- Home

- »

- Next Generation Technologies

- »

-

Analytics as a Service Market Size, Share Report, 2020-2027GVR Report cover

![Analytics as a Service Market Size, Share & Trends Report]()

Analytics as a Service Market Size, Share & Trends Analysis Report By Type (Predictive, Perspective), By Enterprise Size, By End Use (BFSI, Healthcare), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-243-3

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Technology

Report Overview

The global analytics as a service market size was valued at USD 4.98 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 25.9% from 2020 to 2027. Analytics as a service (AaaS) is a deployment model in which a third-party vendor provides analytical solutions through a cloud platform. The increased demand among organizations to evaluate consistency in the patterns among the data has resulted in a growing focus on enhancing their computational and statistical abilities which bode well for the market growth. The growth is driven by enterprises emphasizing analytics for data-driven decision-making to improve the performance of various aspects of business such as sales, demand forecasting, and raw materials procurement. The growing adoption of cloud-based solutions is expected to positively influence the demand for AaaS.

The shift of businesses from traditional systems towards digital solutions is playing a significant role in the centralization of data across all the departments and functions of an organization, thereby increasing the demand for AaaS. The increasing demand for analytical solutions, across a range of applications such as predicting the electricity consumption, trade market, and traffic trend predictions have boosted the market growth. Various companies, including Google LLC; IBM; and Oracle Corporation; provide analytical solutions through their flagship cloud platform, which has significantly impacted the growth. For instance, IBM provides its analytical solutions-Watson Analytics through Watson Cloud, which helps the company’s clientele to analyze structured data.

The rising usage of analytical solutions in demand sensing of products in the e-commerce and retail sector is another major factor that has boosted the market growth. Demand sensing is extensively used in the retail industry to determine potential consumers of a product, helping retailers understand consumer behavior and its impacts on the entire supply chain. Additionally, there has been a rise in the adoption of analytical solutions to translate data generated by the use of RFID tags which bodes well for market growth.

For instance, in August 2019, Nike, Inc. acquired Celect, Inc., a developer of a cloud-based, predictive analytics platform. Post-acquisition, Nike, Inc. began to use RFID technology and Celect, Inc.’s predictive analytical solutions to optimize inventory performance. Moreover, technologies such as virtual reality (VR) and augmented reality (AR) are data immersive technologies and require high bandwidth for operations, resulting in the generation of large amounts of data. As a result of the generation of huge unstructured data, analytical solutions are used to categorize, process, and display it into meaningful insights.

In recent years, there has been a rapid increase in volumes of business data being generated across various industries, such as transportation, manufacturing, healthcare, and retail. As a result, enterprises are focusing on aggregating data collected from multiple departments and converting raw data into meaningful insights. The increasing investments in big data analytics by the government agencies, as well as incumbents of various industries, such as banking, manufacturing, and professional services, bodes well for the market growth. For instance, the BFSI sector alone invested approximately USD 20.8 billion in big data analytics in 2018.

The surge in data security concerns on account of the rise in the number of cyber-crimes is a significant factor that is negatively impacting market growth. As data is always stored on a remote server, when end users are accessing the data while in transit over the internet, the data and applications may be vulnerable to cyberattacks. Therefore, public safety organizations have implemented stringent regulations, and service providers have to abide by these regulations. For instance, the General Data Protection Regulation (GDPR) requires companies to protect the data processed through any system or software, and it applies to organizations operating in the European Union.

COVID-19 Impact Insights

The decrease in the revenue of enterprises owing to COVID-19 has impacted their long-term spending budgets. As a result, these enterprises are re-evaluating their analytical solutions budget. Furthermore, the COVID-19 pandemic is having a significant impact on Consumer Packaged Goods (CPG) and retail industries. As organizations in these industries are leveraging the use of analytical solutions to understand the resulting changes in consumer behavior across brands and channels, the market is expected to witness significant growth from these industries. Various brands are evaluating media data by geographies to utilize analytical solutions for optimizing investments relative to a target market in a particular geography on the pandemic timeline. Ecommerce companies are leveraging the usage of marketing analytical solutions to optimize the launch of campaigns and offers in order to build awareness about their offerings.

