- Home

- »

- Animal Health

- »

-

Animal Health Market Size, Share & Growth Report, 2030GVR Report cover

![Animal Health Market Size, Share & Trends Report]()

Animal Health Market Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals, Others), By Animal Type, By Distribution Channel, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-763-6

- Number of Pages: 250

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Animal Health Market Size & Trends

The global Animal Health market size was valued at USD 62.40 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030. Factors driving the market growth include rising animal health expenditure, the prevalence of diseases in animals, concerns over zoonoses, initiatives by key companies, uptake of pet insurance, and pet humanization. For instance, in January 2023, Merck opened a new manufacturing facility to produce companion animal vaccines in Boxmeer, Netherlands, to meet increased global customer demand.

The market remained resilient during the COVID-19 public health emergency owing to a surge in pet adoption, increasing pet humanization, and growing concerns over zoonoses. Some of the negative impacts of the pandemic include decreased sales, supply chain disruptions, and operational hurdles due to changing regulations worldwide. On the other hand, the trend for telemedicine witnessed significant growth during the pandemic. Online channels such as e-commerce emerged as pet owners' most preferred distribution channels for purchasing vet products and pet food.

The market was also impacted by macroeconomic headwinds such as inflation, foreign exchange rate fluctuations, and geopolitical conflict during H2 2022. Zoetis, for instance, reported a decrease in revenue growth by 3% in Q1 and Q2 and 4% in Q3 in 2022. The company reported an overall decrease of 4% in revenue growth in the year 2022. Elanco’s revenue growth was negatively impacted by the change in foreign exchange rates, with a 4% decrease in H1 and a 5% decrease in the Q3 results in 2022. On the other hand, Vimian, based in Sweden, reported a positive impact on revenue growth, estimated at 2.5% in Q1, 4.9% in Q2, and 5.6% in Q3 2022.

Market Concentration & Characteristics

The animal health market share is held by numerous companies, ranging from large corporations to small and medium-sized enterprises (SMEs). Given the diversity of the market, companies often specialize in particular areas or products. This specialization allows companies to cater to specific animal species, health conditions, or regional markets, creating niche opportunities within the broader animal health sector.Smaller players may focus on niche innovations, developing specialized products or technologies that address specific gaps or emerging trends in animal health. This emphasis on innovation can contribute to the overall growth of the market.

The market growth stage is estimated to be medium while its pace is accelerating. This indicates a steady increase in demand for animal health products and services influenced by factors such as rising pet ownership, increased awareness of animal welfare, and advancements in veterinary care.Companies are also investing in educational initiatives to inform consumers about preventive care, nutrition, and the benefits of specific health products. The increase in consumer awareness is expected to positively impact the market growth in the coming years.

Animal Health Market Trends

The market is characterized by a high degree of innovation in terms of products. Multiple segments within the market are witnessing rapid developments and investments such as biologics, regenerative medicine, monoclonal antibodies, pharmaceuticals, software, diagnostic products, etc. In November 2023, Boehringer Ingelheim for instance received clearance from the European Commission for SENVELGO— its first oral liquid medication for cats with diabetes.

The market is also undergoing some consolidation as larger companies acquire other market players to boost their portfolios and capabilities. In August 2023, Mars Inc. entered into an agreement to acquire a European Veterinary Reference Laboratory called SYNLAB Vetfrom SYNLAB Group. This complemented its Petcare division’s existing footprint in the full-service veterinary diagnostics business in Europe.

The market is subject to diverse regulations. The development and manufacturing of medicines is strictly monitored by government agencies such as FDA while the regulations for veterinary diagnostic and other products are comparatively lax.Regulatory approval processes can be lengthy and complex, creating barriers to entry for new companies. This often results in established players holding notable animal health market share, as they have the resources and experience to navigate regulatory hurdles.

Notable threat of product substitutes may restrain the growth of the market. Point-of-care diagnostic tools and at-home testing kits for example are becoming more common, offering alternatives to traditional veterinary diagnostic procedures. These alternatives provide convenience for pet owners and farmers. Also, herbal and natural remedies, including supplements and extracts, are often considered substitutes for conventional pharmaceuticals. They are perceived by some pet owners and farmers as more natural alternatives with potentially fewer side effects.

Regional expansion in the market is estimated to be moderate to high owing to several initiatives undertaken by key companies. In October 2021, Boehringer Ingelheim invested EUR 100 million in a Lyon-Jonage based veterinary public health (VPH) strategic production center in France. This added to the company’s animal vaccines capacity for emerging and transboundary diseases as well as furthered its footprint in the Lyon region.

Product Insights

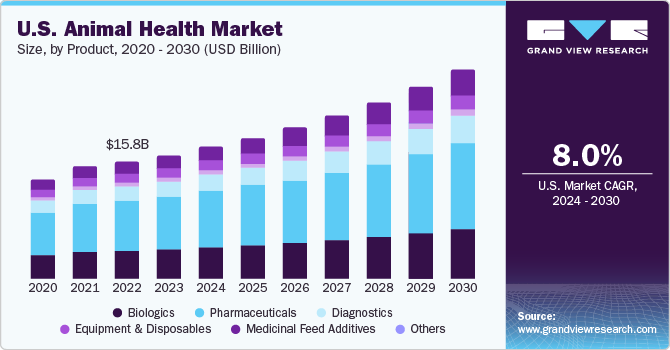

By product, the pharmaceutical segment dominated the market with a share of about 43% in 2023.It is estimated to retain its dominant position throughout the forecast period due to consistent advancements in veterinary drugs. Pharmaceuticals primarily include anti-inflammatory drugs, parasiticides, antibiotics, and others. There is an increasing awareness and concern among pet owners, farmers, and animal caretakers about the importance of animal health. This heightened awareness combined with product development by key companies drives the demand for pharmaceuticals that address various health conditions, from common infections to chronic diseases.

