- Home

- »

- Personal Care & Cosmetics

- »

-

Aromatherapy Diffusers Market Size And Share Report, 2030GVR Report cover

![Aromatherapy Diffusers Market Size, Share & Trends Report]()

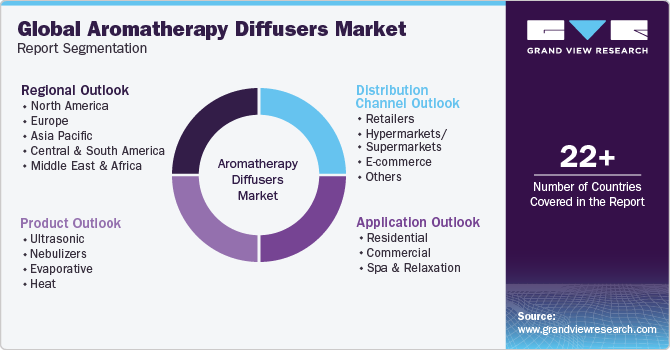

Aromatherapy Diffusers Market Size, Share & Trends Analysis Report By Product (Ultrasonic, Nebulizer, Evaporative, Heat), By Distribution Channel ( Retailers, Hypermarkets/Supermarkets), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-981-4

- Number of Pages: 205

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Aromatherapy Diffusers Market Trends

The global aromatherapy diffusers market size was estimated at USD 1,794.4 million in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The market growth is anticipated to be driven by increasing consumer disposable income coupled with the need to maintain a healthy lifestyle. Moreover, numerous health benefits of essential oils are projected to fuel the product demand. Rising awareness, particularly in developed economies, regarding the various benefits of aromatherapy for stress, depression, and anxiety relief is anticipated to boost the demand for various kinds of diffusers. Inhalation of essential oils through diffusers has no direct side effects unless consumed orally or applied directly to the skin. This factor acts as a major growth driver for the market.

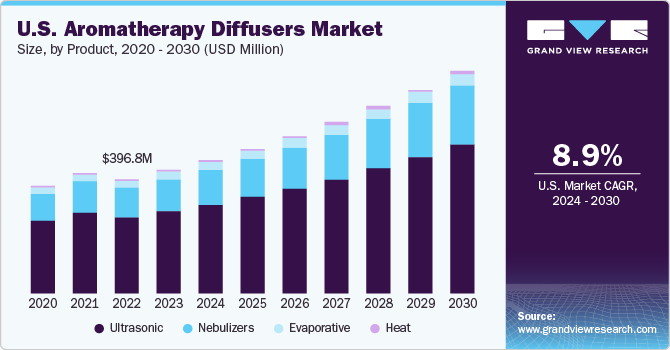

The U.S. occupies the majority share of the North America regional market. Ultrasonic diffusers and nebulizers are widely used by therapists in this region owing to the capability of the products to preserve the therapeutic contents of the oils. In addition, favorable laws and regulations for the cultivation of essential oil crops are expected to boost the regional product demand in the coming years. The demand for relaxing and pleasantly aromatic ambiance at offices is likely to positively influence the number of products in the market. The expansion of end-use industries in emerging markets has also played a role in propelling market growth. However, the limited availability of raw materials, such as essential oils, and stringent laws in contradiction of harvesting and cultivation, are considered to be restraining factors for industry growth.

Ecosystem depletion on account of extensive extraction of essential oils coupled with growing environmental concerns regarding the disposal of plastic and glass used for manufacturing the diffusers is expected to hinder the growth. To overcome such challenges, the market has shifted its focus toward developing environmentally friendly products using bio-based BPA-free plastics. The capital cost for aromatherapy diffuser manufacturing is high; hence, companies have been outsourcing their production to countries, such as China and India, with inexpensive labor and raw materials. Moreover, the presence of a large, unregulated domestic market in Asia Pacific and Middle East has been posing a threat to major multinational corporations, in terms of the low-cost technology offered, creating a price gap in the global market.

Market Concentration & Characteristics

Market growth stage is high, and pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements, such as diffusers with Bluetooth capabilities, enabling users to play soothing music or control the device through a mobile app. Furthermore, ultrasonic technology has become standard, providing a quiet and efficient diffusion process.