Governments globally are using analytical solutions to harvest travel data, and information from hospitals to predict coronavirus disease spread, and its risks. Moreover, law enforcement and healthcare organizations are utilizing analytical solutions to access location intelligence to track the location of individuals who are advised to self-isolate. COVID-19 has the most negative effect of industries that largely depend on the movement of people including the hospitality, and travel industries. As a result, various organizations in these industries are adopting solutions such as financial analytical solutions and risk analytics, among others. Various geospatial analytics companies such as GeoSpark Analytics and Esri are focusing on the development of risk analytics solutions. For instance, in March 2020, Esri designed a special Covid-19 ArcGIS Hub that gathers and shares relevant information through geospatial data.

The analytics as a service market is experiencing a surge in demand for real-time information to track and monitor the impact of COVID-19. It is expected to provide lucrative opportunities for market players. As a result, various companies such as IBM and Oracle Corporation, are emphasizing the development of analytical tools that enable the tracking of COVID-19 cases. For instance, in March 2020, IBM announced that it is offering tools that use IBM Watson to access and analyze data from the World Health Organization and multiple national, state, and local governments. These tools have been integrated in The Weather Channel app and include artificial intelligence (AI) enhanced interactive Incidents Map of the COVID-19 data and stats such as the number of confirmed cases by cities, states, and countries. Besides, it provides details such as patient education materials, public health information, and locations of key healthcare clinics. Moreover, it consists of an interactive dashboard built on IBM Cognos Analytics that enables users to conduct a deeper analysis and filter the data by region.

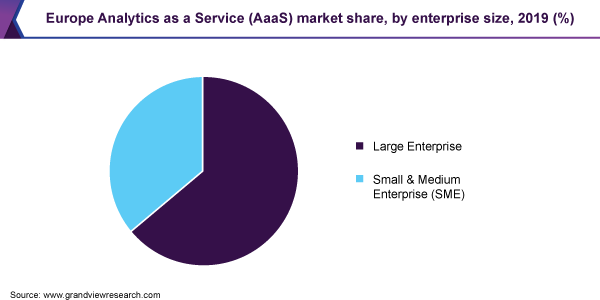

Enterprise Size Insights

In terms of revenue, the large enterprise segment held more than 60% of the market share in 2019. In large enterprises, the amount of data generated is huge which has resulted in a rising demand for solutions such as big data analytics and predictive analytics, which is a major factor boosting the adoption of AaaS. Furthermore, large enterprises in the energy and utility sector are using analytical solutions to implement protective measures for equipment maintenance, real-time customer billing, and management of field services.

Moreover, large enterprises in the retail sector are adopting analytical solutions to improve the accuracy of their sales forecasting models and reduce inventories. In various industries and sectors, including manufacturing, oil and gas, and automotive, among others, analytical solutions are used for activities such as demand forecasting and predictive analytics that are driving the segment growth.

The exponential rise in the number of small and medium enterprises in countries such as China, India, and Singapore is a major factor driving the demand for AaaS. Furthermore, the lower costs of AaaS as compared to software have allowed small and medium enterprises to adopt these services that are further driving the demand. In recent years, there has been a growing demand for analytics among small and medium enterprises as they are focusing on advanced visualization and reporting tools. According to the research conducted by the National Association of Software and Services Companies (NASSCOM), 60% of SMEs in India have adopted cloud-based analytical solutions. It is expected to rise to 75% over the next eight years.

