- Home

- »

- Organic Chemicals

- »

-

Antifreeze Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Antifreeze Market Size, Share & Trends Report]()

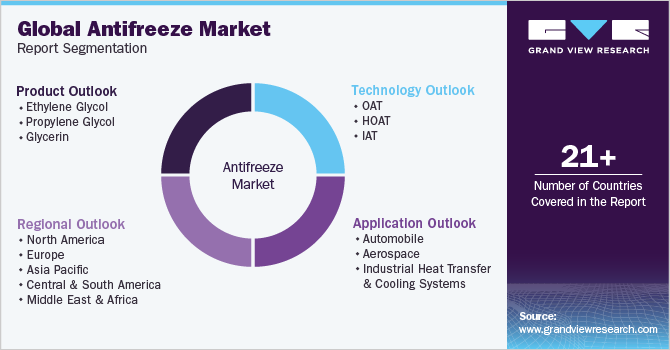

Antifreeze Market Size, Share & Trends Analysis Report By Product (Ethylene Glycol, Propylene Glycol & Glycerin), By Technology, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-600-4

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Antifreeze Market Size & Trends

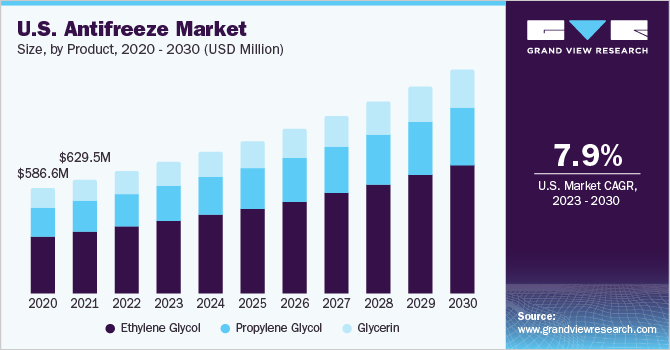

The global antifreeze market size was valued at USD 5,061.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030. The market is expected to show immense growth over the forecast period owing to the rising automotive sector in emerging economies including India, Mexico, China, Indonesia, and South Korea. Rising usage of antifreeze in heat transfer applications and to prevent engine freezing at low temperatures is expected to drive market demand.

The increasing requirement for protection against corrosion & freezing and effective heat dissipation is likely to fuel the demand. In addition, continuous investments in R&D for the development of efficient, cost-effective, environment-friendly, and low-toxic products with a high shelf life by various manufacturers including BP, Shell, and Chevron are expected to create immense market potential over the forecast period.

Asia Pacific is expected to experience significant growth over the forecast period owing to the growing demand for passenger cars and lightweight commercial vehicles in countries including India, Indonesia, Japan, and China. Moreover, the prevalence of major automotive manufacturers in the region including Nissan Motor Company, Toyota Industries, and Komatsu along with increasing government spending in India and China will create immense market potential over the upcoming years.

Growing electric vehicle sales in China owing to the government subsidies and the presence of major players including Beijing Electric Vehicle Co, Hangzhou Changjiang Passenger Vehicle Co, and BYD Auto Ltd will further accelerate the coolant demand over the forecast period.

The easy and abundant availability of various raw materials including ethylene glycol, propylene glycol, and glycerin in India, China, and the U.S. will drive the demand over the forecast period. In addition, the increasing demand in Europe and North America owing to the adverse cold weather conditions is expected to further propel the coolants industry size. However, the fluctuation in raw material price and the regulations on recycling & disposal of these products is likely to hinder the industry growth over the upcoming years.

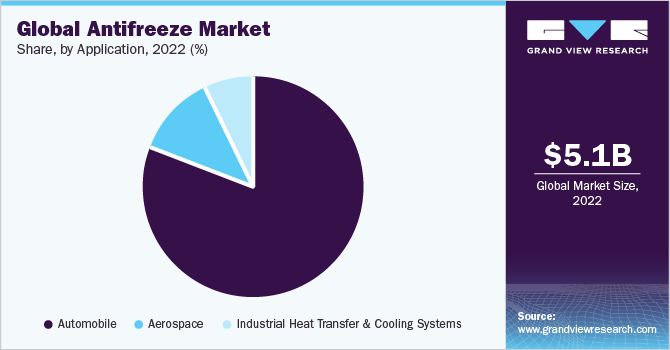

Application Insights

Automotive application dominated the market with a revenue share of above 80.2% in 2022. This is attributed to the increasing usage of antifreeze in HVAC (heating, ventilation, and cooling) for the automotive and industrial sectors is expected to fuel industry expansion. In addition, factors including favorable government initiatives, rising disposable income, changing lifestyles, and rapid urbanization will further propel market growth over the next eight years.

The aerospace and defense sector is expected to witness significant revenue growth at a CAGR of 6.2% from 2023 to 2030 owing to the immense investments made in aerospace R&D and the presence of abundant players in countries including Germany, France, the UK, Sweden, and Poland. Furthermore, the growing commercial aerospace subsector owing to the accelerated equipment replacement cycle and the increase in passenger travel demand is expected to fuel industry growth.

