- Home

- »

- Petrochemicals

- »

-

Asia & Africa Polyethylene Wax Market Size, Industry Report, 2025GVR Report cover

![Asia & Africa Polyethylene Wax Market Size, Share & Trends Report]()

Asia & Africa Polyethylene Wax Market Size, Share & Trends Analysis Report By Technology (Polymerization, Modification, Cracking), By Product, By Applications, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-887-9

- Number of Pages: 133

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Bulk Chemicals

Industry Insights

The Asia & Africa polyethylene wax market size was estimated at USD 250.5 million in 2016. PE waxes have wide applications in the coating & paint industry as they have anti-blocking, water repellent, and anti-settling properties. The growth of printing inks, adhesives, cosmetics, and pharmaceuticals particularly in emerging markets of Asia Pacific and Africa are expected to have a positive impact on market growth.

Distribution is considered to be a critical component in the industry value chain. The product can be supplied to customers in various forms. It can be either transported through specialty bulk trailers in huge volumes or atomized powder form. It is also available in micro-sized particle form, known as micronized PE wax. Primary Major distributor includes SCG Chemicals, Continental Chemical, and EPChem International Pte. Ltd.

PE wax manufacturers in Asia and Africa are engaged in expansion activities to increase the reach of their goods in untapped foreign markets. An FDA accreditation offers manufacturers an added advantage and competitive edge in the polyethylene (PE) wax market. Therefore, FDA approvals play a major role in the industry.

Polyethylene (PE) wax finds important application in coating and printing ink formulations and is added to a maximum level of approximately 0.25% to 2.0%. The product is highly used in paints, coating, and printing ink industries on account of its features including rub resistance, scratch & mark resistance, water repellency, and improved slip. They are applied as additives to every type of ink including lithographic, flexographic, letterpress, and gravure.

Technology Insights

The polymerization segment accounted for 53.5% of the volume in 2016 and is projected to grow at a high CAGR over the coming years. Huge demand for HDPPE wax in application segments such as plastics, printing inks, and adhesives contributed to the need for polymerization technology.

Polymerization is a technology used to obtain high density, and low density polymerized wax in the presence of catalysts mainly Ziegler-Natta. Modification technology is used to manufacture special monomer, oxidized and acid-modified products. The modification segment is projected to grow at the highest CAGR over the forecast period.

Acid-modified products are produced using polymerized and thermal cracked base. Low-density polyethylene, when treated at specific temperature-pressure conditions using thermal cracking technology, forms low-density cracked waxes. Merco Wax Company and Mitsui Chemicals, Inc. use thermal cracking technology.

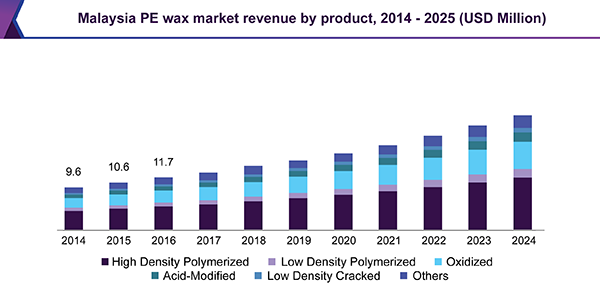

Product Insights

The high density polymerized segment accounted for the largest share in 2016. High density polymerized PE wax is widely used as a lubricant for plastics processing and in the textile industry. In metal processing, it prevents the melt from adhering to the hot metal surfaces of processing machinery and decomposing. The product offers low melt viscosity and shows compatibility with stabilizers, plasticizers, and lubricants.

Oxidized was the second largest product segment with a market share of 22.61%. The polyethylene (PE) wax market is expected to show the highest growth owing to opportunities in plastics, rubber, inks, coating, and masterbatches industries.

Low density polymerized PE wax acts as a matting agent and processing aid for hard to disperse pigments. The product also improves the gloss, smoothness, and water repellency of surfaces, thereby making plastic easier to process.

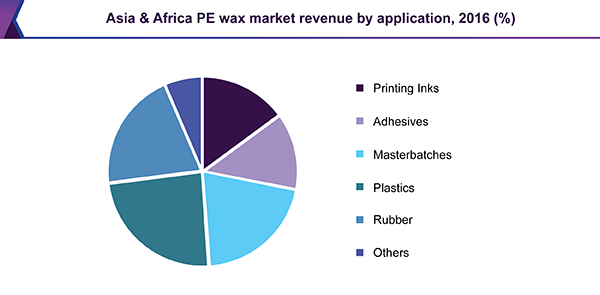

Application Insights

The plastics segment held the largest share in 2016, on account of the properties of the product for efficiently dispersing colorants and additives to produce high-quality products. It is also used in resin processing due to its excellent lubricating and release properties.

Masterbatches, a major application segment held the largest volume share. Young’s Wax, Savita, Yasuhara Chemical, and Liberty Chemicals are some of the company’s manufacturing products for masterbatches.

Polyethylene wax is also widely used in the manufacture of adhesives as it provides consistency and can be used to modify the hardness and viscosity of the product. The printing ink segment includes product usage in letterpress, lithographic, gravure, and flexographic printing. The waxes are used for dispersions in a wide variety of solvents such as oils, aliphatic & aromatics, glycols, and water.

Regional Insights

Asia Pacific is projected to grow at the highest CAGR and accounted for more than 90% of the revenue in 2016. Emerging economies such as Malaysia, Indonesia, and the rest of Southeast Asia are projected to witness strong economic growth over the coming years.

The growing demand for printing ink on account of the expanding packaging industry is expected to augment growth. A large number of manufacturers in the Asia Pacific region coupled will low raw material prices is anticipated to impact demand positively.

High growth in the plastics and color masterbatches segment is projected to propel demand over the coming years. The African region is expected to be influenced by positive trends observed in the plastics, packaging, printing ink, and adhesives sector.

Asia & Africa Polyethylene Wax Market Share Insights

Mitsui Chemicals, Inc., Nanjing Tianshi New Material Technologies Co., Ltd., EPChem International Pte Ltd., Sanyo Chemical Industries, Ltd., and SCG Chemicals Co., Ltd. are the prominent leaders in the industry.

Companies are placing importance on product and distribution expansion strategies. Companies such as Nanjing Tianshi New Material Technologies Co., Ltd. and SCG Chemicals have a broad product portfolio catering to specific end-use applications.

In December 2016, Brenntag acquired EPChem International Pte Ltd, one of the leading manufacturers in the Asia Pacific. This enabled EPChem to gain access to a wider distribution market. Nanjing Tianshi New Material Technologies Co., Ltd. Has an extensive product portfolio that caters to specific end-use applications.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in Kilo Tons, revenue in USD Million and CAGR from 2017 to 2025

Regional scope

Asia and Africa

Country scope

Australia, New Zealand, Malaysia, Indonesia, Thailand, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Asia & Africa polyethylene wax market on the basis of technology, product, application, and region:

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Polymerization

-

Modification

-

Thermal Cracking

-

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

High-Density Polymerized PE Wax

-

Low-Density Polymerized PE Wax

-

Oxidized PE Wax

-

Acid-Modified PE Wax

-

Low-Density Cracked PE Wax

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Printing Inks

-

Adhesives

-

Masterbatches

-

Plastics

-

Rubber

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Asia Pacific

-

Australia

-

New Zealand

-

Malaysia

-

Indonesia

-

Thailand

-

-

Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."