, particularly those traditionally underserved by the formal banking system.

The alternative data market in Middle East and Africa (MEA) is anticipated to reach USD 371.6 million by 2030. One of the main growth drivers of the regional market is the increasing demand for data-driven insights and analysis in the region. Alternative data is widely used for the analysis of e-commerce and digital payment data. With the rise of e-commerce in the region, companies are increasingly looking to use data from online transactions to gain insights into consumer behavior and trends.

Saudi Arabia Alternative Data Market Trends

The alternative data market in Saudi Arabia is witnessing significant growth owing to rapid digital transformation driven by the utilization of Artificial Intelligence (AI) in the country. The Saudi Data & Al Authority (SDAIA) is accelerating the adoption of data and AI solutions in the country, positively impacting the alternative data market.

Key Alternative Data Company Insights

Some of the key players operating in the market include UBS, M Science LLC, and RavenPack.

-

UBS provides data-driven insights by harvesting, cleansing, and connecting numerous data items across various specialized areas. The company provides insights for more than 1,000 companies of all sizes on a subscription basis to its Evidence Lab Innovations platform subscribers. UBS offers insightful datasets across more than 55 specialized products. The company’s various types of alternative data offerings include geospatial data, pricing data, sentimental data, social media data, and transaction data, among others.

-

M Science LLC is a data-driven research and analytics firm that provides critical customer insights to leading financial institutions and private & government corporations. The company integrates data science and technology, and financial models to transform raw data into actionable insights, enabling its customers to make smarter and more informed decisions. It caters to automotive, consumer durables, internet & telecommunication, and media industries.

Thinknum Alternative Data and Earnest are some of the emerging alternative data companies.

-

Thinknum Alternative Data organizes, processes, and analyzes public data from the web and offers over 300 companies (across the globe) unique real-time insights. The company’s clients include hedge funds, universities, internet companies, and investment firms. Its clients access these datasets via an Application Programming Interface (API) and User Interface (UI). A few critical datasets include job listing sites, LinkedIn profiles, and Facebook followers, among others.

-

Earnest is a data analytics company that provides critical information on consumer spending habits to government agencies, corporations, management consultants, and institutional investors by utilizing real-time data. The company uses tools for fundamental analytics of retail pricing, healthcare claims, consumer spending, and foot traffic to offer structured datasets with clear and correlated signals. These datasets are computed to understand national health trends and consumer habits.

Key Alternative Data Companies:

The following are the leading companies in the alternative data market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these alternative data companies are analyzed to map the supply network.

- 1010data, Inc.

- Advan Research Corporation

- Dataminr

- Earnest

- M Science LLC

- Preqin

- RavenPack

- Thinknum Alternative Data

- UBS

- YipitData

Recent Developments

-

In April 2023, Thinknum Alternative Data launched new data fields to its employee sentiment datasets for people analytics teams and investors to use this as an 'employee NPS' proxy, and support highly-rated employers set up interviews through employee referrals.

-

In September 2022, Thinknum Alternative Data announced its plan to combine data Similarweb, SensorTower, Thinknum, Caplight, and Pathmatics with Lagoon, a sophisticated infrastructure platform to deliver an alternative data source for investment research, due diligence, deal sourcing and origination, and post-acquisition strategies in private markets.

-

In May 2022, M Science LLC launched a consumer spending trends platform, providing daily, weekly, monthly, and semi-annual visibility into consumer behaviors and competitive benchmarking. The consumer spending platform provided real-time insights into consumer spending patterns for Australian brands and an unparalleled business performance analysis.

Alternative Data Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.20 billion

Revenue forecast in 2030

USD 135.72 billion

Growth Rate

CAGR of 50.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Data Type, Industry, End-user, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

1010data, Inc.; Advan Research Corporation; Dataminr; Earnest; M Science LLC; Preqin; RavenPack; Thinknum Alternative Data; UBS; YipitData

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alternative Data Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global alternative data market report based on data type, industry, end-user, and region.