The others segment comprising veterinary telehealth, veterinary software, and livestock monitoring solutions is expected to grow the fastest at a rate of about 12% in the near future. The COVID-19 pandemic in particular led to a surge in the adoption of telehealth Apps and software to facilitate patient and veterinarian visits virtually. Many new players have entered the market since 2020 while existing companies enhanced their service offerings. In May 2023, Walmart for instance partnered with a veterinary telehealth provider— Pawp to offer Walmart+ customersaccess to veterinary professionals via video or text.

Animal Type Insights

In 2023, the production animal segment dominated the market and accounted for the largest revenue share. The substantial segment share results from increased concern for food safety and sustainability among end users as well as market stakeholders such as government healthcare organizations. As livestock farming modernizes to suffice the food demand of the global population, market stakeholders are increasingly adopting precision livestock farming techniques, biosecurity measures, and periodic programmes such as annual vaccinations. This is expected to contribute to the continued dominance of the segment over the forecast period.

The companion animal segment is expected to grow at a lucrative rate during the forecast period. This is owing to increasing uptake of pet insurance, pet humanization, expenditure on pets, and medicalization rate. The trend of humanizing companion animals, considering them as integral family members, has led to increased spending on their healthcare. This trend includes a willingness among pet owners to invest in advanced veterinary pharmaceuticals and medical treatments. Pet owners are thus increasingly seeking medical treatments, preventive care, and pharmaceutical solutions to ensure the health and well-being of their animals.

Distribution Channel Insights

The hospital/ clinic pharmacy segment accounted for the largest revenue share in 2023 in terms of distribution channel.The increasing number of hospital pharmacies and high procedural volume have supported segment growth. Retail channels and e-commerce platforms also accounted for a significant share of the total market. The e-commerce segment is anticipated to witness fastest growth rate throughout the forecast period. This can be attributed to various advantages such as increased convenience for patients not willing to purchase medicines from retail or hospital pharmacies.

Moreover, e-commerce channels also facilitate a consistent supply of drugs, and as medications, these can be preordered. Benefits such as these are anticipated to accentuate the demand for e-commerce throughout the forecast period. With the help of online pharmacies, order procurement and tracking become easy as associated Supply Chain Management (SCM) eliminates other market intermediaries of the delivery channel. This reduces overall costs, thereby increasing customer preference. Retail pharmacies for animal health products are expected to grow moderately throughout the forecast period.

End Use Insights

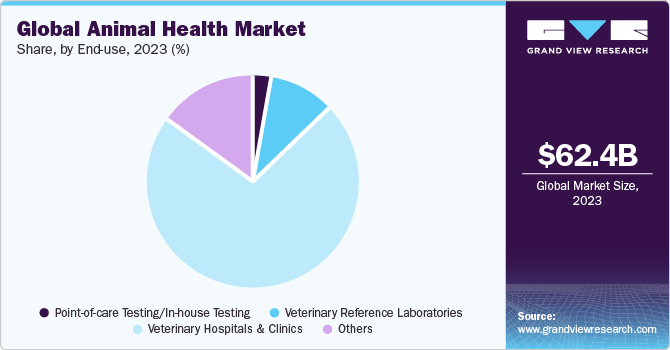

By end use, the veterinary hospitals and clinics segment accounted for the largest revenue share of the market in 2023. This is due to large number of hospitals and clinics across the globe and highest footfall of patients at these care centers. The facilities have a wide range of treatment and diagnostic options which is a key driver for this segment. Certain vaccines are only available in accredited veterinary hospitals and clinics, which is responsible for increasing the share of this end-user segment.

The Point-of-care Testing/In-house Testing segment on the other hand, is projected to grow at the highest CAGR from 2024 to 2030. An increase in the incidences of zoonotic diseases is expected to drive the demand for diagnostic procedures, which will drive the point-of-care testing/ in-house testing segments in the coming years. The increase in initiatives to create awareness among companion animal owners about the benefits and value of preventive care in pets is a key contributing factor to in-house animal health testing. Tests such as ELISA have been proven effective point-of-care tests for heartworm diagnosis.

Regional Insights

By region, North America held the highest share of about 32% of the market in 2023. This can be attributed to the wide range of definitive measures adopted by government and animal welfare organizations that consistently work to improve animal health. Asia Pacific Region is anticipated to grow the fastest a rate of over 10% in the coming years. This is due to growing investments in animal healthcare by prominent players and their efforts to commercialize branded and generic medicines at competitive prices. The animal health market of Europe also held significant share supported by increasing prevalence of diseases in animals and growing veterinary care expenditure.

Animal Health Market by Country

Animal Health Market of India is witnessing a surge in demand for veterinary products and services to address existing and emerging diseases in animals. Global regulatory initiatives promoting responsible antibiotic use and the growing significance of animal welfare standards are shaping the industry. Additionally, the market is experiencing heightened investments in R&D, portfolio acquisition etc., fostering the market growth in the country. For example, in December 2023, Zenex— an Indian animal health company acquired Ayurvet— a company providing ayurvedic and herbal medicines, topical treatments, and feed supplements for production and companion animals. This expanded the portfolio of Zenex and strengthened its geographic access. Overall, the Animal Health Market in India reflects a dynamic landscape responding to evolving consumer preferences, technological advancements, and regulatory imperatives.

