- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Animal Based Protein Supplements Market Report, 2028GVR Report cover

![Animal Based Protein Supplements Market Size, Share & Trends Report]()

Animal Based Protein Supplements Market Size, Share & Trends Analysis Report By Raw Material (Whey, Casein, Egg, Fish), By Product, By Distribution Channel, By Application, By Region, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-731-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Consumer Goods

Report Overview

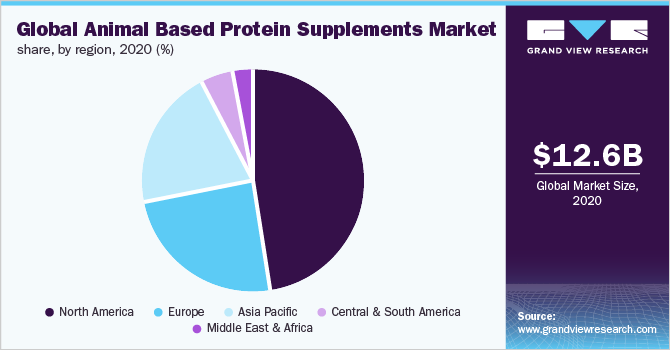

The global animal based protein supplements market size was valued at USD 12.61 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2020 to 2028. An increasing number of health-conscious consumers demanding supplements with high protein content and nutritional value is favoring the market growth. Numerous health benefits are associated with animal based protein supplements and it has been supported by strong scientific evidence and recognized by the government food regulatory institutions, such as the FDA. Thus, an increasing number of health issues among consumers due to a lack of healthy nutrients is expected to drive the market. The dominant trend towards the consumption of high protein products among consumers has enhanced the growth of animal based protein supplements. With the population being inclined towards sports and fitness, the demand for these supplements is further expected to escalate during the forecast period.

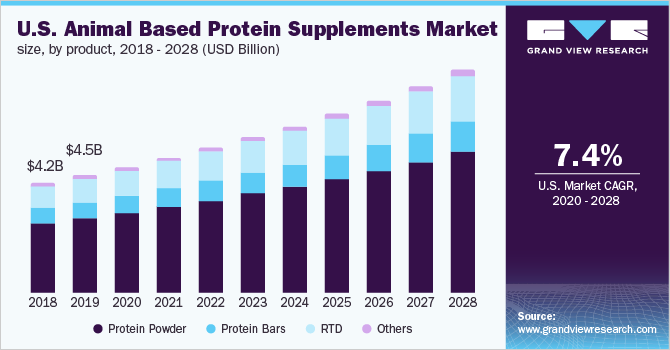

The U.S. dominated the market in 2020. The trend of being proactive toward chronic health problems has spurred the demand for animal based protein supplements in the U.S. Moreover, the growing trend of personalized nutrition in the country is expected to have a positive impact on product demand.

The product is increasingly being preferred by the manufacturers of sports nutrition owing to its wide availability and strong amino profile. However, the market growth is expected to hinder during the forecast period with the increasing number of vegan and lactose-intolerant customers inclining towards plant-based supplements.

With the COVID-19 outbreak, consumers became more aware of the way that health and wellness can reduce the risk of mortality. The pandemic shifted the focus of customers to preventive healthcare. However, the imposition of lockdowns across countries resulted in the closures of gyms and fitness centers impacting sales of protein supplements.

However, with the relaxation in lockdown regulations, the demand for whey protein supplements increased substantially owing to it being a complete source of protein for maintaining overall health. It also offers all the essential amino acids that aid in maintaining the cell structure of the immune system, thereby attracting customers.

Raw Material Insights

Whey protein dominated the market with a revenue share of over 55.0% in 2020. The rising incidence of chronic illnesses due to the changing lifestyles, particularly among the millennial population, is one of the key factors driving the adoption of protein-rich diets, which, in turn, is likely to augment the demand for whey protein during the forecast period.

The consumption of high protein-based foods and the increasing focus on fitness among consumers are projected to drive the demand for egg proteins for sports nutrition applications. In addition, the presence of selenium, zinc, and vitamin B2, D, and B6 in eggs is expected to contribute to the market growth over the forecast period

Fish proteins are likely to witness a growth in demand in the sports nutrition application segment over the forecast period on account of their fast absorption functionality, which promotes lean muscle mass. These proteins are also projected to exhibit an increased demand owing to their ability to reduce the effects of hypertension in consumers.

Fish proteins are also increasingly being utilized in functional food on account of their ability to help reduce wrinkles, support stronger hair, and increase skin elasticity. Moreover, fish protein supplements may help prevent heart attacks and other cardiovascular diseases, thus attracting a large customer base.

Product Insights

Protein powder dominated the market with a revenue share of over 60.0% in 2020. Rising concerns among consumers regarding daily protein intake, coupled with the convenience and easy usability of protein powders for making protein shakes or for blending them with various food products in order to suit varying tastes, are expected to fuel the product demand.

Convenience is one of the major factors driving the demand for RTD protein supplements among consumers, especially working professionals who cook less often look for on-the-go products. The RTD segment is expected to witness the fastest growth over the forecast period owing to the increasing acceptance of the product as a meal replacement.

The demand for RTD animal based protein supplements is also expected to be driven by factors such as increasing awareness regarding healthy living and an increase in health and fitness centers. Manufacturers’ effort in offering animal based protein supplements in convenient formats to attract customers is further expected to fuel the market growth.

Distribution Channel Insights

The online stores segment accounted for the largest revenue share of over 30.0% in 2020 owing to the availability of easy access to products according to varying tastes and preferences as well as the increased number of brands to choose from.

