- Home

- »

- Pharmaceuticals

- »

-

Antibiotics Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Antibiotics Market Size, Share & Trends Report]()

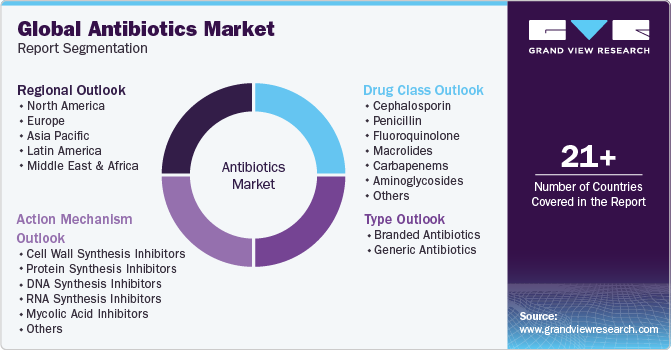

Antibiotics Market Size, Share & Trends Analysis Report By Action Mechanism (Cell Wall Synthesis Inhibitors, RNA Synthesis Inhibitors), By Drug Class (Penicillin, Cephalosporin), By Type (Branded, Generic), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-149-8

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Antibiotics Market Size & Trends

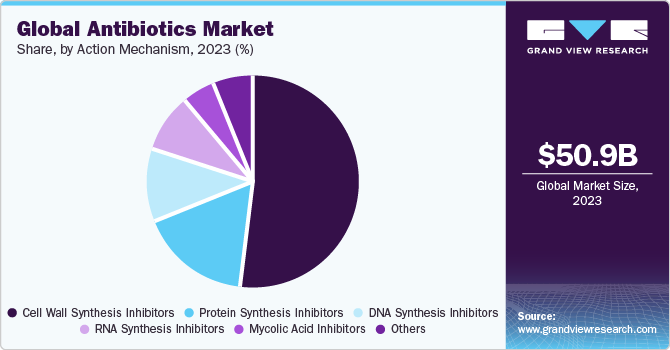

The global antibiotics market size was estimated at USD 50.91 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. Increasing prevalence of infectious diseases is a major factor contributing to market growth. According to the CDC, there were over 31 million cases of influenza in the U.S.during the 2022-2023 flu season. The development of advanced products and growing collaboration activities for the development of antibiotics are also expected to drive industry growth over the forecast period. The COVID-19 pandemic positively impacted the industry's growth.

According to the Elsevier Ltd. article published in February 2023, a study was conducted to estimate the association between COVID-19 cases and vaccination with global antibiotic sales. As per the study, about 75% of patients with COVID-19 were given antibiotics, contributing to antimicrobial resistance. Sales of all four (cephalosporin, penicillin, macrolides, and tetracycline) gradually increased to pre-pandemic levels until May 2022. Increasing efforts are being undertaken for the development of advanced products boosting the market demand.

According to Pew Charitable Trust, in December 2020, around 43 promising molecules were being investigated in the U.S. Out of these molecules, around 15 candidates were in phase 1 clinical trials, 13 in phase 2 and phase 3, and 2 candidates are under review by the U.S. FDA. Around 19 of these candidates were active against gram-negative ESKAPE bacteria.In addition, 1 in 4 drugs in the pipeline belong to novel drug classes. Key players are collaborating for antibiotic development to divide expenses.

According to the Global Antibiotic Research & Development Partnership (GARDP) Foundation article published in November 2022, Mitsubishi Tanabe Pharma Corporation (MTPC) and GARDP signed an agreement that allows access to over 50,000 compounds in MTPC's library by GARDP. To identify new compounds with antibacterial activity for drug-resistant bacteria, a set of substances is evaluated at the Institute Pasteur Korea's Optimized High Throughput Screen. This Agreement promotes the efforts of GARDP in developing antibiotics to address serious bacterial infections while at the same time ensuring that their availability is sustainable. These aspects are boosting the market demand.

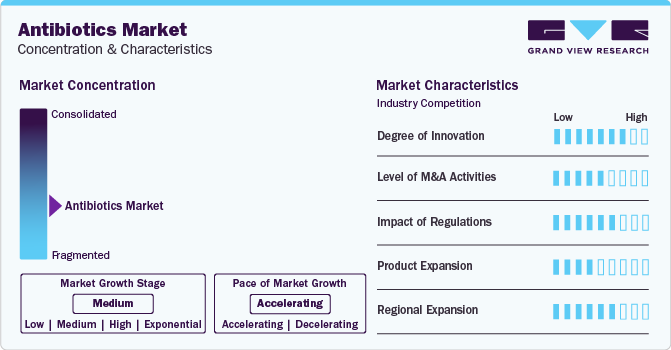

Market Concentration & Characteristics

The global market has experienced a significant degree of innovation, marked by the introduction of advanced formulations, combination therapies, and novel mechanisms of action. This ongoing innovation aims to address antibiotic resistance, enhance efficacy, and adapt to evolving bacterial challenges. The industry's commitment to research and development highlights its dedication to staying at the forefront of infectious disease management.

