- Home

- »

- Medical Devices

- »

-

Asia Pacific Medical Device Cleaning Market Report 2021-2028GVR Report cover

![Asia Pacific Medical Device Cleaning Market Size, Share & Trends Report]()

Asia Pacific Medical Device Cleaning Market Size, Share & Trends Analysis Report By Device Type (Non-critical, Semi-critical, Critical), By Technique (Cleaning, Disinfection, Sterilization), By EPA Classification, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-459-7

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The Asia Pacific medical device cleaning market size was valued at USD 3.22 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.2% from 2021 to 2028. The increasing prevalence of Hospital-acquired Infections (HAIs) coupled with the unprecedented surge in COVID-19 cases has fueled the demand for medical device cleaning products in the Asia Pacific (APAC) region. The rising prevalence of surgical site infections, the introduction of technologically advanced products, and growing government initiatives for spreading awareness about hygiene and cleanliness are a few more factors contributing to the market growth.

According to the Worldometer data, around 54,768,360 COVID-19 cases were reported in the Asia Pacific countries, on June 23rd, 2021. Out of which, 1,829,004 were active while over 772,816 were the deaths recorded in the region. This exponential rise has driven the companies to develop effective products which are majorly utilized by laboratories and hospitals for the cleaning of medical devices and equipment to avoid cross-contamination. Sterilization products such as ethylene oxide and heat sterilizers, or cleaning products such as detergents, alcohol, aldehydes, and chlorine compounds are expected to witness high demand in the region. The high focus on the proper sanitization of equipment and surroundings has tremendously boosted the use of medical device cleaning products in hospitals, diagnostic laboratories, clinics, pharmaceutical manufacturing units, and the biopharmaceutical industry. These factors are projected to contribute to the growth of the Asia Pacific medical device cleaning market.

Pneumonia, bloodstream infection, Urinary Tract Infections (UTIs), surgical site infections, and Methicillin-Resistant Staphylococcus Aureus (MRSA) infections are some of the major Hospital-acquired Infections (HAIs). Thus, the increase in the prevalence of healthcare-acquired infections due to the contaminated instruments and the lack of preventive measures is another major factor expected to propel the market growth over the forecast period. In the region, HAIs are among the major causes of death in hospitalized patients. As per the healthcare-associated infections fact sheet by the World Health Organization (WHO), the risks of HAIs in the developing countries have been estimated to be two to 20 times higher than in developed countries, with up to 25% of hospitalized patients reported to have acquired infections in the APAC region. Such cases are expected to drive the demand for disinfectants and sterilization products in Asia pacific hospitals.

Moreover, the rise in the Research and Development (R&D) activities has increased the demand for various sterilization processes in the pharmaceutical and biotechnology industries. Sterilization of pharmaceutical manufacturing equipment and packaging is essential to kill all forms of microbial life. Terminal sterilization is the process of sterilizing a product in its final container to ensure the product remains sterile. For instance, a renowned company in China-Tuttnauer-is involved in manufacturing pharmaceutical autoclaves that are custom-built to meet the requirements of pharma companies. Such pharmaceutical autoclaves have common applications such as sterilization of sealed liquid, sealed ampoule/vials, prefilled syringes, and sealed contact lenses. These factors are anticipated to increase the application of sterilization equipment, thereby boosting the market growth.

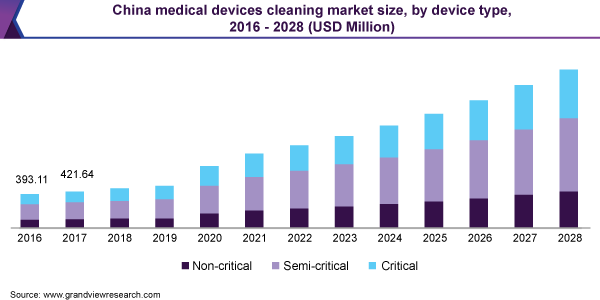

An upsurge in the incidence of diabetes, cancer, and other chronic and autoimmune diseases, is contributing to the growth of the market in China. According to the International Diabetes Federation, in 2019, over 116 million people (10.9% of the adult population) in China had diabetes. Diabetic patients often develop severe Urinary Tract Infections (UTIs) requiring consistent treatment, thus widening the growth prospects of the infection control market. These factors show the high clinical urgency to prevent surgical site infection and adopt personal protective equipment. This results in a significant increase in the growth of the medical device cleaning market in the country. Moreover, growing government focus on the healthcare sector, accelerated economic growth in the country, rising prevalence of infectious diseases, including COVID-19; and the initiatives taken to enhance sterilization and cleaning of medical devices are the factors expected to accelerate the market growth over the forecast period.

