- Home

- »

- Plastics, Polymers & Resins

- »

-

Antimicrobial Plastic Market Size & Growth Report, 2022-2030GVR Report cover

![Antimicrobial Plastic Market Size, Share & Trends Report]()

Antimicrobial Plastic Market Size, Share & Trends Analysis Report By Product (Commodity Plastics, Engineering Plastics, High-performance Plastics), By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-858-9

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2019 - 2020

- Industry: Bulk Chemicals

Report Overview

The global antimicrobial plastic market size was valued at 37.87 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2022 to 2030. Antimicrobial plastic is a synthetic polymeric material containing an integrated active ingredient (antimicrobial additive) that makes it effective against the growth of microbes such as algae, fungi, and mold. These microbes tend to shorten the life of plastic products; thus, the use of antimicrobial plastics has increased in recent years in various end-use industries such as food and beverage, packaging, and healthcare, which are expected to be the main drivers of the global market during the forecast period.

Antimicrobial plastics are now increasingly being used as a substitute for conventional materials in the healthcare sector for manufacturing medical instruments such as ventilators and anesthesia machines due to their pathogen-inhibiting properties. This plastic helps to minimize the growth of pathogens such as algae, bacteria, and fungi and has excellent moisture resistance, which also increases its acceptance as an effective food packaging solution in the food and beverage industry.

These plastics are produced by infusing antimicrobial additives such as arsenic-based oxybisphenoxarsine (OBPA) and organometallic biocides into the material to provide long-lasting protection against microbes and pathogens. These additives help increase the functional life of the plastic and inhibit the growth of bacteria that can cause the plastic to degrade more quickly, making it stronger, rust-proof, odorless, and highly suitable for medical device applications.

Moreover, the U.S. automotive and transportation industry is dominated by well-established players including General Motors, Ford Motor Company, Fiat Chrysler Automobiles, and Toyota Motor Corporation. Rising demand for electric and hybrid vehicles, coupled with the presence of a well-established automotive industry and growing automotive aftermarkets in the country, is expected to drive the building and construction and automotive and transportation industries. This, in turn, is expected to fuel the consumption of antimicrobial plastics in the automotive and transportation industry over the forecast period.

Product Insights

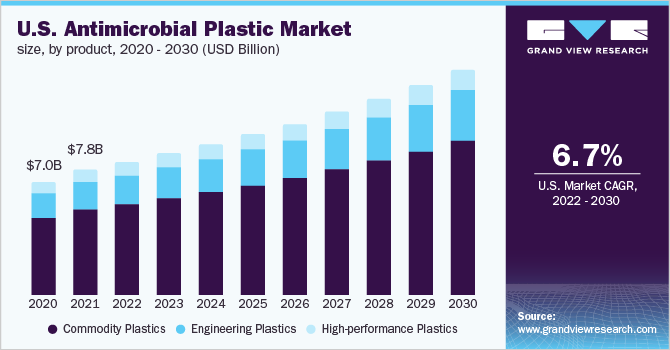

Commercial plastics led the market and accounted for over 65.0% share of the global revenue in 2021. The use of commodity plastic in applications such as consumer goods, packaging, food & beverage, and healthcare is expected to fuel market growth over the forecast period. Product growth in these end-use industries is primarily driven by increased consumer awareness regarding personal hygiene and the changing lifestyles of consumers across the world.

Polypropylene and polyethylene antimicrobial plastics are majorly driving the demand for commodity plastic due to their high impact strength, better biocompatibility, chemical resistance, moisture resistance, and wide range of applications in various end-use industries.

The worldwide spread of the coronavirus disease has positively impacted the demand for these antimicrobial plastics in consumer products. Buying behavior is shifting towards products that are environmentally friendly, trustworthy, and healthy. This shift in consumer purchasing behavior and structural changes in the consumer products industry are expected to increase the demand for consumer plastics with antimicrobial properties in consumer products over the forecast period.

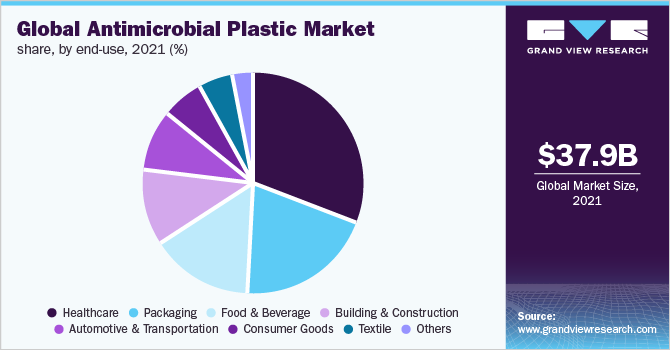

End-use Insights

The healthcare segment dominated the market and accounted for over 30.0% share of the global revenue in 2021. Growth in the home healthcare sector is attributed to low costs compared to hospital care. Growing demand for intensive-care medical devices is expected to increase the demand for antimicrobial plastics in the healthcare sector in the coming years.

