- Home

- »

- Clinical Diagnostics

- »

-

Anatomic Pathology Market Size And Share Report, 2030GVR Report cover

![Anatomic Pathology Market Size, Share & Trends Report]()

Anatomic Pathology Market Size, Share & Trends Analysis Report, By Product & Services, By Application (Disease Diagnosis, Drug Discovery And Development), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-318-8

- Number of Pages: 176

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

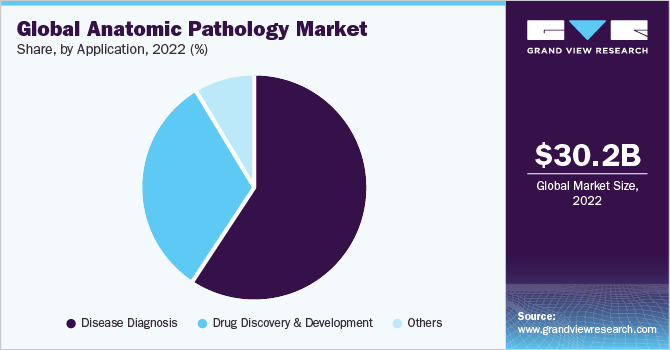

The global anatomic pathology market size was valued at USD 30.16 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. The growing adoption of biomarkers in clinical settings allows pathologists to gain insights into the molecular-level mechanisms. This valuable information not only helps in clinical decision-making but also contributes to enhancing patient outcomes. As a result, there is a rising dependence on pathology tests and procedures based on biomarkers to examine prevalent malignancies and tumorigenesis. This increasing reliance on biomarker-driven pathology is expected to drive the growth of the market.

The COVID-19 pandemic drove the adoption of whole slide imaging, digital pathology, and telepathology. Digital pathology has helped pathologists work remotely; enhancing their overall productivity and helping them address the backlog of cases. The usage rate of these technologies has been gaining momentum over the past few years. The COVID-19 pandemic has further boosted this adoption, in turn, having a positive impact on the market growth.

The increasing adoption of advanced pathology equipment, including digital microscopes, gross imaging systems, and staining systems, is anticipated to significantly enhance anatomic pathological practices. Digital imaging solutions, in particular, offer significant advantages in terms of specificity and accuracy compared to conventional techniques. As a result, the adoption of these solutions in the market for anatomic pathology is experiencing an upsurge, driven by the increased demand for services that can provide improved diagnostic precision and reliability.

Companies are undertaking continuous efforts for the development of advanced and upgraded pathology equipment with respect to their design and ease of use. For instance, in May 2021, OptraScan, a comprehensive on-demand digital pathology solutions and scanners provider for confocal, fluorescence, frozen sections, and brightfield applications announced the launch of CytoSiA, an intelligent solution designed to facilitate fast and cost-effective scanning and analysis of liquid-based cytology slides and pap-smears. This comprehensive solution encompasses OptraScan's digital pathology scanner, storage capabilities, and robust artificial intelligence (AI) algorithms. CytoSiA aims to support pathologists and cytotechnologists in their efforts to screen and detect various cytologic categories, including cervical cancer, pre-cancerous lesions, atypical cells, and more. By combining cutting-edge technology with advanced algorithms, CytoSiA enhances the efficiency and accuracy of cytology diagnostics in a streamlined manner.

Moreover, several partnerships and agreement ventures among key companies for the introduction of an effective portfolio are driving the market growth. For instance, in April 2021, Koninklijke Philips N.V. announced a partnership with Ibex Medical Analytics, an AI software developer, with the aim of advancing the adoption of their digital pathology products across global hospitals, health networks, and pathology laboratories. By integrating Philips' digital pathology solution with Ibex's Galen cancer platform, which is powered by artificial intelligence, the companies anticipate significant enhancements in reporting efficiency, with an estimated improvement of 27%, along with productivity gains of 37%. Moreover, this collaboration is expected to enhance diagnostic consistency and accuracy, ultimately benefiting healthcare providers and patients alike, as affirmed by both companies involved.

The growing focus on personalized medicine and the increasing incidence rate of cancer and other chronic disorders are some of the factors driving the market growth. Moreover, increasing reliance on biomarkers-based pathology procedures and tests to explore tumorigenesis and common malignancy is also driving the market. Clinically useful biomarkers are used for the development of diagnostic tests and therapeutic drugs. Pathological laboratories can rely on these biomarkers to detect & track infections and disease progression during diagnostic procedures. Hence, biomarkers are gaining ground as diagnostic and prognostic markers.

