- Home

- »

- Pharmaceuticals

- »

-

Anti-obesity Medication Market Size & Share Report, 2030GVR Report cover

![Anti-obesity Medication Market Size, Share & Trends Report]()

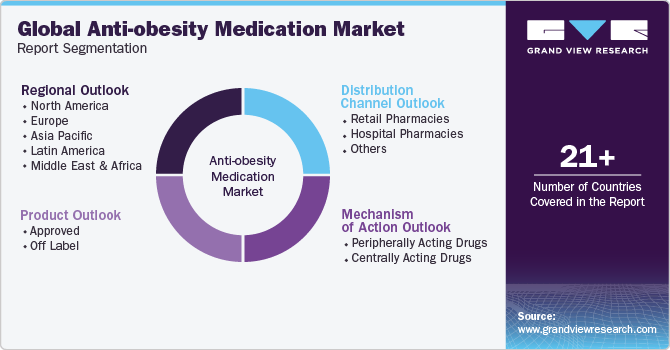

Anti-obesity Medication Market Size, Share & Trends Analysis Report By Product (Approved, Off-label), By Mechanism Of Action (Peripherally Acting Drugs, Centrally Acting Drugs), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-235-6

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Anti-obesity Medication Market Size & Trends

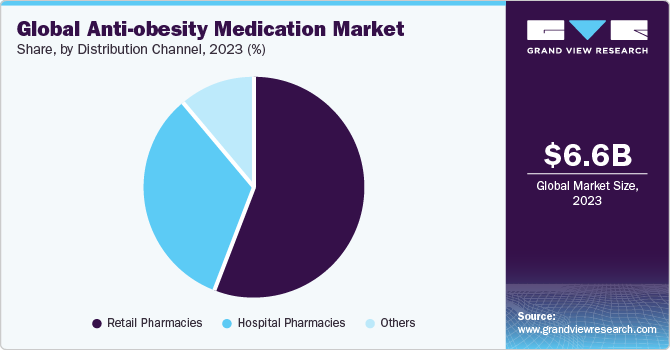

The global anti-obesity medication market size was estimated at USD 6.62 billion in 2023 and is projected to grow at a CAGR of 31.66% from 2024 to 2030. Global obesity is on the rise, creating a demand for effective solutions. Increasing awareness of the health consequences associated with being overweight, such as diabetes and cardiovascular diseases, is expected to contribute to the demand in this market. Acceleration in the development of anti-obesity drugs, supported by significant R&D investments, is expected to drive the market’s growth. With advancements in drug development technologies, the market is poised for further growth, addressing the pressing need to combat overweight-related health challenges.

The World Obesity Atlas 2022, predicts a staggering rise in global obesity rates, with projections indicating that by 2030, around 1 billion people worldwide will be living with obesity. This alarming trend, especially pronounced in low- and middle-income countries, poses significant challenges to healthcare systems and economies worldwide. The report highlights the urgent need for coordinated action to address the root causes of obesity and mitigate its impact. Moreover, the projected increase in obesity prevalence directly correlates with the growth of the overweight treatment market, creating opportunities for pharmaceutical companies, healthcare providers, and other stakeholders. As healthcare costs associated with obesity continue to escalate, there is a growing imperative for innovative solutions and interventions to curb this epidemic and ensure sustainable healthcare cost containment.

Market players are actively investing in R&D to pioneer innovative medicines for weight loss management. Novo Nordisk's completion of a phase 2 clinical trial for CagriSema in August 2022 showcased its potential benefits for individuals managing type 2 diabetes and overweight. Additionally, drugs such as Oral Sema Obesity and GELA, INV-202, currently in phase 3 and phase 2 respectively, promise further market expansion. Moreover, in June 2023, Eli Lilly's phase 2 trial results for orforglipron demonstrated significant weight reduction and A1C improvements in adults with obesity or overweight and type 2 diabetes, marking another significant advancement in the field. If confirmed in phase 3 trials, these findings could broaden treatment options and drive competition, igniting anticipation for enhanced solutions worldwide.

The introduction of new medications such as CagriSema, Oral Sema Obesity, GELA, INV-202, and orforglipron is propelling the market growth. Investing in this sector enables companies to take hold of opportunities arising from evolving demands and gain a competitive edge. Leading the development and commercialization of innovative medications positions the companies as frontrunners, consolidating their presence in the market.