-

Data Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Credit & Debit Card Transactions

-

Email Receipts

-

Geo-location (Foot Traffic) Records

-

Mobile Application Usage

-

Satellite & Weather Data

-

Social & Sentiment Data

-

Web Scraped Data

-

Web Traffic

-

Other Data Types

-

-

Industry Outlook (Revenue, USD Million; 2017 - 2030)

-

Automotive

-

BFSI

-

Energy

-

Industrial

-

IT & Telecommunications

-

Media & Entertainment

-

Real Estate & Construction

-

Retail

-

Transportation & Logistics

-

Other Industries

-

-

End-user Outlook (Revenue, USD Million; 2017 - 2030)

-

Hedge Fund Operators

-

Investment Institutions

-

Retail Companies

-

Other End-users

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alternative data market size was estimated at USD 4,448.51 million in 2022 and is expected to reach USD 7.20 billion in 2023.

b. The global alternative data market is expected to grow at a compound annual growth rate of 52.1% from 2023 to 2030 to reach USD 135,723.5 million by 2030.

b. North America dominated the alternative data market with a share of over 58% in 2022. This is attributable to the presence of numerous players such as Advan, Dataminr, Eagle Alpha, M Science, and UBS Evidence Lab in the region.

b. Some key players operating in the alternative data market include 1010Data, Advan, Dataminr, Earnest Research, M Science, Preqin, RavenPack, Thinknum Alternative Data, UBS Evidence Lab, and YipitData.

b. Key factors that are driving the alternative data market growth include a significant increase in the types of alternative data sources over the last decade and rising demand for alternative data among hedge fund managers to gain alpha.

Table of Contents

Chapter 1. Alternative Data Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Alternative Data Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Alternative Data Market: Variable, Trends & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Increasing demand for alternative data from hedge funds

3.3.1.2. Broadened portfolio with numerous emerging alternative data types

3.3.2. Market Restraints Analysis

3.3.2.1. Conflicts with privacy policies and personally identifiable information

3.3.3. Industry Opportunities

3.3.3.1. Increasing use of machine learning and Natural Language Processing (NLP) for analyzing the data

3.3.4. Industry Challenges

3.4. Alternative Data Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Case Study Analysis

Chapter 4. Alternative Data Market: Data Type Estimates & Trend Analysis

4.1. Alternative Data Market: Data Type Analysis

4.1.1. Credit & Debit Card Transactions

4.1.1.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.1.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.2. Email Receipts

4.1.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.2.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.3. Geo-location (Foot Traffic) Records

4.1.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.4. Mobile Application Usage

4.1.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.5. Satellite & Weather Data

4.1.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.5.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.6. Social & Sentiment Data

4.1.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.6.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.7. Web Scraped Data

4.1.7.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.7.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.8. Web Traffic

4.1.8.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.8.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.1.9. Other Data Types

4.1.9.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.1.9.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

Chapter 5. Alternative Data Market: Industry Estimates & Trend Analysis

5.1. Alternative Data Market: Industry Analysis

5.1.1. Automotive

5.1.1.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.1.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.2. BFSI

5.1.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.2.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.3. Energy

5.1.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.4. Industrial

5.1.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.5. IT & Telecommunications

5.1.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.5.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.6. Media & Entertainment

5.1.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.6.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.7. Real Estate & Construction

5.1.7.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.7.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.8. Retail

5.1.8.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.8.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.9. Transportation & Logistics

5.1.9.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.9.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.1.10. Other Industries

5.1.10.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.1.10.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

Chapter 6. Alternative Data Market: End-user Estimates & Trend Analysis

6.1. Alternative Data Market: End-user Analysis

6.1.1. Hedge Fund Operators

6.1.1.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.1.1.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.1.2. Investment Institutions

6.1.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.1.2.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.1.3. Retail Companies

6.1.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.1.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.1.4. Other End-users

6.1.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.1.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

Chapter 7. Alternative Data Market: Regional Estimates & Trend Analysis

7.1. Alternative Data Market Share By Region, 2023 & 2030

7.2. North America

7.2.1. Market estimates and forecasts, 2017 - 2030

7.2.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.2.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.2.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.2.5. U.S.

