- Home

- »

- Smart Textiles

- »

-

Americas & Europe Polymer Coated Fabrics Market Report, 2019-2025GVR Report cover

![Americas And Europe Polymer Coated Fabrics Market Size, Share & Trends Report]()

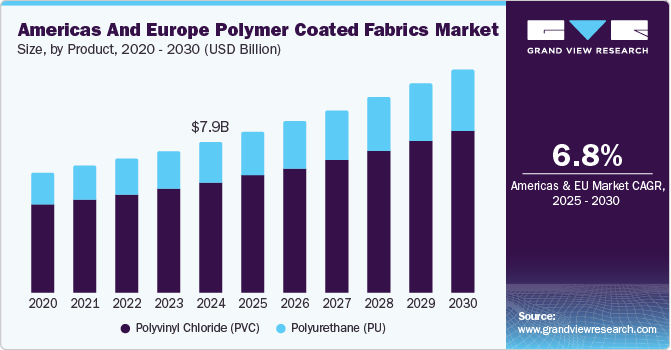

Americas And Europe Polymer Coated Fabrics Market Size, Share & Trends Analysis Report By Product (Polyvinyl Chloride, Polyurethane), By Application (Light Vehicles, Protective Clothing), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-040-8

- Number of Pages: 350

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Advanced Materials

Industry Insights

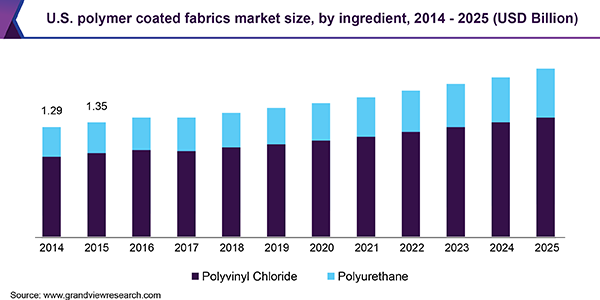

The Americas and Europe polymer coated fabrics market size were estimated at USD 7.39 billion in 2018. The market is driven by growing demand for polymer coated fabrics as upholstery in automotive and marine industries and as apparel in industrial and manufacturing applications.

The rise in demand for protective clothing owing to various government initiatives, such as Model Work Health and Safety Act by the Australian government, European Union’s Directive 89/686/EEC, The Personal Protective Equipment Regulations 2002, and worker safety laws are driving the use of polymer-coated fabrics as protective clothing.

The demand for Polyvinyl Chloride (PVC) coated fabric is expected to witness growth over the forecast period owing to its superior properties as compared to those of its counterparts. These properties enable the product usage in upholstery and protective applications in various end-use industries, such as automotive and furniture and seating. PVC coated fabrics are relatively inexpensive and the cost of the polymer is largely determined by the cost of additives such as plasticizers, light and heat stabilizers, fillers, and flame retardants.

Frontal airbags are considered a major life-saving technology in the automotive industry. Thus, the National Highway Traffic Safety Administration is encouraging car manufacturers to adopt more safety devices using a similar principle. This has a major impact on the increasing installation of side-curtain airbags in passenger cars, thereby driving the demand for polymer coated fabrics.

Factors, such as high weather ability, flexibility at low temperatures, and resistance to high impact and abrasion enable the use of PU coated fabrics for manufacturing high altitude protective clothing, chemical protective clothing, and fire retardant apparels, in turn, driving the demand for the two fabrics in the protective clothing industry.

Manufacturers need to upgrade their technologies regularly to meet the stringent regulations imposed by the U.S. Green Building Council, Consumer Product Safety Improvement Act (CPSIA), and Clean Water Act. These advancements entail heavy capital investments, which affect their profitability. This is one of the major factors restraining the growth of polymer-coated fabrics market.

Rising consumer confidence in the economy coupled with augmenting demand for all types of vehicles is expected to drive automobile production across the globe. The market penetration of polymer-coated fabrics is witnessing growth owing to their increasing utilization in airbags, upholstery, and other minor applications in light vehicles. These factors are likely to boost product demand over the forecast period.

Product Insights

In terms of product, the market is categorized into Polyvinyl Chloride (PVC) and polyurethane. PVC coated fabric accounts for a majority market share. The product is utilized in several industries owing to its high chemical and thermal resistance. Also, the low vulnerability to wear and tear promotes its use in automotive and furniture and seating applications, which in turn is expected to drive the product demand over the forecast period.

Vinyl chloride is a carcinogenic compound and recycling it, is a major challenge faced by manufacturers and consumers. As a result, several countries, including U.S., Sweden, Canada, Spain, Denmark, France, Greece, and Germany, are imposing restrictions on the use of phthalates in PVC compounds, which is expected to negatively impact the market.

Polyurethane coating is used in a wide variety of applications including tents, evacuation slides, life vests, flexible fuel storage tanks, apparels, inflatable boats, rainwear, automotive upholstery, luggage, water storage bags, food conveyor belts, and fuel hoses. Polyurethanes create a clear protective finish for decorative products, such as wall coverings and furniture in addition to offering improved protection from abrasion as compared to PVC.