High demand for advanced medical services due to the presence of well-developed healthcare infrastructure, increasing incidence of cardiovascular diseases, and increasing aging population worldwide are expected to drive the demand for medical devices, which, in turn, will positively affect the demand for antimicrobial plastic in healthcare.

Antimicrobial plastics are widely used in care homes, surgical rooms, hospitals, home care, and drop-in centers, with products including ceiling paints, floors, beds, handles, walls, case note holders, pull cords, cubicle curtains, and nurse call systems. Antimicrobial plastics minimize the risk of microbes such as E. coli, MRSA, and Legionella, thus they play a significant role in infection control protocols. Rising demand for antimicrobial plastics for manufacturing infection prevention and sterilized products such as orthopedic sutures, surgical cables, and tubing is expected to drive the product demand in the healthcare sector. Increasing demand for biocompatible sterile and non-corrosive products in medical applications to replace metal is projected to propel the product demand.

Regional Insights

Asia Pacific dominated the market and held more than 35.0% share of the global revenue in 2021. The demand for antimicrobial plastic is predicted to increase in the healthcare and packaging industries, particularly in developing nations such as India, China, and Japan. Additionally, it is anticipated that the development of insurance coverage in nations including India, China, and Japan, along with the increased prevalence of chronic diseases, will become a significant driver of government investment in healthcare infrastructure.

Europe remains an important market, however, growth in the region is likely to be restrained by various macroeconomic factors such as the debt crisis, rising unemployment, and weak industrial production. Manufacturing and consumption across Eastern Europe will fuel the growth. The region is characterized by strict environmental regulations by authorities such as ECHA, the European Commission, and various federal agencies.

However, other emerging economies, notably those in Central and South America (CSA) and the Middle East and Africa (MEA), are expanding at rates that are comparable to those of North America. These regions gain from the expansion of the end-use industries and the relatively low penetration of antimicrobial plastic in comparison to other regions.

Key Companies & Market Share Insights

The market is characterized by the presence of various small- and medium-scale companies catering to global and local demands. It is characterized by forward integration through raw material production, manufacturing, and distribution to various application industries.

Integration across the stages of the value chain results in continuous raw material supply and low manufacturing costs. R&D initiatives by a few companies to enhance their product specifications and market reach are expected to further augment the product demand in the years to come. For instance, in March 2021, Parx Materials launched an additive technology, Saniconcentrate. This technology is designed to produce antimicrobial plastics that can resist the growth of harmful bacteria and viruses. Some prominent players in the global antimicrobial plastic market include:

-

BASF SE

-

Parx Materials N.V.

-

Ray Products Company Inc.

-

COVESTRO AG

-

King Plastic Corporation

-

Palram Industries Ltd.

-

Clariant AG

-

SANITIZED AG

-

RTP Company

-

Lonza

-

INEOS Styrolution Group GmbH

-

Milliken Chemical

-

BioCote Limited

-

Microban International

-

DuPont de Nemours, Inc.

Antimicrobial Plastic Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 40.6 billion

Revenue forecast in 2030

USD 73.7 billion

Growth rate

CAGR of 7.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

BASF SE; Parx Materials N.V.; Ray Products Company Inc.; COVESTRO AG; King Plastic Corporation; Palram Industries Ltd.; Clariant AG; SANITIZED AG; RTP Company; Lonza; INEOS Styrolution Group GmbH; Milliken Chemicala; BioCote Limited; Microban International; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimicrobial Plastic Market Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global antimicrobial plastic market report on the basis of product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Commodity Plastics

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Acrylonitrile Butadiene Systems (ABS)

-

Polyethylene Terephthalate (PET)

-

-

Engineering Plastics

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Thermoplastic polyurethane (TPU)

-

Others

-

-

High-performance Plastics

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Healthcare

-

Packaging

-

Food & Beverage

-

Textile

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia-Pacific dominated the antimicrobial plastic market with a share of over 39% in 2021. This is attributable to the growing demand for antimicrobial plastic from the healthcare and packaging sector, especially in countries such as India, China, and Japan.

b. Some key players operating in the antimicrobial plastics market include BASF SE, Parx Materials N.V, Ray Products Company Inc., Covestro AG, Steritouch, RTP Company, Compounding Solutions LLC, and The Lubrizol Corporation.

b. Key factors that are driving the market growth include increasing penetration in food & beverages, packaging, and healthcare end-use industry, and rising consumer awareness related to personal hygiene due to increasing cases of epidemic outbreaks such as COVID- 19.

b. The global antimicrobial plastic market size was estimated at USD 37.8 billion in 2021 and is expected to reach USD 40.6 billion in 2022.

b. The global antimicrobial plastic market is expected to grow at a compound annual growth rate of 7.8% from 2022 to 2030 to reach USD 73.7 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."