- Home

- »

- Medical Devices

- »

-

Arrhythmia Monitoring Devices Market Size, Industry Report, 2018-2025GVR Report cover

![Arrhythmia Monitoring Devices Market Size, Share & Trends Report]()

Arrhythmia Monitoring Devices Market Size, Share & Trends Analysis Report By Type (ECG, Implantable, Holter, Mobile Cardiac Telemetry), By Application, By End Use, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-631-8

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Report Overview

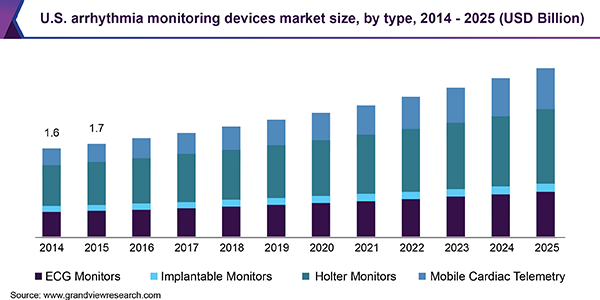

The global arrhythmia monitoring devices market size was valued at USD 4.98 billion in 2017. It is projected to expand at a CAGR of 6.8% during the forecast period. A range of treatment therapies has been developed for management of cardiac arrhythmia including artificial pacemakers, antiarrhythmic drugs, and implanted defibrillators. It is crucial to select a suitable course of treatment within an appropriate timeframe.

In present times, one of the most preferred choices for cardiac monitoring is Holter monitoring, which provides ECG recording as well as monitoring for the time period of 24 to 48 hours. However, the downside of this method is that occurrence of arrhythmia may not coincide with recording period, leading to inefficient repeated monitoring. Hence, the demand for mobile cardiac telemetry is rising as it provides recording of cardiac rhythm for a longer time duration.

Growing focus on technological advancements and innovations are poised to stoke the growth of the market. In May 2018, Preventice Solutions announced the launch of BodyGuardian Mini, a small reusable cardiac monitor with Holter technology that enables up to 14 days of ECG recording that can be delivered to physician in the form of a digital report.

With mounting cases of patients with cardiac disorders, the market is likely to witness significant growth over the coming years. Favorable reimbursement policies are also working in favor of the market. Increasing emphasis on development of inexpensive healthcare devices along with surging adoption of low-cost ECG services among lower income group is expected to provide a fillip to the market.

Type Insights

Based on type, the market is classified into ECG, implantable monitors, Holter monitors, and mobile cardiac telemetry. Of these, Holter monitors dominated the market in terms of revenue in 2017. These devices can be used for longer durations to diagnose sporadic symptoms in patients and they also offer faster and convenient monitoring to increase patient compliance and enhance treatment outcome.

Increasing research studies pertaining to development of arrhythmia monitoring devices are estimated to drive the market over the forthcoming years. Technologies such as rhythm strip generating smartphone devices by Cardiac Designs (ECG Check) and AliveCor (Kardia Mobile) have resulted in expansion of arrhythmia monitoring and wearable technology.

The mobile cardiac telemetry segment is anticipated to experience the fastest growth during the forecast period. These devices read cardiac rhythm with the help of external devices consisting of metal sensors. In addition, some of the monitoring functions offered by smartphones use photo-plethysmography through phone camera to detect atrial fibrillation. In a study published in December 2017, wireless ECG delivered a performance accuracy of 91.62% corresponding to hospital diagnostic standard while providing a portable monitoring.

Application Insights

Atrial fibrillation was the leading application segment in the arrhythmia monitoring devices market in terms of revenue in 2017. It is a common type of arrhythmia associated with a high risk of stroke and blood clotting. In many cases, it remains undiagnosed in clinical practices with conventional monitoring, resulting in inadequate treatment at the right time. Therefore, monitoring of atrial fibrillation requires enhanced technological devices for diagnosis that can help overcome limitations imposed by conventional technologies.

In recent years, innovative smartphone applications have been introduced for arrhythmic patients that can connect them with healthcare professionals. Moreover, hospitals and clinical settings are taking initiatives to involve arrhythmia care in their treatment routine. In May 2018, UNC AFib Care Network launched a new clinic for atrial fibrillation patients - AFib Integrated Care Clinic.

