- Home

- »

- Medical Devices

- »

-

Antibody Drug Conjugates Contract Manufacturing Market Report, 2030GVR Report cover

![Antibody Drug Conjugates Contract Manufacturing Market Size, Share & Trends Report]()

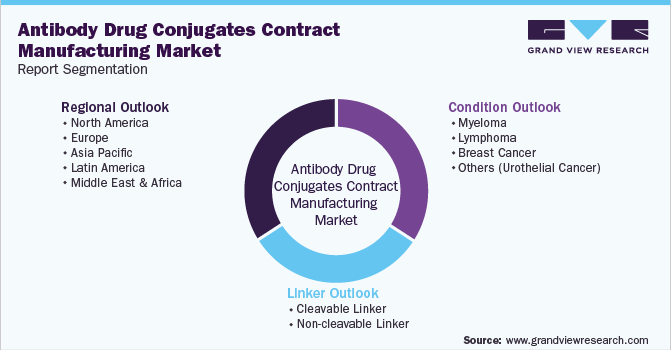

Antibody Drug Conjugates Contract Manufacturing Market Size, Share & Trends Analysis Report By Linker (Cleavable, Non-cleavable), By Condition (Myeloma, Lymphoma, Breast Cancer), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-623-5

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global antibody drug conjugates contract manufacturing market size was valued at USD 9.75 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.9% from 2023 to 2030. The industry is anticipated to witness significant growth over the forecast period on account of the increasing prevalence of cancer, rising demand for biologic therapy, and the challenges associated with antibody drug conjugate (ADC) manufacturing, which contribute to the demand for contract manufacturing. During Q1 and Q2 of 2020, due to the global COVID-19 pandemic, the supply chain was disrupted due to stay-at-home orders by governments across the globe to control the spread of the virus.

Due to these reasons, manufacturing organizations were working with reduced capacity. This hampered the industry's growth slightly. However, beginning in Q3, manufacturing operations were resumed, and many companies implemented strategies, such as expansions to improve their ADC manufacturing capacities. Such actions benefited the industry in 2020. The cases of cancer are rising steadily; as per the estimates of Cancer Tomorrow, over 19.3 million cancer cases were reported in 2020, and this number is expected to rise to 21.9 million by 2025. This is likely to boost the demand for potential ADCs for cancer treatment in the coming years.

Many cancer medicines have toxicities that cause substantial side effects, thus, limiting the dosage and efficacy of these medications is placing a significant burden on patients. An ADC can help reduce some of these complications. ADCs enable the delivery of a particular medication dosage to a specific site of interest. They are most often used in oncology when a large medication dosage is required at the tumor site but not in nearby tissue. These factors are supporting the demand for ADC for cancer treatment and thus contribute to its demand for contract manufacturing. Manufacturing ADC is a complicated process, and owing to this, biopharmaceutical companies are partnering with Contract Manufacturing Organizations (CMOs).

CMOs have technical knowledge in conjugation and linker creation, as well as in solid platforms. Collaborating with CMOs decreases the time for ADCs to reach the market since they can handle all stages, such as conjugation, scale-up, commercial production, and ADC fill-finish operations, saving time in scheduling and testing. Moreover, ADC CMOs are constantly trying to improve their bioconjugation and manufacturing capabilities to provide their clients with high-quality ADCs. For instance, in October 2022, CMO Lonza partnered with the biotechnology company, Singzyme.

As per the partnership, Lonza could use Singzyme’s enzymatic conjugation platform for developing ADC more efficiently. Such collaborations are expected to improve the demand for ADC CMO activities and hence support industry growth. According to the European Pharmaceutical Review (EPR), as of 2021, over 14 ADCs were commercially approved globally. The EPR also states that over 140 ADCs are currently under development. This is expected to create opportunities for manufacturing ADCs post-pandemic and, thus, support market growth.