7.2.5.1. Market estimates and forecasts, 2017 - 2030

7.2.5.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.2.5.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.2.5.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.2.6. Canada

7.2.6.1. Market estimates and forecasts, 2017 - 2030

7.2.6.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.2.6.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.2.6.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.2.7. Mexico

7.2.7.1. Market estimates and forecasts, 2017 - 2030

7.2.7.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.2.7.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.2.7.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.3. Europe

7.3.1. U.K.

7.3.1.1. Market estimates and forecasts, 2017 - 2030

7.3.1.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.3.1.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.3.1.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.3.2. Germany

7.3.2.1. Market estimates and forecasts, 2017 - 2030

7.3.2.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.3.2.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.3.2.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.3.3. France

7.3.3.1. Market estimates and forecasts, 2017 - 2030

7.3.3.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.3.3.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.3.3.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Market estimates and forecasts, 2017 - 2030

7.4.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.4.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.4.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.4.5. China

7.4.5.1. Market estimates and forecasts, 2017 - 2030

7.4.5.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.4.5.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.4.5.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.4.6. India

7.4.6.1. Market estimates and forecasts, 2017 - 2030

7.4.6.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.4.6.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.4.6.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.4.7. Japan

7.4.7.1. Market estimates and forecasts, 2017 - 2030

7.4.7.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.4.7.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.4.7.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.4.8. South Korea

7.4.8.1. Market estimates and forecasts, 2017 - 2030

7.4.8.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.4.8.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.4.8.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.4.9. Australia

7.4.9.1. Market estimates and forecasts, 2017 - 2030

7.4.9.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.4.9.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.4.9.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.5. South America

7.5.1. Market estimates and forecasts, 2017 - 2030

7.5.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.5.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.5.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.5.5. Brazil

7.5.5.1. Market estimates and forecasts, 2017 - 2030

7.5.5.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.5.5.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.5.5.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.6. Middle East & Africa

7.6.1. Market estimates and forecasts, 2017 - 2030

7.6.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.6.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.6.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.6.5. KSA

7.6.5.1. Market estimates and forecasts, 2017 - 2030

7.6.5.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.6.5.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.6.5.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.6.6. UAE

7.6.6.1. Market estimates and forecasts, 2017 - 2030

7.6.6.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.6.6.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.6.6.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

7.6.7. South Africa

7.6.7.1. Market estimates and forecasts, 2017 - 2030

7.6.7.2. Market estimates and forecasts, by data type, 2017 - 2030 (USD Million)

7.6.7.3. Market estimates and forecasts, by industry, 2017 - 2030 (USD Million)

7.6.7.4. Market estimates and forecasts, by End-user, 2017 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Strategy Mapping

8.5.1. Expansion

8.5.2. Mergers & Acquisition

8.5.3. Partnerships & Collaborations

8.5.4. New Transport Launches

8.5.5. Research And Development

8.6. Company Profiles

8.6.1. 1010data, Inc.

