- Home

- »

- Agrochemicals & Fertilizers

- »

-

Ammonia Market Size, Share & Growth Trends Report, 2030GVR Report cover

![Ammonia Market Size, Share & Trends Report]()

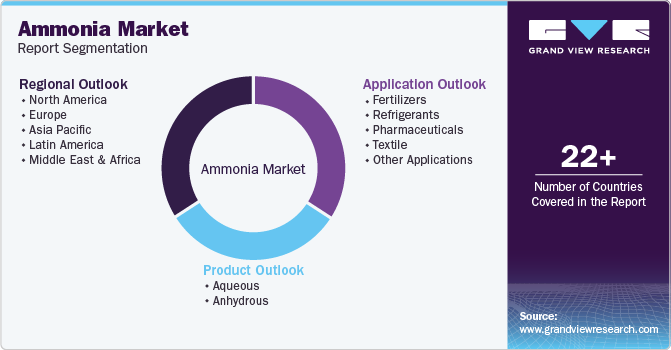

Ammonia Market Size, Share & Trends Analysis Report By Product Form (Aqueous, Anhydrous), By Application (Fertilizers, Refrigerants, Pharmaceuticals, Textile), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-207-5

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Ammonia Market Size & Trends

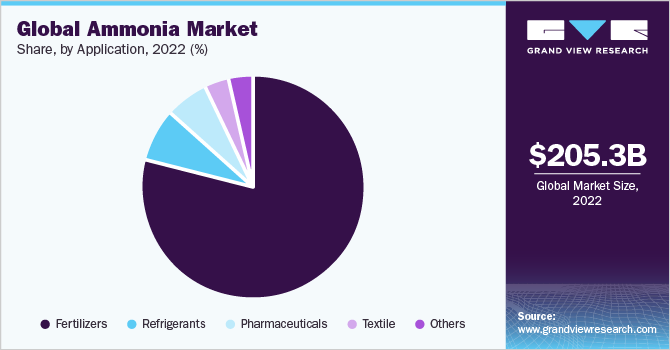

The global ammonia market size was valued at USD 205.34 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. This is attributed to its rising demand for ammonia in fertilizers and refrigerants. Rise in population, increasing demand for food, and decreasing arable land globally are some of the key factors contributing to boosting the NH3 fertilizers, which in turn, will boost the market growth. Ammonia is commonly used in large-scale refrigeration plants and is available in various forms such as liquid and gas. It is 10-20% cost efficient compared to systems that use CFCs and hence is highly preferred. Moreover,the product is also considered a natural refrigerant as it has no direct greenhouse effect and no potential for ozone depletion. In addition, NH3 exhibits favorable thermodynamic properties that enable it to require low energy input to provide refrigerating ability. These factors are expected to fuel the product market growth over the forecast period.

Moreover, the use of green ammonia as a feedstock for the production of fertilizers and other chemicals presents a significant opportunity. This has the potential to significantly reduce greenhouse gas emissions and help combat climate change. Green ammonia can be used as zero-carbon fuel in areas such as transportation, heating, and electricity, as well as a fertilizer. Hence, the increasing demand for green/sustainable ammonia is a major restraint for conventional NH3 and an opportunity for the sustainable product market.

According to the Food and Agriculture Organization of the United Nations (FAO), the total production of nitrogenous fertilizers for crops stood at 112.36 million tons in 2020 and is expected to reach 136.71 million tons by 2025 owing to the increasing application of it along with and other nitrogen fertilizers by the farmers.

Moreover, the NH3 helps in boosting crop yield by speeding up germination cycles, preventing direct contact of the crop with soil, and by ensuring that fertilizers and nutrients are in the vicinity of the roots. Thus, the product demand is expected to witness a rise over the forecast period.

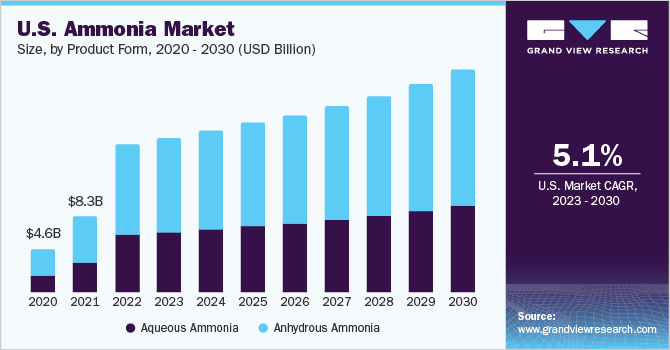

Product Form Insights

Anhydrous ammonia dominated the market with the highest revenue share of 60.1% in 2022. This is due to its ease of handling and its abundant availability for the farmers. Moreover, NH3-based nitrogenous fertilizers offer increased yield, effective crop protection, and enhanced production cycles. The anhydrous form of product-based fertilizer is widely used in agriculture due to its high nitrogen content of 82 percent. However, it is more effective in warmer climates compared to cooler climates.

Anhydrous ammonia has a strong odor and a high heat of vaporization, which makes it useful as a refrigerant and a solvent. Liquefied NH3 is also utilized in various industrial applications, including the production of synthetic fibers, the manufacturing of pharmaceuticals, and the extraction of metals from ores.

Liquefied/anhydrous form is also a commonly used solvent in the production of synthetic fibers, such as nylon and rayon. This can be attributed to its ability to dissolve a wide range of polymers, making it an ideal solvent in the spinning process. Moreover, the pharmaceutical industry also utilizes liquefied NH3 in the manufacturing of numerous drugs. It is often used as a reagent or solvent in chemical reactions that create the necessary compounds for these drugs. Furthermore, the liquefied form of the product is commonly utilized as a leaching agent in the mining industry. In this application, it is used in the extraction of valuable metals such as copper and nickel from their ores.

