- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence Market Size And Share Report, 2030GVR Report cover

![Artificial Intelligence Market Size, Share & Trends Report]()

Artificial Intelligence Market Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning, NLP), By Function, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-955-5

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2017 - 2023

- Industry: Technology

Artificial Intelligence Market Size & Trends

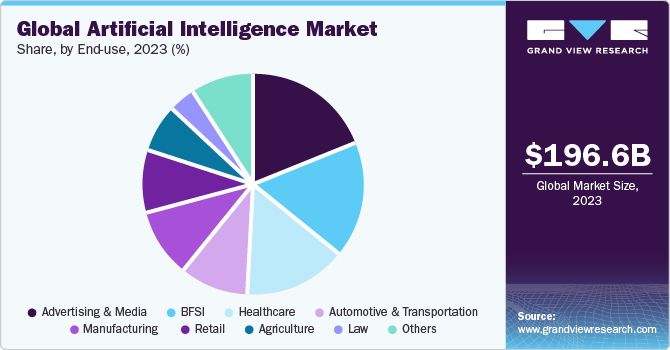

The global artificial intelligence market size was valued at USD 196.63 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030. The continuous research and innovation directed by tech giants are driving adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing. For instance, in December 2023, Google LLC launched ‘Gemini’, a large language AI model. Google's new Gemini model would come with three variants Gemini Nano, Gemini Pro, and Gemini Ultra. Gemini stands from its competitors out due to its native multimodal characteristic.

AI has proven to be a significant revolutionary element of the upcoming digital era. Tech giants like Amazon.com, Inc.; Google LLC; Apple Inc.; Facebook; International Business Machines Corporation; and Microsoft are investing significantly in research and development of AI, thus increasing the artificial intelligence market cap. These companies are working to make AI more accessible for enterprise use cases. Moreover, various companies adopt AI technology to provide a better customer experience and improve their presence in the artificial intelligence industry 4.0. For instance, in March 2020, McDonald’s made its most significant tech investment of USD 300 million to acquire an AI start-up in Tel Aviv to provide a personalized customer experience using artificial intelligence.

The essential fact accelerating the rate of innovation in AI is accessibility to historical datasets. Since data storage and recovery have become more economical, healthcare institutions and government agencies build unstructured data accessible to the research domain. Researchers are getting access to rich datasets, from historic rain trends to clinical imaging. The next-generation computing architectures, with access to rich datasets, are encouraging information scientists and researchers to innovate faster.

Furthermore, progress in profound learning and ANN (Artificial Neural Networks) has also fueled the adoption of AI in several industries, such as aerospace, healthcare, manufacturing, and automotive. ANN works in recognizing similar patterns and helps in providing modified solutions. Tech companies like Google Maps have been adopting ANN to improve their route and work on feedback received using ANN. ANN is substituting conventional machine learning systems to evolve precise and accurate versions. For instance, recent advancements in computer vision technology, such as GAN (Generative Adversarial Networks) and SSD (Single Shot MultiBox Detector), have led to digital image processing techniques. For instance, images and videos taken in low light, or low resolution, can be transformed into HD quality by employing these techniques. Continuous research in computer vision has built the foundation for digital image processing in security & surveillance, healthcare, and transportation, among other sectors. Such emerging methods in machine learning are anticipated to alter the manner AI versions are trained and deployed.

COVID-19 outbreak is expected to stimulate market growth of next-generation tech domains, including artificial intelligence, owing to mandated WFH (work-from-home) policy due to the pandemic. For instance, LogMeIn, Inc., a U.S.-based company that provides Software-as-a-Service (SaaS) and cloud-based customer engagement and remote connectivity & collaboration services, has experienced a significant increase in new sign-ups across its product portfolios amid the pandemic. Also, tech companies are expanding their product offerings and services to widen availability across the globe. For instance, in April 2020, Google LLC launched an AI-enabled chatbot called Rapid Response Virtual Agent for call centers. This chatbot is built to respond to issues customers might be experiencing due to coronavirus (COVID-19) outbreak over voice, chat, and other social channels.

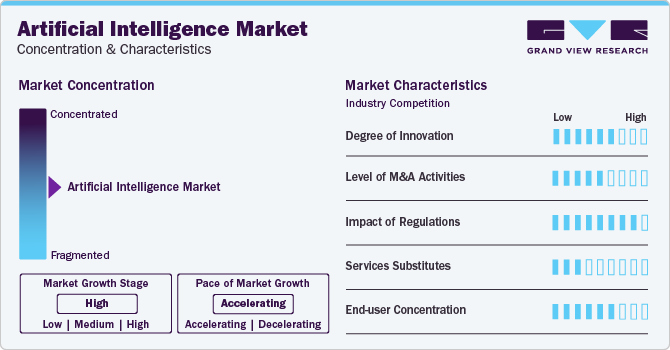

Market Concentration & Characteristics

The market growth stage in the artificial intelligence market is high, and the pace of the market growth is accelerating. The AI market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in machine learning algorithms, availability of big data, and increasing computing power. Subsequently, innovative AI applications are constantly emerging, disrupting existing industries and creating new ones.