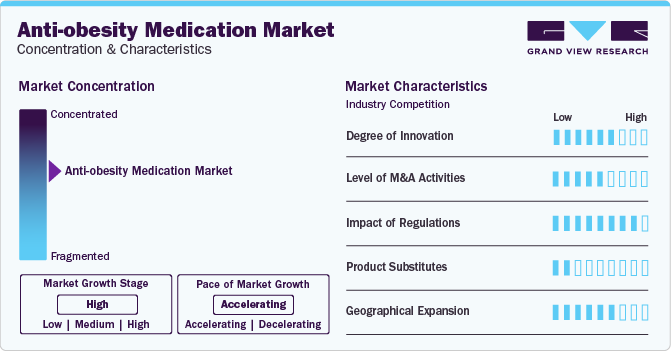

Market Concentration & Characteristics

The market is currently in a growth stage with an accelerating pace of expansion. This market is marked by innovation driven by technological advancements and innovative approaches. Product approvals and clinical advancements are driving this evolution. As innovation continues, opportunities for transformative solutions emerge, promising improved outcomes for individuals with obesity.

The market is also characterized by a moderately high level of merger and acquisition (M&A) and collaboration activity by the leading players. For instance, in December 2023, Fauna Bio partnered with Eli Lilly to utilize its Convergence AI platform for weight management drug discovery. The collaboration aims to identify novel targets leveraging insights from hibernation biology. Fauna's platform integrates diverse genomic data to accelerate the discovery of effective treatments, supported by a multi-million-dollar investment.

The market is also subject to increasing regulatory scrutiny. Balancing benefit-risk evaluation, emphasizing safety profiles, and conducting long-term efficacy studies. New drugs must demonstrate efficacy in weight loss, maintain a favorable safety profile, and pass rigorous regulatory scrutiny.

Product substitutes in the anti-obesity medication market are alternative treatments that can be used instead of traditional pharmaceuticals for managing overweight. These alternatives can range from lifestyle changes to other types of medications. Herbal supplements, Ayurveda, and homeopathy are some of the common methods that can serve as substitutes for anti-obesity medications in certain cases. These medicines offer holistic approaches to healing and emphasize a combination of natural remedies, lifestyle modifications, and individualized treatments.

The market sees a high degree of geographical expansion strategies, with key players such as Rhythm Pharmaceuticals and LG Chem employing this approach to broaden their service reach. This strategy enhances service availability across diverse geographic areas, ensuring a more extensive market presence. For instance, in January 2024, Rhythm Pharmaceuticals entered into a global licensing agreement with LG Chem for LB54640, a Phase II weight loss drug targeting the melanocortin-4 receptor. Rhythm will sponsor Phase II trials SIGNAL and ROUTE, investigating LB54640's efficacy in hypothalamic obesity.

Product Insights

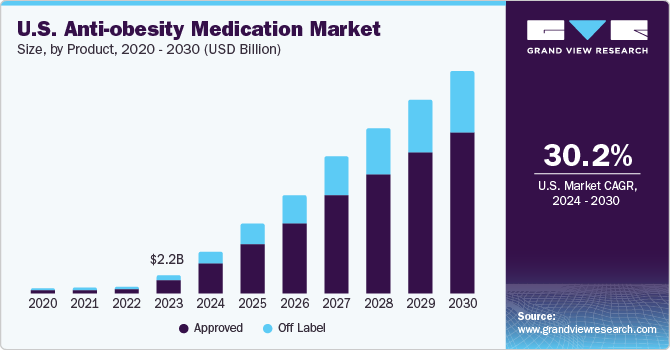

The approved product segment held a dominant revenue share in 2023 and is expected to grow at a CAGR of 32.41% from 2024 to 2030. This dominance is due to the accessibility of therapeutically effective weight management drugs, the rising prevalence of overweight, and the high consumption of approved anti-obesity medications. Approved medications such as Zepbound, Wegovy, Saxenda, Orlistat, and Qsymia have undergone rigorous clinical trials and received regulatory approval from the FDA. These drugs are specifically formulated and indicated for the treatment of weight-related medical conditions, ensuring their safety and efficacy profiles are well-established. The dominance of the approved segment is also attributed to the effectiveness and safety of these medications, as well as the focus of pharmaceutical companies on strategic initiatives and new advanced product launches thereby increasing the adoption of these drugs.

The off-label segment of the anti-obesity medication market includes medications that are not approved by the FDA but are prescribed by healthcare providers for weight loss. The off-label segment includes medications such as Semaglutide (Ozempic), Liraglutide (Victoza), Dulaglutide (Trulicity), and Topiramate (Dulaglutide (Trulicity)). The growth of this segment is supported by affordable pricing and comparatively similar drug efficacy as compared to branded drugs. For instance, Naltrexone and bupropion are combined in Contrave, an FDA-approved weight-loss drug, the two medications may be prescribed separately off-label.

