- Home

- »

- Pharmaceuticals

- »

-

Antifungal Drugs Market Size, Share & Growth Report, 2030GVR Report cover

![Antifungal Drugs Market Size, Share & Trends Report]()

Antifungal Drugs Market Size, Share & Trends Analysis Report By Drug Class (Azoles, Polyenes), By Indication (Dermatophytosis, Aspergillosis), By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-293-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Antifungal Drugs Market Size & Trends

The global antifungal drugs market size was estimated at USD 15.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030. The growing prevalence of fungal infections such as aspergillosis and candidiasis is one of the key factors propelling the market. Fungal infections encompass both systemic and superficial infections including infections of the skin, eye, mouth, and vagina. Antifungal products with fungicidal activity are mostly used to treat a wide array of diseases, such as athlete's foot, ringworm, and fungal meningitis, caused by fungal agents. Mounting cases of hospital-acquired or nosocomial infections and infectious diseases are poised to propel the growth of the market during the forecast period.

Fungal diseases are a public health problem as they can affect any individual. However, there is severe threat of fungal infections to people with weak immune responses such as patients with AIDS. There is a high possibility of development of opportunistic fungal infections in these patients. According to statistics published by the CDC, every year, nearly 152,000 new individuals are affected by cryptococcal meningitis, which is a brain infection and has resulted in 112,000 deaths per year globally. Most of the deaths are reported in sub-Saharan Africa, as the prevalence of HIV/AIDS is more in these countries. This indicates a potential unmet need for highly potent antifungal drugs.

Increase in awareness levels is expected to improve the diagnosis rate of fungal infections, which, in turn, is projected to drive the adoption rate of the treatment drugs. In September 2022, Fungal Disease Awareness Week was celebrated by CDC to highlight the importance of antifungal treatments, reducing resistance to antifungal drugs, and recognizing fungal infections at an early stage to reduce mortality rate. These initiatives are being conducted by authorities to improve the level of awareness. Organizations such as Aspergillosis Trust are working toward increasing the awareness levels about aspergillosis while platforms such as aspergillosis.org have introduced World Aspergillosis Day and raised funds in alliance with Fungal Infection Trust for patients.

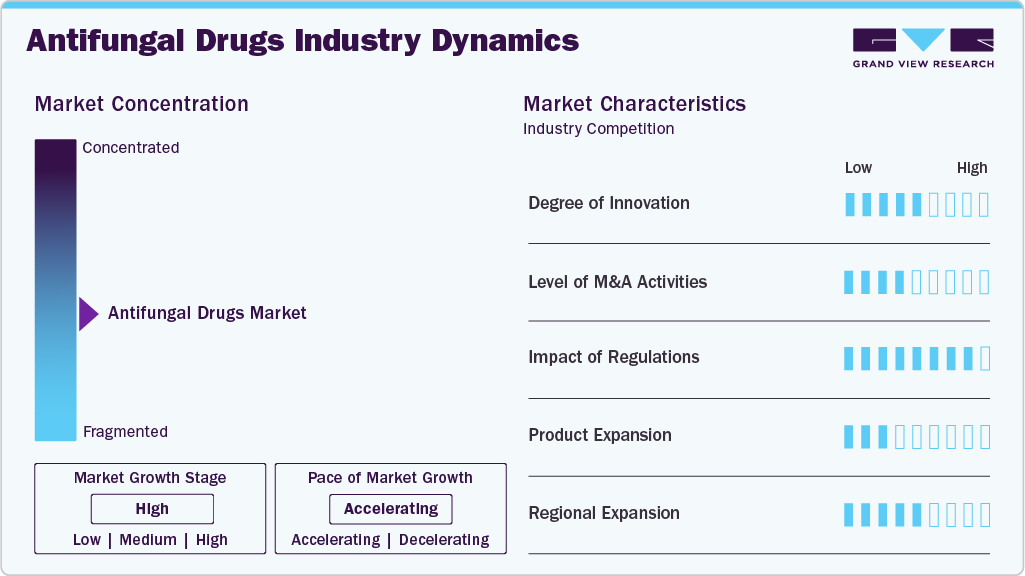

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a moderate degree of innovation owing to the introduction of novel drugs, propelled by advancements in innovative products and increasing awareness. Furthermore, the market's momentum is continually increasing, reflecting the dynamic landscape of advancements and growing recognition of antifungal solutions.