The AI market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new AI technologies and talent, the need to consolidate in a rapidly growing market, and increasing strategic importance of AI.

The AI market is also subject to increasing regulatory scrutiny due to concerns about the potential negative impacts of AI, such as algorithmic bias, privacy violations, and job displacement. As a result, governments around the world are developing regulations to govern the development and use of AI. These regulations could have a significant impact on the AI market, affecting the development and adoption of AI technologies.

There are a limited number of direct product substitutes for AI. However, several technologies can be used to achieve similar outcomes to AI, such as automation, rule-based systems, and expert systems. These technologies can be used as substitutes for AI in certain applications, but they typically do not offer the same level of performance or flexibility as AI.

End-user concentration is a significant factor in the AI market. Since there are a number of end-user industries that are driving demand for AI solutions. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing AI solutions for these industries. However, it also creates challenges for companies that are trying to compete in a crowded market.

Market Dynamics

The introduction of big data is projected to accelerate the expansion of the artificial intelligence market as a large volume of data needs to be stored, captured, and analyzed. End-users are increasingly concerned about the need to manage and improve the computational model of such data. This is encouraging companies to introduce artificial intelligence solutions at a faster pace and increase the implementation of artificial intelligence in business. Several private and public organizations have gathered tasks or application-specific information comprising issues, such as medical informatics, fraud detection, national intelligence, marketing, and cybersecurity. Artificial Intelligence algorithms enable automated analysis of unsupervised and unorganized data by continuously improving each set of data.

Artificial intelligence is becoming increasingly important in big data because it enables the extraction of high-level and complex abstractions through a centralized learning process. The need for extracting and mining meaningful patterns from large amounts of data propels the growth of artificial intelligence in big data analytics. Furthermore, the technology aids in overcoming big data analytics challenges such as data analysis trustworthiness, raw data format variation, imbalanced input data, and highly distributed input sources. Another issue is a lack of efficient storage and information retrieval, as data is collected in large quantities and made available across multiple domains. These difficulties are overcome by using semantic indexing, which improves comprehension and knowledge discovery.

Solution Insights

Software solutions led the market and accounted for more than 36.7% of the global revenue in 2022. This high percentage can be attributed to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end services. Furthermore, the ability to extract data, provide real-time insight, and aid decision-making has positioned this segment to capture a significant portion of the market. Artificial intelligence software solutions include libraries for designing and deploying artificial intelligence applications, such as primitives, linear algebra, inference, sparse matrices, video analytics, and multiple hardware communication capabilities. The need for enterprises to understand and analyze visual content to gain meaningful insights is expected to spur the adoption of artificial intelligence software over the forecast period.

Companies adopt AI services to reduce their overall operational costs, yielding more profit. Artificial Intelligence as a Service, or AIaaS, is being used by companies to obtain a competitive advantage over the cloud, thus assisting the growth of the mobile AI market. Artificial intelligence services include installation, integration, maintenance, and support undertakings. The segment is projected to grow significantly over the forecast period. AI hardware includes chipsets such as GPU (Graphics Processing Unit), CPU, application-specific integrated circuits (ASIC), and field-programmable gate arrays (FPGAs). GPUs and CPUs currently dominate the artificial intelligence hardware market due to their high computing capabilities required for AI frameworks. For instance, in September 2020, Atomwise partnered with GC Pharma to offer AI-based services to the former and help develop more effective novel hemophilia therapies.

Technology Insights

On the back of its growing prominence because of its complicated data-driven applications, including text/content or speech recognition, deep learning segment led the market and accounted for around 36.4% share of global revenue in 2022. Deep learning offers lucrative investment opportunities as it helps overcome the challenges of high data volumes. For instance, in July 2020, Zebra Medical Vision collaborated with TELUS Ventures to enhance the availability of the former’s deep learning solutions in North America and expand AI solutions to clinical care settings and new modalities.

Machine learning and deep learning cover significant investments in AI. They include both AI platforms and cognitive applications, including tagging, clustering, categorization, hypothesis generation, alerting, filtering, navigation, and visualization, which facilitate the development of advisory, intelligent, and cognitively enabled solutions. Growing deployment of cloud-based computing platforms and on-premises hardware equipment for the safe and secure restoration of large volumes of data has paved a way for the expansion of the analytics platform. Rising investments in research and development by leading players will also play a crucial role in increasing the uptake of artificial intelligence technologies. During the forecast period, NLP segment is expected to gain momentum. NLP is becoming increasingly widely used in various businesses to understand client preferences, evolving trends, purchasing behavior, decision-making processes, and more, in a better manner.