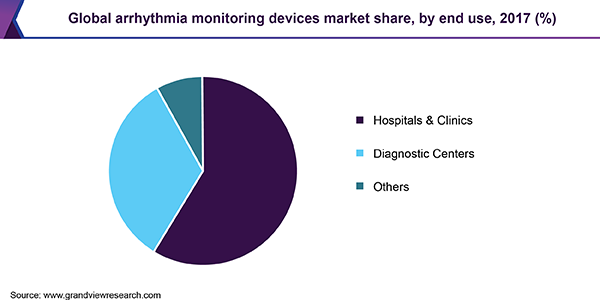

End-use Insights

Hospitals and clinics were the leading end users of arrhythmia monitoring devices in 2017. Tremendous research and technological advancements in the field and rising number of geriatric patients suffering from cardiac disorders are contributing to the growth of the segment. In a study published in April 2018, it was observed that daily short-term rhythm strip recordings identified an increase of 13.0% in elderly population hospitalized for atrial fibrillation, leading to an overall prevalence of 46.0% in hospitalized patients.

A novel imaging technique, developed by an international team of researchers of the Heart Center at the University Medical Center Göttingen and Max Planck Institute for Dynamics and Self-Organization, is projected to help physicians at hospitals to identify heart rhythm disorders in the coming years. The new diagnostic method is poised to assist in treatment of ventricular fibrillation and atrial fibrillation.

Regional Insights

North America was at the forefront of the global arena in 2017 due to rising FDA approval for arrhythmic monitoring devices. Manufacturers of medical devices are continually investing in R&D activities of monitoring devices leading to a constant improvement in the monitoring and diagnostic technology.

In 2015, Icentia, a Canadian manufacturer of medical devices, launched CardioSTAT which provided comfortable ECG recording for up to seven days. The device became an essential tool for detection of heart rhythm disorders across the country. In 2017, the company launched a new version of CardioSTAT which had an extended recording duration for more accurate and definitive diagnosis, especially, with patients suffering from paroxysmal atrial fibrillation (AF).

The market in the Asia Pacific is likely to post the highest growth during the forecast period due to rising population and introduction of technologies including wearables such as fitness monitors, mobile monitoring systems, and fabric monitoring systems. Moreover, availability of portable and homeâ€based arrhythmia monitors is a significant medical advancement in the region.

Arrhythmia Monitoring Devices Market Share Insights

Some of the key players operating in the market are AliveCor, Inc.; Applied Cardiac Systems; BioTelemetry, Inc.; BIOTRONIK; FU.K.uda Denshi Co., Ltd.; GE Healthcare; iRhythm; Medi-Lynx; St. Jude Medical (Abbott); Medtronic; Nihon Kohden Corporation; Nuubo; and Spacelabs Healthcare.

Abbott received FDA clearance for Confirm Rx, a smartphone-compatible implantable cardiac monitor, indicated for diagnosis of arrhythmia. The device can remotely connect patient’s cardiac reading to physicians for tracking and managing treatment. Boston Scientific announced its FDA approval for Resonate, a line of cardiac resynchronization therapy defibrillator and cardioverter defibrillator systems for management of cardiac failure.

Arrhythmia Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 6.02 billion

Revenue forecast in 2025

USD 8.41 billion

Growth Rate

CAGR of 6.8% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Brazil; Mexico; South Africa

Key companies profiled

AliveCor, Inc.; Applied Cardiac Systems; BioTelemetry, Inc.; BIOTRONIK; FU.K.uda Denshi Co., Ltd.; GE Healthcare; iRhythm; Medi-Lynx; St. Jude Medical (Abbott); Medtronic; Nihon Kohden Corporation; Nuubo; Spacelabs Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global arrhythmia monitoring devices market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

ECG

-

Implantable Monitors

-

Holter Monitors

-

Mobile Cardiac Telemetry

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Bradycardia

-

Tachycardia

-

Atrial Fibrillation

-

Ventricular Fibrillation

-

Premature Contraction

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global arrhythmia monitoring devices market size was estimated at USD 5.64 billion in 2019 and is expected to reach USD 6.02 billion in 2020.

b. The global arrhythmia monitoring devices market is expected to grow at a compound annual growth rate of 6.8% from 2018 to 2025 to reach USD 8.41 billion by 2025.

b. North America dominated the arrhythmia monitoring devices market with a share of 41.7% in 2017. This is attributable to the growth in R&D investments by the market participants and FDA approvals for arrhythmia monitoring devices.

b. Some of the key players operating in the market are AliveCor, Inc.; Applied Cardiac Systems; BioTelemetry, Inc.; BIOTRONIK; FU.K.uda Denshi Co., Ltd.; GE Healthcare; iRhythm; Medi-Lynx; St. Jude Medical (Abbott); Medtronic; Nihon Kohden Corporation; Nuubo; and Spacelabs Healthcare.

b. Key factors that are driving the market growth include rising cases of patients with cardiac disorders, growing focus on technological advancements and innovations, and emphasis on developing affordable devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."