The Animal Health Market in Australia is characterized by a robust and sophisticated industry addressing the health and well-being of both pets and livestock. With a strong emphasis on preventive care, the market witnesses a growing demand for biologics such as vaccines as well as health supplements. The market is influenced by a rising trend of pet humanization, driving investments in high-quality veterinary medicines, diagnostics, and healthcare services. Livestock management is marked by a focus on biosecurity measures and sustainable practices, leading to increased adoption of innovative solutions.Regulatory frameworks ensure product safety and efficacy, while ongoing R&D initiatives contribute to the introduction of novel therapies.The industry reflects a commitment to animal welfare, aligning with global standards, and the market is poised for further growth through technological advancements and an evolving understanding of the interconnectedness of animal and human health.

Key Animal Health Company Insights

The market is highly fragmented and competitive in nature due to the presence of numerous companies. Companies that excel in product development, market understanding, strategic decision-making, and regulatory compliance hold a substantial share in the dynamic and evolving animal health industry.

Animal health market share by company is determined by factors such as product penetration, regional presence, strategic initiatives, and company’s financial performance. Leading companies in the market include Zoetis, Merck, Mars, IDEXX, and Boehringer Ingelheim. Leading companies have a diverse portfolio of effective and innovative veterinary pharmaceuticals, biologics, diagnostics, and other solutions that enable them to hold a notable market share by addressing a wider spectrum of animal health needs. These companies also have a strong and well-established presence in key markets and are better positioned to capture significant market share. They also engage in effective strategic planning to expand their capabilities, enter new markets, or enhance their product offerings which supports positive shifts in market share.

Key Animal Health Companies:

The following are the leading companies in the animal health market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these animal health companies are analyzed to map the supply network.

- Zoetis

- Ceva Santé Animale

- Merck & Co., Inc.

- Vetoquinol S.A.

- Boehringer Ingelheim Gmbh

- Elanco

- Virbac

- Mars Inc.

- Dechra Pharmaceuticals Plc

- Idexx Laboratories, Inc.

Recent Developments

-

In November 2023,Bimeda inaugurated a new manufacturing facility in China for sterile injections and parasite-control products thus extending its capabilities.

-

In October 2023, Zoetis commercially launched Librela— its anti-NGF monoclonal antibody treatment in the U.S. for control of canine osteoarthritis pain.

-

In August 2023, Boehringer Ingelheim received U.S. FDA clearance for SENVELGO (velagliflozin oral solution) for diabetic cats.

-

In June 2023, Mars Inc. acquired a leading provider of advanced veterinary diagnostic solutions— Heska Corp. This expanded the company’s diagnostics lineup.

Animal Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 66.9 billion

Revenue forecast in 2030

USD 112.3 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, animal type, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Russia; Ireland; Norway; Netherlands; Switzerland; Poland; Sweden; Norway; Rest of Europe; Japan; China; India; Australia; Thailand; South Korea; Philippines; Malaysia; Singapore; Indonesia; Rest of Asia Pacific; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Turkey; Egypt; Iran; Israel; Rest of MEA

Key companies profiled

Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim GmbH; Elanco; Virbac; Mars Inc.; Dechra Pharmaceuticals plc; IDEXX Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Animal Health market report based on product, animal type, distribution channel, end use and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

Diagnostics

-

Consumables, reagents, and kits

-

Instruments and devices

-

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Others

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Hospital/ Clinic Pharmacy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Sweden

-

Denmark

-

Norway

-

Russia

-

Ireland

-

Poland

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Thailand

-

Australia

-

South Korea

-

Philippines

-

Malaysia

-

Singapore

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

Kuwait

-

Egypt

-

Iran

-

Israel

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global animal health market size was estimated at USD 62.4 billion in 2023 and is expected to reach USD 66.9 billion in 2024.

b. The global animal health market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 112.3 billion by 2030.

b. By region, North America held the highest share of about 32% of the market in 2023. This can be attributed to the wide range of definitive measures adopted by government and animal welfare organizations that consistently work to improve animal health.

b. Some key players operating in the animal health market include Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim GmbH; Elanco; Virbac; Mars Inc.; Dechra Pharmaceuticals plc; IDEXX Laboratories, Inc.

b. Key factors that are driving the animal health market growth include rising animal health expenditure, prevalence/ incidence of diseases in animals, concerns over zoonoses, initiatives by key companies, and pet humanization.

Table of Contents

Chapter 1 Animal Health Market: Research Methodology & Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources

1.3.4. Primary Research

1.4. Information/Data Analysis

1.5. Market Formulation & Visualization

1.6. Data Validation & Publishing

1.7. Model Details

1.7.1. Commodity flow analysis

1.7.2. Global Market: CAGR Calculation

1.8. List of Secondary Sources

Chapter 2 Animal Health Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3 Animal Health Market: Variables, Trends & Scope

3.1. Market Dynamics

3.1.1. Market Drivers Analysis

3.1.1.1. Increasing expenditure on pets

3.1.1.2. Increasing advancements in veterinary medicine

3.1.1.3. Increasing medicalization rate

3.1.1.4. Increasing demand for animal protein

3.1.1.5. Increasing prevalence of diseases in animals

3.1.1.6. Rising Government Initiatives

3.1.2. Market Restraints Analysis

3.1.2.1. Complex regulations

3.1.2.2. Limited Awareness and Education

3.1.2.3. High cost of animal care

3.1.2.4. Limited access to veterinary care

3.1.3. Market Opportunity Analysis

3.1.4. Market Challenge Analysis

3.2. Animal Health Market Analysis Tools

3.2.1. Porter’s Analysis

3.2.1.1. Bargaining power of suppliers

3.2.1.2. Bargaining power of buyers

3.2.1.3. Threat of substitutes

3.2.1.4. Threat of new entrants

3.2.1.5. Competitive rivalry

3.2.2. PESTEL Analysis

3.2.2.1. Political landscape

3.2.2.2. Economic and Social landscape

3.2.2.3. Technological landscape

3.2.2.4. Environmental landscape

3.2.2.5. Legal landscape

3.3. Estimated Animal Population, by Key Species & Key Countries, 2023

3.4. COVID-19 Impact Analysis

3.5. Pricing Analysis

3.6. Pet Owner Demographics in key Countries

Chapter 4. Animal Health Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Animal Health Market: Product Movement Analysis, 2023 & 2030 (USD Billion)