End-use Insights

The advertising & media segment led the market and accounted for more than 19.5% of the global revenue share in 2022. This high share is attributable to growing AI marketing applications with significant traction. For instance, in January 2022, Cadbury started an initiative to let small business owners create their AD for free using the face and voice of a celebrity, with the help of an AI tool. However, the healthcare sector is anticipated to gain a leading share by 2030. Healthcare segment has been segregated based on use cases such as robot-assisted surgery, dosage error reduction, virtual nursing assistants, clinical trial participant identifier, hospital workflow management, preliminary diagnosis, and automated image diagnosis. The BFSI segment includes financial analysis, risk assessment, and investment/portfolio management solicitations.

Artificial intelligence has witnessed a significant share in the BFSI sector due to high demand for risk & compliance applications along with regulatory and supervisory technologies (SupTech). By using AI-based insights in Suptech tools in financial markets, the authorities are increasingly examining FinTech-based apps used for regulatory, supervisory, and oversight purposes for any potential benefits. In a similar vein, regulated institutions are creating and implementing FinTech applications for reporting and regulatory and compliance obligations. Financial institutions are using AI applications for risk management and internal controls as well. The combination of AI technology with behavioral sciences enables large financial organizations to prevent wrongdoing, moving the emphasis from ex-post resolution to proactive prevention.

Other verticals for artificial intelligence systems include retail, law, automotive & transportation, agriculture, and others. Increasing government regulations play a crucial role in driving the growth of the automotive artificial intelligence market. Governments worldwide are becoming increasingly concerned about road safety and enacting strict safety measures. Additionally, conversational AI platform is also one of the most used artificial intelligence app in every vertical. Retail segment is anticipated to witness a substantial rise owing to the increasing focus on providing an enhanced shopping experience. An increasing amount of digital data in text, sound, and images from different social media sources is driving the need for data mining and analytics. In the entertainment and advertising industry, AI has been creating a positive impact, and companies are using AI techniques to promote their products and connect to the customer base.

Regional Insights

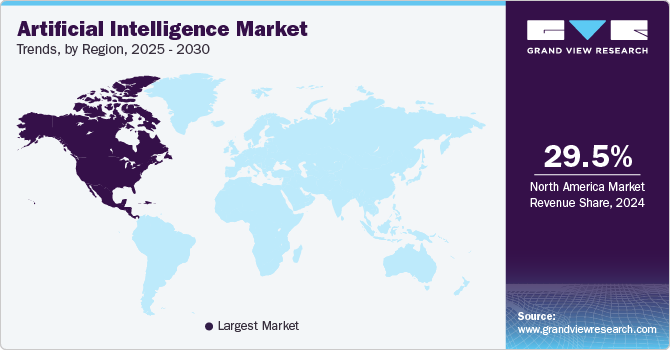

North America dominated the market and accounted for over 36.8% share of global revenue in 2022. This high share is attributable to favorable government initiatives to encourage the adoption of artificial intelligence (AI) across various industries. Governments in North America are investing in AI research and development, establishing specialized research institutes and centers, and funding AI-related projects. They also utilize AI in many fields, such as enhancing public safety and transportation and promoting healthcare innovation.

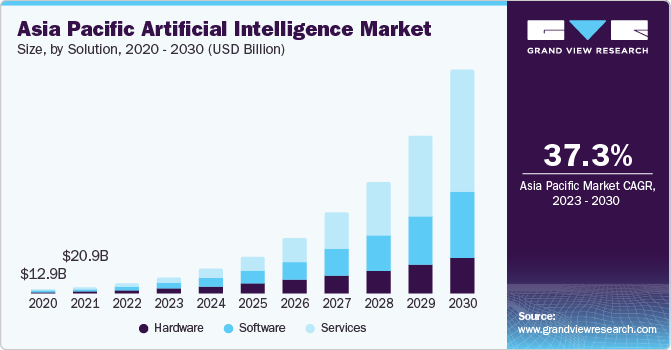

The regional market in Asia Pacific is anticipated to witness significant growth in artificial intelligence market. This growth owes to the significantly increasing investments in artificial intelligence. The artificial intelligence market in China is diverse and covers various applications, such as natural language processing, computer vision, robotics, autonomous vehicles, and virtual assistants. With its substantial population and extensive data resources, China provides a fertile environment for developing and implementing AI technologies.

In addition, the government in Saudi Arabia is actively promoting artificial intelligence through a range of initiatives, policies, and financial support programs. For instance, the Saudi Data and AI Authority (SDAIA) is a government agency to help Saudi Arabia create an AI ecosystem of government and private sector entities. SDAIA deploys innovative AI solutions, which comprise strategies for combining data and AI into key domains.

