- Home

- »

- Animal Feed and Feed Additives

- »

-

Animal Feed Additives Market Size & Share Report, 2030GVR Report cover

![Animal Feed Additives Market Size, Share & Trends Report]()

Animal Feed Additives Market Size, Share & Trends Analysis Report By Product, By Source, By Form, By Livestock, By Region (Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-070-5

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Specialty & Chemicals

Report Overview

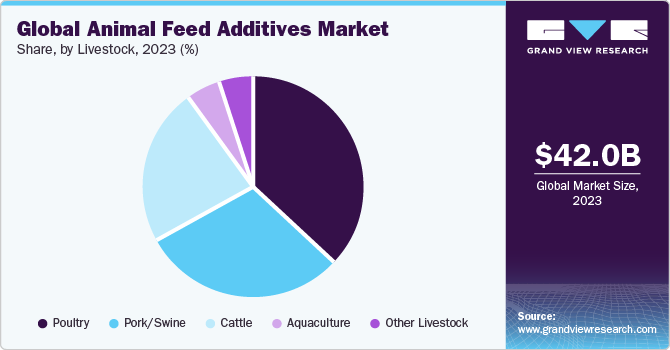

The global animal feed additives market size was valued at USD 42.01 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030. This is attributed to the rising meat consumption across the world. In addition, increasing consciousness regarding the benefits of feed additives and the recent outbreak of various diseases has positively impacted the industry. Rising consumer awareness about the disease caused in livestock animals including swine flu along with foot & mouth diseases has increased the concerns regarding meat quality and safety, which has prompted the use of feed additives.

However, the restriction on the use of antibiotics in the U.S. and Europe is expected to open the market for substitute products, such as enzymes, acidifiers, and amino acids. The animal feed additive value chain is optimally integrated via multiple players in the industry. Key grain producers, such as BASF SE and Cargill Inc., are integrated along the value chain to provide feed additives and serve as a comprehensive supplier to animal feed manufacturers and reduce sourcing and logistics costs. Companies, such as Alltech and Charoen Pokphand (CP) are also integrated backward to produce raw materials (feed grains) as well as animal feed end-products to cut down on raw material costs.

Livestock production requires significant outputs of feed, land, water, and energy for raising, transporting, and processing the animals. Animal feed is the major constituent in the breeding process of animals as it is responsible for the nutritional values of the product. The increased productivity has been made a success due to growth in feedstock production and factory farming methods, which have been advanced with technological/genetic advances and fertilizers. Moreover, it is estimated that the rising global meat trade will boost industrialization in meat production, especially in the developing parts of the world, such as China, India, and Brazil, which have the benefit of lower cost of meat production.

Increasing consumption of dairy products owing to their associated health benefits, as well as wide applications, is expected to fuel the industry's growth over the forecast period. A sudden increase in cattle farming has been witnessed across various regions on account of cattle being the major source of dairy products such as milk, cream, butter, yogurt, and cheese among others. This is likely to propel product demand in the coming years. Stringent norms laid by the regulatory bodies regarding the use of feed additives are anticipated to hamper the overall market growth. The players, focused on marketing and selling additives across the EU, are required to apply the use, control methods, and data demonstrating the safety & efficacy of the product, which is expected to further restrain the market growth.

Market Concentration & Characteristics

The market is moderately fragmented in nature. Market growth is driven by rising investments in setting up new production facilities across the world in order to meet the increasing demand for animal feed globally. For example, in February 2023, ADM opened its new state-of-the-art production facility in Valencia, Spain, with an investment of USD 30 million. This investment was made to meet global demand for probiotics, from various end-uses such as animal feed, human nutrition & wellbeing.

With growing demand patterns, companies such as Evonik Industries AG, BASF SE, Cargill, Incorporated, Novus International, Inc., and ADM are increasing their production capacities. Moreover, the industry is largely characterized by dominance of domestic companies in respective countries.

Governments, regulatory bodies around the world are proposing innovative methods of approval for animal feed additives to create a more efficient approval process for livestock feed additives. For example, Government of U.S. proposed an innovative pathway for gaining approvals for additives used in feed formulation. The American Feed Industry Association (AFIA) has come out in support of the proposed process.