4.3. Biologics

4.3.1. Biologics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2. Vaccines

4.3.2.1. Vaccines Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2.2. Modified/ Attenuated Live

4.3.2.2.1. Modified/ Attenuated Live Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2.3. Inactivated (Killed)

4.3.2.3.1. Inactivated (Killed) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2.4. Other Vaccines

4.3.2.4.1. Other Vaccines Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.3. Other Biologics

4.3.3.1. Other Biologics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Pharmaceuticals

4.4.1. Pharmaceuticals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.2. Parasiticides

4.4.2.1. Parasiticides Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.3. Anti-infectives

4.4.3.1. Anti-infectives Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.4. Anti-inflammatory

4.4.4.1. Anti-inflammatory Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.5. Analgesics

4.4.5.1. Analgesics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.6. Others

4.4.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Diagnostics

4.5.1. Diagnostics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.2. Consumables, reagents and kits

4.5.2.1. Consumables, reagents and kits Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3. Instruments and devices

4.5.3.1. Instruments and devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Equipment & Disposables

4.6.1. Equipment & Disposables Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.2. Critical Care Consumables

4.6.2.1. Critical Care Consumables Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.3. Anesthesia Equipment

4.6.3.1. Anesthesia Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.4. Fluid Management Equipment

4.6.4.1. Fluid Management Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.5. Temperature Management Equipment

4.6.5.1. Temperature Management Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.6. Rescue & Resuscitation Equipment

4.6.6.1. Rescue & Resuscitation Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.7. Research Equipment

4.6.7.1. Research Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.8. Patient Monitoring Equipment

4.6.8.1. Patient Monitoring Equipment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Medicinal Feed Additives

4.7.1. Medicinal Feed Additives Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8. Other Products

4.8.1. Other Products Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8.2. Veterinary Telehealth

4.8.2.1. Veterinary Telehealth Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8.3. Veterinary Software

4.8.3.1. Veterinary Software Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8.4. Livestock Monitoring

4.8.4.1. Livestock Monitoring Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Animal Health Market: Distribution Channel Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Animal Health Market: Distribution Channel Movement Analysis, 2023 & 2030 (USD Billion)

5.3. Retail

5.3.1. Retail Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. E-Commerce

5.4.1. E-Commerce Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Hospital/ Clinic Pharmacy

5.5.1. Hospital/ Clinic Pharmacy Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Animal Health Market: Animal Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Animal Health Market: Animal Type Movement Analysis, 2023 & 2030 (USD Billion)

6.3. Production Animals

6.3.1. Production Animals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.2. Poultry

6.3.2.1. Poultry Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.3. Swine

6.3.3.1. Swine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.4. Cattle

6.3.4.1. Cattle Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.5. Sheep & Goats

6.3.5.1. Sheep & Goats Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.6. Fish

6.3.6.1. Fish Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Companion Animals

6.4.1. Companion Animals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.2. Dogs

6.4.2.1. Dogs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.3. Cats

6.4.3.1. Cats Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.4. Horses

6.4.4.1. Horses Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.5. Others

6.4.5.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Animal Health Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Animal Health Market: End Use Movement Analysis, 2023 & 2030 (USD Billion)

7.3. Veterinary Reference Laboratories

7.3.1. Veterinary Reference Laboratories Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Point-of-care Testing/In-house Testing

7.4.1. Point-of-care Testing/In-house Testing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Veterinary Hospitals & Clinics

7.5.1. Veterinary Hospitals & Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Others

7.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Animal Health Market: Regional Estimates & Trend Analysis