Key strategies undertaken by major players include new product development, strategic partnerships, and expansions. In March 2022, The Gift of Scent launchedUSB diffusers. Consumers can choose between two scents, lavender or peppermint, for The Gift of Scent's Aromatherapy USB-powered essential oil diffusers.

Many consumers are looking for products that are environmentally friendly and have a low carbon footprint. As a result, manufacturers are increasingly using eco-friendly materials and incorporating energy-efficient features in their products. Which will further drive the product demand.

The industry is impacted by various regulations and standards aimed at promoting sustainability and eco-friendliness. For instance, the Leadership in Energy and Environmental Design (LEED) program offers certification for buildings that meet certain sustainability standards, including indoor air quality.

Product Insights

The ultrasonic product segment held a significant share of 66.9% in 2023. The segment growth can be attributed to high product demand on account of its characteristics to retain the therapeutic properties of essential oils and create a pleasing ambiance. Ultrasonic diffusers use electronic frequencies to cause vibrations in the water, that break essential oil into tiny micro particles, thus, dispersing the oil in a fine mist.

The nebulizer segment is expected to register the fastest CAGR over the forecast period as the product offers the best diffusion of essential oils in large rooms without losing the therapeutic value of oils. However, it is known to cause sound disturbances as it tends to vaporize and disperse oil at a faster rate compared to its counterparts.

Distribution Channel Insights

Aromatherapy diffusers are supplied through numerous channels including retailers, supermarkets and hypermarkets, e-commerce, and others. The retail segment is anticipated to witness substantial growth over the forecast period as consumers prefer retail stores over other options owing to the personalized services offered. Consumer-buying behavior has been reshaped over the past few years owing to factors, such as product availability, variety, selection of desired delivery period, and lucrative offers and discounts; prompting consumers to opt for retail shopping. However, factors, including budget constraints, make online shopping convenient as consumers tend to focus on products that fit their budget without compromising on the content, brand, and quality.

The e-commerce segment is expected to register the fastest CAGR from 2024 to 2030. An increasing number of internet users in emerging and developed countries is likely to propel the demand for products that are available through online channels. In addition, the trend of online shopping is on the rise on account of the ease of accessibility. Supermarkets & hypermarkets will be the largest segment, in terms of revenue share. Manufacturers prefer selling their products to supermarkets and hypermarkets since it is easier to deal with one large retailer than to supply to several small independent retailers. In addition, supermarkets generate more sales compared to other channels as they have access to a larger consumer base. New entrants in the market opt to sell their products in supermarkets and hypermarkets, as it is an efficient way to increase brand awareness.

Application Insights

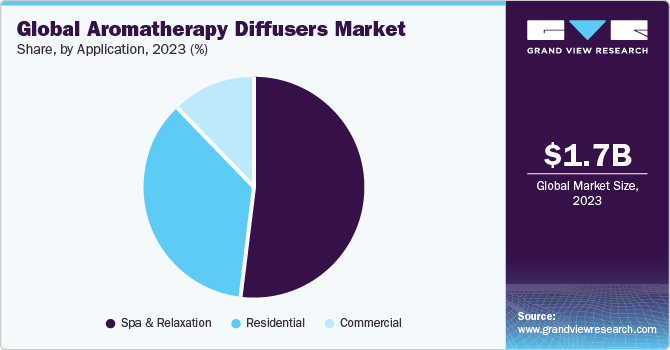

Aromatherapy diffusers are widely used in various applications, such as residential, commercial, and spas. The spa & relaxation application segment dominated the market in 2023. It is also anticipated to expand at the fastest CAGR from 2024 to 2030 owing to the increasing consumer spending on spa vacations and treatments. Most spas procure diffusers and essential oils in the form of kits at low prices. The kits are sold in bundles of 10 to 20 and comprise different types of essential oils, including eucalyptus, lavender, and lemongrass, that help with various health problems, from anxiety to sinus issues.