The market is also characterized by a high level of M&A activity by the leading players. The market exhibits dynamic merger and acquisition activities. For instance, in August 2023, Sandoz's acquisition of worldwide brand rights for Mycamine from Astellas showcases strategic consolidation to strengthen global hospital offerings. This aligns with industry trends, emphasizing the importance of anti-infectives portfolios to meet evolving healthcare needs.

The antifungal drugs industry is also subject to increasing regulatory scrutiny. Regulations significantly impact the antifungal drugs sector. Stringent FDA approvals and compliance standards, as seen with Lupin Limited's approval for Fluconazole Tablets in October 2023, reflect the market's adherence to regulatory frameworks. This ensures product safety and efficacy, shaping the market landscape and fostering consumer trust.

There are a limited number of direct product substitutes for antifungal drugs. The market faces a low threat of external substitutes but a moderate threat of internal substitutes. Ongoing research to develop more effective antifungals with fewer adverse effects, as evidenced by extensive research activities, increases the likelihood of internal replacements. The presence of numerous companies offering similar products heightens the potential for substitution.

The market is witnessing a significant adoption of geographical expansion strategies, with key players such as GSK and SCYNEXIS employing this approach to broaden their service reach. This strategy enhances service availability across diverse geographic areas, ensuring a more extensive market presence. The collaboration between GSK and SCYNEXIS in March 2023, focused on Brexafemme, an FDA-approved antifungal, aims to foster commercialization and development activities across diverse regions. This collaboration exemplifies the prevalent trend seen in exclusive licensing agreements.

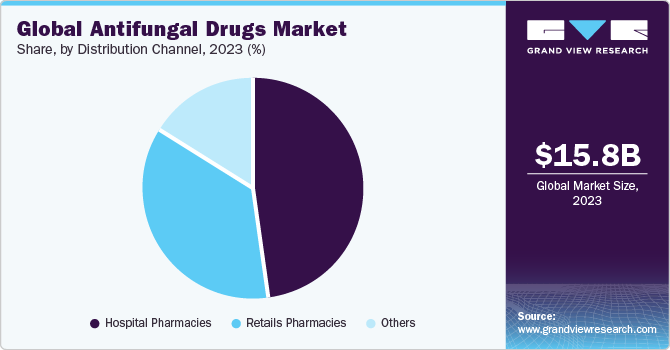

Distribution Channel Insights

Hospital pharmacies led the market in 2023. Hospital pharmacies play a key role in ensuring immediate access to crucial medications. They serve both out-patient and in-patient services, facilitating the seamless treatment of fungal infections. Key drivers for this dominance include their proximity to hospitals, ensuring easy medication access, and providing emergency medication services. The segment's dominance is further underscored by factors such as accessibility, cost-effectiveness, adherence to clinical guidelines, and the global increase in prescription rates, especially with the introduction of fluconazole, driving the consumption of antifungal agents worldwide. Triazoles and terbinafine are witnessing expanded usage due to evolving prescribing patterns and resistance epidemiology changes. Despite their life-saving potential, parenterally administered antifungals such as echinocandins and polyenes may be underutilized.

The retail pharmacy segment is projected to witness a significant growth rate over the forecast period. Witnessing consolidation trends, pharmacies are forming chains, leading to segment growth by key players. This horizontal integration enhances market consolidation, leveraging the physical presence and expertise of pharmacists. The segment gains a competitive edge over online pharmacies due to immediate access, proximity, quality, and security assurance. With the rise in fungal infections, the need for early treatment fuels self-medication, especially with over-the-counter antifungal medications available in retail pharmacies. This trend of self-medication significantly contributes to the segment's growth during the forecasted period.