8.6.1.1. Participant’s Overview

8.6.1.2. Financial Performance

8.6.1.3. Product Benchmarking

8.6.1.4. Recent Developments

8.6.2. Advan Research Corporation

8.6.2.1. Participant’s Overview

8.6.2.2. Financial Performance

8.6.2.3. Product Benchmarking

8.6.2.4. Recent Developments

8.6.3. Dataminr

8.6.3.1. Participant’s Overview

8.6.3.2. Financial Performance

8.6.3.3. Product Benchmarking

8.6.3.4. Recent Developments

8.6.4. Earnest

8.6.4.1. Participant’s Overview

8.6.4.2. Financial Performance

8.6.4.3. Product Benchmarking

8.6.4.4. Recent Developments

8.6.5. M Science LLC

8.6.5.1. Participant’s Overview

8.6.5.2. Financial Performance

8.6.5.3. Product Benchmarking

8.6.5.4. Recent Developments

8.6.6. Preqin

8.6.6.1. Participant’s Overview

8.6.6.2. Financial Performance

8.6.6.3. Product Benchmarking

8.6.6.4. Recent Developments

8.6.7. RavenPack

8.6.7.1. Participant’s Overview

8.6.7.2. Financial Performance

8.6.7.3. Product Benchmarking

8.6.7.4. Recent Developments

8.6.8. Thinknum Alternative Data

8.6.8.1. Participant’s Overview

8.6.8.2. Financial Performance

8.6.8.3. Product Benchmarking

8.6.8.4. Recent Developments

8.6.9. UBS

8.6.9.1. Participant’s Overview

8.6.9.2. Financial Performance

8.6.9.3. Product Benchmarking

8.6.9.4. Recent Developments

8.6.10. YipitData

8.6.10.1. Participant’s Overview

8.6.10.2. Financial Performance

8.6.10.3. Product Benchmarking

8.6.10.4. Recent Developments

List of Tables

Table 1 List of Abrevation

Table 2 Global Alternative Data Market revenue estimates and forecast, by Data Type, 2017 - 2030 (USD Million)

Table 3 Global Alternative Data Market revenue estimates and forecast, by industry, 2017 - 2030 (USD Million)

Table 4 Global Alternative Data Market revenue estimates and forecast, By End-user, 2017 - 2030 (USD Million)

Table 5 Global Alternative Data Market revenue, by Region, 2023 & 2030, (USD Million)

Table 6 North America Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 7 North America Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 8 North America Alternative Data Market estimates & forecasts, by industry, 2017 - 2030 (USD Million)

Table 9 North America Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 10 U.S. Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 11 U.S. Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 12 U.S. Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 13 U.S. Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 14 Canada Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 15 Canada Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 16 Canada Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 17 Canada Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 18 Mexico Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 19 Mexico Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 20 Mexico Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 21 Mexico Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 22 Europe Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 23 Europe Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 24 Europe Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 25 Europe Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 26 U.K. Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 27 U.K. Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 28 U.K. Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 29 U.K. Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 30 Germany Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 31 Germany Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 32 Germany Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 33 Germany Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 34 France Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 35 France Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 36 France Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 37 France Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 38 Asia Pacific Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 39 Asia Pacific Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 40 Asia Pacific Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 41 Asia Pacific Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 42 China Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 43 China Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 44 China Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 45 China Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 46 India Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 47 India Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 48 India Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 49 India Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 50 Japan Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 51 Japan Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 52 Japan Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 53 Japan Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 54 South Korea Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 55 South Korea Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 56 South Korea Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 57 South Korea Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 58 Australia Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 59 Australia Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 60 Australia Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 61 Australia Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 62 South America Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 63 South America Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 64 South America Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 65 South America Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 66 Brazil Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 67 Brazil Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 68 Brazil Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 69 Brazil Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 70 Middle East & Africa Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 71 Middle East & Africa Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 72 Middle East & Africa Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 73 Middle East & Africa Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 74 KSA Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 75 KSA Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 76 KSA Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 77 KSA Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 78 UAE Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 79 UAE Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 80 UAE Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 81 UAE Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 82 South Africa Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Table 83 South Africa Alternative Data Market estimates & forecasts, by Data Type, 2017 - 2030 (USD Million)

Table 84 South Africa Alternative Data Market estimates & forecasts, by Industry, 2017 - 2030 (USD Million)

Table 85 South Africa Alternative Data Market estimates & forecasts, by end-user, 2017 - 2030 (USD Million)

Table 86 Participant’s Overview

Table 87 Financial Performance

Table 88 Product Benchmarking

Table 89 Key companies undergoing expansion

Table 90 Key companies involved in mergers & acquisitions

Table 91 Key companies undertaking partnerships and collaboration

Table 92 Key companies launching new product/service launches

List of Figures

Fig. 1 Alternative Data Market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segment snapshot, by Product and Type

Fig. 8 Segment snapshot By Vertical

Fig. 9 Competitive landscape snapshot

Fig. 10 Alternative Data Market value, 2017 - 2030 (USD Million)