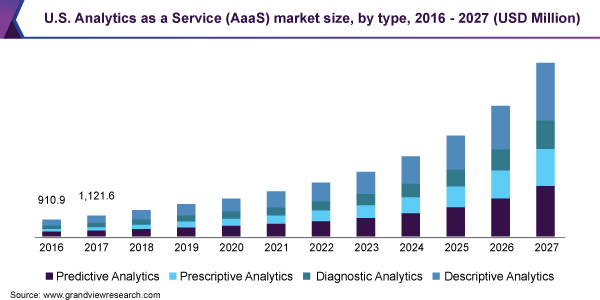

Type Insights

In terms of revenue, the predictive analytics segment accounted for more than 25% of the market share in 2019. Various organizations in the retail sector are leveraging on these solutions in demand forecasting, helping them make informed decisions and augment their profitability, thereby contributing to the growth. Moreover, companies developing the automated driver assistance system (ADAS) technology and autonomous vehicles are extensively using predictive analytics to analyze sensor data from connected cars and to build driver assistance algorithms.

Additionally, there has been a rise in the demand for AaaS for managing plant operations and distribution networks through predictive analytics, thereby driving the segment growth. Furthermore, companies in the e-commerce sector are leveraging predictive solutions to provide a tailored and customized shopping experience to their customers.

The prescriptive analytics segment is anticipated to expand at a significantly high CAGR over the next eight years. This can be attributed to the ability of prescriptive analytics to combine tools and techniques such as Artificial Intelligence (AI), computational modeling procedures, and mathematical sciences to prescribe decision-making effectively. The segment growth is further fueled by increasing demand in the manufacturing sector for prescriptive maintenance.

Moreover, there has been an increasing demand for prescriptive analytics in the healthcare sector which bodes well for segment growth. Prescriptive solutions help incumbents in the healthcare sector accurately plan for future capital investments for facilities and equipment. Besides, it also helps them understand the trade-offs between the addition of beds and the expansion of an existing facility.

End-Use Insights

The increasing demand for AaaS in banking for services such as revenue management, financial crime control, compliance management, billing management, and lending and leasing services has propelled the growth of AaaS in the BFSI segment. The rising usage of analytical solutions from banks for monitoring and tracking various transactions performed by their customers is a major factor influencing the segment growth. Furthermore, increased usage of AaaS for applications such as stock market predictions and Bitcoin prediction bodes well for the growth of the segment. Stock exchanges such as the New York Stock Exchange (NYSE) and the National Stock Exchange of India have implemented analytical solutions enabling investors to make predictions on the increase or decrease in the stock prices.

Network service providers are capturing and analyzing network-related data to help them in providing proactive support, predict service outages, enhance customer experience, and determine impactful product roadmaps that bode well for the growth of AaaS in IT and telecom segment. Moreover, they are shifting from on-premise to cloud-based solutions for limiting capital expenditure, thereby fueling the segment growth further.

In recent years, there has been a tremendous rise in the demand for database management tools owing to the increasing unorganized data generated from streaming activities for media subscription services such as NetFlix, Amazon Prime Video, and Hulu. The synergy of cellular networks and analytical solutions has enabled IoT to enhance the efficiency of organizations which bodes well for segment growth. It has improved the speed and accuracy of the information and data being shared among the IoT devices without human intervention.

Regional Insights

North America dominated the AaaS market with a share of over 40% in 2019. This is attributed to various associations and organizations in the region such as the Cloud Native Computing Foundation and the National Cloud Technologists Association promoting the use of cloud computing for the deployment of various high-tech solutions such as advanced analytics, big data analytics, and predictive analytics. Furthermore, various healthcare organizations and government agencies are collaborating on the development of analytical solutions for the healthcare sector, which bodes well for the growth of the regional market.

For instance, in May 2017, under the “Million Veterans Program Computational Health Analytics for Medical Precision to Improve Outcomes Now (MVP CHAMPION)” the U.S. Department of Energy (DOE) partnered with the U.S. Department of Veterans Affairs (VA) to develop analytical solutions. The solution combines VA’s healthcare data with DOE’s High Performance Computing (HPC) and data analytical solutions. It has enabled healthcare organizations to identify trends that will support the development of new treatments and preventive strategies.

