- Home

- »

- Next Generation Technologies

- »

-

AI In Education Market Size & Share Report, 2022-2030GVR Report cover

![AI In Education Market Size, Share & Trends Report]()

AI In Education Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment, By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-948-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

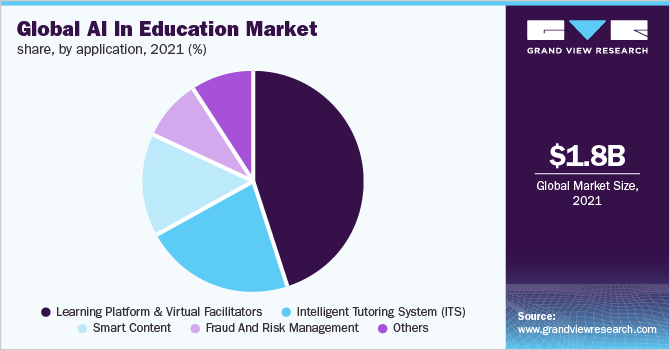

The global AI in education market size was valued at USD 1.82 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 36.0% from 2022 to 2030. Factors such as increasing investments in AI and EdTech by private as well as public sectors and the increasing penetration of edutainment are driving the demand for Artificial Intelligence (AI) in education. Additionally, the advancement in technology is fueling the demand for AI in education around the world. The COVID-19 pandemic severely impacted industries across the world. However, the market witnessed a significant rise in the demand for innovative AI-based education solutions during the pandemic. According to a survey published by the University Professional and Continuing Education Association in 2021, 51% of the faculty in the U.S. are more confident about online education than they were before the outbreak. In May 2020, Jenzabar, Inc., a technology innovator for higher education, announced the launch of the Jenzabar Unity platform to improve operational efficiency and reduce technical barriers associated across campus with the help of iPaas integration.

The AI in education component involves providing a better experience to the students, teachers, and educators. Various service providers are innovating different solutions or services for AI in education that connect to various education platforms. Additionally, the increasing adoption of online education for the development of skills is boosting the demand for AI in education.

Moreover, the demand for AI in education is high due to the pandemic but the lack of skilled professionals is restraining the market growth. In 2021, tech companies partnered with universities for introducing new training formats for talent in the AI field to better align with the development trends and newest industry shifts as there is an increase in AI-backed industry applications.

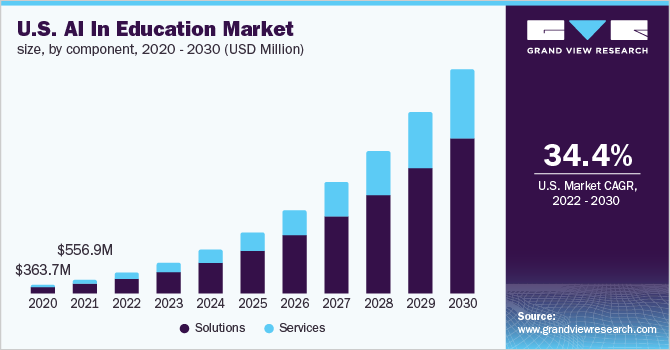

Component Insights

The solutions segment accounted for the largest revenue share of over 70.0% in 2021 and is anticipated to retain its lead during the forecast period. The emergence of a large number of smartphone users, an increase in the involvement at the government level, advanced internet connectivity, and the adoption of digital payment options have substantially aided in the growth of the online education/digital market globally, which, in turn, is driving the solutions segment. In terms of components, the market has been segmented into solutions and services.

The services segment is anticipated to expand at the highest CAGR of 37.1% during the forecast period due to the rise in online education due to the pandemic. Moreover, increasing investment in AI education by government and private organizations for advancement in the education sector is driving the market. According to the Organization for Economic Cooperation and Development (OECD) report in 2020, venture capitalists (VCs) invested over USD 75 billion in AI startups.

Deployment Insights

The cloud segment dominated the market with a revenue share of over 55.0% in 2021 and is expected to register the highest CAGR from 2022 to 2030. The growth of the cloud segment can be attributed to the factors such as reduced ownership prices and an increase in the need to share educational information across global campuses. Moreover, it enables universities and schools to advance their prevailing model with advanced AI technology without any reinvestment in their capital cost.

Based on deployment, the market is segmented into cloud and on-premises. The rising concerns over data privacy of students’ personal details and increasing demand from educational institutions to maintain essential documents on-premise are the key factors boosting the growth of the on-premises segment.

Technology Insights

The machine learning (ML) segment accounted for the largest revenue share of over 60.0% in 2021. The growth of this segment can be attributed to the growth of virtual support in high school and K-12 schools, driven by rising investments in AI technology by educational institutions. Based on technology, the market is segmented into Natural Language Processing (NLP) and Machine Learning.

Moreover, the rise in ML technology in the education sector has witnessed an increase due to assistance in reading knowledge stored in digital format and support in understanding human language with data sets. Furthermore, natural language processing (NLP) is expected to register the fastest CAGR of 36.6% during the forecast period. The increasing demand for virtual learning by schools and universities, coupled with the rising investment in technological development by educational institutes, is fueling the segment growth.