Regional Insights

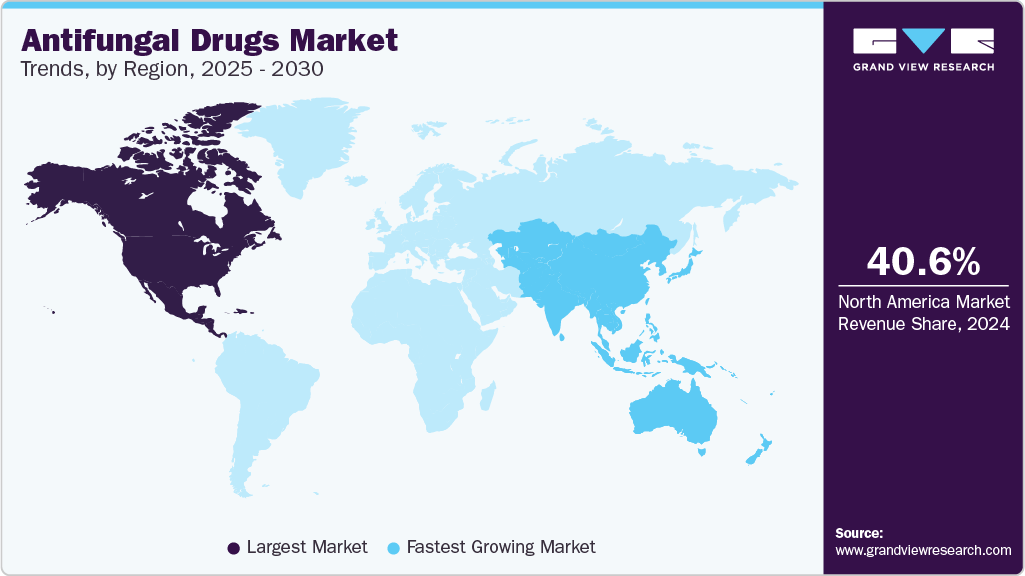

North America dominated the market and accounted for 40.9% share in 2023. This region dominance is attributed to the highly developed healthcare infrastructure, better affordability, and increasing awareness. Key players are constantly trying to gain a greater market share through various strategic initiatives. Players in the U.S. are leveraging their commercialization abilities to improve their profit margins. In March 2023, Cidara and Melinta announce FDA approval of REZZAYO (rezafungin for injection) for treating candidemia and invasive candidiasis in adults with limited options. It's a novel once-weekly echinocandin, the first FDA-approved in over a decade, offering potential improvements in managing fungal infections, as demonstrated in clinical trials. Such factors are likely to fuel the market in the country.

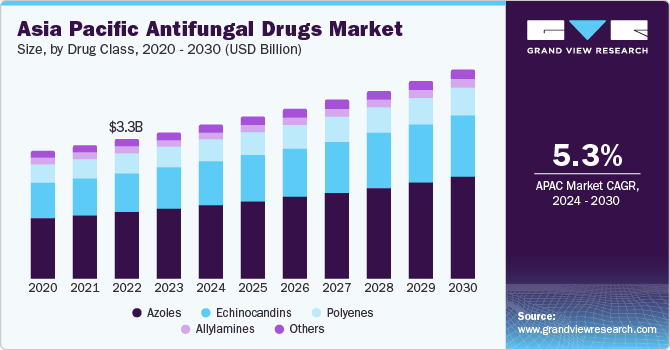

Asia Pacific is anticipated to witness significant growth during the forecast period. This is owing to the presence of large target population, developing healthcare facilities, and increase in investments by leading market players. With a rising prevalence of fungal infections, there's a growing demand for effective antifungal medications in Asia Pacific. According to research studies from the NCBI, the prevalence of fungal infections in Japan is substantial, affecting over 2.37 million people annually.

Esophageal candidiasis and recurrent vulvovaginal candidiasis are reported as among the most common infections in the country. Approximately 1.9% of the population is impacted by serious fungal infections each year. The prevalence of recurrent vulvovaginal candidiasis is around 1,525 per 100,000 females in Japan. These findings underscore the significant burden of fungal infections in the region, highlighting the pressing need for effective antifungal medications and interventions. Initiatives by major industry players to tap into this market, coupled with advancements in healthcare infrastructure, contribute to the region's increasing growth.