Key Companies & Market Share Insights

Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies. For instance, in April 2020, Advanced Micro Devices announced a strategic alliance with Oxide Interactive LLC, a video game developer company, to develop graphics technologies for cloud gaming market space. Both companies have planned to create a set of tools & techniques to address the real-time demands of cloud-based gaming. Also, in October 2023, NVIDIA Corporation and Oracle enter into a partnership agreement to assist customers in overcoming business difficulties using accelerated computing and AI. The partnership is aimed to help speed up customer adoption of artificial intelligence services.

Key Artificial Intelligence Companies:

- Advanced Micro Devices

- AiCure

- Arm Limited

- Atomwise, Inc.

- Ayasdi AI LLC

- Baidu, Inc.

- Clarifai, Inc

- Cyrcadia Health

- Enlitic, Inc.

- Google LLC

- H2O.ai.

- HyperVerge, Inc.

- International Business Machines Corporation

- IBM Watson Health

- Intel Corporation

- Iris.ai AS.

- Lifegraph

- Microsoft

- NVIDIA Corporation

- Sensely, Inc.

- Zebra Medical Vision, Inc.

Recent Developments

-

Open AI is developing an innovative artificial general intelligence (AGI) model code-named Project Q-Star. The model could have an immense impact on the overall AI market and provide breakthroughs in how one interacts with technology, automate processes, and solve a few of the world’s most pressing issues.

-

In November 2023, The University of Cambridge, along with Intel Corporation and Dell Technologies announced the implementation of the co-designed fastest AI supercomputer ‘Dawn Phase 1’. Leading technical teams built the supercomputer that mobilize the power of both high-performance computing (HPC) and artificial intelligence (AI) for solving some of the world’s most critical challenges. This is projected to accelerate the future technology leadership and inward investment into the U.K. technology sector.

-

In March 2023, Enlitic introduced the latest release of Enlitic Curie, a platform that makes it easy for radiology departments to manage their workflow. The platform hosts Curie|ENDEX, which utilizes NLP and computer vision for the analysis & processing of medical images; and Curie|ENCOG, which leverages AI to identify and protect Protected Health Information.

-

In June 2023, AMD unveiled its AI Platform strategy with the introduction of the AMD Instinct MI300 Series accelerator family, which included a first look at the AMD Instinct MI300X accelerator. The accelerator has been developed for the purpose of large language model training and inference for generative AI workloads.

-

In June 2023, IBM announced that it would be partnering with The All England Lawn Tennis Club at the 2023 Wimbledon Championship. The company would be leveraging IBM watsonx’s generative AI technology to product commentary for video highlights during the tournament. Additionally, the IBM AI Draw Analysis will offer insights regarding how favorable the draws would be for every singles player.

-

In April 2023, H20.ai announced a strategic partnership with GeoTechnologies, a Japan-based provider of map data & location information solutions for vehicle navigation systems. The company has leveraged H20.ai’s H2O AI Cloud to develop an AI-powered platform that uses on-board camera footage for gauging sidewalk safety.

-

In January 2023, Iris.ai announced that it had received the EIC Accelerator Blended finance, which is EIC’s flagship startup funding program. The funding includes a €2.4 million grant as well as up to €12 million in investments from the EIC and the European Investment Grant.

-

In September 2022, AiCure launched its clinical site services program that partners with sponsors and sites through the course of research and offers data-driven, actionable insights to minimize study risks and optimize the workflow.

-

In August 2022, Atomwise announced an exclusive, strategic research collaboration with Sanofi for AI-powered drug discovery. As part of the deal, Sanofi is leveraging Atomwise’s AtomNet platform for the purpose of computational discovery & research of up to 5 drug targets.

-

In July 2022, Clarifai announced the launch of its ‘Clarifai Community’ free service for enabling everyone to share, create, and use The World’s AI. Moreover, it also announced the development of the ‘AI Lake’ product category, which collects and centralizes every AI resource of an enterprise, and offers tools for sharing across the enterprise.

-

In June 2022, Francisco Partners announced that it had acquired the healthcare analytics and data assets that formed a part of Watson Health business of IBM. As part of this development, the new standalone company was named Merative, with its products organized in 6 product categories.

-

In April 2022, Sensely and Keralty S.A.S, along with its American affiliate Sanitas USA, Inc., announced a multi-year partnership. Through this collaboration, Sanitas aims to power its next-gen mySanitas application by leveraging Sensely’s advanced visual UI and multilingual symptom assessment tool.

Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 196.63 billion

Revenue forecast in 2030

USD 1,811.75 billion

Growth rate

CAGR of 37.3% from 2023 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, technology, end-use, function, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; China; Japan; India; Brazil

Key companies profiled

Advanced Micro Devices; AiCure; Arm Limited; Atomwise, Inc.; Ayasdi AI LLC; Baidu, Inc.; Clarifai, Inc; Cyrcadia Health; Enlitic, Inc.; Google LLC; H2O.ai.; HyperVerge, Inc.; International Business Machines Corporation; IBM Watson Health; Intel Corporation; Iris.ai AS.; Lifegraph; Microsoft; NVIDIA Corporation; Sensely, Inc.; and Zebra Medical Vision, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence market report based on solution, technology, function, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Accelerators

-

Processors

-

Memory

-

Network

-

-

Software

-

Services

-

Professional

-

Managed

-

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Natural Language Understanding (NLU)

-

Natural Language Generation (NLG)

-

-

Machine Vision

-

Generative AI

-

Generative Adversarial Networks (GANs)

-

Transformers

-

Variational Auto-encoders

-

Diffusion Networks

-

-

-

Function Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cybersecurity

-

Finance and Accounting

-

Human Resource Management

-

Legal and Compliance

-

Operations

-

Sales and Marketing

-

Supply Chain Management

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Healthcare

-

Robot Assisted Surgery

-

Virtual Nursing Assistants

-

Hospital Workflow Management

-

Dosage Error Reduction

-

Clinical Trial Participant Identifier

-

Preliminary Diagnosis

-

Automated Image Diagnosis

-

-

BFSI

-

Risk Assessment

-

Financial Analysis/Research

-

Investment/Portfolio Management

-

Others

-

-

Law

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Agriculture

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global artificial intelligence market size was estimated at USD 136.6 billion in 2022 and is expected to reach USD 196.6 billion in 2023.

b. The global artificial intelligence market is expected to grow at a compound annual growth rate of 37.3% from 2023 to 2030 to reach USD 1,811.8 billion by 2030.

b. North America dominated the AI market and accounted for over 36.8% share of global revenue in 2021.

b. Some key players operating in the AI market include Atomwise, Inc.; Lifegraph; Sense.ly, Inc.; Zebra Medical Vision, Inc.; Baidu, Inc.; H2O ai; IBM Watson Health; NVIDIA; Enlitic, Inc.; Google LLC; Intel Corporation; and Microsoft Corporation.

b. Key factors that are driving the artificial intelligence market growth include a rise in the adoption of big data, analytics, and the increasing potential of R&D in developing AI systems and technological innovations across the globe.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Artificial Intelligence Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.5. Artificial Intelligence Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. Artificial Intelligence Market: Solution Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Artificial Intelligence Market: Solution Movement Analysis, 2022 & 2030 (USD Million)

4.3. Hardware

4.3.1. Hardware Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Software

4.4.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Services

4.5.1. Services Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. Artificial Intelligence Market: Technology Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Artificial Intelligence Market: Technology Movement Analysis, 2022 & 2030 (USD Million)

5.3. Deep Learning

5.3.1. Deep Learning Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Machine Learning

5.4.1. Machine Learning Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5. Natural Language Processing (NLP)

5.5.1. Natural Language Processing (NLP) Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.6. Machine Vision

5.6.1. Machine Vision Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.7. Generative AI

5.7.1. Generative AI Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. Artificial Intelligence Market: Function Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Artificial Intelligence Market: Function Movement Analysis, 2022 & 2030 (USD Million)

6.3. Cybersecurity

6.3.1. Cybersecurity Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Finance and Accounting

6.4.1. Finance and Accounting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Human Resource Management

6.5.1. Human Resource Management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. Legal and Compliance

6.6.1. Legal and Compliance Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.7. Operations

6.7.1. Operations Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.8. Sales and Marketing

6.8.1. Sales and Marketing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.9. Supply Chain Management

6.9.1. Supply Chain Management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. Artificial Intelligence Market: End-user Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Artificial Intelligence Market: End-user Movement Analysis, 2022 & 2030 (USD Million)

7.3. Healthcare

7.3.1. Healthcare Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. BFSI

7.4.1. BFSI Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. Law

7.5.1. Law Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. Retail

7.6.1. Retail Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7. Advertising & Media

7.7.1. Advertising & Media Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.8. Automotive & Transportation

7.8.1. Automotive & Transportation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.9. Agriculture

7.9.1. Agriculture Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.10. Manufacturing

7.10.1. Manufacturing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.11. Others

7.11.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. Artificial Intelligence Market: Regional Estimates & Trend Analysis

8.1. Artificial Intelligence Market Share, By Region, 2022 & 2030, USD Million

8.2. North America

8.2.1. North America Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.4. Mexico

8.2.4.1. Mexico Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.2. U.K.

8.3.2.1. U.K. Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Germany Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.4. France

8.3.4.1. France Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.2. China

8.4.2.1. China Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.3. Japan

8.4.3.1. Japan Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.4. India

8.4.4.1. India Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. South America

8.5.1. South America Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Brazil Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis

9.5. Company Heat Map Analysis

9.6. Strategy Mapping

9.6.1. Expansion

9.6.2. Mergers & Acquisition

9.6.3. Partnerships & Collaborations

9.6.4. New Product Launches

9.6.5. Research And Development

9.7. Company Profiles

9.7.1. Advanced Micro Devices

9.7.1.1. Participant’s Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.1.4. Recent Developments

9.7.2. AiCure

9.7.2.1. Participant’s Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.2.4. Recent Developments

9.7.3. Arm Limited

9.7.3.1. Participant’s Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.3.4. Recent Developments

9.7.4. Atomwise, Inc.

9.7.4.1. Participant’s Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.4.4. Recent Developments

9.7.5. Ayasdi AI LLC

9.7.5.1. Participant’s Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.5.4. Recent Developments

9.7.6. Baidu, Inc.

9.7.6.1. Participant’s Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.6.4. Recent Developments

9.7.7. Clarifai, Inc

9.7.7.1. Participant’s Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.7.4. Recent Developments

9.7.8. Cyrcadia Health

9.7.8.1. Participant’s Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.8.4. Recent Developments

9.7.9. Enlitic, Inc.

9.7.9.1. Participant’s Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.9.4. Recent Developments

9.7.10. Google LLC

9.7.10.1. Participant’s Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.10.4. Recent Developments

9.7.11. H2O.ai.

9.7.11.1. Participant’s Overview

9.7.11.2. Financial Performance

9.7.11.3. Product Benchmarking

9.7.11.4. Recent Developments

9.7.12. HyperVerge, Inc.

9.7.12.1. Participant’s Overview

9.7.12.2. Financial Performance

9.7.12.3. Product Benchmarking

9.7.12.4. Recent Developments

9.7.13. International Business Machines Corporation

9.7.13.1. Participant’s Overview

9.7.13.2. Financial Performance

9.7.13.3. Product Benchmarking

9.7.13.4. Recent Developments

9.7.14. IBM Watson Health

9.7.14.1. Participant’s Overview

9.7.14.2. Financial Performance

9.7.14.3. Product Benchmarking

9.7.14.4. Recent Developments

9.7.15. Intel Corporation

9.7.15.1. Participant’s Overview

9.7.15.2. Financial Performance

9.7.15.3. Product Benchmarking

9.7.15.4. Recent Developments

9.7.16. Iris.ai AS.

9.7.16.1. Participant’s Overview

9.7.16.2. Financial Performance

9.7.16.3. Product Benchmarking

9.7.16.4. Recent Developments

9.7.17. Lifegraph

9.7.17.1. Participant’s Overview

9.7.17.2. Financial Performance

9.7.17.3. Product Benchmarking

9.7.17.4. Recent Developments

9.7.18. Microsoft

9.7.18.1. Participant’s Overview

9.7.18.2. Financial Performance

9.7.18.3. Product Benchmarking

9.7.18.4. Recent Developments

9.7.19. NVIDIA Corporation

9.7.19.1. Participant’s Overview

9.7.19.2. Financial Performance

9.7.19.3. Product Benchmarking

9.7.19.4. Recent Developments

9.7.20. Sensely, Inc.

9.7.20.1. Participant’s Overview

9.7.20.2. Financial Performance

9.7.20.3. Product Benchmarking

9.7.20.4. Recent Developments

9.7.21. Zebra Medical Vision, Inc.

9.7.21.1. Participant’s Overview

9.7.21.2. Financial Performance

9.7.21.3. Product Benchmarking

9.7.21.4. Recent Developments

List of Tables

Table 1 Global AI Market by Solution, 2017 - 2030 (USD Million)

Table 2 Global AI Market by Technology, 2017 - 2030 (USD Million)

Table 3 Global AI Market by function, 2017 - 2030 (USD Million)

Table 4 Global AI Market by End Use, 2017 - 2030 (USD Million)

Table 5 Global AI Market by Region, 2017 - 2030 (USD Million)

Table 6 North America AI Market by country, 2017 - 2030 (USD Million)

Table 7 Europe AI Market by country, 2017 - 2030 (USD Million)

Table 8 Asia Pacific AI Market by country, 2017 - 2030 (USD Million)

Table 9 South America AI Market by country, 2017 - 2030 (USD Million)

Table 10 MEA AI Market by country, 2017 - 2030 (USD Million)

Table 11 Key companies launching new products/services

Table 12 Key companies engaged in mergers & acquisition

Table 13 Key companies engaged in Research & development

Table 14 Key Companies engaged in expansion

List of Figures

Fig. 1 AI Market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Market formulation & validation

Fig. 7 AI Market snapshot

Fig. 8 AI Market segment snapshot

Fig. 9 AI Market competitive landscape snapshot

Fig. 10 Market driver impact analysis

Fig. 11 Market restraint impact analysis

Fig. 12 AI Market, solution outlook key takeaways (USD Million)

Fig. 13 AI Market: solution movement analysis 2022 & 2030 (USD Million)

Fig. 14 Hardware market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 15 Software market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 16 Services market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 17 AI Market: technology outlook key takeaways (USD Million)

Fig. 18 AI Market: technology movement analysis 2022 & 2030 (USD Million)

Fig. 19 Deep Learning market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 20 Machine Learning market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 21 Natural Language Processing market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 22 Machine Vision market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 23 Generative AI market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 24 AI Market: Function outlook key takeaways (USD Million)