8.1. Animal Health Market Share, By Region, 2023 & 2030, USD Million

8.2. Regional Outlook

8.3. North America

8.3.1. North America Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.2. U.S.

8.3.2.1. Key Country Dynamics

8.3.2.2. Regulatory Landscape

8.3.2.3. Competitive Landscape

8.3.2.4. U.S. Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.3. Canada

8.3.3.1. Key Country Dynamics

8.3.3.2. Regulatory Landscape

8.3.3.3. Competitive Landscape

8.3.3.4. Canada Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Europe

8.4.1. Europe Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.2. UK

8.4.2.1. Key Country Dynamics

8.4.2.2. Regulatory Landscape

8.4.2.3. Competitive Landscape

8.4.2.4. UK Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.3. Germany

8.4.3.1. Key Country Dynamics

8.4.3.2. Regulatory Landscape

8.4.3.3. Competitive Landscape

8.4.3.4. Germany Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.4. France

8.4.4.1. Key Country Dynamics

8.4.4.2. Regulatory Landscape

8.4.4.3. Competitive Landscape

8.4.4.4. France Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.5. Italy

8.4.5.1. Key Country Dynamics

8.4.5.2. Regulatory Landscape

8.4.5.3. Competitive Landscape

8.4.5.4. Italy Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.6. Spain

8.4.6.1. Key Country Dynamics

8.4.6.2. Regulatory Landscape

8.4.6.3. Competitive Landscape

8.4.6.4. Spain Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.7. Sweden

8.4.7.1. Key Country Dynamics

8.4.7.2. Regulatory Landscape

8.4.7.3. Competitive Landscape

8.4.7.4. Sweden Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.8. Denmark

8.4.8.1. Key Country Dynamics

8.4.8.2. Regulatory Landscape

8.4.8.3. Competitive Landscape

8.4.8.4. Denmark Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.9. Norway

8.4.9.1. Key Country Dynamics

8.4.9.2. Regulatory Landscape

8.4.9.3. Competitive Landscape

8.4.9.4. Norway Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.10. Russia

8.4.10.1. Key Country Dynamics

8.4.10.2. Regulatory Landscape

8.4.10.3. Competitive Landscape

8.4.10.4. Russia Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.11. Netherlands

8.4.11.1. Key Country Dynamics

8.4.11.2. Regulatory Landscape

8.4.11.3. Competitive Landscape

8.4.11.4. Netherlands Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.12. Switzerland

8.4.12.1. Key Country Dynamics

8.4.12.2. Regulatory Landscape

8.4.12.3. Competitive Landscape

8.4.12.4. Switzerland Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.13. Ireland

8.4.13.1. Key Country Dynamics

8.4.13.2. Regulatory Landscape

8.4.13.3. Competitive Landscape

8.4.13.4. Ireland Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.14. Poland

8.4.14.1. Key Country Dynamics

8.4.14.2. Regulatory Landscape

8.4.14.3. Competitive Landscape

8.4.14.4. Poland Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5. Asia Pacific

8.5.1. Asia Pacific Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. China

8.5.2.1. Key Country Dynamics

8.5.2.2. Regulatory Landscape

8.5.2.3. Competitive Landscape

8.5.2.4. China Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3. Japan

8.5.3.1. Key Country Dynamics

8.5.3.2. Regulatory Landscape

8.5.3.3. Competitive Landscape

8.5.3.4. Japan Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4. India

8.5.4.1. Key Country Dynamics

8.5.4.2. Regulatory Landscape

8.5.4.3. Competitive Landscape

8.5.4.4. India Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.5. South Korea

8.5.5.1. Key Country Dynamics

8.5.5.2. Regulatory Landscape

8.5.5.3. Competitive Landscape

8.5.5.4. South Korea Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.6. Australia

8.5.6.1. Key Country Dynamics

8.5.6.2. Regulatory Landscape

8.5.6.3. Competitive Landscape

8.5.6.4. Australia Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.7. Thailand

8.5.7.1. Key Country Dynamics

8.5.7.2. Regulatory Landscape

8.5.7.3. Competitive Landscape

8.5.7.4. Thailand Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.8. Indonesia

8.5.8.1. Key Country Dynamics

8.5.8.2. Regulatory Landscape

8.5.8.3. Competitive Landscape

8.5.8.4. Indonesia Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.9. Philippines

8.5.9.1. Key Country Dynamics

8.5.9.2. Regulatory Landscape

8.5.9.3. Competitive Landscape

8.5.9.4. Philippines Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.10. Malaysia

8.5.10.1. Key Country Dynamics

8.5.10.2. Regulatory Landscape

8.5.10.3. Competitive Landscape

8.5.10.4. Malaysia Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.11. Singapore

8.5.11.1. Key Country Dynamics

8.5.11.2. Regulatory Landscape

8.5.11.3. Competitive Landscape

8.5.11.4. Singapore Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Latin America

8.6.1. Latin America Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. Brazil

8.6.2.1. Key Country Dynamics

8.6.2.2. Regulatory Landscape

8.6.2.3. Competitive Landscape

8.6.2.4. Brazil Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3. Mexico

8.6.3.1. Key Country Dynamics

8.6.3.2. Regulatory Landscape

8.6.3.3. Competitive Landscape

8.6.3.4. Mexico Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4. Argentina

8.6.4.1. Key Country Dynamics

8.6.4.2. Regulatory Landscape

8.6.4.3. Competitive Landscape

8.6.4.4. Argentina Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7. Middle East and Africa

8.7.1. Middle East and Africa Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.2. Saudi Arabia

8.7.2.1. Key Country Dynamics

8.7.2.2. Regulatory Landscape

8.7.2.3. Competitive Landscape

8.7.2.4. Saudi Arabia Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.3. UAE

8.7.3.1. Key Country Dynamics

8.7.3.2. Regulatory Landscape

8.7.3.3. Competitive Landscape

8.7.3.4. UAE Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.4. South Africa

8.7.4.1. Key Country Dynamics

8.7.4.2. Regulatory Landscape

8.7.4.3. Competitive Landscape

8.7.4.4. South Africa Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.5. Kuwait

8.7.5.1. Key Country Dynamics

8.7.5.2. Regulatory Landscape

8.7.5.3. Competitive Landscape

8.7.5.4. Kuwait Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.6. Turkey

8.7.6.1. Key Country Dynamics

8.7.6.2. Regulatory Landscape

8.7.6.3. Competitive Landscape

8.7.6.4. Turkey Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.7. Iran

8.7.7.1. Key Country Dynamics

8.7.7.2. Regulatory Landscape

8.7.7.3. Competitive Landscape

8.7.7.4. Iran Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.8. Israel

8.7.8.1. Key Country Dynamics

8.7.8.2. Regulatory Landscape

8.7.8.3. Competitive Landscape

8.7.8.4. Israel Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.9. Egypt

8.7.9.1. Key Country Dynamics

8.7.9.2. Regulatory Landscape

8.7.9.3. Competitive Landscape

8.7.9.4. Egypt Animal Health Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Market Participant Categorization

9.2. Company Market Position Analysis/ Heap Map Analysis

9.3. Company Profiles

9.3.1. Zoetis

9.3.1.1. Participant’s Overview

9.3.1.2. Financial Performance

9.3.1.3. Product Benchmarking

9.3.1.4. Strategic Initiatives

9.3.2. Ceva Santé Animale

9.3.2.1. Participant’s Overview

9.3.2.2. Financial Performance

9.3.2.3. Product Benchmarking

9.3.2.4. Strategic Initiatives

9.3.3. Merck & Co., Inc.

9.3.3.1. Participant’s Overview

9.3.3.2. Financial Performance

9.3.3.3. Product Benchmarking

9.3.3.4. Strategic Initiatives

9.3.4. Vetoquinol S.A.

9.3.4.1. Participant’s Overview

9.3.4.2. Financial Performance

9.3.4.3. Product Benchmarking

9.3.4.4. Strategic Initiatives

9.3.5. Boehringer Ingelheim Gmbh

9.3.5.1. Participant’s Overview

9.3.5.2. Financial Performance

9.3.5.3. Product Benchmarking

9.3.5.4. Strategic Initiatives

9.3.6. Elanco

9.3.6.1. Participant’s Overview

9.3.6.2. Financial Performance

9.3.6.3. Product Benchmarking

9.3.6.4. Strategic Initiatives

9.3.7. Virbac

9.3.7.1. Participant’s Overview

9.3.7.2. Financial Performance

9.3.7.3. Product Benchmarking

9.3.7.4. Strategic Initiatives

9.3.8. Mars Inc.

9.3.8.1. Participant’s Overview

9.3.8.2. Financial Performance

