- Home

- »

- Medical Devices

- »

-

Anesthesia And Respiratory Devices Market Size Report, 2030GVR Report cover

![Anesthesia And Respiratory Devices Market Size, Share & Trends Report]()

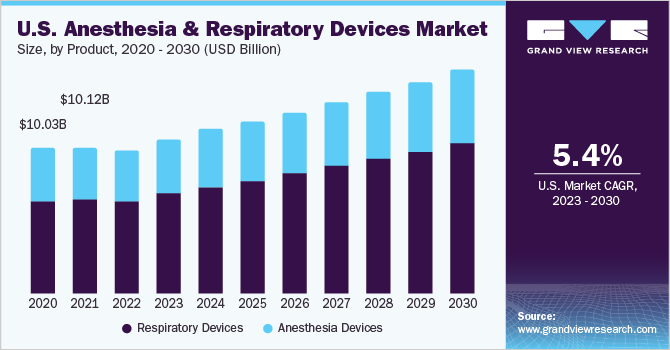

Anesthesia And Respiratory Devices Market Size, Share & Trends Analysis Report By Product (Respiratory Devices, Anesthesia Devices), By Region (APAC, Europe, North America), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-557-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

The global anesthesia and respiratory devices market size was estimated at USD 47.1 billion in 2022 and is likely to grow at a compound annual growth rate (CAGR) of 6.0% during the forecast period. This growth is driven by an increase in the incidence of respiratory disorders, such as Obstructive Sleep Apnea (OSA) and Chronic Obstructive Pulmonary Disease (COPD), rapid urbanization, increased volumes of surgical operations, rising pollution levels, and a growing geriatric population. For instance, according to the Centers for Disease Control & Prevention (CDC), COPD affected more than 15.0 million Americans in the year 2021. Furthermore, according to the National Health Service (NHS) U.K., around 1.17 million people have been diagnosed with COPD in England in 2020-2021.

The COVID-19 pandemic has raised the need for a variety of medical devices around the globe, including ventilators and other vital sign monitoring equipment. As a result, in some circumstances, some devices may need to be modified to treat extremely sick patients. For instance, it could be necessary to modify anesthesia and transport ventilators so that patients can get long-term ventilation. Furthermore, during the COVID-19 pandemic, companies were also investing in launching new products to cater to the exponential demand for devices used in the treatment of the disease. For instance, in April 2020, InnAccel Technologies launched a non-invasive ventilation system intended for use in the Intensive Care Unit (ICU) with COVID-19 patients.

Owing to such factors, the pandemic had a positive impact on the ventilators segment. Similarly, the capnography devices market was also significantly impacted. End‐tidal Carbon Dioxide (ETCO2) or capnography devices emerged as a useful adjunct for assessing sedation/analgesia and ventilation in COVID-19 patients. Masimo, a developer, manufacturer, and marketer of noninvasive monitoring technologies, including capnography solutions, faced significant challenges and opportunities during the pandemic. The company increased its manufacturing capacity to fulfill the growing demand for its products while continuing to launch new products, such as Masimo SafetyNet, a remote patient management system, to help combat the pandemic.

Masimo’s revenue continued to grow year-on-year basis during 2020 and 2021. Post-pandemic, the demand for anesthesia and respiratory devices is likely to resume to the pre-COVID era, and hence, the year-on-year growth, i.e. from 2021 to 2022 and forward is expected to be low as compared to the year-on-year growth from 2019 to 2020 and 2020 to 2021. For instance, in the resuscitators market, its demand is likely to normalize owing to a reduction in the need for oxygen supply to patients. However, in concerning segments, such as pulse oximeters and spirometers, among others, the demand for these devices might increase owing to the growing preference for home healthcare devices. The rising cases of smoking are further leading to the rising incidence of respiratory diseases, such as emphysema, bronchitis, cancer, and other lung diseases.

This is resulting in the growing demand for respiratory devices, hence boosting the industry growth. According to the data published by the CDC in June 2021, cigarette smoking is responsible for over 480,000 deaths in the U.S. every year. Out of this, 41,000 deaths were due to secondhand smoke exposure. The demand for anesthetic and respiratory equipment is expected to increase due to the rising spending on the construction of healthcare facilities in emerging nations. The industry value for anesthesia and respiratory equipment will continue to increase due to high cases of respiratory disorders and traffic accidents. Long-term market expansion will also be facilitated by the leading players placing more emphasis on technological advancements. The expansion of the industry will be slowed down by a lack of technological resources in low- and middle-income countries.