In addition, numerous governments around the world are providing subsidies under their development schemes to boost the production of animal feed, its additives, and livestocks. For example, Dairy Development Department of Department of Animal Husbandry and Dairying (DAHD), Government of India has outlaid plans for “Cattle Feed Subsidy Scheme” with a total plan outlay of INR 500 Lakhs.

Product Insights

The amino acids product segment dominated the global industry in 2023 and accounted for the largest share of 35.14% of the overall revenue. Its high share is attributed to its ability to build immunity and promote animal growth. It aids in preventing nail and skin problems in animals. Furthermore, it plays an important role in preventing cerebral dysfunction, which can cause muscular incoordination in animals. Thus, amino acids are projected to have a high demand from the product industry as a feed supplement, as well as a pet food ingredient. The ability of antibiotics to promote growth in livestock is one of the primary factors triggering its market growth. Antibiotics also improve meat quality and result in high protein content and less fat content.

The excessive use of antibiotics as growth promoters resulted in the local bacterial population becoming resistant to the antibiotics. Traces of antibiotics in the meat can also affect human health because of their excess use as growth promoters. Vitamins naturally exist, but to provide proper nutrition, additional vitamin supplements are mixed in livestock feeds. Majorly used vitamin additives include vitamins A, D, E, & K and riboflavin; and these are added as supplements into the feed to improve and maintain animal health. Vitamins are also given to animals for improving reproductivity. Moreover, rising awareness among consumers regarding the benefits of fat-soluble vitamins is anticipated to drive its demand in the industry.

Source Insights

Synthetic source dominated the market in 2023. Synthetic additives are often more cost-effective to produce compared to natural alternatives. This makes them attractive to farmers and feed manufacturers looking to optimize production costs. Further, synthetic products allow for greater control over the composition of feed, ensuring consistency in nutrient content. This is crucial for meeting specific nutritional requirements and achieving uniform results in animal production.

The demand for natural animal feed additives has been rapidly increasing for several reasons, driven by consumer preferences, regulatory considerations, and a growing awareness of sustainability and environmental impact. Consumers are increasingly conscious of the quality and safety of the food they consume. There is a growing demand for products that are perceived as natural, organic, and free from synthetic additives. This trend extends to animal products, such as meat, milk, and eggs, leading to a higher demand for natural feed additives.

Form Insights

Dry form dominated the animal feed additives market in 2023. Dry additives often have a longer shelf life and better stability compared to liquid counterparts. This is important for storage and transportation, as dry additives are less prone to degradation, spoilage, and contamination. Further, they allow for more precise control over the dosage and uniform distribution within the feed. This is crucial for ensuring that animals receive consistent and accurate levels of nutrients, vitamins, minerals, and other additives in each batch. Additionally, dry additives can be more cost-effective to produce, package, and transport compared to liquid alternatives. The reduced weight and volume of dry additives contribute to lower transportation costs, making them economically advantageous for manufacturers.

Liquid additives can enhance the palatability of feed, making it more appealing to animals. This is especially important in situations where animals may be reluctant to consume certain feed formulations, such as during periods of stress or illness. In addition, liquid products can be more easily and uniformly mixed into feed compared to some dry alternatives. This ensures a more consistent distribution of additives throughout the feed, leading to better precision in nutrient delivery.

Livestock Insights

The poultry segment dominated the industry in 2023 and accounted for the largest share of 29.70% of the overall revenue. The segment’s high share is attributed to the continuous growth in broiler production across regions. Different types of poultry feed additives available in the market are enzymes, antioxidants, vitamins, and acidifiers, which are used to increase efficiency and add nutritional value to the product. An increase in consumption is observed in developing countries where increasing income and urbanization are making consumers add variety to their diets. Thus, developing countries will continue to dominate the poultry feed segment due to the growing population and high ratio of meat consumption.

The key parameters impacting the pork industry include high efficiency, productivity, and profitability. Antimicrobials, antioxidants, binders, emulsifiers, enzymes, and pH control agents are some of the major additives used in pork feed. Antibiotics aid in improving growth performance and disease control. Furthermore, fat-soluble vitamins, such as A, K, E, and D, and water-soluble vitamins, such as B12, riboflavin, choline, and niacin, are added to pork feed to enhance the growth performance of the pork. The rapid industrialization of cattle products like meat and dairy products along with the growing population has positively influenced the cattle feed market globally.