Drug Class Insights

The Azoles drug class segment dominated the market and accounted for a revenue share of 47.6% in 2023. This dominance is attributed to the influence of key therapeutic agents, including noxafil, vfend, diflucan, and cresemba. Azoles stand out due to their broad-spectrum activity, effectively inhibiting fungal enzymes and supporting fungistatic actions. They treat various conditions such as candidemia, blastomycosis, systemic candidiasis, and ocular fungal infections. Systemic fungal infections are categorized into triazoles and imidazoles, with triazoles offering improved safety profiles, reduced adverse effects, and enhanced absorption, thereby contributing to the growth of this segment.

For instance, in August 2023, Astellas Pharma's FDA acceptance of the supplemental New Drug Application (sNDA) for CRESEMBA marks a significant industry initiative toward innovation. This acceptance, targeting the treatment of invasive aspergillosis or invasive mucormycosis in pediatric patients. The industry's commitment to addressing invasive fungal infections in children through the approval of azole drugs, particularly isavuconazole, could potentially lead to an increased market share for this class of antifungal medications.

Allylamines are synthetic fungicidal agents that are anticipated to register a significant CAGR during the forecast period. These drugs are prescribed for nail infections, jock itch, athlete’s foot, and ringworms. Lamisil is the most commonly prescribed topical antifungal medication after fluconazole for the treatment of systematic antifungals by dermatologists. Thus, the rising prevalence of dermatological diseases is likely to further boost the growth of the segment.

Indication Insights

The Candidiasis segment held the largest market share in 2023 due to rising incidence of the disease in immunocompromised patients and high rate of recurrent infections. An increase in the prevalence of opportunistic fungal infections is anticipated to fuel the demand for antifungals over the forecast period. Furthermore, the most commonly occurring systemic fungal infection is systemic candidiasis. Candidiasis is an infection caused by yeast known as candida. It can impact the skin, mouth, gut, throat, penis, and vagina. As per CDC, one of the most common bloodstream infections is candidemia, and it has an incidence rate of 9 per 100,000 people, approximately affecting 25,000 people annually.

As per BMC Infectious Disease Journal, in June 2021, 75% of women globally experienced vulvovaginal candidiasis at least once, while 25% experienced recurrent disease. Candida albicans is the most prominent organism causing the disease. As per the Lancet Journal in 2018, recurrent vulvovaginal candidiasis affects over 138 million women every year, which is projected to reach 158 million by 2030, creating an opportunity for the antifungals market. Moreover, invasive candida infections are often associated with high morbidity and mortality, with mortality rate of 25%.

Aspergillosis is expected to register significant CAGR during the forecast period. Aspergillosis is an infection caused by mold called aspergillosis, which usually affects the respiratory system. The condition is rare in healthy individuals. However, it largely affects people with lung conditions such as chronic obstructive pulmonary disease & asthma, weakened immune system, and tuberculosis. The pandemic has also increased the number of immunocompromised patients, and these patients with weakened lungs are at a higher risk of fungal infection. It is a common secondary infection in SARS-CoV-2 patients. Antifungal drugs such as voriconazole (Vfend) and amphotericin B are highly effective against this condition. Various molecules under trial are albaconazole, ASP2397, CD101 IV, F901318, and E1210. Thus, the abovementioned factors are expected to drive market growth.

Dosage Form Insights

Oral drugs dosage form led the market in 2023. This is attributed to the fact that certain antifungal medications are designed for oral administration to ensure proper ingestion. For instance, oral antifungal medications are commonly prescribed to treat throat and mouth yeast infections, such as thrush. Moreover, oral antifungal medications pose a higher risk of drug interactions compared to over-the-counter topical antifungal creams.

Increasing initiatives by market players to strengthen the segment's growth further contribute to its expansion. For instance, in March 2023, GSK announced plans to exclusively license the novel oral antifungal Brexafemme from SCYNEXIS, the only FDA-approved treatment for vulvovaginal candidiasis and recurrent VVC. This antifungal addresses the unmet need for new oral treatments against fungal infections. The initiative is expected to boost the growth of the oral segment in the market by introducing a novel treatment option, reinforcing GSK's market position, and addressing unmet needs in the field of oral antifungal therapies.