Fig. 11 Alternative Data Market - Industry value chain analysis

Fig. 12 Alternative Data Market - Market trends

Fig. 13 Alternative Data Market: Porter’s analysis

Fig. 14 Alternative Data Market: PESTEL analysis

Fig. 15 Alternative Data Market, by Data Type: Key takeaways

Fig. 16 Alternative Data Market, by Data Type: Market share, 2022 & 2030

Fig. 17 Credit & Debit Card Transactions Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 18 Email Receipts Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 19 Geo-location (Foot Traffic) Records Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 20 Mobile Application Usage Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 21 Satellite & Weather Data Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 22 Social & Sentiment Data Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 23 Web Scraped Data Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 24 Web Traffic Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 25 Other Data Types Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 26 Alternative Data Market, by Industry: Key takeaways

Fig. 27 Alternative Data Market, by Industry: Market share, 2022 & 2030

Fig. 28 Automotive Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 29 BFSI Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 30 Energy Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 31 Industrial Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 32 IT & Telecommunications Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 33 Media & Entertainment Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 34 Real Estate & Construction Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 35 Retail Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 36 Transportation & Logistics Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 37 Others Industries Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 38 Alternative Data Market, By End-user: Key takeaways

Fig. 39 Alternative Data Market, By End-user: Market share, 2022 & 2030

Fig. 40 Hedge Fund Operators Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 41 Investment Institutions Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 42 Retail Companies Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 43 Other End-users Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 44 Global Alternative Data Market revenue, by Region, 2023 & 2030, (USD Million)

Fig. 45 North America Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 46 U.S. Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 47 Canada Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 48 Mexico Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 49 Europe Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 50 U.K. Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 51 Germany Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 52 France Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 53 Asia Pacific Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 54 China Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 55 India Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 56 Japan Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 South Korea Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 58 Australia Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 59 South America Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 60 Brazil Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 61 Middle East & Africa Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 62 KSA Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 63 UAE Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 64 South Africa Alternative Data Market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 65 Key company categorization

Fig. 66 Alternative Data Market - Key company market share analysis, 2023

Fig. 67 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Alternative Data Type Outlook (Revenue, USD Million, 2017 - 2030)

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Alternative Data Industry Outlook (Revenue, USD Million, 2017 - 2030)

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Alternative Data End-user Outlook (Revenue, USD Million, 2017 - 2030)

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Alternative Data Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- North America Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- North America Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- U.S.

- U.S. Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- U.S. Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- U.S. Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- U.S. Alternative Data Market, By Data Type

- Canada

- Canada Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Canada Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Canada Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Canada Alternative Data Market, By Data Type

- Mexico

- Mexico Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Mexico Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Mexico Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Mexico Alternative Data Market, By Data Type

- North America Alternative Data Market, By Data Type

- Europe

- Europe Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Europe Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Europe Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- U.K.

- U.K. Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- U.K. Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- U.K. Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- U.K. Alternative Data Market, By Data Type

- Germany

- Germany Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Germany Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Germany Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Germany Alternative Data Market, By Data Type

- France

- France Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- France Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- France Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- France Alternative Data Market, By Data Type

- Europe Alternative Data Market, By Data Type

- Asia Pacific

- Asia Pacific Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Asia Pacific Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Asia Pacific Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- China

- China Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- China Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- China Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- China Alternative Data Market, By Data Type

- India

- India Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- India Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- India Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- India Alternative Data Market, By Data Type

- Japan

- Japan Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Japan Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Japan Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Japan Alternative Data Market, By Data Type

- Australia

- Australia Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Australia Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Australia Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Australia Alternative Data Market, By Data Type

- South Korea

- South Korea Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- South Korea Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- South Korea Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- South Korea Alternative Data Market, By Data Type

- Asia Pacific Alternative Data Market, By Data Type

- South America

- South America Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- South America Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- South America Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Brazil

- Brazil Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- Brazil Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- Brazil Alternative Data Market, By Industry

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- Brazil Alternative Data Market, By Data Type

- South America Alternative Data Market, By Data Type

- Middle East & Africa

- MEA Alternative Data Market, By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- MEA Alternative Data Market, By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- MEA Alternative Data Market, By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- KSA

- KSA Alternative Data Market by Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- KSA Alternative Data Market by Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- KSA Alternative Data Market by Industry