It mainly comprises fodder, legumes, grass, and silage along with hay and dry forages. An increase in consumer awareness toward the safety of meat and milk products from cattle along with the nutritional content of cattle feed emerged as the key factor driving the product segment. Aqua feed is prepared by mixing raw materials and various additives considering the age and species of various aquatic animals, such as salmon, cod, tilapia, shrimp, zander, and oysters. As it is a niche market, there is a high demand for a methodized R&D approach by new entrants in the market. Furthermore, a rise in income, increasing demand for seafood, and growing consumer awareness are projected to stimulate product demand.

Regional Insights

Asia Pacific dominated the global industry in 2023 and accounted for the largest share of more than 33.50% of the overall revenue. This is attributed to the presence of an abundant livestock population along with the presence of various agricultural economies. Key players are likely to develop their poultry feed portfolio owing to the shifting preferences for meat consumption among consumers. The market in Europe is innovation-driven and highly regulated in terms of human health and well-being, as well as the environment.

This results in regular changes in the guidelines for the product, such as bans and restrictions. Free trade agreements in the region for the European Union countries will have a positive influence on product growth over the forecast period. The swine industry in Spain is growing at a significant growth rate owing to lower product prices, reduced hog production costs owing to increased efficiency, and an increase in Spanish pork exports. Growth in the swine population across the country is creating more demand for animal feed for the swine/pork sector, which is projected to boost the market growth.

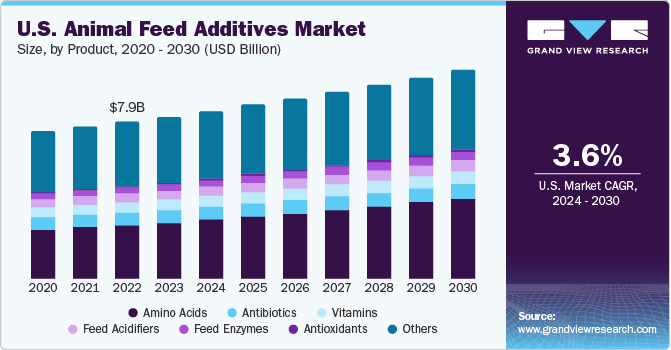

Rising meat consumption in North America, mainly in the U.S., coupled with stringent regulations regarding meat quality is expected to remain a key driving factor for the market. The strong presence of the mills and pet food manufacturing industries will boost product demand. The rising health consciousness among consumers coupled with the growing per capita meat consumption in the country will further support the industry expansion. In addition, the availability of abundant raw materials, such as maize and dextrose, is also expected to drive the market during the forecast period.

Indonesia Animal Feed Additives Market

Indonesia stands as one of the foremost contributors to global aquaculture production, boasting the participation of approximately 2.5 million farmers within this industry. Notably, the nation experienced a substantial 35% upswing in the production of aquaculture feed since 2017, culminating in the attainment of 1.7 million metric tons in 2022. This growth can be attributed to the expanding domains of aquaculture and fisheries, coupled with an escalation in per capita consumption of aquaculture products.

A pivotal factor in this advancement has been the proactive involvement of the Indonesian government, which has played a critical role in the sector's expansion. The government's contributions extend to the formulation of robust policies addressing infrastructure development, entrepreneurship, technology integration, environmental considerations, and enhancement of production systems. Such factors contribute to the advancements of animal feed additives market in Indonesia.

Russia Animal Feed Additives Market

In the year 2022, Russia produced 34.2 million tons of feed, marking an increase from the 31.95 million tons manufactured in the preceding year. Notably, approximately 49% of the total feed production in Russia is designated for poultry, while 41.9% is allocated for pigs, with only 8.5% dedicated to cattle. The favorable trend can be attributed to the expansion of production within the Russian poultry and pig sectors in the preceding year. Traditionally, Russian cattle farmers have relied on pastures and green fodder; however, as the industry evolves towards greater efficiency, the utilization of compound feed is emerging as the predominant solution.