Several players, such as AbbVie, Inc., Pfizer Inc., Novartis AG, Merck & Co., Inc., and Teva Pharmaceutical Industries Ltd. are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This results in increasing the cost of developing novel antibiotic technologies.

The market has seen a notable product expansion with the introduction of novel formulations and combinations to combat bacterial infections. These innovations include advanced antibiotics with enhanced efficacy and a broader spectrum of activity, addressing the challenge of antibiotic resistance. In addition, there is a focus on developing combination therapies to improve treatment outcomes. The market also witnesses ongoing research into novel mechanisms of action and formulations to stay ahead of evolving bacterial strains.

Drug Class Insights

The penicillin segment accounted for the largest revenue share of 23.8% in 2023. Penicillin is the first drug class to be discovered and is still widely used to treat various infections, especially those caused by staphylococci and streptococci, clostridium, and listeria. They act by either inhibiting cell wall synthesis or by preventing the formation of the peptidoglycan layer. In treating infections like pharyngitis, skin infection, bronchial cough, gonorrhea, and ear fungus, these medicines represent the first line of treatment. Antibiotic resistance development, allergic activities, and several other adverse effects are the main reasons these drugs are expected to lose market share over the forecast period. According to a WHO article published in March 2023, the primary public health issue is skin-related neglected tropical diseases (NTDs). About 1.8 billion people in the world are estimated to be affected by skin diseases at any point in time.

Cephalosporin is anticipated to witness a significant growth rate over the forecast period. Cephalosporin are subtypes of the beta-lactam group of antibiotics. These drugs act against gram-positive and gram-negative bacteria, such as Pseudomonas aeruginosa, Klebsiella pneumonia, and Bactericides fragilis. Similar to the penicillin class, generics dominate the cephalosporin segment and have demonstrated comparably seasonal usage patterns.Cephalosporin include five generations of drugs with a varied spectrum of activity. However, these drugs' third, fourth, and fifth generations are conventional antibiotics used to treat resistant pathogens. Cefixime is the most common third-generation broad-spectrum cephalosporin used to treat infection caused by P. aeruginosa & N. gonorrhea. It has activity against S. aureus, S. pneumonia, and Enterobacteriaceae spp.These aspects are augmenting the market demand.

Type Insights

The generic antibiotics segment accounted for the largest revenue share in 2023, the affordability of generic formulations, the presence of a large number of manufacturers leading to high bargaining power of buyers, and a supportive regulatory framework are the key factors responsible for the segment’s dominance. In addition, favorable government initiatives to promote generic preparations and easy access to generic drugs are fueling segment expansion.

The branded antibiotics segment is estimated to register a significant CAGR from 2024 to 2030 due to the robust investigational pipeline, rising need for new & novel antibiotics, and increasing focus of key players to strengthen their product offerings & distribution network. For instance, in January 2023, Alembic Pharmaceuticals received approval from the U.S. Food and Drug Administration for Fesoterodine Fumarate Extended Release tablets, 4 mg and 8 mg. These aspects are increasing the market demand.

Action Mechanism Insights

The cell wall synthesis inhibitors segment dominated the market in 2023. Cell wall synthesis inhibitors are widely used antibiotics, as they are described with wide-spectrum action against gram-positive and gram-negative bacteria. These drugs inhibit the synthesis of the peptidoglycan layer, which is crucial for the structural activity of the cell wall. This category of drugs includes cephalosporin, penicillin, carbapenems, and others. This segment is expected to grow significantly over the forecast period due to increased research initiatives and government funding.

According to the U.S. FDA article, in 2022, 37 novel drugs were approved by the Center for Drug Evaluation and Research (CDER) as new beneficial biological products under Biologics License Applications (BLAs) or as novel molecular entities (NMEs) under New Drug Applications (NDAs). The RNA synthesis inhibitors segment is estimated to register a significant CAGR over the forecast period owing to a surge in R&D initiatives and product launches undertaken by market players. According tothe Royal Society of Chemistry article published in 2022, segment growth is further driven by rifamycins and fidaxomycin, which are well-known and clinically approved classes of natural products that inhibit RNAP.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 43.8% in 2023 owing to increased cases of infectious diseases, high instances of administering non-prescribed medications, the presence of well-established clinics & hospitals, and a growing number of skilled professionals in the region. According to the University of OSLO article published in May 2023, the chief suppliers of antibiotics are India and China. Imports of antibiotics and antibiotic ingredients from both countries are very important to the world. China is the world's major producer and manufacturer of antibacterial ingredients. Similarly, According to the BBC news article published in September 2023, National data show that 29.1% of the 125 million population is aged 65 years or older. Japan's birth rate is the lowest in the world. The geriatric population is more susceptible to infectious diseases. In addition, the incidence of drug-resistant infectious diseases is increasing, leading to a rise in demand for novel treatment options.

