- Home

- »

- Homecare & Decor

- »

-

Americas Range Hood Market Share Report, 2021-2028GVR Report cover

![Americas Range Hood Market Size, Share & Trends Report]()

Americas Range Hood Market Size, Share & Trends Analysis Report By Product (Under Cabinet, Wall Mounted, Ceiling Mount), By End User, By Distribution Channel, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-339-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The Americas range hood market size was valued at USD 4.45 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 4.0% from 2021 to 2028. Higher penetration of modular kitchens with the rise in home remodeling is boosting the growth. With the expansion of real estate as well as commercial construction, the market is bound to witness a higher demand for range hoods in these segments. According to the World Property Journal, U.S. Housing Market's combined value hit USD 33.6 trillion in January 2020. The increasing infrastructural developments, as well as new building permits in the region, are expected to boost the market growth. Technological advancements in kitchen appliances, along with the rising usage of IoT in kitchen hood devices, are expected to be the key factors boosting the growth.

Manufacturers are focusing on developing innovative devices owing to consumer preference for smart features, such as noise reduction, wireless connectivity, and installation of temperature, optic, and infrared sensors, in the products. For instance, manufacturers of range hoods use multiple insulation layers, sound-absorbing base, and filtration system motors to reduce noise. This factor is also likely to contribute to market growth.

Increased spending on home improvement projects or home remodeling is also boosting product demand. Growing home values have doubled homeowners’ equity in five years till 2019, indicating a surge in spending capacity on home improvement. According to the National Association of Realtors (NAR), the existing home sales rose by 10.5% y-o-y to a seasonally adjusted annual rate of 6 million units in August 2020. Likewise, according to the US Census Bureau, sales of new homes soared by 43.2% y-o-y to a seasonally adjusted annual rate of 1,011,000 units in August 2020. In Canada, house prices grew 4.6 % YoY in November 2020, following an increase of 3.9 % YoY in the previous month.

The covid-19 pandemic has also significantly impacted the market with stay-at-home orders and safer-at-home advisories, Americans have become increasingly reliant on their household appliances. Consumers are relying on common kitchen appliances with greater frequency. According to the blog by Applied Marketing Science, Inc., 35-40% of consumers have turned to home-cooked meals for the first time as a result of the pandemic. This scenario is likely to cause greater attraction of consumers towards the market in the forthcoming years.

Stringent regulations by various regional governments regarding cleanliness and hygiene in restaurants and food chains have mandated the installation of range hoods, which is also boosting the market growth. Moreover, these devices offer added advantages such as heat reduction, maintenance of air quality, and increased safety.

Product Insights

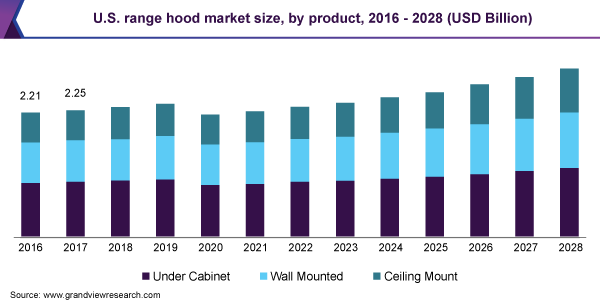

The under cabinet product segment held the largest revenue share of more than 42.7% in 2020. This high share is attributed to the fact that the under-cabinet range hood mounts directly beneath an over-the-range cabinet and blends into the design flow of the cabinets above and around the range or cooktop. Careful measurement of available dimensions in the under-cabinet area is important when choosing an under-cabinet range vent.

Furthermore, ceiling mount products have gained higher penetration among consumers. The increasing trend of kitchen remodeling in the country is expected to spur the demand for trendy ceiling-mounted range hoods. According to a report by the National Kitchen & Bath Association, a large number of people in the U.S. opted for kitchen renovation with a market value of USD 49.7 billion in 2016. The growing popularity of kitchen renovation is expected to have a positive influence on this range hood products owing to the greater availability of products of this category.