Furthermore, there is a consistent increase observed in the production of premixes in Russia. In the year 2022, the output within this segment amounted to 519,900 tons, reflecting an uptick from the 499,100 tons recorded in the previous year. However, while there is growth, it may still be deemed insufficient to fulfill the expanding demand.

Key Companies & Market Share Insights

The competition in the global industry is highly dependent on the quality of the product, the number of manufacturers & distributors, and their geographical locations. Several participants and stakeholders are also concentrating on increasing their manufacturing capacities. Major market participants including DSM, BASF, Evonik, and Danisco have been highly active in the M&A activities over the last five years. These companies offer a mixed portfolio of products, in comparison to Novozymes and Ajinomoto, which offer specific products, such as enzymes and amino acids. In addition, key companies are engaged in research & development activities to offer consumers efficient products, which is expected to fuel market growth.

Key Animal Feed Additives Companies:

- ADM

- Ajinomoto Co., Inc.

- Alltech, Inc.

- ANOVA Group

- BASF SE

- BIOMIN Holding GmbH

- Cargill Inc.

- Centafarm SRL

- Chr. Hansen Holding

- DSM

- Evonik Industries

- HONG HA NUTRITION

- International Flavors & Fragrances, Inc.

- Kemin Industries, Inc.

- Novozymes

- Novus International, Inc.

- Olmix Group

- Solvay S.A.

Recent Developments

-

In July 2023, Olmix announced the acquisition of Yes Sinergy to reinforce its animal care portfolio. With this transaction, Olmix pursued international development and positioned itself as a significant supplier of bio sourced solutions.

-

In June 2023, Alltech unveiled the launch of Triad – an advanced solution that supports pig livability and successful farrowing. Triad comprises an appetizing blend of the company’s flagship ingredients.

-

In May 2023, Kemin Food Technologies commenced the opening of BITEPod – the company’s center of excellence for food advancements in Asia. This facility was aimed at creating prototypes and enhancing formulations in the food & beverage industry.

Animal Feed Additives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 43.48 billion

Revenue forecast in 2030

USD 53.71 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, form, Livestock, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; The Netherlands; Belgium; Russia; China; India; Japan; South Korea; Thailand; Vietnam; Indonesia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

ADM, Ajinomoto Co., Inc., Alltech, Inc., ANOVA Group, BASF SE, BIOMIN Holding GmbH, Cargill Inc., Centafarm SRL, Chr. Hansen Holding, DSM, Evonik Industries, HONG HA NUTRITION, International Flavors & Fragrances, Inc., Kemin Industries, Inc., Novozymes, Novus International, Inc., Olmix Group, Solvay S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Feed Additives Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global animal feed additives market report based on product, livestock, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antibiotics

-

Vitamins

-

Vitamin A

-

Vitamin E

-

Vitamin B

-

Vitamin C

-

Other Vitamins

-

-

Antioxidants

-

Amino Acids

-

Tryptophan

-

Lysine

-

Methionine

-

Threonine

-

Other Amino Acids

-

-

Feed Enzymes

-

Phytase

-

Non-Starch Polysaccharides & Other Feed Enzymes

-

-

Feed Acidifiers

-

Phosphates

-

Carotenoids

-

Mycotoxin Detoxifiers

-

Flavors & Sweeteners

-

Minerals

-

Non-Protein Nitrogen

-

Phytogenics

-

Preservatives

-

Probiotics

-

Other Products

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Livestock Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pork/Swine

-

Poultry

-

Cattle

-

Aquaculture

-

Other Livestock

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Vietnam

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific emerged as the largest regional market for animal feed additives in 2022 with a volume share of over 33.34%. The region has experienced a strong rise in demand on account of strong economic growth in emerging economies, such as China, Indonesia, and India.

b. Key players in the market include Cargill, Incorporated; Alltech; Kemin Industries, Inc.; DSM, and Novozymes.

b. Growing meat consumption coupled with a recent outbreak of diseases has generated the need for additives in poultry, aqua, and other animal-based products which in turn, is expected to drive the demand.

b. The global animal feed additives market size was USD 40.74 billion in 2022 and is expected to reach USD 42.01 billion by 2023.

b. The global animal feed additives market is projected to expand at a CAGR of 3.5% from 2023 to 2030 to reach USD 53.70 billion by 2030

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."