Fig. 25 AI Market: Function movement analysis 2022 & 2030 (USD Million)

Fig. 26 Cybersecurity market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 27 Finance and Accounting market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 28 Human Resource Management market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 29 Legal and Compliance market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 30 Operations market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 31 Sales and Marketing market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 32 Supply Chain Management market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 33 AI Market: End-Use outlook key takeaways (USD Million)

Fig. 34 AI Market: End-Use movement analysis 2022 & 2030 (USD Million)

Fig. 35 Healthcare market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 36 BFSI market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 37 Law market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 38 Legal market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 39 Retail market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 40 Advertising & Media market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 41 Automotive & Transportation market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 42 Agriculture market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 43 Manufacturing market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 44 Others market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 45 Regional marketplace: Key takeaways

Fig. 46 AI Market: Regional outlook, 2022 & 2030 (USD Million)

Fig. 47 North America AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 U.S. AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Canada AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Mexico AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 Europe AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 UK AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Germany AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 France AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 Asia Pacific AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 China AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Japan AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 India AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 South America AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Brazil AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 MEA AI Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 Strategy framework

Fig. 63 Company CategorizationWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Artificial Intelligence Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Artificial Intelligence Technology Outlook (Revenue, USD Billion, 2017 - 2030)

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Artificial Intelligence Function Outlook (Revenue, USD Billion, 2017 - 2030)

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Artificial Intelligence End-Use Outlook (Revenue, USD Billion, 2017 - 2030)

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Artificial Intelligence Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- North America Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- North America Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- North America Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- North America Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- U.S.

- U.S. Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- U.S. Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- U.S. Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- U.S. Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- U.S. Artificial Intelligence Market, By Solution

- Canada

- Canada Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Canada Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Canada Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Canada Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Canada Artificial Intelligence Market, By Solution

- Mexico

- Mexico Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Mexico Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Mexico Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Mexico Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Mexico Artificial Intelligence Market, By Solution

- North America Artificial Intelligence Market, By Solution

- Europe

- Europe Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Europe Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Europe Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Europe Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- U.K.

- U.K. Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- U.K. Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- U.K. Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- U.K. Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- U.K. Artificial Intelligence Market, By Solution

- Germany

- Germany Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Germany Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Germany Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Germany Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Germany Artificial Intelligence Market, By Solution

- France

- France Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- France Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- France Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- France Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- France Artificial Intelligence Market, By Solution

- Europe Artificial Intelligence Market, By Solution

- Asia Pacific

- Asia Pacific Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Asia Pacific Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Asia Pacific Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Asia Pacific Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- China

- China Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- China Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- China Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- China Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- China Artificial Intelligence Market, By Solution

- Japan

- Japan Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Japan Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Japan Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Japan Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Japan Artificial Intelligence Market, By Solution

- India

- India Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- India Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- India Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- India Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- India Artificial Intelligence Market, By Solution

- Asia Pacific Artificial Intelligence Market, By Solution

- South America

- South America Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- South America Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- South America Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- South America Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Brazil

- Brazil Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Brazil Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Brazil Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Brazil Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Brazil Artificial Intelligence Market, By Solution

- South America Artificial Intelligence Market, By Solution

- MEA

- MEA Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- MEA Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Natural Language Understanding (NLU)

- Natural Language Generation (NLG)

- Machine Vision

- Generative AI

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- MEA Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- MEA Artificial Intelligence Market, By End-Use

- Healthcare

- BFSI

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- MEA Artificial Intelligence Market, By Solution

- North America

Artificial Intelligence Market Dynamics

Driver: Economical parallel processing set-up

The artificial intelligence sector has predominantly been driven by software, with a limited number of companies producing hardware components like CPUs, ASICs, FPGAs, and GPUs. However, recent advancements in design tools have made FPGAs more compatible with intricate software methodologies, making them more accessible to those who design and construct algorithm models. To address issues related to power consumption, slow processing, and inefficiency, hardware-based AI solutions are being introduced. As the market matures, there is a growing demand for a new business model that leverages predictive, efficient automation and scalable parallel processing capabilities. The requirement for hardware-based AI products emerged as end-use applications called for lower power and higher performance. In the past few years, only a handful of companies have ventured into the development of these components. To gain a competitive edge, vendors like IBM Corporation and Intel Corporation have begun manufacturing AI chipsets to achieve high performance in scaling dynamic parallel processes.

Driver: Potential R&D in artificial intelligence systems

Artificial Intelligence employs layers of algorithms to recognize objects visually, interpret human speech, and process data. These algorithms are utilized for calculations, data processing, and automated reasoning tasks. There’s a growing demand to refine these algorithms to deliver improved and efficient solutions for various end-use applications. AI researchers are continually striving to enhance algorithms across different domains. Traditional algorithms often fall short in terms of accuracy and efficiency, prompting manufacturers and technology developers to concentrate on developing standardized algorithms. For example, NVIDIA’s traditional GPUs used a machine learning algorithm for voice recognition and image labeling. However, this approach had limitations concerning accuracy and solution time. Consequently, the company revised its algorithm by integrating big data and computational power, altering these dynamics. This has enabled machines and devices to operate with increased accuracy, thereby propelling the growth of AI computing and artificial intelligence.