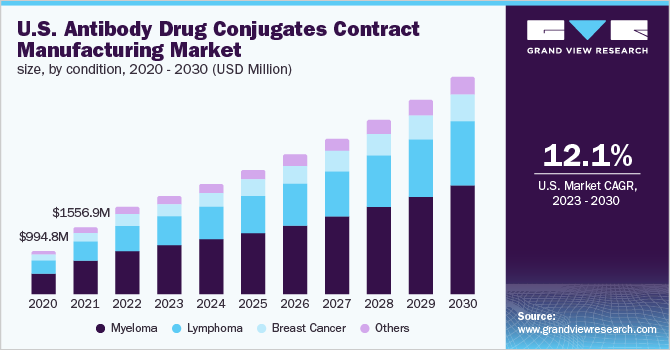

Condition Insights

The myeloma segment dominated the industry and accounted for the largest revenue share of more than 49.45% in 2022. Based on the condition, the industry is segmented into myeloma, lymphoma, breast cancer, and others (urothelial cancer and cervical cancer). ADCs for myeloma is a novel type of treatment that delivers a powerful cytotoxic chemical only to the myeloma cell. This mode of action reduces bystander cell damage and opens up a therapeutic window. ADCs have a high potential for use in the treatment of myeloma as they are “off-the-shelf” therapies. It can be utilized in almost all myeloma treatment clinics and for a diverse spectrum of patients. These factors are supporting ADCs demand for myeloma treatment and thus contributing to the segment growth.

The lymphoma segment is expected to register the fastest CAGR over the forecast period. Lymphoma affects a significant number of people worldwide. According to Cancer Tomorrow, in 2020, 83,100 cases of Hodgkin lymphoma were reported globally, while over 544,000 cases of non-Hodgkin lymphoma were reported. Currently, there are three approved ADC products for lymphoma: Adcetris, Polivy, and Zynlonta. Among the commercially available ADCs, the majority are used for the treatment of lymphoma and breast cancer. The segment is supported by a large number of commercially available ADCs used for treating lymphoma. As of 2021, over 10 ADC for Lymphoma is under the preclinical and clinical stage of development. This is likely to improve the demand for its contract manufacturing during the forecasted period.

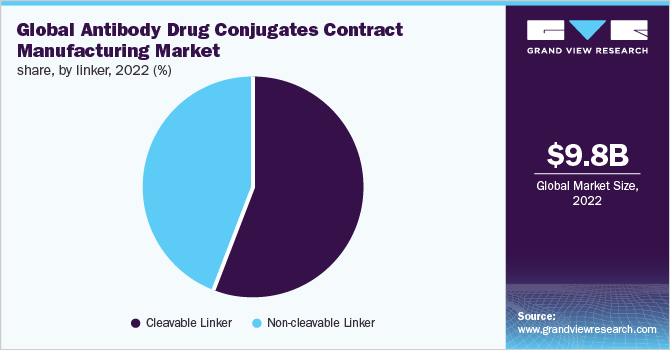

Linker Insights

Based on linkers, the industry is segmented into cleavable and non-cleavable linkers. The cleavable linker segment dominated the industry in 2022 and accounted for the highest share of more than 56.00% of the overall revenue. The segment is likely to remain dominant over the coming years. A major factor that influences the growth of this segment is the advantages that cleavable linkers offer in certain circumstances to deliver the medication to the target cell. The characteristics of the linker between the antibody and the payload are seen as crucial to an ADC’s success. The capacity of cleavable linkers to efficiently distinguish between circulatory and target-cell circumstances accounts for their effectiveness.

The non-cleavable linker segment is expected to register the fastest CAGR over the forecast period. ADCs produced using a non-cleavable linker are reliant on the ADC’s lysosomal degradation, which releases the cytotoxic molecules after the ADC molecule has been internalized in the target cell. This prevents the non-specific release of the drug, thus reducing the overall cytotoxicity of the ADC to surrounding healthy cells. Furthermore, one of the major advantages of non-cleavable linkers is that they have higher plasma stability than cleavable linkers, thus increasing the therapeutic window, they also have a longer half-life in circulation. The above-listed factors are supporting the segment growth.