Aqueous ammonia, also known as ammonia water, is a solution of ammonia gas dissolved in water. The solution is usually clear and colorless, though it can have a faint yellow tint due to impurities. Aqueous ammonia is commonly used as a cleaning agent for various surfaces and materials because of its ability to dissolve and remove dirt, oils, and grease.

Applications Insights

The fertilizers segment dominated the market with the highest revenue share of 78.5% in 2022 owing to its increasing usage by the farmers as the nitrogenous fertilizers are high solubility, which allows them to be absorbed by plants quickly and efficiently. This means that they can provide the necessary nitrogen for plant growth more rapidly than organic fertilizers, which can take time to decompose and release their nutrients.

Ammonia is one of the most commonly used nitrogenous fertilizers and is the basic compound of the nitrogen industry. Consumption of NH3 for nitrogen fertilizers accounts for approximately 80% of the global demand for the product.

Additionally, NH3 based fertilizers can be produced in a variety of forms that are tailored to different agricultural settings and crops. For example, ammonium nitrate is often used in crops that require a quick nitrogen boost, such as corn and wheat, while urea is commonly used in crops that require a longer-lasting nitrogen supply, such as vegetables.

Ammonia is widely used as a refrigerant due to its excellent thermodynamic properties. Unlike CFCs and HFCs refrigerants, NH3 has zero ozone depletion potential, zero global warming potential, and is non-flammable. It is also relatively cheap and readily available. Moreover, NH3 is typically used in smaller refrigeration applications such as ice rinks, cold storage facilities, and food processing plants. It is also used in large-scale industrial refrigeration applications such as in the chemical, petroleum, and gas processing industries.

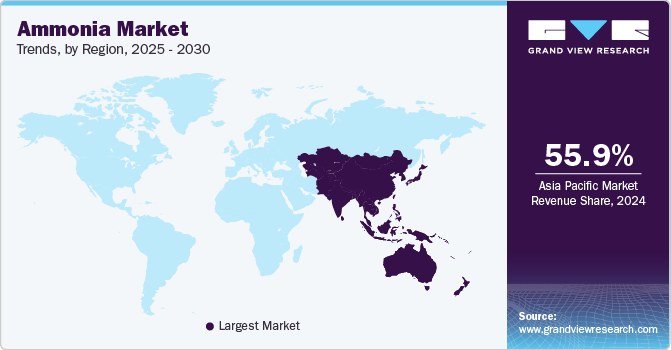

Regional Insights

Asia Pacific region dominated the product market with the highest revenue share of 55.6% in 2022. This is attributed large number of agrarian countries, including Thailand, Japan, India, Indonesia, and the Philippines in the APAC region. The region accounts for around 60% of the global consumption of nitrogenous fertilizers.

According to the International Energy Agency, China is the largest producer of ammonia in the world, accounting for around 30% of the global production. China is also the largest consumer of nitrogenous fertilizers in the world and accounts for one-third of the total global consumption.

As per Ammonia Energy Association, India is one of the world's largest producers of ammonia, accounting for around 8% of the global production. The majority of the product produced in the country is directly converted to urea, which is further used as a fertilizer.

The European market consumed around 15.5 million tons of nitrogen fertilizers in 2020. according to the Food and Agriculture Organization. Europe is highly dependent on imports for most of its mineral fertilizer needs. Nitrogen-based fertilizers have been the most-traded product between Europe and other countries. The region imports nitrate-based fertilizers primarily from Algeria, Egypt, and Russia. Compounds of NPK are mostly imported from Norway and Russia.

Key Companies & Market Share Insights

Key companies are involved in increasing the product length by developing different grades of product in order to cater to different end-use industries. Moreover, industry players are focusing on the production of sustainable/green ammonia in order to reduce their carbon footprint in the upcoming years. For instance, in March 2022, Hegra (Herøya Green Ammonia) was launched as a cooperation between Yara, Aker Clean Hydrogen, and Statkraft, with an aim to decarbonize Yara’s ammonia plant at Herøya in Porsgrunn and eliminating 800,000 tonnes of annual CO2 emissions. Some prominent players in the global ammonia market include:

-

Acron

-

Koch Fertilizer, LLC

-

Yara

-

CF Industries Holdings, Inc.

-

Nutrien Ltd.

-

Qatar Fertiliser Company

-

Togliattiazot

-

SABIC

-

Sumitomo Chemical Co., Ltd.

Ammonia Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 213.9 billion

Revenue forecast in 2030

USD 313.21 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in kilotons, revenue in USD Billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Market Players

Acron; Koch Fertilizer, LLC; Yara, CF Industries Holdings, Inc.; Nutrien Ltd; Qatar Fertiliser Company; Togliattiazot; SABIC; Sumitomo Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammonia Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ammonia market report on the basis of product from, application, and region:

-

Product Form Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 -2030)

-

Aqueous Ammonia

-

Anhydrous Ammonia

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Fertilizers

-

Refrigerants

-

Pharmaceuticals

-

Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ammonia market size was estimated at USD 205.34 billion in 2022 and is expected to reach USD 213.9 billion in 2023.

b. The global ammonia market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 313.21 billion by 2030.

b. Asia Pacific dominated the ammonia market with a share of 55.6% in 2022. This is attributable to large number of agrarian countries, including Thailand, Japan, India, Indonesia, and the Philippines in the APAC region.

b. Some key players operating in the ammonia market include Acron, Koch Fertilizer, LLC, Yara, CF Industries Holdings, Inc., Nutrien Ltd, QATAR FERTILISER COMPANY, Togliattiazot, SABIC & Sumitomo Chemical Co., Ltd.

b. Key factors that are driving the ammonia market growth include rising demand for ammonia majorly in the fertilizers and refrigerants industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."