Restraint: Vast demonstrative data requirement

A significant challenge hindering the growth of the industry is the need for vast amounts of data to train AI systems for character and image recognition. Additionally, storing such large volumes of data contributes to the issue of data traceability. Companies like Google, Inc., and Facebook employ artificial intelligence in image recognition applications, which necessitates access to a substantial amount of data. In the healthcare sector, the data needed for identifying tumors in X-rays is extremely limited. The primary issue that emerges in artificial intelligence due to the lack of data availability is making effective decisions using the data at hand. Moreover, the development of networks that can be trained using less data is ongoing and is anticipated to be commercialized in the next 10 to 12 years.

What Does This Report Include?

This section will provide insights into the contents included in this artificial intelligence market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Artificial Intelligence market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Artificial Intelligence market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the artificial intelligence market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for artificial intelligence market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of artificial intelligence market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Artificial Intelligence Market Categorization:

The artificial intelligence market was categorized into four segments, namely solution (Hardware, Software, Services), technology (Deep Learning, Machine Learning, Natural Language Processing, Machine Vision), end-use (Healthcare, BFSI, Law, Retail, Advertising & Media, Automotive & Transportation, Agriculture, Manufacturing), regions (North America, Europe, Asia Pacific, South America, Middle East and Africa).

Segment Market Methodology:

The artificial intelligence market was segmented into solution, technology, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The artificial intelligence market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, South America, Middle East and Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into nine countries, namely, the U.S.; Canada; Mexico; Germany; the UK; China; Japan; India; Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Artificial intelligence market companies & financials:

The artificial intelligence market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Advanced Micro Devices. - Advanced Micro Devices (AMD) is a multinational corporation known for its semiconductor production. The company’s offerings include Graphics Processing Units (GPUs), Accelerated Processing Units (APUs), and System-on-Chip (SoC) solutions. They also provide technology for gaming consoles, chipsets, and processors for embedded systems and servers. AMD operates under two main business divisions: Computing and Graphics, and Enterprise, Embedded and Semi-custom. The Computing and Graphics segment focuses on GPUs, APUs, and chipsets, while the Enterprise, Embedded and Semi-custom segment concentrates on server and embedded processors, semi-custom SoC products, and technology for game consoles. AMD’s clientele is diverse and extensive. It includes large direct data centers, which are primarily cloud service providers. Original Design Manufacturers (ODMs), Original Equipment Manufacturers (OEMs), and online retailers are also part of AMD’s customer base. Additionally, the company serves add-in-board manufacturers (AIBs), PC OEMs, independent distributors, and system integrators. This wide range of customers underscores AMD’s significant presence in the global semiconductor industry.

-

AiCure - Established in 2010, AiCure is a company based in the United States that designs and implements AI technologies that have been clinically validated to enhance medication compliance and patient behavior. The company provides a software-as-a-service (SaaS) model that incorporates motion detection and facial recognition technology. AiCure is in the process of creating a mobile technology platform that integrates the latest advancements in artificial intelligence, including machine learning, predictive analytics, deep learning, and computer vision. This platform leverages AI on mobile devices to verify medication intake in high-risk groups and clinical trials. The company’s areas of expertise include artificial intelligence, risk management, clinical research, population health, health outcomes, and randomized clinical trials. This wide range of specializations highlights AiCure’s commitment to leveraging advanced technology to improve health outcomes.

-

Arm Limited - Arm Limited, a subsidiary of ARM Holdings Plc, is a global player in the semiconductor Intellectual Property (IP) sector. The company licenses its technology to semiconductor and systems companies, and designs these technologies both in the UK and internationally. Original Equipment Manufacturers (OEMs) utilize Arm’s technology for a variety of applications, including digital set-top boxes, mobile handsets, network routers, and car braking systems. Arm offers a comprehensive suite of solutions encompassing processors, graphics and multimedia, physical IP, development tools, IoT solutions, system IP, and wireless IP. With a presence in North America, Europe, the Middle East, and the Asia Pacific, Arm has a truly global footprint.

-

Atomwise Inc. - Atomwise, Inc. is a company that utilizes deep learning technology for the purpose of drug discovery. It has formed partnerships with several biotechnology and pharmaceutical corporations, such as Jiangsu Hansoh Pharmaceutical Group Co., Ltd. in China, the Drugs for Neglected Diseases initiative (DNDi) in Switzerland, and BridgeBio Therapeutics in the U.S., to create superior medicines using its AI platform. The company’s solution is driven by AtomNet technology, a deep learning neural network designed specifically for structure-based drug design and discovery. This technology leverages insights gathered from a multitude of experimental affinity measurements and protein structures to predict the binding of small molecules to proteins.

-