Application Insights

Based on application, the market is categorized into light vehicles, light commercial vehicles, heavy commercial vehicles, marine, furniture and seating, protective clothing, industrial, roofing, awnings and canopies, wallcoverings, and footwear and leather goods. The protective clothing segment is anticipated to expand at a CAGR of 9.1% owing to the rise in the spending on protective clothing for military personnel by the defense sector.

Light vehicles accounted for a major market share in terms of demand in 2018 owing to the growing automotive applications including airbags, upholstery, headliners, trim, tops, and covers. Polymer coated fabrics are majorly used in automobile seat covers and interiors light vehicles.

Increasing automotive production across the globe coupled with rising per capita income is propelling the demand for high-quality polymer coated fabrics to be employed in airbags, automotive soft tops, and aftermarket. All the aforementioned factors are anticipated to boost the market growth over the forecast period.

Polymer coated fabrics are widely used for manufacturing carpets, mats, bedding products, curtains, and a wide range of upholstery products in residential and commercial sectors. Evolving trends in home decoration and fancy furniture designs in the developed economies of Europe and America are boosting the application in the furniture industry.

Regional Insights

North America, which is one of the largest producers of polymer-coated fabrics, extensively exports the product to developing economies, where the transportation industry is growing rapidly owing to the high demand for vehicles including marine, light vehicles, and light and heavy commercial vehicles.

Also, the demand for polymer coated fabrics is increasing significantly owing to the growing demand from the automotive, textile, furniture, and seating industry. The growing Light Commercial Vehicle (LCV) production along with the stringent rules about the safety of drivers has led to increased penetration of polymer-coated fabrics in the regional automotive sector.

The manufacturing sector is expected to continue witnessing growth over the forecast period in developing economies, thereby driving the demand for raw materials used for manufacturing finished goods. This, in turn, is anticipated to augment the regional market in the forthcoming years.

Growing automotive production in Mexico is the major driving factor for increasing the production of light vehicles, which in turn is expected to propel the demand for polymer coated fabrics. However, the dip in car sales in Panama by around 14% in 2017 from the previous year is expected to hamper the regional product demand.

Americas and Europe Polymer Coated Fabrics Market Share Insights

The market is highly competitive with high pressure about pricing and a limited number of suppliers delivering premium quality raw materials to meet the high standards of application industries. The market players adopt merger and acquisition strategies to expand their businesses and manufacturing capabilities.

OMNOVA Solutions, a major producer of polymer-coated fabrics, has a broad product portfolio, including brands such as Boltaflex, Nautolex, and PreVaill, offering high-performance polyvinyl and polyurethane automotive upholstery as well as marine upholstery used in exterior and interior marine applications. The company also caters to construction and architecture, corporate offices, healthcare, hospitality, sports, and several other industries.

Spradling International, another major market player, offers over 500 products designed specifically for individual markets and applications. Continental AG and Solvay are integrated across three stages of the value chain as the companies are involved in raw material production, manufacturing of coated fabrics, and product supply or distribution. The companies operate in the international markets and are major players in the global coated fabrics industry with distribution networks spread across all the regions.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Million Square Meters and Revenue in USD Million & CAGR from 2019 to 2025

Regional scope

North America, Central Europe, Eastern Europe, South America, and Central America

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Poland, Argentina, Brazil, Peru, Chile, Colombia, Ecuador, and Mexico

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the Americas and Europe polymer coated fabrics market report based on product, application, automotive by application, product by application, and region:

-

Product Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2014 - 2025)

-

Polyvinyl Chloride

-

Polyurethane

-

-

Application Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2014 - 2025)

-

Light Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Marine

-

Furniture & Seating

-

Protective Clothing

-

Industrial

-

Roofing, Awnings & Canopies

-

Wallcoverings

-

Footwear & Leather Goods

-

Others

-

-

Automotive by Application Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2014 - 2025)

-

Airbags

-

Upholstery

-

Headliners

-

Trims

-

Tops

-

Covers

-

Flooring

-

-

Application by Product Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2014 - 2025)

-

Light Vehicles

-

Polyvinyl Chloride

-

Polyurethane

-

-

Light Commercial Vehicles

-

Polyvinyl Chloride

-

Polyurethane

-

-

Heavy Commercial Vehicles

-

Polyvinyl Chloride

-

Polyurethane

-

-

Marine

-

Polyvinyl Chloride

-

Polyurethane

-

-

Furniture & Seating

-

Polyvinyl Chloride

-

Polyurethane

-

-

Protective Clothing

-

Polyvinyl Chloride

-

Polyurethane

-

-

Industrial

-

Polyvinyl Chloride

-

Polyurethane

-

-

Roofing, Awnings & Canopies

-

Polyvinyl Chloride

-

Polyurethane

-

-

Wallcoverings

-

Polyvinyl Chloride

-

Polyurethane

-

-

Footwear & Leather Goods

-

Polyvinyl Chloride

-

Polyurethane

-

-

Others

-

Polyvinyl Chloride

-

Polyurethane

-

-

-

Regional Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Central Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Eastern Europe

-

Poland

-

-

South America

-

Argentina

-

Brazil

-

Peru

-

Chile

-

Colombia

-

Ecuador

-

-

Central America

-

Mexico

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."