End-user Insights

The residential application held the largest revenue share of more than 85.7% of the America range hood market in 2020. This high share is attributed to the fact that modern urban lifestyles and smart upgrades and visually appealing product innovations by key industry participants are driving the adoption rate of premium range hoods. According to the Joint Center for Housing Studies of Harvard University, the home improvement industry was valued at USD 425 billion in 2017. This, in turn, will boost the overall market growth in the residential sector.

Developments in the hospitality sector have resulted in the growth of the hotel industry, leading to the construction of a greater number of hotels across the country. A thriving travel and tourism industry also offers growth opportunities for different categories owing to consumer preference for luxurious stays in resorts or highly-rated hotels. Thus, these trends are likely to shift the spotlight on premium-quality cookware in hotel chains and restaurants, which would subsequently drive the demand for range hoods in commercial kitchens.

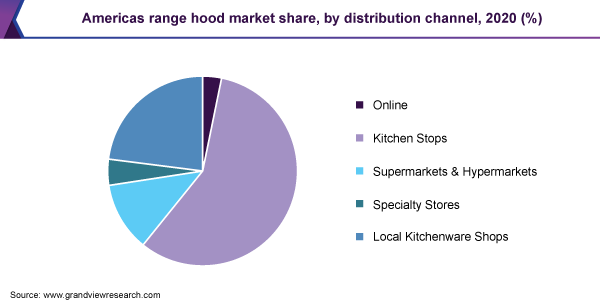

Distribution Channel Insights

The kitchen stops channel of distribution contributed a revenue share of more than 57.7% in 2020. Kitchen shops include the official stores owned by various brands such as Whirlpool, Haube Range Hood Co., and KOBE Range Hoods. The sales of range hood products through kitchen shops continue to flourish as consumers seek more specialty products for their kitchens, particularly the consumers in the luxurious household and hotel space. Nowadays, consumers are looking for range hoods that are unique and better reflect their lifestyle. Hence, they opt for kitchen shops such as company stores, as premium products are not always found at traditional retail outlets.

Kitchen shops are also popular since they offer customers set configurations based on current trends. These stores are capitalizing on this trend and offer products to meet consumer demand. Kitchen shops have a wide range of products, such as different mounting types and finishes, which allows consumers to choose a range hood items that best serve their requirements.

However, the online distribution channel is expected to register the fastest CAGR of 4.9% from 2021 to 2028. Although the offline distribution channel is predominant for the sales of range hood products, online distribution is gaining significant popularity. Increasing Internet penetration among the middle-class population and the rising usage of smartphones and similar devices are among the key reasons driving online retail. Consumers are rapidly shifting towards the online mode of purchase with the rise of e-commerce giants such as Amazon, Alibaba, eBay, and JD.com.

Observing this drastic shift in consumer behavior from offline to online, several range hood manufacturers are opting for direct-to-consumer sales to primarily sell their range hood products and gain higher profit margins. Direct-to-consumer sales channels are also expected to strengthen brand relationships with customers by delivering high-quality products quickly.

Regional Insights

The U.S. made the largest contribution with a revenue share of 48.6% in 2020. Continuous expansion of the residential sector on account of the increasing number of households, coupled with major home improvement projects undertaken by consumers in the country, is boosting the demand for range hoods. According to the National Association of Home Builders (NAHB), 82% of the remodelers in the U.S. ranked kitchen renovation as their top job as of 2019. Consumers are likely to invest in high-end kitchen appliances that complement their kitchen décor.

Canada is expected to register the fastest CAGR of 4.5% from 2021 to 2028. Steady growth in the number of foodservice joints and residential construction projects is the main factor driving the demand for range hoods. As per Statistics Canada, there were about 94,400 eateries in 2017, which served an average of 22 million customers each day.

