- Home

- »

- Beauty & Personal Care

- »

-

Antibacterial Products Market Size & Share Report 2028GVR Report cover

![Antibacterial Products Market Size, Share & Trends Report]()

Antibacterial Products Market Size, Share & Trends Analysis Report By Product (Hand Soaps, Body Wash), By Distribution Channel (Hypermarkets & Supermarkets, Online), By Region (APAC, MEA), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-653-5

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The global antibacterial products market size was valued at USD 27.04 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 2.3% from 2021 to 2028. Increasing demand for antibacterial products owing to the rising customer awareness about cleanliness is contributing to market growth. Moreover, the increasing prevalence of bacterial and viral diseases, such as cellulitis, impetigo, and leprosy, has boosted the demand for such products among consumers across the globe. The COVID-19 pandemic has played a vital role in boosting the demand for these products as the consumers’ inclination has shifted towards antibacterial skin & personal hygiene products.

The significant demand for hand soaps, masks, hand washes, and hand sanitizers to prevent the increased risks associated with bacterial infections is driving the market growth. Skin-conscious consumers are opting for safer skincare and hygiene solutions that support the skin’s microbiome and prevent bacterial infections, such as acne and breakouts.

According to the American Academy of Dermatology Association, acne is the most common skin condition in the U.S., affecting up to 50 million Americans annually. Approximately 85% of Americans between the ages of 12 and 24 years experience at least minor acne and more than 5.1 million people sought medical treatment for acne. These factors are expected to drive the demand for antibacterial products to prevent acne breakouts during the forecast period.

Moreover, individuals with sensitive skin, weak immune systems, and diabetes are prone to skin infections including cellulitis, impetigo, and staphylococcal (staph), which leads to skin problems, such as rashes, swelling, redness, pain, pus, and itching. These instances are further expected to drive the adoption of antibacterial products in the coming years.

Product manufacturers are coming up with innovative launches to engage an increasing number of consumers. For instance, in March 2021, Keepers Collective LLC launched its new range of honey face wash, which contains antibacterial and antimicrobial properties that prevent dirt and help eliminate bacteria from the skin to treat and prevent blemishes.

Major players, such as Reckitt Benckiser Group PLC, have been at the forefront in providing aid and relief during the COVID-19 pandemic and spreading awareness about basic hand hygiene. For instance, in January 2020, the company’s most recognized brand Dettol donated RMB 50 million along with antibacterial products to combat the Coronavirus outbreak in China. The company donated soaps and sanitizer products to Wuhan’s hospitals.

Product Insights

The hand soaps segment held the largest market share of 35.0% in 2020 and is expected to maintain dominance over the forecast period. Hand soaps have seen an uptick in demand in 2020 owing to the release of hand hygiene directives amid the COVID-19 outbreak. This has resulted in bulk buying of antibacterial products, such as hand soaps, which has offered significant growth opportunities to the segment.

The hand sanitizers segment also held a significant revenue share in 2020. The COVID-19 pandemic has played a vital role in escalating the demand for antibacterial products, which is likely to continue during the forecast period.

However, the body wash segment is projected to register the fastest CAGR during the forecast period. Several product manufacturers are offering a new range of variants with the addition of fragrances, which is projected to boost the segment growth. Furthermore, improvement in living standards, rise in health expenditure, and increase in awareness about personal hygiene are expected to augment the segment growth.

Distribution Channel Insights

The hypermarkets & supermarkets segment accounted for the largest revenue share of over 46.6% in 2020 and will expand at a steady CAGR from 2021 to 2028. The growth is credited to the increasing penetration of independent retail giants, such as Walmart and Costco, which are boosting product visibility and attracting a larger consumer base. Moreover, consumers prefer to physically verify skincare products before buying, which is driving the sales through these channels.

The online distribution channel segment is projected to register a considerable CAGR from 2021 to 2028. Consumers are switching from offline to online channels owing to a change in their purchasing patterns and a considerable shift in lifestyles. Online platforms offer high levels of convenience, increased product visibility, and at-home delivery features, which are driving the segment growth.

The specialty store segment is projected to register the fastest CAGR of 3.3% from 2021 to 2028. An increasing number of consumers are seeking natural, plant-based, vegan, and cruelty-free skin and hygiene products that are easily accessible at premium specialty stores. These stores offer an exclusive range of products from several international and local brands for the consumers to choose from, which is boosting the segment growth.