The high competition in the protein supplement space has pushed manufacturers to distribute their products from different retail channels, along with traditional distribution channels in order to reach a wide customer base. This is further expected to boost the sales of animal based protein supplements through online retail during the forecast period.

Supermarkets and hypermarkets contribute significantly to the sales of protein supplements in Europe and North America owing to the higher prevalence. Furthermore, an increasing number of supermarkets and hypermarkets in developing countries such as China, India, and Brazil is expected to augment the sales of animal based protein supplements.

The specialty stores segment is likely to register a CAGR of 6.1% during the forecast period. The robust growth of specialty stores in developed and developing countries owing to their wide product offerings in a single category, flexible store formats, unique designs, and product displays has been attracting customers towards specialty stores.

Application Insights

Sports nutrition accounted for the largest revenue share of over 60.0% in 2020. This is due to animal proteins exhibiting prebiotic, antimicrobial, antioxidant, and hypertensive properties in nutritional beverages, ready-to-drink protein shakes, and dry-mix beverages.

Rising obesity levels globally are expected to propel the demand for sports nutritional supplements. With an increasing number of individuals engaging in sports and other physical activities to fight obesity, coupled with an increase in the number of fitness centers, health clubs, and gymnasiums, the demand for protein-rich animal based supplements is expected to further increase the application in sports nutrition during the forecast period.

The demand for functional foods is increasing owing to a change in customer lifestyle and eating habits, which has led to a deficiency of essential nutrients. Functional foods are increasingly being enriched with protein supplements to keep up with the customer demand for health and wellness beyond the essential intake of nutrition.

Additionally, food and beverage companies such as The Coca-Cola Company, Cargill, Incorporated, JBF, Friesl and Campina, and Danone have increased their expenditure to develop functional products. This is expected to generate positive growth scenarios for animal protein supplement manufacturers.

Regional Insights

North America accounted for the largest revenue share of over 45.0% in 2020 owing to high consumer awareness regarding the protein content in animal based supplements and focus on leading healthy and active lifestyles. The popularity of e-commerce portals as one of the selling mediums is high, which has contributed towards a large market share of the supplements in the region.

The consumption of animal-based protein supplements in Europe is high due to consumer awareness regarding the link between right nutrition and exercising regularly. In addition, high disposable income and the availability of raw materials in the region are expected to create growth potential for the market.

Changing lifestyles, rising urbanization, and shifting dietary preferences of consumers have led to increasing demand for nutritive food products in Asia Pacific, which is further likely to drive the market statistics. A favorable outlook toward functional food consumption on account of the rising prevalence of cardiovascular diseases and the number of weight management programs is expected to further boost the market growth.

Moreover, an increase in physical activity and rising consumption of protein and energy supplements are contributing to the market growth. Advancements in nutrition science and food technology and innovation in the field of healthier ingredients are further expected to fuel product demand in the region over the forecast period.

Key Companies & Market Share Insights

The industry is highly fragmented and is characterized by intense competition, with both public and privately-held market players focusing on innovation to stay competitive. Public companies in the industry are proactive in initiating strategies to push the adoption of their products in the global market.

Key players are focused on new product launches with varied flavors and convenient packaging to attract a large customer base. For instance, in March 2019, Quest Nutrition launched protein powders in 1.6 lbs. and 3 lbs. size variations in a wide variety of flavors. Some prominent players in the global animal based protein supplements market include:

-

Glanbiaplc

-

MusclePharm Corporation

-

Abbott Laboratories

-

CytoSport, Inc.

-

Iovate Health Sciences International Inc.

-

QuestNutrition

-

THE BOUNTIFUL COMPANY

-

AMCO Proteins

-

NOW Foods

-

Transparent Labs

-

WOODBOLT DISTRIBUTION LLC

Animal Based Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 13.55 billion

Revenue forecast in 2028

USD 22.26 billion

Growth Rate

CAGR of 7.4% from 2020 to 2028

Base year for estimation

2020

Historical data

2017- 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; UAE

Key companies profiled

Glanbia plc; Muscle Pharm Corporation; Abbott Laboratories; Cyto Sport, Inc.; Iovate Health Sciences International Inc.; Quest Nutrition; THE BOUNTIFUL COMPANY; AMCO Proteins; NOW Foods; Transparent Labs; WOODBOLT DISTRIBUTION LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global animal based protein supplements market report on the basis of raw material, product, distribution channel, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2017 - 2028)

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Protein Powder

-

Protein Bars

-

Ready-to-Drink

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Supermarkets/ Hypermarkets

-

Online Stores

-

Chemist/ Drugstores

-

Specialty Stores

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Sports Nutrition

-

Functional Food

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global animal based protein supplements market size was estimated at USD 12.61 billion in 2020 and is expected to reach USD 13.55 billion in 2021

b. The animal based protein supplements market is expected to grow at a compound annual growth rate of 7.4% from 2020 to 2028 to reach USD 22.26 billion by 2028.

b. Whey protein dominated the raw material segment with a share of 57.3% in 2020. Rising incidences of chronic illnesses due to changing lifestyles, particularly among the millennial population, is one of the key factors driving the adoption of protein-rich diets.

b. Some of the key players operating in the animal based protein supplements market include Glanbia plc, MusclePharm Corporation, Abbott Laboratories, CytoSport, Inc., Iovate Health Sciences International Inc, QuestNutrition, THE BOUNTIFUL COMPANY, AMCO Proteins, NOW Foods, Transparent Labs, WOODBOLT DISTRIBUTION LLC.

b. The key factor that is driving the animal based protein supplements market include the rising importance of a healthy lifestyle and an increase in fitness activities which has increased the need of protein-rich supplements among consumers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."