The growth of the Asia Pacific region is attributed to the rise in the number of analytics companies such as EXL; IDG Ventures Partners, and TA Associates, investing in emerging analytics firms in the region. For instance, in May 2018, EXL made has investment worth USD 240 million in SCIOInspire, Corp., which provides AaaS to the healthcare sector. Furthermore, various trade associations such as Asia Cloud Computing Association (ACCA) and Asia Analytics Alliance in the region are promoting the adoption of AaaS solutions that is boosting the market growth.

For instance, the Asia Analytics Alliance, found in 2016, is focusing on accelerating the growth and development of analytics technologies in the region. Besides, the growing emphasis on the adoption of technologies such as cloud computing and big data analytics by industries in countries such as India, Japan, and Australia has boosted the regional market.

Key Companies & Market Share Insights

Major companies in the market are emphasizing R&D activities for the development of new products and enhancements of existing solutions. For instance, Microsoft Corporation’s R&D expenses accounted for USD 16.87 billion, USD 14.72 billion, and USD 13.03 billion in FY 2019, FY 2018, and FY 2017, respectively. These investments have enabled the company to launch the new version of its Azure Synapse Analytics service in November 2019. It combines enterprise data and big data analytics, allowing clients to gain insights from data generated and aggregated from various sources.

Various other players such as Google, LLC; Hewlett Packard Enterprise Development LP, and SAS Institute Inc., are focusing on developing cloud platforms for making various AaaS available to their customers. For instance, in December 2019, Hewlett Packard Enterprise Development LP announced the launch of its new cloud platform, through which the company aimed at providing various AaaS, including big data analytics and predictive analytics.

Major players are emphasizing strategies such as mergers, acquisitions, and partnerships to expand their market share. For instance, in February 2020, Amazon Web Services, Inc. completed the acquisition of DataRow which is used to provide analytics as a service to organizations operating in the sectors such as IT and telecom and BFSI. The acquisition helped Amazon Web Services, Inc. expand its market share. Some prominent players in the analytics as a service market include:

-

Amazon Web Services, Inc.

-

GoodData Corporation

-

Google LLC

-

Hewlett Packard Enterprise Development LP

-

IBM

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

SAS Institute Inc.

Analytics as a Service (AaaS) Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 5.93 billion

Revenue forecast in 2027

USD 29.68 billion

Growth Rate

CAGR of 25.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, end use, and region

Regional scope

North America, Europe, Asia Pacific, South America, and MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, China, India, Japan, Brazil

Key companies profiled

Amazon Web Services, Inc.; Google LLC; IBM; Microsoft Corporation; Oracle Corporation; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global analytics as a service market report on the basis of type, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Predictive

-

Prescriptive

-

Diagnostic

-

Descriptive

-

-

Enterprise Size Outlook (Revenue, USD Million, 2016 - 2027)

-

Large Enterprise

-

Small & Medium Enterprise (SME)

-

-

End-Use Outlook (Revenue, USD Million, 2016 - 2027)

-

BFSI

-

Retail

-

Government

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global Analytics as a Service (AaaS) market size was estimated at USD 4.98 billion in 2019 and is expected to reach USD 5.93 billion in 2020.

b. The global Analytics as a Service (AaaS) market is expected to grow at a compound annual growth rate of 25.9% from 2020 to 2027 to reach USD 29.68 billion by 2027.

b. North America dominated the Analytics as a Service (AaaS) market with a share of 44.1% in 2019. This is attributable to rising usage of analytical solutions in demand sensing of products in the e-commerce and retail sector.

b. Some key players operating in the Analytics as a Service (AaaS) market include GoodData Corporation; Amazon Web Services, Inc.; Microsoft Corporation; Hewlett Packard Enterprise Development LP; Google LLC; Oracle Corporation; IBM; SAS Institute Inc.; TIBCO Software Inc.; and SAP SE.

b. Key factors that are driving the market growth include increased demand among organizations to evaluate consistency in the patterns among the data has resulted into a growing focus on enhancing their computational and statistical abilities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."