Regional Insights

Asia Pacific held the largest market share of 46.5% in 2020 and is expected to maintain dominance over the forecast period. The growth of the regional market is supported by increased product offerings in the germ protection category by regional manufacturers. Local companies like Emami Ltd., Godrej Consumer Products Ltd., and Dabur India are now offering antiseptic germ-kill soaps and sanitizers. The demand for antibacterial and antiseptic products containing neem, aloe vera, and eucalyptus oil is driven by increased frequency of usage and awareness among consumers after the COVID-19 pandemic.

Central & South America is projected to register a significant CAGR during the forecast period. After the COVID-19 pandemic, consumers in countries including Brazil are following precautionary measures to prevent infections, which has led to a surge in demand for natural, herbal, and antibacterial products in the skincare and personal care categories.

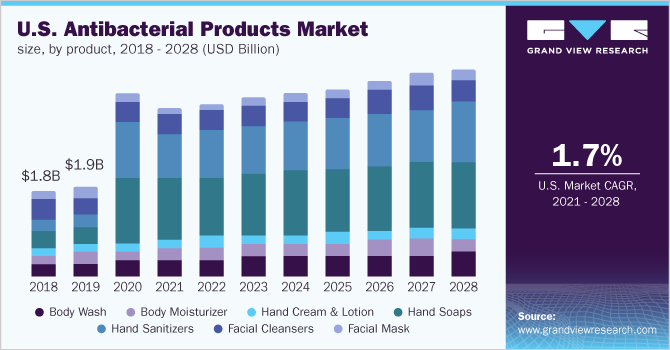

North America is expected to register a considerable CAGR from 2021 to 2028 due to the rising focus on personal wellness, which is driving the product demand. Moreover, the presence of well-established companies and a high number of millennials, and Gen X & Gen Z population and their willingness to spend more on antibacterial personal care products, are driving the market growth in the region.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players and several small- & medium-scale players. Product launches are one of the key strategic initiatives undertaken by companies to gain a competitive edge over competitors. For instance, in March 2021, AVA Group’s brand Medimix launched its new range of antibacterial hand sanitizer gels. The product contains aloe vera, glycerin, and basil extracts. In August 2020, Farouk Systems Inc.’s brand BioSilk launched its new range of antibacterial hand soaps and lotions. In August 2020, in the U.K., Unilever’s brand Lifebuoy launched its new line of hand sanitizer gel, liquid handwash, moisturizing hand cream, and antibacterial hydrating cream enriched with antibacterial ingredients. Some of the key players operating in the global antibacterial products market include:

-

Reckitt Benckiser Group PLC

-

Unilever

-

GOJO Industries, Inc.

-

The Himalaya Drug Company

-

Sebapharma GmbH & Co. KG

-

Bielenda

-

Colgate-Palmolive Company

-

Henkel Corporation

-

Johnson & Johnson

-

Farouk Systems, Inc.

Antibacterial Products Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 25.10 billion

Revenue forecast in 2028

USD 32.36 billion

Growth rate

CAGR of 2.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Japan; India; Brazil; Saudi Arabia

Key companies profiled

Reckitt Benckiser Group PLC; Unilever; GOJO Industries, Inc.; The Himalaya Drug Company; Sebapharma GmbH & Co. KG; Bielenda; Colgate-Palmolive Company; Henkel Corp.; Johnson & Johnson; Farouk Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global antibacterial products market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Body Wash

-

Body Moisturizer

-

Hand Cream & Lotion

-

Hand Soaps

-

Hand Sanitizers

-

Facial Cleansers

-

Facial Mask

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global antibacterial products market size was estimated at USD 27.04 billion in 2020 and is expected to reach USD 25.10 billion in 2021.

b. The global antibacterial products market is expected to grow at a compound annual growth rate of 2.3% from 2021 to 2028 to reach USD 32.4 billion by 2028.

b. Asia Pacific held the largest market share of 46.5% in 2020 and is expected to maintain dominance over the forecast period. The growth of the market in the region is supported by increased product offerings in the germ protection category by regional players.

b. Some key players operating in the antibacterial products market include Reckitt Benckiser Group PLC, Unilever, GOJO Industries, Inc., The Himalaya Drug Company, Sebapharma GmbH & Co. KG, Colgate-Palmolive Company, and Henkel Corporation.

b. The demand for skin care and hygiene products containing antibacterial, and antiseptic properties are gaining popularity owing to the shifting consumer inclination towards personal hygiene and wellness is driving the antibacterial products market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."