Product Insights

Ethylene Glycol based antifreeze product dominated the market with a revenue share of above 59% in 2022. This is attributed to the rising usage of ethylene glycol in deicing, prevention of radiator overheating, protection against radiator freezing, and hydraulic brakes are expected to drive the market demand. In addition, increasing usage as a heat conductor in heating & cooling systems is likely to further fuel the market growth.

However, the demand for these products is likely to grow at a slower pace over the forecast period as a result of the stringent regulatory framework regarding coolant disposal & recycling, toxicity, high rate of degradation, corrosive properties, and high cost of storage & handling.

Propylene glycol is expected to witness the fastest growth over the forecast period owing to non-toxicity, high compatibility & low cost as compared to conventional ethylene glycol. Advancements in processing technologies and stringent regulations promoting the substitution of toxic compounds are expected to propel propylene glycol demand over the forecast period.

The glycerine-based antifreeze industry is likely to revive owing to the increasing demand for environment-friendly antifreeze with lower toxicity and cost-efficiency. In addition, the ASTM standards promoting the use of glycerine in antifreeze coupled with stringent regulations on toxic compounds including ethylene glycol are expected to drive the demand for glycerine-based antifreeze.

Technology Insights

The organic acid technology application segment held the largest revenue share of above 52.7% in 2022. This is attributed to the presence of environment-friendly, easily decomposable neutralized inorganic salts and acids. In addition, the extended drain interval of OAT is expected to further propel market growth.

The HOAT market is expected to witness significant demand over the forecast period owing to its extended lifetime and efficient corrosion inhibition. In addition, the excellent coolant to coolant compatibility (can be used as a top-up for both IAT and OAT antifreeze) and the rising usage of HOAT as factory fill by automotive OEMs including Mercedes, BMW, Mini Cooper, and Volvo along with increasing demand in general aftermarket coolant is expected to augment market growth.

Regional Insights

Asia Pacific dominated the market with a revenue share of 26.22% in 2022. This is attributed to increasing demand for passenger cars and light commercial vehicles mainly in China and India.

In addition, the rising automotive sector in various countries including India, China, Indonesia, and Thailand coupled with improved standard of living, consumer awareness levels, and rising disposable income will promote growth over the forecast period. Furthermore, increasing the sale of electric vehicles along with rising investments in R&D for hybrid vehicles is expected to open new growth avenues.

North America is the second-largest market for antifreeze. North America is expected to show steady growth over the forecast period owing to the increasing automotive manufacturing in countries including Mexico, Canada, and the U.S. In addition, the increasing production of light and heavy-duty commercial vehicles is expected to drive coolant market growth.

The European market is expected to witness steady growth over the forecast period owing to the increasing automotive manufacturing and aerospace sector. The rising demand for light and heavy commercial vehicles across Europe for freight transportation will fuel the demand for heavy-duty antifreeze.

Key Companies & Market Share Insights

The global antifreeze market is highly concentrated in nature. The market comprises prominent and well-established players who collectively captured the larger portion of the industry in 2022. The market is highly competitive with all the major players continuously investing heavily in R&D and capacity expansion. Some prominent players in the global antifreeze market include:

-

Royal Dutch Shell

-

CCI Corporation

-

BASF SE

-

Old World Industries Inc

-

KMCO

-

SONAX GmbH

-

KOST USA, Inc

-

Recochem Inc

-

Amsoil

-

MITAN

-

PARAS Lubricants

-

TOTAL

-

Gulf Oil International

-

PENTOSIN

-

Millers Oils

Antifreeze Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5,404.2 million

Revenue forecast in 2030

USD 8,709.6 million

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company market positioning, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Royal Dutch Shell; CCI Corporation; BASF SE; Old World Industries Inc; KMCO; SONAX GmbH; KOST USA, Inc; Recochem Inc; Amsoil; MITAN; PARAS Lubricants; TOTAL; Gulf Oil International; PENTOSIN; Millers Oils

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase option

Global Antifreeze Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antifreeze market report based on product, application, technology, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene Glycol

-

Propylene Glycol

-

Glycerin

-

-

Technology (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

OAT

-

HOAT

-

IAT

-

-

Application (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automobile

-

Aerospace

-

Industrial heat transfer and cooling systems

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global antifreeze market size was estimated at USD 5,061.1 million in 2022 and is expected to reach USD 5,404.2 million in 2023.

b. The global antifreeze market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 8709.6 million by 2030.

b. Asia Pacific dominated the antifreeze market with a share of 42.7% in 2022.This is attributable to increasing demand for passenger cars and light commercial vehicles mainly in China and India.

b. Some key players operating in the antifreeze market include Royal Dutch Shell, CCI Corporation, BASF SE, Old World Industries Inc, KMCO, SONAX GmbH, KOST USA, Inc, Recochem Inc, Amsoil, MITAN, PARAS Lubricants, TOTAL, Gulf Oil International, PENTOSIN, Millers Oils

b. Key factors that are driving the market growth include increasing owing to the rising automotive sector in emerging economies including India, Mexico, China, Indonesia, and South Korea. Moreover, rising usage of antifreeze in heat transfer applications and to prevent engine freezing at low temperatures is expected to further drive market demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."