In addition, key market players are performing various strategic initiatives to discover innovative and advanced pathology devices with upgraded designs and easy access to use. For instance, in April 2021, Leica Biosystems announced a collaboration with Paige, an AI-based company, with a motive to evolve computational pathology systems. The company performed this strategic step to expand its digital pathology product portfolio. Furthermore, in May 2021, Quest Diagnostics Incorporated announced a partnership with Paige AI, Inc.to jointly create a range of products catered to individual clinical oncologists, as well as larger biopharmaceutical companies and their research and development initiatives. The collaboration's initial focus lies in leveraging data and digitized tissue slides obtained from Quest Diagnostics Incorporated's Dermpath and AmeriPath businesses, which will be fed into Paige AI, Inc.'s machine learning algorithms. This collaboration aims to enhance the diagnosis of solid tumors, encompassing cancers of the prostate, breast, colon, and lung. By combining their respective expertise, Quest Diagnostics Incorporated and Paige AI, Inc. are poised to develop innovative solutions that benefit the medical community and advance cancer diagnostics and treatment.

The availability of refurbished anatomic pathology systems has impeded the growth of this space. International Equipment Trading Ltd., LabX, ReScience, and AL-TAR are some of the entities offering refurbished anatomic pathology systems such as microtomes, ICH& ISH, and staining systems. Mainly medium and small-sized laboratories in developing countries opt for refurbished systems due to the high prices of instruments. This factor is anticipated to increase the demand for refurbished instruments, thereby restraining market growth.

Product & Services Insights

The consumables segment dominated the market with the largest revenue share of 69.1% in 2022. This segment's prominence can be attributed to multiple factors, including the widespread availability and affordability of pathology consumables. Furthermore, the market's growth is fueled by the extensive accessibility of a diverse range of products within this segment. An array of essential reagents, antibodies, and probes specifically designed for anatomic pathology protocols are being actively marketed. Significant examples of key reagents and kits include the ultra-view SISH DNP Detection Kit , Instrument Cleaning Kit by Agilent, Tamping Tools KitsISH iVIEW Blue Plus Detection Kit by F. Hoffmann-La Roche Ltd, and , CISH Centromere Detection Kits by Thermo Fisher. In May 2023, Sysmex announced the launch of its Clinical Flow Cytometry1 System in Japan, & other antibody reagents including Sample Preparation System PS-10 in regions such as Asia Pacific, and North America. This launch is helpful in contributing to higher efficiency and testing strategies or standards. In September 2022, F. Hoffmann-La Roche Ltd announced the launch of its PRAME (EPR20330) antibody that computes PRAME protein expression and helps to diagnose through tissue sampling from melanoma patients.

The instruments segment is expected to expand at the fastest CAGR of 9.6% over the forecast period from 2023 to 2030. The continuous innovation in technology and consistent efforts by the market participants to provide anatomic pathological instruments with an advanced design are anticipated to boost the growth of the instruments segment with a CAGR of 9.6%. For instance, in March 2023, Virscio, Inc. announced the establishment of a new Pathology and Tissue Pharmacodynamics Division, which serves as a valuable addition to their existing preclinical capabilities. This strategic move aims to enhance and facilitate the efficient execution, significant impact, and overall success of preclinical drug development programs. By bolstering their expertise in pathology and tissue pharmacodynamics, Virscio aims to provide comprehensive solutions that contribute to the advancement of drug development endeavors in a timely and effective manner. In April 2020, Precision Instruments announced the launch of its CF-6100 cryostat that offers and supports tissue sectioning in histology; pathology, and dermatology