9.3.8.3. Product Benchmarking

9.3.8.4. Strategic Initiatives

9.3.9. Dechra Pharmaceuticals Plc

9.3.9.1. Participant’s Overview

9.3.9.2. Financial Performance

9.3.9.3. Product Benchmarking

9.3.9.4. Strategic Initiatives

9.3.10. Idexx Laboratories, Inc.

9.3.10.1. Participant’s Overview

9.3.10.2. Financial Performance

9.3.10.3. Product Benchmarking

9.3.10.4. Strategic Initiatives

9.4. Strategy Mapping

9.4.1. Mergers & Acquisitions

9.4.2. Partnerships & Collaborations

9.4.3. Others

9.5. List of Other Key Manufacturers

9.6. List of Distributors by Region

List of Tables

Table 1 List of secondary sources

Table 2 Global Animal Health market, by region, 2018 - 2030 (USD Million)

Table 3 Global Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 4 Global Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 5 Global Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 6 Global Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 7 Global Biologics market, by Type, 2018 - 2030 (USD Million)

Table 8 Global Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 9 Global Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 10 Global Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 11 Global Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 12 Global Other Products market, by Type, 2018 - 2030 (USD Million)

Table 13 Global Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 14 Global Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 15 North America Animal Health market, by country, 2018 - 2030 (USD Million)

Table 16 North America Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 17 North America Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 18 North America Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 19 North America Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 20 North America Biologics market, by Type, 2018 - 2030 (USD Million)

Table 21 North America Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 22 North America Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 23 North America Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 24 North America Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 25 North America Other Products market, by Type, 2018 - 2030 (USD Million)

Table 26 North America Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 27 North America Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 28 U.S. Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 29 U.S. Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 30 U.S. Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 31 U.S. Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 32 U.S. Biologics market, by Type, 2018 - 2030 (USD Million)

Table 33 U.S. Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 34 U.S. Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 35 U.S. Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 36 U.S. Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 37 U.S. Other Products market, by Type, 2018 - 2030 (USD Million)

Table 38 U.S. Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 39 U.S. Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 40 Canada Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 41 Canada Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 42 Canada Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 43 Canada Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 44 Canada Biologics market, by Type, 2018 - 2030 (USD Million)

Table 45 Canada Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 46 Canada Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 47 Canada Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 48 Canada Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 49 Canada Other Products market, by Type, 2018 - 2030 (USD Million)

Table 50 Canada Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 51 Canada Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 52 Europe Animal Health market, by country, 2018 - 2030 (USD Million)

Table 53 Europe Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 54 Europe Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 55 Europe Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 56 Europe Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 57 Europe Biologics market, by Type, 2018 - 2030 (USD Million)

Table 58 Europe Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 59 Europe Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 60 Europe Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 61 Europe Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 62 Europe Other Products market, by Type, 2018 - 2030 (USD Million)

Table 63 Europe Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 64 Europe Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 65 Germany Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 66 Germany Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 67 Germany Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 68 Germany Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 69 Germany Biologics market, by Type, 2018 - 2030 (USD Million)

Table 70 Germany Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 71 Germany Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 72 Germany Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 73 Germany Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 74 Germany Other Products market, by Type, 2018 - 2030 (USD Million)

Table 75 Germany Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 76 Germany Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 77 UK Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 78 UK Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 79 UK Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 80 UK Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 81 UK Biologics market, by Type, 2018 - 2030 (USD Million)

Table 82 UK Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 83 UK Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 84 UK Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 85 UK Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 86 UK Other Products market, by Type, 2018 - 2030 (USD Million)

Table 87 UK Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 88 UK Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 89 France Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 90 France Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 91 France Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 92 France Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 93 France Biologics market, by Type, 2018 - 2030 (USD Million)

Table 94 France Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 95 France Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 96 France Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 97 France Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 98 France Other Products market, by Type, 2018 - 2030 (USD Million)

Table 99 France Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 100 France Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 101 Italy Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 102 Italy Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 103 Italy Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 104 Italy Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 105 Italy Biologics market, by Type, 2018 - 2030 (USD Million)

Table 106 Italy Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 107 Italy Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 108 Italy Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 109 Italy Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 110 Italy Other Products market, by Type, 2018 - 2030 (USD Million)

Table 111 Italy Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 112 Italy Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 113 Spain Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 114 Spain Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 115 Spain Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 116 Spain Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 117 Spain Biologics market, by Type, 2018 - 2030 (USD Million)

