- Home

- »

- Healthcare IT

- »

-

Ambulatory Surgical Centers IT Services Market Report, 2027GVR Report cover

![Ambulatory Surgical Centers IT Services Market Size, Share & Trends Report]()

Ambulatory Surgical Centers IT Services Market Size, Share & Trends Analysis Report By Service Type (EHR, Clinical Documentation), By Solution, By Delivery Mode, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-066-6

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

The global ambulatory surgical centers IT services market size was valued at USD 3.1 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 22.8% from 2020 to 2027. The growing number of Ambulatory Surgical Centers (ASCs) due to the shift of surgeries from inpatient settings to outpatient settings coupled with the increasing need to curb the growing healthcare costs is expected to bolster the demand for IT services in ambulatory surgical centers. Moreover, increasing adoption of healthcare IT solutions such as practice management, patient portal, revenue cycle management, and clinical documentation for better workflow management is further driving the demand for these services. According to industry journals, in 2017, outpatient surgeries have increased by around 32% from the surgeries in 2005 and are expected to expand at an average growth rate of 6% to 7% by 2021. Furthermore, the usage of technologically advanced techniques in outpatient settings coupled with higher hospitalization costs is driving the number of surgeries in these centers.

The growing number of surgeries has influenced the need for healthcare IT services as these services to help ASCs to control increasing healthcare costs and improve productivity by reducing errors and assisting in streamlining the whole process. Due to this, the adoption of healthcare IT services is gaining momentum amongst the ASCs. Another key factor promoting the adoption of healthcare IT services in ambulatory surgical centers is the growing need for integrated solutions for various functions that provide useful insights to the healthcare providers and help in improving patient care. For instance, the ASCs use ambulatory practice management systems, which allow providers to initiate laboratory tests, electronic orders for medications, referrals, insurance eligibility verification, radiographic imaging, and admissions. Agency for Healthcare Research and Quality is funding several projects to study and increase the adoption of these systems in ambulatory settings, which is influencing the growth of this market.

Another key factor boosting the market growth is the shift of healthcare IT services toward cloud computing. Increasing the adoption of cloud-based computing worldwide is transforming the healthcare industry. Manufacturers and providers are focusing on achieving improved patient care and revenue cycle optimization, which is driving the demand for cloud-based solutions.

Advancements in healthcare IT are providing opportunities to cut down healthcare spending by improving care delivery and clinical outcomes. Best possible interventions enabled through timely data aggregation coupled with an increase in patient involvement for the management of chronic care through patient engagement portals are among the factors contributing to cost reduction. The major factor contributing to the escalated healthcare costs is the waste associated with treatment and patient variation. To reduce the cost of patient care and cut unnecessary costs, healthcare providers' use of financial IT tools in ambulatory centers is further contributing to the market growth.

Service Type Insights

Based on service type, the Electronic Health Record (EHR) segment accounted for the largest market share of 27.8% in 2019. The revenue share is attributable to the attractive benefits associated, such as less or no up-front cost of licensing, little or no investments required for infrastructure or maintenance, and possibly easy information exchange within or external organization. Furthermore, the growing need for better access to patient health information and the increasing implementation of Healthcare IT solutions in ambulatory surgical centers to enhance patient satisfaction and improve care quality are the major factors driving the growth of this segment.

Furthermore, the clinical documentation segment is expected to witness lucrative growth over the forecast period. The effectiveness of these services in achieving economies of scale, reducing healthcare costs, examining the medical billing and coding errors causing loss of revenue, resolving issues raised through the decline in reimbursement rates, and maintaining regulatory compliance are some of the key factors anticipated to boost the growth of this segment.

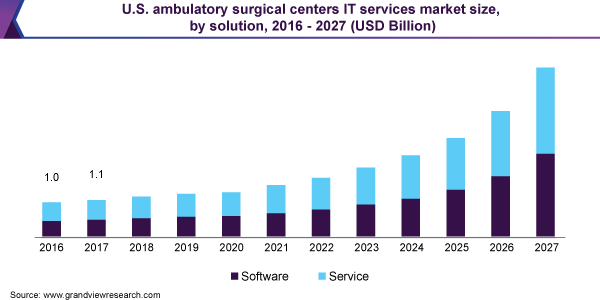

Solution Insights

In 2019, the service segment dominated the global market, with a revenue share of 54.8%. The largest share is attributable to the rising acceptance of IT solutions across healthcare organizations to cut down healthcare costs, the growing need to reduce administrative expenses, and shifting toward cloud-based services are some of the factors that are expected to drive the market growth.

On the other hand, the software is anticipated to emerge as the fastest-growing solution segment over the forecast period. The increasing demand for Software as a Service (SaaS) in the healthcare industry due to the affordability and effortless deployment of cloud-based healthcare IT software is driving the growth of this segment. The SaaS tools allow the software to run on the endpoint device without storing any data on the device. The deployment of these tools can be leveraged for medical practice management systems, Health Information Exchange (HIE), EHRs, and other healthcare IT functions.

Deployment Mode Insights

In 2019, the cloud-based segment dominated the global ambulatory surgical centers IT services market, with a revenue share of 84.4%. The increasing adoption of cloud-based IT tools to optimize revenue cycle, clinical decision support, performance, and supply chain management owing to agility and accessibility is significantly contributing to the market growth.