Mechanism Of Action Insights

The peripherally acting anti-obesity drugs segment accounted for the largest revenue share of 59.87% in 2023. The substantial share can be attributed to the ability of this mechanism to enhance the absorption of nutrients and reduce the feeling of hunger. These drugs work by blocking the absorption of fats in the intestines, which leads to a decrease in calorie intake and promoting weight loss. The dominance of this segment is also attributed to the effectiveness of these drugs in promoting a sense of fullness without causing side effects commonly associated with appetite suppressants. Moreover, their mechanism of action allows for less dependence on calorie restriction and physical activity, making them appealing to patients seeking convenient and sustainable weight management solutions.

The market for centrally acting drugs is expected to growth at a lucrative CAGR over the forecast period. Centrally acting drugs in the anti-obesity market manipulate the central nervous system to suppress appetite and promote weight loss. These drugs, such as Bupropion (Wellbutrin) and Naltrexone, work by stimulating specific receptors that reduce the feelings of hunger and increase energy expenditure. The dominance of centrally acting drugs can be attributed to their ability to provide a sense of fullness, potentially reducing overall calorie intake without affecting physical activity levels. Furthermore, their mechanism of action aligns with the concept of lifestyle changes that are integral to weight management programs, making them a preferred choice for many individuals. The recent withdrawal of certain amphetamines from the market due to adverse side effects has also contributed to the shift towards safer centrally acting drugs, reinforcing their market position.

Distribution Channel Insights

Retail pharmacies dominated the distribution channel segment in 2023 with a revenue share of 55.90%. These outlets offer convenient access to medications for consumers, often located in easily accessible locations within communities. Retail pharmacies provide a familiar and trusted environment for patients seeking treatment for overweight, allowing them to conveniently fill prescriptions and receive guidance from pharmacists on medication use and lifestyle modifications.

Hospital pharmacies also play a significant role, particularly in managing severe cases of obesity or patients with comorbidities requiring specialized care. These pharmacies are integral in dispensing medications prescribed by healthcare professionals within hospital settings, ensuring continuity of care and adherence to treatment protocols.

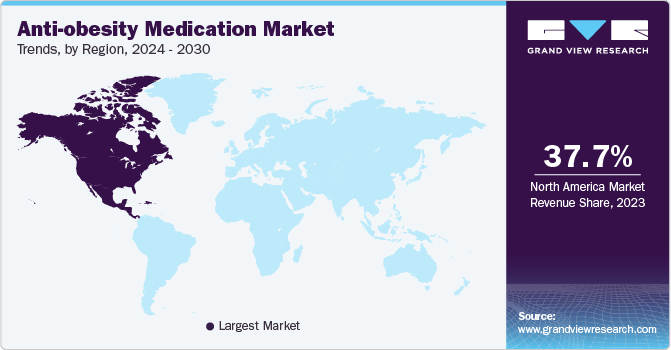

Regional Insights

North America dominated the market and accounted for a revenue share of 37.67% in 2023. North America’s dominance is evident due to various factors, including the high prevalence of obesity and supportive government policies. Key market players such as Novo Nordisk, Pfizer, Merck & Co., and F. Hoffmann-La Roche further solidify its position. Strategic initiatives such as mergers, acquisitions, and partnerships among pharmaceutical giants are actively shaping the competitive landscape. For instance, Roche's USD 2.7 billion acquisition of Carmot Therapeutics in December 2023 demonstrates this trend, aiming to access promising clinical-stage obesity drugs like CT-388, CT-996, and CT-868. Moreover, research from the Cureus Journal of Medical Science highlights the significant obesity burden in rural America, driven by various factors. While progress has been made, the exploration of genetics and rural-focused research remains crucial to inform effective prevention and management strategies.

U.S. Anti-obesity Medication Market Trends

The anti-obesity medication market in the U.S. is expected to grow over the forecast period, due to the strong pharmaceutical industry, with leading players like Eli Lilly and Novo Nordisk driving innovation in the field, particularly in the development of GLP-1 drugs. Furthermore, the Treat and Reduce Obesity Act (TROA), reintroduced by bipartisan U.S. Senators and Representatives in July 2023, aims to combat obesity-related diseases by expanding Medicare coverage for treatments and screenings.