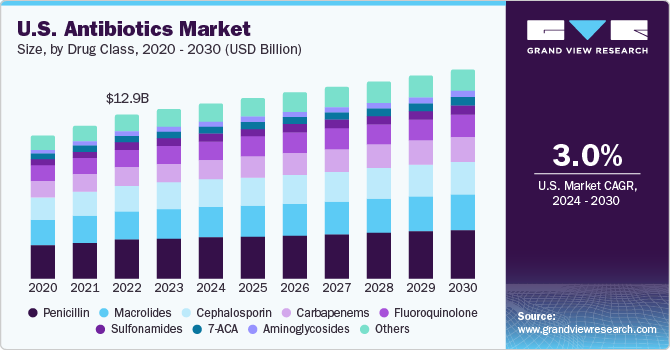

North America is anticipated to witness significant growth. These markets are highly standardized with advancements in healthcare infrastructure. Regional market growth is driven by rising incidences of infectious diseases, which, in turn, are boosting the demand for new antimicrobial formulations. The growth is also driven by increased research and development activity, as well as by a variety of existing antibiotic stewardship initiatives. According to a Definitive Healthcare article published in August 2023, in 2021, the number of antibiotic prescriptions issued by healthcare providers increased to 211.1 million. In years prior, this number fluctuated between 201.9 million (2020) and about 250 million (2018 and 2019).

Key Companies & Market Share Insights

AbbVie, Inc., Merck & Co., Inc., Pfizer Inc., and Novartis AG are some of the dominant players operating in the market.

-

Merck & Co., Inc. was incorporated in 1891 and is headquartered in the U.S. It is a global healthcare company involved in the development, discovery, manufacturing, and commercialization of prescription, branded, and over-the-counter vaccines, pharmaceuticals, and consumer care products for human & animal healthcare markets

-

Pfizer, Inc. is a multinational American pharmaceutical company. It was incorporated in 1849 and is headquartered in New York, U.S. The company is involved in the discovery, development, and manufacture of pharmaceutical products

-

Nabriva Therapeutics PLC, Viatris, Inc., and Teva Pharmaceutical Industries Ltd. are some of the emerging market players in the market.

-

Nabriva Therapeutics Plc is a commercial-stage biopharmaceutical company that develops antibiotics for the treatment of infectious diseases

-

Viatris, Inc. is a multinational pharmaceutical and healthcare company with its principal place of business in Canonsburg, Pennsylvania

Key Antibiotics Companies:

- AbbVie, Inc.

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals, Inc.

- Viatris, Inc.

- Melinta Therapeutics LLC

- Cipla, Inc.

- Shionogi & Co., Ltd.

- KYORIN Pharmaceutical Co., Ltd.

- GSK Plc

- Nabriva Therapeutics PLC

Recent Developments

-

In July 2023, Orchid Pharma, a pharmaceutical company based in India, entered into a technology transfer agreement with a biotechnology company for its fermentation based on the "7ACA" project in the production-linked incentive scheme

-

In April 2023, Baxter International Inc. launched ZOSYN in the U.S. (piperacillin and tazobactam) Injection

-

In May 2023, Innoviva Specialty Therapeutics got FDA Approval for XACDURO (durlobactam for injection; sulbactam for injection), Co-packaged for Intravenous Use

-

In December 2022, the drug application of the new Siderophore Cephalosporin Antibacterial Drug Cefiderocol was accepted for Review in Taiwan

Antibiotics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 53.06 billion

Revenue forecast in 2030

USD 68.03 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, type, action mechanism, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie, Inc.; Pfizer Inc.; Novartis AG; Merck & Co. Inc.; Teva Pharmaceutical Industries Ltd.; Lupin Pharmaceuticals Inc.; Viatris Inc.; Melinta Therapeutics LLC; Cipla Inc.; Shionogi & Co. Ltd.; KYORIN Pharmaceutical Co. Ltd.; GSK plc.; Nabriva Therapeutics PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibiotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antibiotics market report based on drug class, type, action mechanism, and region:

-

Drug Class Outlook (Revenue in USD Million, 2018 - 2030)

-

Cephalosporin

-

Penicillin

-

Fluoroquinolone

-

Macrolides

-

Carbapenems

-

Aminoglycosides

-

Sulfonamides

-

7-ACA

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Antibiotics

-

Generic Antibiotics

-

-

Action Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Wall Synthesis Inhibitors

-

Protein Synthesis Inhibitors

-

DNA Synthesis Inhibitors

-

RNA Synthesis Inhibitors

-

Mycolic Acid Inhibitors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antibiotics market size was estimated at USD 50.92 billion in 2023 and is expected to reach USD 53.06 billion in 2024.

b. The global antibiotics market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 and is expected to reach USD 68.03 billion by 2030.

b. Penicillin is expected to dominate the antibiotics market with a share of 23.8% in 2023 due to the maximum prescription and the largest number of generic manufacturers in the space.

b. Some key players operating in the antibiotics market include Merck & Co., Inc., Allergan, GlaxoSmithKline plc., Pfizer Inc., Melinta Therapeutics, Basilea Pharmaceutica Ltd., and Tetraphase Pharmaceuticals among others.

b. The rising prevalence of infectious diseases and supportive government legislation are the major factors driving the antibiotics market growth over the forecast period.

b. Cell wall inhibitor mechanism was mostly preferred in the antibiotics market and accounted for a share of 52.1% in 2023. High consumption as per prescription pattern and significant government funding are the key factors driving the segment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."