Table 118 Spain Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 119 Spain Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 120 Spain Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 121 Spain Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 122 Spain Other Products market, by Type, 2018 - 2030 (USD Million)

Table 123 Spain Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 124 Spain Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 125 Denmark Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 126 Denmark Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 127 Denmark Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 128 Denmark Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 129 Denmark Biologics market, by Type, 2018 - 2030 (USD Million)

Table 130 Denmark Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 131 Denmark Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 132 Denmark Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 133 Denmark Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 134 Denmark Other Products market, by Type, 2018 - 2030 (USD Million)

Table 135 Denmark Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 136 Denmark Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 137 Sweden Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 138 Sweden Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 139 Sweden Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 140 Sweden Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 141 Sweden Biologics market, by Type, 2018 - 2030 (USD Million)

Table 142 Sweden Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 143 Sweden Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 144 Sweden Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 145 Sweden Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 146 Sweden Other Products market, by Type, 2018 - 2030 (USD Million)

Table 147 Sweden Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 148 Sweden Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 149 Norway Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 150 Norway Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 151 Norway Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 152 Norway Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 153 Norway Biologics market, by Type, 2018 - 2030 (USD Million)

Table 154 Norway Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 155 Norway Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 156 Norway Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 157 Norway Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 158 Norway Other Products market, by Type, 2018 - 2030 (USD Million)

Table 159 Norway Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 160 Norway Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 161 Russia Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 162 Russia Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 163 Russia Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 164 Russia Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 165 Russia Biologics market, by Type, 2018 - 2030 (USD Million)

Table 166 Russia Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 167 Russia Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 168 Russia Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 169 Russia Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 170 Russia Other Products market, by Type, 2018 - 2030 (USD Million)

Table 171 Russia Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 172 Russia Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 173 Netherlands Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 174 Netherlands Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 175 Netherlands Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 176 Netherlands Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 177 Netherlands Biologics market, by Type, 2018 - 2030 (USD Million)

Table 178 Netherlands Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 179 Netherlands Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 180 Netherlands Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 181 Netherlands Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 182 Netherlands Other Products market, by Type, 2018 - 2030 (USD Million)

Table 183 Netherlands Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 184 Netherlands Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 185 Switzerland Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 186 Switzerland Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 187 Switzerland Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 188 Switzerland Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 189 Switzerland Biologics market, by Type, 2018 - 2030 (USD Million)

Table 190 Switzerland Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 191 Switzerland Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 192 Switzerland Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 193 Switzerland Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 194 Switzerland Other Products market, by Type, 2018 - 2030 (USD Million)

Table 195 Switzerland Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 196 Switzerland Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 197 Ireland Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 198 Ireland Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 199 Ireland Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 200 Ireland Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 201 Ireland Biologics market, by Type, 2018 - 2030 (USD Million)

Table 202 Ireland Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 203 Ireland Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 204 Ireland Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 205 Ireland Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 206 Ireland Other Products market, by Type, 2018 - 2030 (USD Million)

Table 207 Ireland Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 208 Ireland Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 209 Poland Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 210 Poland Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 211 Poland Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 212 Poland Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 213 Poland Biologics market, by Type, 2018 - 2030 (USD Million)

Table 214 Poland Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 215 Poland Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 216 Poland Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 217 Poland Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 218 Poland Other Products market, by Type, 2018 - 2030 (USD Million)

Table 219 Poland Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 220 Poland Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 221 Asia Pacific Animal Health market, by country, 2018 - 2030 (USD Million)

Table 222 Asia Pacific Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 223 Asia Pacific Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 224 Asia Pacific Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 225 Asia Pacific Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 226 Asia Pacific Biologics market, by Type, 2018 - 2030 (USD Million)

Table 227 Asia Pacific Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 228 Asia Pacific Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 229 Asia Pacific Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 230 Asia Pacific Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 231 Asia Pacific Other Products market, by Type, 2018 - 2030 (USD Million)

Table 232 Asia Pacific Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 233 Asia Pacific Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 234 China Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 235 China Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 236 China Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 237 China Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 238 China Biologics market, by Type, 2018 - 2030 (USD Million)

Table 239 China Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 240 China Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 241 China Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 242 China Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 243 China Other Products market, by Type, 2018 - 2030 (USD Million)

Table 244 China Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 245 China Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 246 Japan Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 247 Japan Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 248 Japan Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 249 Japan Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 250 Japan Biologics market, by Type, 2018 - 2030 (USD Million)

Table 251 Japan Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 252 Japan Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 253 Japan Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 254 Japan Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 255 Japan Other Products market, by Type, 2018 - 2030 (USD Million)

Table 256 Japan Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 257 Japan Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 258 India Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 259 India Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 260 India Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 261 India Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 262 India Biologics market, by Type, 2018 - 2030 (USD Million)

Table 263 India Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 264 India Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 265 India Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 266 India Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 267 India Other Products market, by Type, 2018 - 2030 (USD Million)

Table 268 India Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 269 India Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 270 South Korea Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 271 South Korea Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 272 South Korea Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 273 South Korea Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 274 South Korea Biologics market, by Type, 2018 - 2030 (USD Million)

Table 275 South Korea Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 276 South Korea Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 277 South Korea Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 278 South Korea Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 279 South Korea Other Products market, by Type, 2018 - 2030 (USD Million)

Table 280 South Korea Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 281 South Korea Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 282 Australia Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 283 Australia Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 284 Australia Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 285 Australia Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 286 Australia Biologics market, by Type, 2018 - 2030 (USD Million)

Table 287 Australia Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 288 Australia Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 289 Australia Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 290 Australia Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 291 Australia Other Products market, by Type, 2018 - 2030 (USD Million)

Table 292 Australia Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 293 Australia Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 294 Thailand Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 295 Thailand Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 296 Thailand Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 297 Thailand Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 298 Thailand Biologics market, by Type, 2018 - 2030 (USD Million)