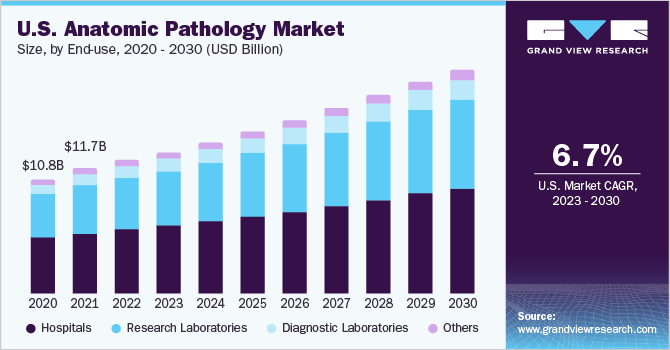

End-use Insights

The hospitals segment dominated the market with the largest revenue share of 48.2% in 2022 owing to the high hospitalization rate of cancer patients, coupled with a substantial number of frequent readmissions in hospitals. Moreover, the presence of well-developed infrastructure, coupled with a well-trained staff in hospital-based pathological laboratories, stimulates the growth of the hospital segment. The hospital segment is also expected to be befitted by an increasing number of initiatives undertaken by public and private agencies to promote advanced healthcare systems. In June 2023, Sheikh Shakhbout Medical City (SSMC), a known hospital in the UAE also in joint-venture partnership with Abu Dhabi Health Services Company (SEHA) and Mayo Clinic announced the launch of the Anatomical Pathology Laboratory. It is also known as a state-of-the-art that compliments SSMC’s specialists’ pathology team which helps in the diagnosis of diseases and complicated situations with high efficiency through AI applications and tools.

The diagnostic laboratories segment is expected to grow at the fastest CAGR of 9.7% over the forecast period from 2023 to 2030. The emergence of advanced testing techniques and equipment has led to a lucrative growth of the diagnostic laboratories market. In June 2022, Roche announced the launch of its VENTANA DP 600 which is a slide scanner for use in digital pathology, to felicitate and improvise patient care with precision diagnostics. A large number of clinical trials through various ongoing projects spurs the growth of the research laboratories segment. Research laboratories are engaged in offering rapid and comprehensive information about the functioning of diseased tissues, with the overall objective of achieving a high degree of patient satisfaction.

Application Insights

The disease diagnosis segment dominated the market with the largest revenue share of 59.1% in 2022. Anatomic pathology plays a pivotal role in disease diagnosis, offering researchers an opportunity to delve into disease etiology and associated outcomes. Consequently, the market is experiencing a notable surge in the widespread application of anatomic pathology protocols in disease diagnosis. The primary driving force behind the growth of the disease diagnosis segment is attributed to the escalating prevalence of chronic conditions, particularly cancer, and the rising proportion of elderly individuals within the population. These factors collectively contribute to the increased demand for accurate and comprehensive disease diagnosis facilitated by anatomic pathology practices. For instance, in March 2023, PathAI, an AI-powered pathology company, launched its AISight, which helps to evaluate the percentage of PD-L1 positive tumors and immune cells in lung cancer. PathAI's network of laboratories will take part in the revolution of anatomic pathology and will have access to its extensive and growing algorithm products across oncology and non-oncology. The anatomic pathology workflow aids the detection of a tumor at the inflammatory and proliferating stromal cells stage, thus minimizing costs associated with tumor eradication. In addition, the increasing focus of the manufacturers on the introduction of innovative and novel diagnostics techniques accelerates segment growth.

The drug discovery and development segment is expected to grow at the fastest CAGR of 9.2% over the forecast period from 2023 to 2030. Tissue analysis carried out by pathologists generates a wealth of information for pharmaceutical manufacturers during preclinical trials. Anatomic pathology plays a vital role in toxicology assessment for the evaluation of the adverse effects of candidate drugs. In December 2022, Krishgen Biosystems launched its ELISA range for computing Bispecific Antibody Drugs in plasma and serum samples.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 44.9% in 2022. The region is anticipated to continue its dominance over the forecast period. This growth can be attributed to the presence of well-established players the, growing implementation of digital pathology services with advanced imaging tools, rising awareness about regular health screening, and favorable government reimbursement policies. Efforts by key players for maintaining their share drive the U.S. market to a dominant position. For instance, In September 2021, Agilent Technologies announced a partnership with Visiopharm to expand its (AI)-driven precision pathology software globally. Such partnerships are anticipated to supplement market growth. In April 2021, Abbott Laboratories announced a partnership with Walgreens Boots Alliance to offer affordable healthcare services at ease such as medical consultation, and diagnostic tests in the U.S.