Furthermore, this segment is anticipated to emerge as the fastest-growing segment over the forecast period. An increased number of cost-effective and accessible technology is the key factor for the high acceptance rate of these products. Besides, the growing use of cloud computing in outpatient settings to manage their revenue cycle and improve the quality of patient care is enhancing market growth.

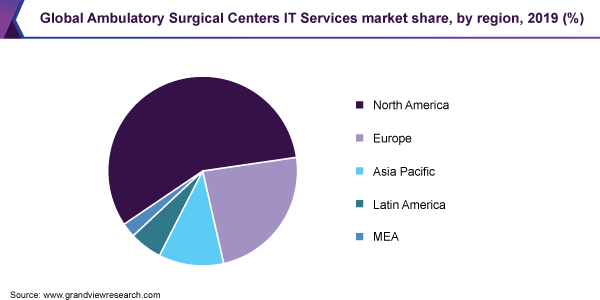

Regional Insights

North America dominated the market, with a revenue share of 57.6% in 2019. The key factors attributable to the large market share are the high adoption of healthcare IT services by the ambulatory centers in the U.S., which are further propelled by the presence of key market participants in the country. Furthermore, the increasing number of surgical procedures performed in ambulatory settings, and increasing demand to curb the escalating healthcare costs, are some of the major factors boosting the growth of this region.

The Asia Pacific is anticipated to emerge as the fastest-growing region during the forecast period. The high demand for healthcare IT services as a result of increasing government expenditure on healthcare infrastructure coupled with the increasing need to curtail the growing unnecessary healthcare costs due to medical errors is expected to accentuate the IT market. This is expected to drive demand for healthcare IT services for ambulatory centers. The Asia Pacific market is projected to expand at a CAGR of 23.9% by the end of the forecast period.

Key Companies & Market Share Insights

Competition is intense among existing players attributed to the rising demand for healthcare IT solutions to manage workflow and reduce unnecessary medical costs caused due to errors in reporting. These companies are launching innovative integrated services that help ambulatory centers to provide quality care to patients. Some of the key players operating in the market are Cerner corporation; eClinical Works; McKesson Corporation; Medical Information Technology, Inc.; Surgical Information Systems, LLC; NextGen Healthcare; Allscripts Healthcare Solutions Inc.; HST Pathways; CUREMD; and Epic Systems Corporation. Furthermore, strategic expansions by companies in the form of collaborations and the launch of innovative products are expected to boost the competition and propel the growth of the market. As the companies have started collaborating with IT service providers to improve scalability and facilitate interoperability among various processes is expected to witness continuous growth. Some prominent players in the ambulatory surgical centers IT services market include:

-

Cerner Corporation

-

eClinical Works

-

McKesson Corporation

-

Medical Information Technology, Inc.

-

Surgical Information Systems, LLC

-

NextGen Healthcare

-

Allscripts Healthcare Solutions, Inc.

-

HST Pathways

-

CUREMD

-

Epic Systems Corporation

-

Athenahealth, Inc.

-

Optum

-

Quatris Health

-

Epic Systems Corporation

Ambulatory Surgical Centers IT Services Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.2 billion

Revenue forecast in 2027

USD 13.5 billion

Growth Rate

CAGR of 22.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, solution, delivery mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cerner corporation; eClinical Works; McKesson Corporation; Medical Information Technology, Inc.; Surgical Information Systems, LLC; NextGen Healthcare; Allscripts Healthcare Solutions Inc.; HST Pathways; CUREMD; Epic Systems Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research, Inc. has segmented the global ambulatory surgical centers IT services market report based on service type, solution, delivery mode, and region:

-

Service Type Outlook (Revenue, USD Million, 2016 - 2027)

-

EHR

-

Clinical Documentation

-

Practice Management

-

Revenue Cycle Management

-

Supply Chain Management

-

Patient Engagement

-

Others

-

-

Solution Outlook (Revenue, USD Million, 2016 – 2027)

-

Software

-

Service

-

-

Delivery Mode Outlook (Revenue, USD Million, 2016 – 2027)

-

On-Premise

-

Cloud-Based

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ambulatory surgical centers IT services market size was estimated at USD 3.1 billion in 2019 and is expected to reach USD 3.2 billion in 2020.

b. The global ambulatory surgical centers IT services market is expected to grow at a compound annual growth rate of 22.8% from 2020 to 2027 to reach USD 13.5 billion by 2027.

b. North America dominated the ambulatory surgical centers IT services market with a share of 57.6% in 2019. This is attributable to the high adoption of healthcare IT services by the ambulatory centers in the U.S.

b. Some key players operating in the ambulatory surgical centers IT services market include Cerner corporation; eClinical Works; McKesson Corporation; Medical Information Technology, Inc.; Surgical Information Systems, LLC; NextGen Healthcare; Allscripts Healthcare Solutions Inc.; HST Pathways; CUREMD; and Epic Systems Corporation.

b. Key factors driving the ambulatory surgical centers IT services market growth include the growing number of ambulatory surgical centers due to the shift of surgeries from inpatient settings to outpatient settings coupled with increasing need to curb the growing healthcare costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."