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- KSA Alternative Data Market by Data Type

- UAE

- UAE Alternative Data Market by Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- UAE Alternative Data Market by Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- UAE Alternative Data Market by Industry

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- UAE Alternative Data Market by Data Type

- South Africa

- South Africa Alternative Data Market by Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

- South Africa Alternative Data Market by Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

- South Africa Alternative Data Market by Industry

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

- South Africa Alternative Data Market by Data Type

- MEA Alternative Data Market, By Data Type

- North America

Alternative Data Market Dynamics

Drivers: Increasing Demand For Alternative Data From Hedge Funds

Alternative data has revolutionized the hedge fund industry. Firms that effectively use it can enhance their research and decision-making, whether algorithmic or human-based. It doesn’t replace traditional information like economic forecasts and company reports but enriches them with deeper insights into risks and opportunities. Leading hedge fund companies have successfully incorporated alternative data into their strategies, facilitating successful fundraising with potential investors. These firms consider alternative data as a fundamental part of their process and have the financial resources to invest in AI-powered analytics platforms and hire data scientists for valuable insights. The use of alternative data extends beyond portfolio management decisions. For example, mutual fund companies in the retail investment space are using it to analyze trends and investor profile data to improve their product, distribution, and marketing. Fund managers use alternative data to better understand their investor clients and concentrate on their fundraising efforts. Firms planning to use alternative data ensure they have the necessary skills and software to use the data and establish policies for its use. They conduct thorough due diligence on vendors to assess the integrity and reliability of their data sources. After identifying suitable data and providers, firms conduct a trial agreement and perform a cost-benefit analysis to evaluate the potential return on investment. Firms conduct regular reviews post-implementation to ascertain if alternative data is yielding the expected benefits.

Drivers: Broadened Portfolio With Numerous Emerging Alternative Data Types

Buy-side companies like hedge funds, mutual funds, pension funds, private-equity firms, and corporations have significantly increased their spending on alternative data, supported by over 400 providers. This has led to increased investments in IT infrastructure, data sources, data science, systems development, and data management. The data sets used are primarily driven by web-based activities like social media sentiment, web scrape data, point of sale systems, credit cards, web traffic, and crowdsource data. Some top firms are interested in sophisticated data like geospatial data, geolocation data, IoT sensors, footfall data, satellite data, and wearables data. Web scraping is the most common form of alternative data, collecting data from targeted websites to gain information on companies, brands, and corporate activity. Satellite images are used to count cars in parking lots, providing insights into factory output or retail sales activity. Investment professionals seek insights from point of sale or purchase systems, with several data providers persuading a large panel of consumers to share their debit and credit card activity. Corporate announcements, social-media feeds, and news flow are analyzed to understand sentiment on products, stocks, and the economy. In a volatile and uncertain world, investors seek alternative data datasets for a competitive advantage, helping find the alpha and offering higher market returns.

Restrains: Conflicts With Privacy Policies And Personally Identifiable Information

Alternative data carries more risk than traditional data due to the content of the data fields and how it’s handled and sourced. If alternative data providers’ risk control procedures are underdeveloped, they may increase enterprise risk by incorporating invalid or non-compliant data, leading to a reputational threat. The potential inclusion of Personally Identifiable Information (PII) in a data set is another risk. Receiving data from a source without PII is preferable to removing PII upon receipt as it reduces risk. Some alternative data sets are generated based on user browsing patterns or specific online transactions, and this risk should be actively managed. Currently, global data privacy regulators do not have a unified approach to the issues surrounding the collection and use of alternative data. While a standardized approach is unlikely, regulators’ growing focus on the use of personal data indicates increased concern for potential market risks and ethical concerns. The alternative data industry is expected to grow due to the demand for tradable insights from complex data sets. Financial services firms that source or use such data would implement best practices and robust governance frameworks to safely navigate regulatory obstacles.

What Does This Report Include?

This section will provide insights into the contents included in this smart home market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Alternative data market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Alternative data market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance