- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Flat Products Market Size & Share Report, 2020-2027GVR Report cover

![Aluminum Flat Products Market Size, Share & Trends Report]()

Aluminum Flat Products Market Size, Share & Trends Analysis Report By Product (Plates, Sheets), By Application (Building & Construction, Automotive & Transportation), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-726-1

- Number of Pages: 102

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

The global aluminum flat products market size was valued at USD 53.9 billion in 2019 and is anticipated to attain a compound annual growth rate (CAGR) of 4.2% from 2020 to 2027. Increasing penetration of aluminum in vehicles on account of its lightweight properties is projected to fuel the growth of the market. Aluminum and its various alloy products are lightweight in nature and also have characteristics such as corrosion resistance, ductility, and high strength. These aluminum flat products also show excellent flexibility and rigidity with a reduction in temperature. Lightweight properties of aluminum flat products are likely to assist in a smaller carbon footprint, lower costs, and more robust and corrosion-resistant products in end-use industries such as automotive, aerospace, and construction.

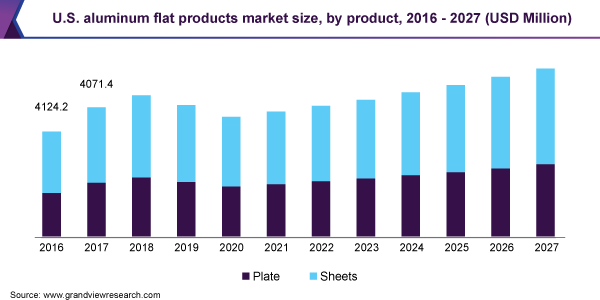

In terms of revenue, the market for aluminum flat products in the U.S. is projected to witness a CAGR of 3.1% from 2020 to 2027. Government policies regarding the manufacturing of auto components are projected to remain key focus areas for market vendors. In August 2018, USMCA was formed by the President of the U.S. as a new agreement between the U.S., Mexico, and Canada. Under this agreement, the majority of cars and trucks accounted for 75.0% of a vehicle components to be manufactured in North America in order to qualify for zero tariffs. North American Free Trade Agreement (NAFTA) announced that the cars and trucks need to achieve the 54.5 mpg fuel efficiency by 2025.

The increased utilization of aluminum flat products to reduce vehicle and aircraft weight has been driving the market growth. Vehicles are being manufactured with high fuel efficiency in order to satisfy the regulatory requirements and achieve the targets set to reduce greenhouse gas emissions. The use of aluminum instead of steel and iron is anticipated to propel market growth over the forecast period.

The use of sheets and plates in automotive manufacturing is witnessing an increase on account of their lightweight as well as good formability offered. The aesthetics and crashworthiness of the car are essential factors in automotive manufacturing.

Product Insights

Aluminum plates accounted for a share of 42.0% in 2019, in terms of volume. Aluminum plates have wide usage in the end-use industry and are used in applications such as furniture, interior, and exterior of vehicles, aircraft, household appliances, and various machines.

Advancements in civil engineering have resulted in an increased number of skyscrapers around the world. The key material that initiated the aesthetic aspect of skyscrapers is aluminum as the product is widely utilized in the installation of facades. Skyscrapers require sturdy and lightweight aluminum frames to support the glass face of the building.

In terms of revenue, sheets are projected to witness a CAGR of 4.5% in the market for aluminum flat products from 2020 to 2027. Aluminum sheets have a wide range of applications in the end-use industry. Some of the applications include aircraft skins, heat exchangers, exteriors and structures of automobiles, small boat hulls, trailer, and van panels, flashing, roofing, siding, curtain wall, and gutter panels for industrial, commercial, and residential buildings, home appliances, cooking utensils, food and beverage cans, and light bulb bases.

Application Insights

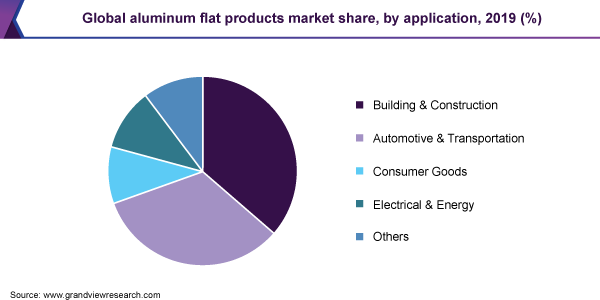

Building and construction application segment accounted for a volume share of 37.5% in 2019. The use of recycled materials is projected to remain a key focus area driving the demand for aluminum flat products. The extraction of recyclable materials also creates a positive impact on the environment.

In terms of revenue, the automotive and transportation segment is projected to witness a growth rate of 3.6% in the aluminum flat products market over the forecast period. The increasing use of aluminum flat products in aircraft and vehicles on account of its lightweight properties is projected to drive market growth over the coming years. Aluminum has the highest strength to weight ratio which makes it suitable in aerospace applications.

Many air transportation companies are replacing their old models with modern and fuel-efficient models, which is likely to remain a key driver for the rising demand for aluminum flat products. Aircraft experienced harsh environments such as freezing temperatures, and rainstorms. Products in such cases protect the aircraft and withstand environmental corrosion.

Regional Insights

In terms of revenue, Asia Pacific held the largest market share of 72.8% in 2019 and is projected to witness a revenue-based CAGR of 4.7% from 2020 to 2027. Increasing demand for luxury vehicles, growing motor vehicle production, and advancements in vehicle manufacturing technologies are the key factors driving the market in the region. Considering safety and convenience as primary requirements of the customers, aluminum flat products are likely to witness positive demand over the coming years.

North America accounted for a market share of 7.9% in 2019, in terms of volume. Consumer preferences toward high-quality and more fuel-efficient motor vehicles coupled with stringent CAFÉ regulations to improve the fuel economy of the vehicles are likely to increase the use of aluminum in the automotive industry in the region over the coming years.

Expansion of manufacturing units by the key players in the market is anticipated to boost the demand for aluminum flat products in Europe. For instance, Constellium N.V. introduced a new technology for aluminum smelting at its Neuf-Brisach plant in France with an investment of USD 202.0 million in 2016. The initiative was taken to meet the growing demand for aluminum flat products in the body sheet application.

Key Companies & Market Share Insights

Numerous vendors in the market are focused on the development of advanced alloys in applications specific to end-uses. An increase in production capacities and acquisitions of small companies are also likely to remain another key focus area for aluminum flat products vendors. Some of the prominent players in the aluminum flat products market include:

-

Norsk Hydro

-

Hindalco

-

Aleris Corporation

-

UAJC Corporation

-

Novelis

-

Arconic

Aluminum Flat Products Market Report Scope

Report Attribute

Details

Market size value of 2020

USD 51.6 billion

Revenue forecast value in 2027

USD 74.9 billion

Growth rate

CAGR of 4.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative Units

Volume in kilotons, revenue in USD million, CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France; U.K.; China; Japan; India; Brazil

Key companies profiled

Norsk Hydro; Hindalco; Aleris Corporation; UAJC Corporation; Novelis; Arconic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global aluminum flat products market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Plates

-

Sheets

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Building & Construction

-

Automotive & Transportation

-

Consumer Goods

-

Electrical & Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."