The ointments segment is projected to witness highest growth rate over the forecast period due to its convenience for treating less severe fungal infections. Antifungal ointments, such as Nystatin, Lotrisone, Lamisil, and Lotrimin AF, offer ease of application and lower side effects. Ongoing research into faster-acting formulations and the availability of over-the-counter options, such as Lamisil, contribute to the segment's popularity. Diverse product offerings cater to specific infections, making topical treatments a preferred choice, emphasizing their projected high growth rate in the market.

Key Companies & Market Share Insights

Some of the key players operating in the market include Pfizer, Inc.; Merck & Co., Inc., Novartis AG, GlaxoSmithKline plc, etc.

-

Pfizer, Inc. is engaged in discovery, development, and manufacture of pharmaceutical products. It has a portfolio of vaccines and medicines. The company operates through two business segments: Essential Health (EH) and Innovative Health (IH).

-

Merck & Co., Inc. is a global healthcare company involved in development, discovery, manufacture, and commercialization of prescription, branded, & over-the-counter vaccines, pharmaceuticals, and consumer care products for human & animal healthcare markets

-

Enzon Pharmaceuticals, Inc. and Astellas Pharma, Inc. are some of the emerging market participants in the antifungal drugs market.

-

Astellas Pharma, Inc. is engaged in import/export, manufacture, and marketing of pharmaceuticals. The company has products in the following segments: oncology, neurology, urology, nephrology, immunology, and women's health treatments.

Key Antifungal Drugs Companies:

- Novartis AG

- Pfizer, Inc.

- Bayer AG

- Sanofi

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Abbott

- Glenmark

- Enzon Pharmaceuticals, Inc.

- Astellas Pharma, Inc.

Recent Developments

-

In December 2023, Astellas Pharma received FDA approval for Cresemba, an antifungal drug, to treat invasive aspergillosis (IA) and invasive mucormycosis (IM) in children.

-

In November 2023, Basilea Pharmaceutica acquires rights to fosmanogepix, a broad-spectrum antifungal, through an agreement with Amplyx Pharmaceuticals. The transformative move strengthens Basilea's clinical antifungal pipeline, with plans for phase 3 studies.

-

In October 2023, Basilea Pharmaceutica acquires GR-2397, a clinical-stage antifungal compound, from Gravitas Therapeutics. Rebranded as BAL2062, it targets invasive mold infections, completing a phase 1 study. Basilea plans preclinical profiling, targeting phase 2 by H1 2025. The upfront payment is USD 2 million.

Antifungal Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.35 billion

Revenue forecast in 2030

USD 20.52 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug Class, indication, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novartis AG; Pfizer, Inc.; Bayer AG; Sanofi; Merck & Co., Inc.; GlaxoSmithKline plc; Abbott; Glenmark; Enzon Pharmaceuticals, Inc.; Astellas Pharma, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antifungal Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antifungal drugs market report based on drug class, indication, dosage form, distribution channel, and region.

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Azoles

-

Echinocandins

-

Polyenes

-

Allylamines

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatophytosis

-

Aspergillosis

-

Candidiasis

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Drugs

-

Ointments

-

Powders

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retails Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Argentina

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antifungal drugs market size was estimated at USD 15.8 billion in 2023 and is expected to reach USD 16.35 billion in 2024.

b. The global antifungal drugs market is expected to grow at a compound annual growth rate of 3.86% from 2024 to 2030 to reach USD 20.52 billion by 2030.

b. North America dominated the antifungal drugs market with a share of 40.9% in 2023. This is attributable to an increase in the development of innovative drugs, and high awareness regarding fungal diseases and its treatment.

b. Some key players operating in the antifungal drugs market include Novartis AG, Pfizer, Inc., Bayer AG, Sanofi S.A., Merck & Co., Inc., GlaxoSmithKline plc, Abbott Laboratories, Glenmark Pharmaceuticals, Enzon Pharmaceuticals, Inc., Astellas Pharma, Inc.

b. Key factors that are driving the antifungal drugs market growth include the introduction of new antifungal drugs, frequent government initiatives, and a high prevalence of fungal infections in emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."