Diffusers used in spas and other relaxation applications have different light modes and intensity settings, which helps create an extremely pleasant ambiance. Several other applications, such as households, offices, and cars, are increasingly utilizing diffusers that release fragrant oils to create products that appeal to the olfactory senses of consumers, thereby heightening their interest. The numerous health benefits associated with essential oils are anticipated to fuel the demand for aromatherapy diffusers in homes, workplaces, and hotels.

Regional Insights

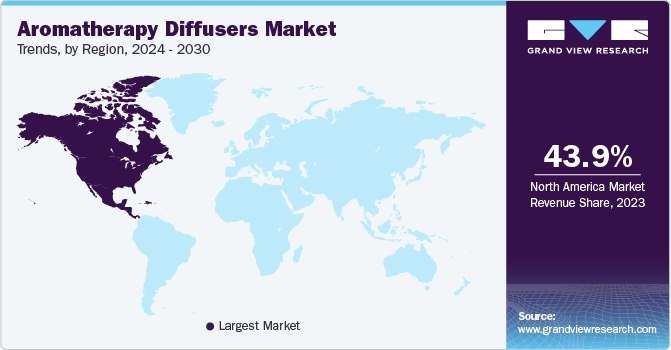

The aromatherapy diffusers market in North America accounted for a dominant share of 43.9% in 2023 owing to the high preference for natural ingredients for the treatment of anxiety, stress, and depression. There has been a growing emphasis on creating conducive and relaxing environments within offices and hotels across North America. Aromatherapy is being increasingly recognized for its potential to enhance overall well-being and reduce stress. Several businesses and hotels have recognized the value of providing a pleasant atmosphere to improve the overall experience of their employees, guests, and customers.

U.S. Aromatherapy Diffusers Market Trends

The U.S. aromatherapy diffusers market accounted for a share of over 54% of the regional market in 2023. Growing wellness tourism and increasing product awareness are expected to drive market growth in the country.

Europe Aromatherapy Diffusers Trends

The aromatherapy diffusers market in Europe will witness rapid growth. Europe is a major producer and consumer of essential oils, such as lavender, coriander, rosemary, and citrus oils. Moreover, rising demand for natural beauty & cosmetic products, medicines, and nutraceuticals is driving the demand for aroma diffusers that can disperse essential oils. This, in turn, will positively impact the regional market growth.

The Germany aromatherapy diffusers market held over 21% share of the Europe market in 2023, and it is mainly driven by increasing awareness about the benefits of essential oils and aromatherapy.

The aromatherapy diffusers market in France is expected to grow at a rate of 7.8% from 2024 to 2030 due to the increasing popularity of wellness and spa treatments, as more people are looking for ways to relax and de-stress.

Asia Pacific Aromatherapy Diffusers Market Trends

The Asia Pacific aromatherapy diffusers market was the second-largest regional market in 2023. High disposable income coupled with the flourishing health & wellness sector, especially in developing countries including India, China, and Japan, resulted in an increased product demand.

The aromatherapy diffusers market in China accounted for a share of over 60% of the Asia Pacific market in 2023/ due to increased awareness of the benefits of aromatherapy, such as improved health and overall well-being.

The aromatherapy diffuser market in Japan is anticipated to grow at aCAGR of 8.5% from 2024 to 2030. Japanese consumers are becoming more conscious of the harmful effects of chemicals and are looking for products that are made from natural materials. This will support the local market growth.

Central & South America Aromatherapy Diffusers Market Trends

The Central & South America aromatherapy diffusers market will grow at a significant CAGR over the forecast perioddue to the increasing adoption of aromatherapy for stress relief, relaxation, and to improve overall well-being.

The aromatherapy diffusers market in Brazil held a revenue share of over 26% of the Central & South America market in 2023. The increasing demand for eco-friendly and natural products is expected to drive market growth further.

Middle East & Africa Aromatherapy Diffusers Market Trends

The Middle East & Africa aromatherapy diffuser market will grow at a significant rate as more people become aware of the benefits of aromatherapy and seek to incorporate it into their daily lives. Aromatherapy is the therapeutic use of essential oils to promote mental, physical, and spiritual well-being. It forms an integral part of natural remedies in Arabia and incorporates oils obtained from many healing plants found in the traditional markets of Middle East & Africa.