Table 299 Thailand Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 300 Thailand Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 301 Thailand Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 302 Thailand Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 303 Thailand Other Products market, by Type, 2018 - 2030 (USD Million)

Table 304 Thailand Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 305 Thailand Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 306 Indonesia Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 307 Indonesia Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 308 Indonesia Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 309 Indonesia Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 310 Indonesia Biologics market, by Type, 2018 - 2030 (USD Million)

Table 311 Indonesia Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 312 Indonesia Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 313 Indonesia Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 314 Indonesia Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 315 Indonesia Other Products market, by Type, 2018 - 2030 (USD Million)

Table 316 Indonesia Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 317 Indonesia Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 318 Philippines Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 319 Philippines Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 320 Philippines Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 321 Philippines Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 322 Philippines Biologics market, by Type, 2018 - 2030 (USD Million)

Table 323 Philippines Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 324 Philippines Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 325 Philippines Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 326 Philippines Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 327 Philippines Other Products market, by Type, 2018 - 2030 (USD Million)

Table 328 Philippines Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 329 Philippines Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 330 Malaysia Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 331 Malaysia Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 332 Malaysia Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 333 Malaysia Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 334 Malaysia Biologics market, by Type, 2018 - 2030 (USD Million)

Table 335 Malaysia Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 336 Malaysia Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 337 Malaysia Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 338 Malaysia Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 339 Malaysia Other Products market, by Type, 2018 - 2030 (USD Million)

Table 340 Malaysia Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 341 Malaysia Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 342 Singapore Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 343 Singapore Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 344 Singapore Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 345 Singapore Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 346 Singapore Biologics market, by Type, 2018 - 2030 (USD Million)

Table 347 Singapore Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 348 Singapore Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 349 Singapore Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 350 Singapore Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 351 Singapore Other Products market, by Type, 2018 - 2030 (USD Million)

Table 352 Singapore Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 353 Singapore Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 354 Latin America Animal Health market, by country, 2018 - 2030 (USD Million)

Table 355 Latin America Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 356 Latin America Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 357 Latin America Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 358 Latin America Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 359 Latin America Biologics market, by Type, 2018 - 2030 (USD Million)

Table 360 Latin America Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 361 Latin America Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 362 Latin America Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 363 Latin America Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 364 Latin America Other Products market, by Type, 2018 - 2030 (USD Million)

Table 365 Latin America Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 366 Latin America Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 367 Brazil Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 368 Brazil Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 369 Brazil Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 370 Brazil Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 371 Brazil Biologics market, by Type, 2018 - 2030 (USD Million)

Table 372 Brazil Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 373 Brazil Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 374 Brazil Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 375 Brazil Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 376 Brazil Other Products market, by Type, 2018 - 2030 (USD Million)

Table 377 Brazil Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 378 Brazil Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 379 Mexico Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 380 Mexico Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 381 Mexico Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 382 Mexico Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 383 Mexico Biologics market, by Type, 2018 - 2030 (USD Million)

Table 384 Mexico Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 385 Mexico Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 386 Mexico Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 387 Mexico Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 388 Mexico Other Products market, by Type, 2018 - 2030 (USD Million)

Table 389 Mexico Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 390 Mexico Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 391 Argentina Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 392 Argentina Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 393 Argentina Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 394 Argentina Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 395 Argentina Biologics market, by Type, 2018 - 2030 (USD Million)

Table 396 Argentina Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 397 Argentina Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 398 Argentina Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 399 Argentina Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 400 Argentina Other Products market, by Type, 2018 - 2030 (USD Million)

Table 401 Argentina Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 402 Argentina Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 403 MEA Animal Health market, by country, 2018 - 2030 (USD Million)

Table 404 MEA Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 405 MEA Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 406 MEA Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 407 MEA Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 408 MEA Biologics market, by Type, 2018 - 2030 (USD Million)

Table 409 MEA Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 410 MEA Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 411 MEA Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 412 MEA Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 413 MEA Other Products market, by Type, 2018 - 2030 (USD Million)

Table 414 MEA Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 415 MEA Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 416 South Africa Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 417 South Africa Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 418 South Africa Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 419 South Africa Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 420 South Africa Biologics market, by Type, 2018 - 2030 (USD Million)

Table 421 South Africa Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 422 South Africa Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 423 South Africa Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 424 South Africa Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 425 South Africa Other Products market, by Type, 2018 - 2030 (USD Million)

Table 426 South Africa Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 427 South Africa Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 428 Saudi Arabia Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 429 Saudi Arabia Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 430 Saudi Arabia Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 431 Saudi Arabia Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 432 Saudi Arabia Biologics market, by Type, 2018 - 2030 (USD Million)

Table 433 Saudi Arabia Vaccines market, by Type, 2018 - 2030 (USD Million)

Table 434 Saudi Arabia Pharmaceuticals market, by Type, 2018 - 2030 (USD Million)

Table 435 Saudi Arabia Diagnostics market, by Type, 2018 - 2030 (USD Million)

Table 436 Saudi Arabia Equipment & Disposables market, by Type, 2018 - 2030 (USD Million)

Table 437 Saudi Arabia Other Products market, by Type, 2018 - 2030 (USD Million)

Table 438 Saudi Arabia Production Animals market, by Type, 2018 - 2030 (USD Million)

Table 439 Saudi Arabia Companion Animals market, by Type, 2018 - 2030 (USD Million)

Table 440 UAE Animal Health market, by Animal Type, 2018 - 2030 (USD Million)

Table 441 UAE Animal Health market, by Distribution Channel, 2018 - 2030 (USD Million)

Table 442 UAE Animal Health market, by Product, 2018 - 2030 (USD Million)

Table 443 UAE Animal Health market, by End Use, 2018 - 2030 (USD Million)

Table 444 UAE Biologics market, by Type, 2018 - 2030 (USD Million)

Table 445 UAE Vaccines market, by Type, 2018 - 2030 (USD Million)