Europe Anti-obesity Medication Market Trends

The Europe anti-obesity medication market presents a lucrative opportunity for pharmaceutical companies, with significant growth potential in the region. Despite the meaningful progress in recognizing obesity as a disease, patient access to medications and treatments remains a significant challenge. The lack of reimbursement for weight management treatments under government healthcare programs such as Medicare and commercial payers makes these medications unaffordable for many patients. Currently, there are four drugs registered in the European Union that help reduce body weight: long-acting GLP-1 analogs and orlistat, a drug composed of hydrochloride naltrexone and hydrochloride bupropion. These medications offer promising solutions for individuals struggling with obesity, but the lack of access limits their effectiveness in combating the obesity epidemic.

The anti-obesity medication market in the UK is at a turning point with the limited launch of Wegovy, targeting individuals with obesity or at risk of type 2 diabetes through specialist NHS services. A pilot program explores broader prescription access amid supply issues affecting GLP-1 RAs like Ozempic and Wegovy until at least 2025.

France Anti-obesity Medication Market is poised for growth despite challenges. The French National Agency for the Safety of Medicines (ANSM) and Assurance Maladie's heightened surveillance of Ozempic due to misuse for weight loss highlights the need for effective regulation. Social media influence and forged prescriptions indicate non-diabetic usage for weight loss, prompting ANSM to emphasize Ozempic's intended use solely for diabetes treatment.

The anti-obesity medication market in Germany is witnessing significant developments and investments, indicating a promising outlook despite challenges. In August 2023, Boehringer Ingelheim's advancement of survodutide into Phase III studies demonstrates growing interest in innovative treatments. Phase II data showing up to 19% weight loss underscores the potential effectiveness of such medications.

Asia Pacific Anti-obesity Medication Market Trends

The anti-obesity medication market in Asia Pacific is set for significant growth, propelled by the rising obesity rates and governmental initiatives across countries like China, Japan, and India. Pharmaceutical firms are investing in research. For instance, in February 2024, Innovent Biologics announced NMPA acceptance of mazdutide NDA for overweight treatment in China, showcasing Phase 3 trial success with weight reduction and cardiometabolic benefits, potentially revolutionizing anti-obesity pharmacotherapy. Additionally, advancements in drug development technology enhance treatment options. Co-occurring health issues linked to obesity underscore the urgent need for sophisticated medications. This collective effort signifies a burgeoning market, driven by the regional commitment to combat overweight and pharmaceutical innovation, poised to meet the escalating demand for effective anti-obesity treatments.

The anti-obesity medication market in China is expected to grow over the forecast period. The rising prevalence of obesity, driven by changing lifestyles and a large population underscore the urgent need for effective treatments. Government initiatives prioritize addressing this health crisis, supporting research and treatment development.

India Anti-obesity Medication Market is expected to grow over the forecast period. The market is expanding rapidly, with Indian pharma firms entering the space and observing growing demand due to lifestyle changes. Factors such as urbanization and sedentary work culture contribute to the rising obesity rates, creating opportunities for new entrants. India's anti-obesity medications include orlistat, metformin, and liraglutide.

The anti-obesity medication market in Japan is expected to grow over the forecast period. Japan stands out compared to countries with lower obesity rates due to several key factors. The approval of orlistat as the first over-the-counter medication tailored for visceral fat reduction signals a significant departure from traditional options.

Latin America Anti-obesity Medication Market Trends

The anti-obesity medication market in Latin America is expected to grow over the forecast period due to the high prevalence of obesity. An increase in healthcare spending and a robust pharmaceutical industry are other significant factor contributing to the growth of the regional market.

The anti-obesity medication market in Brazil is expected to grow over the forecast period. Despite the absence of reimbursement, shows robust growth with over 6 million units sold, reflecting the country's high obesity rate of over 22%. Major players like Novo Nordisk, with Saxenda, and Merck, with Contrave, aim to expand accessibility and capture market share.

Middle East & Africa Anti-obesity Medication Market Trends

The anti-obesity medication market in MEA is expected to grow over the forecast period due to the high prevalence of obesity and increasing healthcare spending. With a growing middle class and changing dietary habits, there is a growing demand for effective therapeutic measures. Recent developments like the fast-track designation of tirzepatide for obesity treatment and the positive opinion of Wegovy for chronic weight management highlight the evolving landscape of the market. The current pipeline of market players indicates a surge in R&D activities aimed at meeting the demand for novel anti-obesity drugs.