Appliance stores in Canada were struggling with surging product demand and supply chain challenges due to the COVID-19 pandemic during the peak season of Black Friday sales. In October 2020, Jason Goemans, president of Goemans Appliances, shared with CBC/Radio-Canada that the company had mounting backorders during October due to swelling demand. Vice-president and general manager of Whirlpool Canada, Gary Power, stated that the company sometimes is unable to operate at maximum capacity due to COVID-19 safety protocols.

Key Companies & Market Share Insights

The industry has a large number of international and local players. The impact of these established players on the market is quite high as a majority of them have vast distribution networks across the North America and Latin America regions to reach out to their large customer base. The key players operating in the Americas range hood market are focusing on strategic initiatives such as product launches, participation in events, and expansions to drive revenue growth and reinforce their position in the market.

Key players operating in the market adopt strategic initiatives such as product launches to drive the company's growth in the future as well as to solidify their position in the market. For instance, in December 2020, Broan-NuTone, LLC launched a series of three new models of chimney hoods in the new Designer Collection. The models, available in stainless steel and black stainless steel (model BWS1 exclusively), feature refined lines that form a slim contemporary design. Some of the key players operating in the Americas range hood market are:

-

Whirlpool Corporation

-

Broan-NuTone, LLC

-

GE Appliances, a Haier Company

-

Robert Bosch GmbH

-

Haube Range Hood Co.

-

KOBE Range Hoods

-

Victory Range Hoods

-

Proline Range Hoods

-

Faber US and Canada

-

Vent-A-Hood® Ltd.

Americas Range Hood Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 4.57 billion

Revenue forecast in 2028

USD 6.11 billion

Growth rate

CAGR 4.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, end user, distribution channel, region

Regional scope

U.S.; Canada; South America

Country scope

Northeast U.S.; Southeast U.S.; Southwest U.S.; Midwest U.S.; West U.S.; Toronto; Montreal; Calgary; Ottawa; Brazil

Key companies covered

Whirlpool Corporation; Broan-NuTone, LLC; GE Appliances, a Haier Company; Robert Bosch GmbH; Haube Range Hood Co.; KOBE Range Hoods; Victory Range Hoods; Proline Range Hoods; Faber US and Canada; Vent-A-Hood® Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the Americas range hood market report based on product, end user, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Under Cabinet

-

Wall Mounted

-

Ceiling Mount

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2028)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Online

-

Kitchen Stops

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Local Kitchenware Shops

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

U.S.

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

-

Canada

-

Toronto

-

Montreal

-

Calgary

-

Ottawa

-

-

South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The U.S. dominated the Americas range hood market with a share of 48.6% in 2020. This is attributable to the continuous expansion of the residential sector on account of the increasing number of households, coupled with major home improvement projects undertaken by consumers in the country.

b. The Americas range hood market size was estimated at USD 4,450.9 million in 2020 and is expected to reach USD 4,571.1 million in 2021.

b. The Americas range hood market is expected to grow at a compound annual growth rate of 4.0% from 2021 to 2028 to reach USD 6,107.1 million by 2028.

b. The under cabinet product segment led the Americas range hood market with the largest revenue share of more than 42.7% in 2020.

b. The residential application held the largest revenue share of more than 85.7% of the America range hood market in 2020.

b. The kitchen stops channel of distribution dominated the Americas range hood market and accounted for a revenue share of more than 57.7% in 2020.

b. Some key players operating in the Americas range hood market include Whirlpool Corporation, Broan-NuTone, LLC, GE Appliances, Haier company, Robert Bosch GmbH, Haube Range Hood Co., KOBE Range Hoods, Victory Range Hoods, Proline Range Hoods, Faber US and Canada, and Vent-A-Hood® Ltd.

b. Key factors that are driving the Americas range hood market growth include higher penetration of modular kitchens with rising in home remodeling and expansion of real estate as well as commercial construction.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."