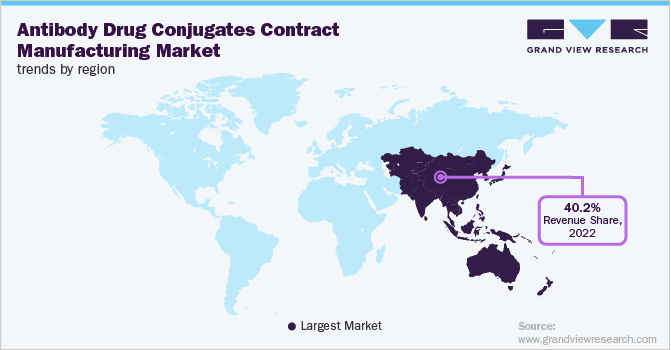

Regional Insights

In terms of region, Asia Pacific dominated the global industry in 2022 and accounted for the maximum share of more than 40.15% of the overall revenue. It is expected to remain dominant growing at the fastest CAGR during the forecast period. This region has a high burden of cancer as compared to other regions. According to Cancer Tomorrow,9.4 million cases of cancer were reported in 2020 in Asia, and this number is expected to rise to 14.2 million by 2040. Thus, a rise in the cancer cases is expected to boost the demand for targeted therapies like ADC for treatment, thereby supporting its demand for manufacturing. In addition, the cost of contract manufacturing in Asia Pacific countries is relatively low compared to that in developed economies.

Thus, it further supports regional market growth. North America also accounted for a considerable revenue share in 2022. This growth can be attributed to the increasing number of biopharmaceutical companies within the U.S. and Canada. The presence of a large number of major players in this region is expected to contribute significantly to the region’s growth. Moreover, the regulatory authority in the region is actively providing regulatory approval for ADCs. For instance, the USFDA has approved 12 ADCs as of 2021. This improves its commercial availability and, thus, supports its adoption in the region. The above-mentioned factors are boosting regional market growth.

Key Companies & Market Share Insights

The global ADCs contract manufacturing market is characterized by the presence of a large number of global companies. Regional expansions, partnerships, collaborations, and M&A activities are some of the key strategies undertaken by most of these companies. For instance, in April 2022, Sterling expanded its site in the U.K., dedicated to improving the cGMP bioconjugation/ADC manufacturing capabilities, with an investment of USD 1.3 million. Some of the prominent players in the global antibody drug conjugates contract manufacturing market include

-

Sterling

-

Recipharm AB

-

Lonza

-

Catalent, Inc.

-

Sartorius AG

-

Wuxi Biologics

-

Samsung BioLogics

-

Piramal Group (Piramal Pharma Solutions)

-

Abbvie, Inc. (Abbvie Contract Manufacturing)

-

Merck KGaA

Antibody Drug Conjugates Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.08 billion

Revenue forecast in 2030

USD 25.79 billion

Growth rate

CAGR 12.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Condition, linker, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Sterling; Recipharm AB; Lonza; Catalent, Inc.; Sartorius AG; Wuxi Biologics; Samsung BioLogics; Piramal Group (Piramal Pharma Solutions); Abbvie, Inc. (Abbvie Contract Manufacturing); Merck KGaA

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibody Drug Conjugates Contract Manufacturing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global antibody drug conjugates contract manufacturing market report on the basis of condition, linker, and region:

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Myeloma

-

Lymphoma

-

Breast Cancer

-

Others (Urothelial Cancer)

-

-

Linker Outlook (Revenue, USD Million, 2018 - 2030)

-

Cleavable Linker

-

Non-cleavable Linker

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

Rest of Asia Pacific

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global antibody drug conjugates contract manufacturing market size was estimated at USD 9.75 billion in 2022 and is expected to reach USD 11.08 billion in 2023.

b. The global antibody drug conjugates contract manufacturing market is expected to grow at a compound annual growth rate of 12.9% from 2023 to 2030 to reach USD 25.79 billion by 2030.

b. Asia Pacific dominated the ADC contract manufacturing market with a share of 40.2% in 2022. This is attributable to the availability of cheap labor coupled with cost efficiency, time-saving, and specialized expertise offered by CMOs in the region.

b. Some key players operating in the ADC contract manufacturing market include Sterling; Recipharm AB; Lonza; Catalent, Inc; Sartorius AG; Wuxi Biologics; Samsung BioLogics; Piramal Group (Piramal Pharma Solutions) ; Abbvie, Inc.(Abbvie Contract Manufacturing) and Merck KGaA

b. Key factors that are driving the antibody drug conjugates contract manufacturing market growth include the complex nature of ADCs, increasing demand for manufacturing capacity as well as an increasing number of research on antibody therapies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."