The Asia Pacific market is expected to grow at the fastest CAGR of 11.6% over the forecast period from 2023 to 2030. China’s anatomic pathology market is booming due to several Chinese pathology congresses conducted in the country in the past few years. For instance, the 2nd Digital Pathology & AI Congress: China is expected to be held in September 2022 in China. This meeting is aimed at increasing the implementation of digital pathology to enhance workflow efficiency and standardization of image analysis.

Key Companies & Market Share Insights

Anatomic pathology is a mature industry with a large number of key players in it. The advent of new strategic plans to maintain competitiveness stimulates market growth. The market is well equipped with upcoming and innovative instruments and consumables to address the challenges in transforming pathology trends. For instance, in June 2022, EmeritusDX, a known cancer diagnostic & information company, acquired Freedom Pathology Partners to increase its reach and uplift its presence nationally in the Anatomic Pathology, Molecular testing, and Fluorescence in situ Hybridization. Additionally, in September 2021, F. Hoffmann-La Roche Ltd announced the launch of digital pathology open environment. The new workflow allows researchers and physicians to share images for better analysis. Further, the platform is compatible with whole slide imaging technology. Similarly, in May 2021, F. Hoffmann-La Roche Ltd announced the merger with GenMark to expand and uplift its molecular diagnostic portfolio through GenMark’s ePlex system which will boost Roche’s work in managing antibiotic resistance and infectious diseases. Hence, the ongoing strategies adopted by key players boost the market growth as it helps retain their leadership in the market. Some prominent players in the global anatomic pathology market include:

-

Danaher

-

PHC Holdings Corporation

-

Quest Diagnostics Incorporated

-

Laboratory Corporation of America Holdings

-

F. Hoffmann-La Roche AG

-

Agilent Technologies, Inc.

-

Cardinal Health

-

Sakura Finetek USA, Inc.

-

NeoGenomics Laboratories, Inc.

-

BioGenex

-

Bio SB

Anatomic Pathology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.54 billion

Revenue forecast in 2030

USD 58.42 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Danaher Corporation; PHC Holdings Corporation; Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; F. Hoffmann-La Roche AG; Agilent Technologies, Inc.; Cardinal Health; Sakura Finetek USA, Inc.; NeoGenomics Laboratories, Inc.; BioGenex; Bio SB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

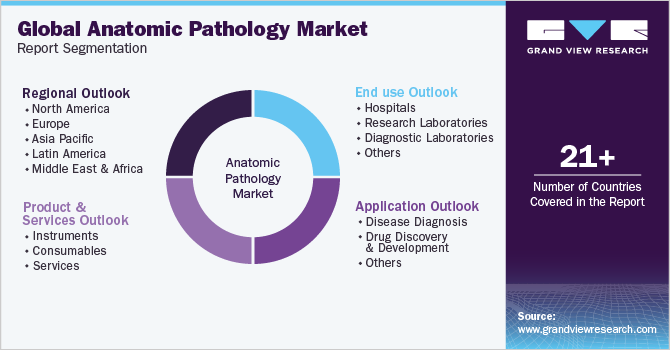

Global Anatomic Pathology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anatomic pathology market report based on product & services, application, end-use, and region:

-

Product & Services Outlook (Revenue in USD Million, 2018 - 2030)

-

Instruments

-

Microtomes & Cryostat

-

Tissue Processors

-

Automatic Stainers

-

Whole Slide Imaging (WSI) Scanners

-

Other Products

-

-

Consumables

-

Reagents & Antibodies

-

Probes & Kits

-

Others

-

-

Services

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Disease Diagnosis

-

Drug Discovery and Development

-

Others

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Research Laboratories

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anatomic pathology market size was estimated at USD 30.16 billion in 2022 and is expected to reach USD 32.54 billion in 2023.

b. The global anatomic pathology market is expected to grow at a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 58.42 billion by 2030.

b. Some key players operating in the anatomic pathology market include Cardinal Health, Inc.; F. Hoffmann-La Roche AG; Agilent Technologies, Inc.; Sakura Finetek USA, Inc.; Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; NeoGenomics Laboratories, Inc.; BioGenex; PHC Holdings Corporation and Bio SB.

b. Key factors that are driving the anatomic pathology market growth include implementation of biomarker-based disease assessments, rising competitiveness among the market vendors, a substantial number of supporting programs and training modules by the government, and increasing incidence of chronic disorders.

b. Key anatomic pathology market opportunities include a growing focus on tissue base diagnostic procedures and the emergence of automated systems in the market space.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."