In addition, a low adoption rate of new technology by healthcare professionals would hinder industry expansion. Another obstacle to the expansion of the business will be the shortage of professional or educated healthcare personnel in these areas. Enforcing strict requirements for the approval of medical equipment would further obstruct growth. The need for anesthetic and respiratory equipment is anticipated to increase as technology advances over time. The need is further fueled by manufacturers' engagement in patient care innovation through the incorporation of improved patient monitors, novel metrics, wireless devices, processes, and integrated IT solutions. These developments made it possible for different doctors and anesthesiologists to provide end customers with personalized services.

Product Type Insights

In 2022, the respiratory devices product type segment accounted for the largest share of over 67.3% of the global revenue. The increasing prevalence of respiratory diseases, availability of advanced respiratory devices, an increasing number of surgeries performed, and rising healthcare expenditure are the key factors expected to fuel the segment growth over the years to come. Medical equipment termed a respiratory device is used to help a patient with breathing difficulties. These devices are employed in managing and treating conditions including fibrosis, asthma, COPD, and acute respiratory distress syndrome. The anesthesia devices segment is further segmented into anesthesia machines and anesthesia disposables.

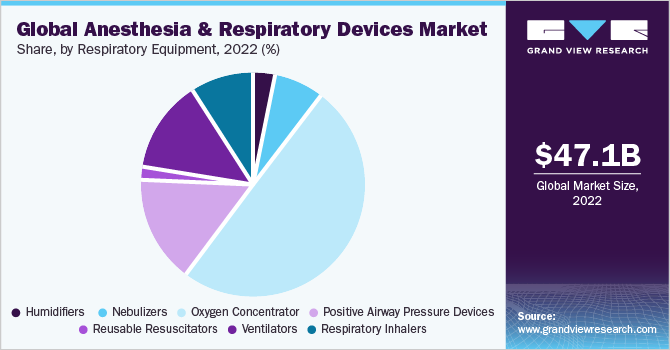

The anesthesia machines segment is further divided into anesthesia workstations, anesthesia delivery machines, anesthesia ventilators, and anesthesia monitors. The anesthesia delivery machines segment is anticipated to grow at the fastest growth rate during the forecast period owing to the rising number of surgeries performed and various technological advancements by key players. The respiratory devices segment is further divided into respiratory equipment, respiratory disposables, and respiratory measurement devices. The respiratory equipment segment held the largest revenue share in 2022 and is further sub-segmented into humidifiers, nebulizers, oxygen concentrators, positive airway pressure devices, reusable resuscitators, ventilators, and respiratory inhalers.

Oxygen concentrators were the largest segment in 2022 owing to a surge in their demand, especially during the pandemic. This is because the patients who did not require ventilators were treated using medical oxygen concentrators. Over the projection period, it is anticipated that the high prevalence of COPD and OSA will drive the respiratory devices segment worldwide. For instance, the Global Initiative for Chronic Obstruction Disease's 2018 study estimates that COPD would cause 4.5 million yearly deaths worldwide by 2030. Increased preterm birth rates are also anticipated to support industry expansion. For instance, according to the CDC data published in the year 2020, preterm birth in the United States affected 1 of every 10 infants.

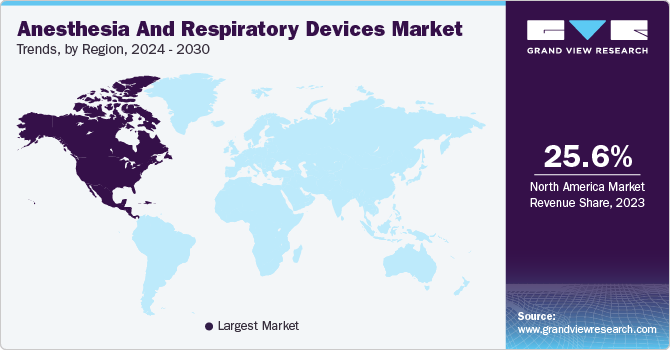

Regional Insights

North America accounted for the largest share of more than 25.6% of the global revenue in 2022. The rise in the geriatric population in the U.S. is leading to a corresponding rise in the volume of surgeries in the country, which further boosts industry growth. For instance, according to the U.S. Census Bureau, more than 54 million adults aged 65 years and above were reported in the U.S. in 2021. In addition, according to the World Health Organization, the percentage of the geriatric population is expected to reach 22% in 2050 from 12% in 2015. In addition, healthcare cost containment issues post the economic crisis have compelled the government to introduce new strategies to reduce the patient stay in hospitals and impose an excise tax on medical devices.