The aromatherapy diffusers market in Saudi Arabia is expected to grow at a lucrative rate of 9.8% from 2024 to 2030 owing to the increasing demand for high-quality diffusers that can effectively disperse essential oils, providing a range of therapeutic benefits, such as helping relieve stress, anxiety, sleep issues, etc.

Key Aromatherapy Diffusers Company Insights

The global market is highly fragmented on account of the presence of global and local manufacturers. Companies are engaged in expansion through mergers & acquisitions and joint ventures. These companies offer a wide range of systems that are sold through multiple channels, including distributors, company-owned websites, retailers & their websites, and e-commerce websites. For instance, in October 2023, Young Living introduced a delightful winter-themed product line in anticipation of the holiday season. Among the offerings was a portable diffuser, providing users with the convenience of on-the-go aromatherapy. The WanderBliss portable diffuser adds a touch of whimsy to the festive season, offering a unique and aromatic experience for users seeking a cozy and joyful ambiance.

Key Aromatherapy Diffusers Companies:

The following are the leading companies in the aromatherapy diffusers market. These companies collectively hold the largest market share and dictate industry trends.

- Young Living Essential Oils

- NOW Foods

- doTERRA International

- SpaRoom

- Muji

- GreenAir, Inc.

- Vitruvi

- ESCENTS

- Organic Aromas

- Puzhen

- Ellia

- Pilgrim

- Edens Garden

- NOW Foods

- Rocky Mountain Oils, LLC

- Helias Oils

- Stadler Form

Recent Developments

-

In August 2023, Escents launched a fresh line of natural fragrance diffusers and reed essential oils, aiming to elevate the experience of body aromatherapy. The innovative Reed Diffusers introduced by Escents present customers with a distinctive approach to aromatherapy. These diffusers incorporate micro-mini straws serving as natural wicks, efficiently drawing the liquid upward and dispersing it into the surrounding air. This design proves especially well-suited for smaller and confined spaces, offering a unique and effective method for experiencing the benefits of aromatherapy

-

In December 2022, Young Living launched two new essential oil diffusers perfect for gift-giving. The launch was for the holiday season. The new launches, Duet Diffuser and Sprout the Puppy Diffuser, use innovative technologies to provide two perfect diffusing options for users of any age

Aromatherapy Diffusers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,942.5 million

Revenue forecast in 2030

USD 3,192.3 million

Growth rate

CAGR of 8.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Young Living Essential Oils; NOW Foods; dōTERRA International; SpaRoom; Muji; GreenAir, Inc.; Vitruvi LC; ESCENTS; Organic Aromas; Puzhen; Ellia; Pilgrim; Edens Garden; NOW Foods; Rocky Mountain Oils, LLC; Helias Oils; Stadler Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aromatherapy Diffusers Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aromatherapy diffusers market report based on product, distribution channel, application, and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Ultrasonic

-

Nebulizers

-

Evaporative

-

Heat

-

-

Distribution Channel Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Retailers

-

Hypermarkets/Supermarkets

-

E-commerce

-

Others

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Spa & Relaxation

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aromatherapy diffusers market size was estimated at USD 1,794.4 million in 2023 and is expected to be USD 1,942.5 million in 2024.

b. The global aromatherapy diffusers market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 3,192.3 million by 2030.

b. North America dominated the aromatherapy diffusers market in 2023 with a revenue share of 43.9%. This is attributable to the rising preference for natural ingredients for the treatment of anxiety, stress, and depression and the favorable regulations for essential oil farming.

b. Some of the key players operating in the aromatherapy diffusers market include Young Living Essential Oils; NOW Foods; dōTERRA International; SpaRoom; Muji; GreenAir, Inc.; Vitruvi LC; Greenair; ESCENTS; Organic Aromas; Puzhen; Ellia; Pilgrim; Edens Garden; NOW Foods; Rocky Mountain Oils, LLC; Helias Oils; Stadler Form.

b. Key factors that are driving the aromatherapy diffusers market growth include increasing consumer disposable income, the need to maintain a healthy lifestyle, and rising awareness of various benefits associated with aromatherapy, such as anxiety and stress relief.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."