End-use Insights

The higher education segment accounted for the largest revenue share of over 40.0% in 2021. The growth is attributed to an increase in academic standards and shifting focus on students’ critical thinking capabilities, problem-solving, preparation for higher studies, and career success. Based on end-use, the market is segmented into K-12 education, higher education, and corporate training and learning.

Rapidly changing market scenarios and increasing market rivalry are some of the key factors that are pushing organizations to utilize most of their resources. Therefore, to meet the ever-changing market demands, organizations need to train their employees quickly and keep them up-to-date with the current market scenarios. Hence, such factors are driving the demand for AI in the corporate training and learning segment.

Application Insights

The learning platform and virtual facilitators segment dominated the market with a revenue share of over 45.0% in 2021 and is projected to retain its position during the forecast period. The growth of this segment can be attributed to the growing digital education learning technology around the globe. Based on application, the market is segmented into learning platform and virtual facilitators, Intelligent Tutoring System (ITS), smart content, fraud & risk management, and others.

Furthermore, virtual facilitators help students to resolve complicated real-time social problems using various skills and guidance related to social development. The smart content segment is expected to expand at the fastest CAGR of 37.8% during the forecast period. This is due to the adoption of smart content to ease the time-consuming work of creating exercises for teachers and students. To create interactive work, the use of technologies including natural language processing and computer vision is increasing.

Regional Insights

North America dominated the market with a revenue share of over 35.0% in 2021. Factors such as the existence of leading companies that develop the solutions and services, technology infrastructure facilities, and the enormous number of end-users utilizing educational devices for AI in education are the factors driving the market in the region. For instance, in October 2021, IBM corporation announced to provide 30 million people with new skills with more than 170 industry and academic partnerships by 2030, which would help to fill the growing skills gap, democratize opportunity, and give new generations of employees the skills they needed to build a better future.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growth of the regional market can be attributed to the existence of market players in the region. Baidu, TechNode, Squirrel AI, BYJU'S, Noodle Factory PTE. Ltd., and Liulishuo are a few tech giants and startups operating in the region. Advancements in AI technology, increasing investment and expenditure by governments, and new technology adoption in the education sector in the region are the key factors boosting the market growth. For instance, in July 2021, the Prime minister of India announced AI for All program by the Central Board of Secondary Education (CBSE) in partnership with Intel and the SAFAL assessment system. AI for All is a four-hour, self-paced learning session that demystifies artificial intelligence in a way that is accessible to everyone.

Key Companies & Market Share Insights

The competitive landscape of the market is fragmented, featuring several global as well as regional players. The key participants are entering into strategic collaborations, partnerships, and mergers & acquisitions to expand their business footprint and survive the highly competitive environment. Moreover, service providers are investing considerably in research & development activities to incorporate new technologies in their offerings and develop advanced solutions to gain a competitive advantage over other market players.

In November 2021, IBM Corporation announced the acquisition of SXiQ, a digital transformation services company based in Australia that specializes in cloud platforms, cloud applications, and cloud cybersecurity. The acquisition is expected to increase IBM Consulting's capabilities in New Zealand and Australia to modernize technology infrastructure and applications in the cloud. Some prominent players in the global AI in education market include:

-

Amazon Web Services, Inc.

-

IBM Corporation

-

Microsoft Corporation

-

Cognizant

-

Google LLC

-

Pearson Plc

-

BridgeU

-

DreamBox Learning, Inc.

-

Carnegie Learning, Inc.

-

Nuance Communications, Inc.

-

Blackboard Inc.

AI In Education Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.75 billion

Revenue forecast in 2030

USD 32.27 billion

Growth rate

CAGR of 36.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil; Mexico; Rest of Latin America

Key companies profiled

Amazon Web Services, Inc.; IBM Corporation; Microsoft Corporation; Google LLC; Pearson Plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI in education market report based on component, deployment, technology, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Natural Language Processing (NLP)

-

Machine Learning

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Learning Platform & Virtual Facilitators

-

Intelligent Tutoring System (ITS)

-

Smart content

-

Fraud and Risk Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

K-12 Education

-

Higher Education

-

Corporate Training & Learning

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The higher education segment dominated the AI in education market in 2021, accounting for over 42.7% share of the global revenue. The high share can be attributed to the to an increase in academic standards and shifting focus on students’ critical thinking capabilities, problem-solving, preparation for higher studies, and career success.

b. The solution segment led the AI in education market in 2021 accounting for over 71.0% of the global revenue share. And is anticipated to retain its dominance over the forecast period. The segment is anticipated to grow at a CAGR of over 35.6% over the forecast period.

b. North America dominated the AI in education market in 2021 and held over 37.4% share of the global revenue. Factors such as the existence of leading companies that develop the solutions & services, technology infrastructure facilities, and the enormous number of end-users utilizing educational devices for AI in education are the factors driving the market growth in the region.

b. The global AI in education market is expected to grow at a compound annual growth rate of 36.0% from 2022 to 2030 to reach USD 32.27 billion by 2030.

b. The global AI in education market size was valued at USD 1.82 billion in 2021 and is expected to reach USD 2.75 billion in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."