These initiatives have compelled patients and physicians to opt for respiratory and anesthesia monitoring and therapeutic devices for home care. However, the excise tax is expected to negatively affect the Original Equipment Manufacturers (OEMs). The Asia Pacific region is expected to witness the fastest CAGR from 2022 to 2030 owing to the growing elderly population. India’s elderly population (aged 60 years and above) is projected to reach 194 million in 2031 from 138 million in 2021, accounting for a 41% increase over a decade, according to the National Statistical Office Elderly in India 2021 report.

Key Companies & Market Share Insights

The industry is highly fragmented and competitive and is characterized by the presence of various small-, medium-, and large-scale companies. Companies are involved in the deployment of strategic initiatives, such as regional expansion, product advancements, distribution partnerships, collaborations, and mergers & acquisitions to gain a greater market share. For instance, in April 2022, Medtronic collaborated with GE Healthcare, aimed at focusing on unique demands and needs for care at Ambulatory Surgical Centers (ASCs). Some of the key players in the global anesthesia and respiratory devices market include:

-

General Electric Company

-

Medtronic

-

Teleflex Inc.

-

Koninklijke Philips N.V.

-

Drägerwerk AG & Co. KGaA

-

Getinge AB.

-

Smiths Group plc

-

Fisher & Paykel Healthcare Ltd.

-

Masimo

-

B. Braun Melsungen AG

-

ResMed

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Anesthesia And Respiratory Devices Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 50.4 billion

The revenue forecast in 2030

USD 75.9 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

General Electric company; Medtronic; Teleflex Inc.; Koninklijke Philips N.V.; Drägerwerk AG & Co. KGaA; Getinge AB; Smiths Group plc; Fisher & Paykel Healthcare Ltd.; Masimo; B. Braun Melsungen AG; ResMed; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anesthesia And Respiratory Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global anesthesia & respiratory devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Respiratory Devices

-

Respiratory Equipment

-

Humidifiers

-

Heat Humidifiers

-

Heated Wire Breathing Circuits

-

Heat Exchangers

-

Pass Over Humidifiers

-

-

Nebulizers

-

Pneumatic Nebulizers

-

Mesh Nebulizers

-

Ultrasonic Nebulizers

-

-

Oxygen Concentrator

-

Fixed Oxygen Concentrators

-

Portable Oxygen Concentrators

-

-

Positive Airway Pressure Devices

-

Bilevel & automatic positive airway pressure devices

-

Continuous positive airway pressure devices

-

-

Reusable Resuscitators

-

Ventilators

-

Adult Ventilators

-

Neonatal Ventilators

-

-

Respiratory Inhalers

-

Dry Powdered Inhalers

-

Metered Dose Inhaler

-

-

-

Respiratory Disposables

-

Disposable Oxygen Masks

-

Resuscitators

-

Tracheostomy Tubes

-

Oxygen Cannula

-

-

Respiratory Measurement Devices

-

Pulse Oximetry systems

-

Capnographs

-

Spirometers

-

Peak Flowmeters

-

-

-

Anesthesia Devices

-

Anesthesia Machines

-

Anesthesia Workstation

-

Anesthesia delivery machines

-

Portable

-

Standalone

-

-

Anesthesia Ventilators

-

Anesthesia Monitors

-

-

Anesthesia Disposables

-

Anesthesia Masks

-

Anesthesia Accessories

-

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the anesthesia and respiratory devices market include General Electric company, Medtronic, Teleflex Incorporated, Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Getinge AB, Smiths Group plc, Fisher & Paykel Healthcare Limited., Masimo, B. Braun Melsungen AG, ResMed, Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

b. Key factors that are driving the anesthesia and respiratory devices market growth include increasing demand for anesthesia and respiratory devices, an increase in the incidence of respiratory disorders, fast urbanization, an increase in surgical operations, an increase in pollution levels, a rise in the elderly population, and an increase in cigarette use.

b. The global anesthesia and respiratory devices market size was estimated at USD 47.1 billion in 2022 and is expected to reach USD 50.4 billion in 2023.

b. The global anesthesia and respiratory devices market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 75.9 billion by 2030.

b. North America dominated the anesthesia and respiratory devices market with a share of 25.6% in 2022. This is attributable to the increasing geriatric population, high investments by pharmaceutical companies, and rising healthcare expenditure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."