The anti-obesity medication market in South Africa is expected to grow over the forecast period due to a high prevalence of obesity, impacting public health and economy. The market is responding with new weight loss medicines to address the rising overweight rates, which are expected to reach 37% by 2030. These developments underscore the urgency to tackle the epidemic and reduce the substantial direct costs associated with obesity

Key Anti-obesity Medication Company Insights

Some of the leading market players include Novo Nordisk A/S, GlaxoSmithKline plc, Novartis AG, VIVUS LLC, Currax Pharmaceuticals, and Kintai Therapeutics. Different strategies are adopted by the players to strengthen their market positions. Companies are involved in expanding their market presence by signing agreements with other players in emerging economies. Product approval is another strategy adopted by these companies.

Emerging players such as Rhythm Pharmaceuticals, Inc. and Boehringer Ingelheim International GmbH are adopting different strategic initiative such as collaborations & partnerships with key participants and other players in the industry to enhance their presence. Capturing niche areas of supply chain, such as distribution and delivery of products & solutions, to establish themselves.

Key Anti-obesity Medication Companies:

The following are the leading companies in the anti-obesity medication market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- GlaxoSmithKline plc

- Novartis AG

- VIVUS LLC

- Currax Pharmaceuticals

- Kintai Therapeutics

- Boehringer Ingelheim International GmbH

- Rhythm Pharmaceuticals, Inc.

- Gelesis

Recent Developments

-

In December 2023, Roche announces acquisition of Carmot Therapeutics for USD 2.7 billion plus potential USD 400 million in milestones, gaining access to clinical-stage obesity drugs, including lead asset CT-388, targeting obesity and associated diseases.

-

In November 2023, Eli Lilly's Zepbound (tirzepatide) injection, the first GIP and GLP-1 hormone receptor activator for obesity, receives FDA approval based on phase 3 trial results, offering significant weight loss potential with gastrointestinal side effects.

-

In November 2023, Eli Lilly's investment in a USD 2.5 billion production facility reaffirms Germany's attractiveness as a pharmaceutical hub. The facility's construction and operational timeline align with the country's robust healthcare infrastructure and skilled workforce, further strengthening its pharmaceutical sector.

-

In November 2023, Novo Nordisk's investment in expanding production facilities in Chartres, France, signals confidence in the market's potential. The investment, totaling overUSD 2.32 billion, will boost capacity for chronic disease treatments, potentially including anti-obesity medications.

Anti-obesity Medication Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.83 billion

Revenue forecast in 2030

USD 77.24 billion

Growth rate

CAGR of 31.66% from 2024 to 2030

Base year for estimation

2023

Actual Years

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mechanism of action, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; Denmark; Sweden; Norway; France; Italy; China; India; Japan; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novo Nordisk A/S; GlaxoSmithKline plc; Novartis AG; VIVUS LLC; Currax Pharmaceuticals; Kintai Therapeutics; Boehringer Ingelheim International GmbH; Rhythm Pharmaceuticals, Inc.; Gelesis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-obesity Medication Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-obesity medication market report based on product, mechanism of action, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Approved

-

Bupropion-naltrexone (Contrave)

-

Liraglutide (Orlistat)

-

Orlistat

-

Xenical

-

Alli

-

-

Phentermine-topiramate (Qsymia)

-

Semaglutide (Wegovy)

-

Setmelanotide (Imcivree)

-

Tirzepatide (Zepbound)

-

-

Off Label

-

Semaglutide (Xenical Alli)

-

Liraglutide (Semaglutide (Wegovy))

-

Dulaglutide (Trulicity)

-

Topiramate (Dulaglutide (Trulicity))

-

Others

-

-

-

Mechanism of Action Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripherally Acting Drugs

-

Centrally Acting Drugs

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Hospital Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anti-obesity medication market size was estimated at USD 6.62 billion in 2023 and is expected to reach USD 14.83 billion in 2024.

b. The global anti-obesity medication market is expected to grow at a compound annual growth rate of 31.66% from 2024 to 2030 to reach USD 77.24 billion by 2030.

b. Peripherally acting anti-obesity drugs accounted for the largest share of 59.86% in 2023. owing to their ability to enhance the absorption of nutrients and reduce the feeling of hunger.

b. Novo Nordisk A/S, GlaxoSmithKline plc, Novartis AG, VIVUS LLC, Currax Pharmaceuticals, Kintai Therapeutics, Boehringer Ingelheim International GmbH, Rhythm Pharmaceuticals, Inc., and Gelesis are key players in the anti-obesity medication market.

b. Globally, obesity rates are increasing, creating a demand for effective solutions. Increasing awareness of the health consequences associated with overweight, such as diabetes and cardiovascular diseases, further drives this demand. Additionally, acceleration in the development of anti-obesity drugs, supported by significant investments in R&D. With advancements in drug development technologies, the market is poised for further growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."