Moreover, the increase in the prevalence of surgical site infections is anticipated to boost the demand for infection control equipment. As per the research published in the National Institution of Health (NIH), 40% to 60% of infections were estimated to be Surgical Site Infections (SSIs). It has been observed that consistent implementation of infection control and prevention measures have resulted in a significant decline in the number of HAIs cases, and the scenario is likely to improve in the forthcoming year if these measures are implemented at the same pace. As per the National and State Healthcare-Associated Infections Progress Report (CDC) published in 2016, there has been a significant decrease in central line-associated bloodstream infections between 2008 and 2016. It was also observed that there has been a 17.0% decline in SSI. Thus, various healthcare facilities are adopting sterilization methods and programs to provide a safe environment to patients and other healthcare workers and as a result, reducing the occurrence rate of infectious diseases.

Device Type Insights

The semi-critical device type segment dominated the market with a revenue share of 46.26% in 2020. Devices in this category include those that are exposed to the mucus membrane, for example, dental equipment, endoscopes, and some surgical instruments. These devices usually need sterilization before use, mostly using heat or chemical methods as the frequency of sterilization required is high. When these sterilization methods are not utilized, disinfectants approved and registered with the United States Environmental Protection Agency (U.S. EPA) are recommended. These include glutaraldehyde, ortho-phthalaldehyde, hydrogen peroxide, and peracetic acid. Since the quantity and frequency of materials and equipment used for reprocessing of semi-critical devices are higher than the other types of devices, therefore, fueling the segment growth.

The critical device type segment is expected to expand at the highest CAGR of 11.42% from 2021 to 2028. This segment includes devices that pierce body tissues; therefore, they are required to be sterilized before packaging and most of them are disposable devices. Ethylene Oxide (EtO) and heat sterilization are widely used methods in hospital settings to disinfect most medical devices and related products. Similar to semi-critical devices, increasing adoption of disposable devices has reduced the need for cleaning, sterilizing, and disinfecting the critical devices, which are expected to hinder the market growth over the forecast period.

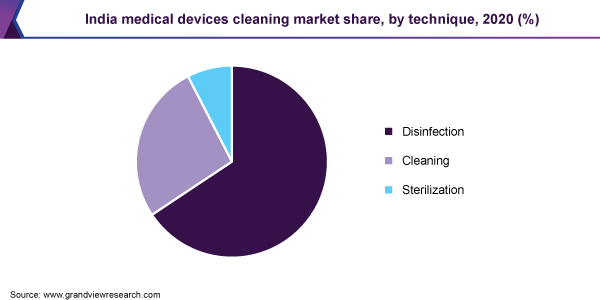

Technique Insights

Among the three techniques for reprocessing medical devices, the disinfection segment captured the largest revenue share of 57.40% in 2020. Disinfection is an important step in reprocessing semi-critical and critical medical devices. The disinfectants used in this step are generally categorized as fungicidal, bactericidal, and virucidal. The selection of these materials generally depends on the type of medical equipment. However, the selection of such materials for processing of devices such as endoscopes is difficult for example, decisions regarding the selection of method-sterilization or high-level disinfection. Availability of a wide range of disinfectants specific to various medical devices is an important factor boosting the segment growth. The disinfection segment is further sub-segmented into chemical, metal, ultraviolet, and others.

Moreover, the sterilization segment is expected to register the highest CAGR of 11.52% from 2021 to 2028. Sterilization includes the removal of any microorganism from medical devices. Out of the various methods used for sterilization of medical devices, steam sterilization and EtO sterilization methods are mostly employed in hospital settings. The introduction of surgical devices made of materials other than stainless steel has led to the need for finding alternatives for heat sterilization. Trends of forming central sterile services department (Sterile processing department) are driving the demand for the advanced sterilization equipment to optimize time and money required in the process.

EPA Classification Insights

The intermediate level segment held the largest revenue share of 52.35% in 2020. Intermediate level disinfectant is the chemical agent that is tuberculocidal and kills the disease-producing microbes. Some of the most common types of intermediate-level disinfectants used are water-based phenolics, quat and alcohol blends, bleach, and hydrogen peroxide blends. The increasing prevalence of hospital-acquired infections and infectious diseases are contributing to the growth of the segment.

The high-level segment is expected to expand at the highest CAGR of 11.81% from 2021 to 2028. High-level disinfection refers to the treatment of dental instruments and medical devices for inhibiting microorganisms. High-level disinfection refers to the reprocessing of heat-sensitive semi-critical medical devices and dental instruments. Semi-critical devices contact non-intact skin or mucous membranes. Some of the most common high-level disinfectants are glutaraldehydes, special hydrogen peroxide, and special peracetic acid products.

Country Insights

China dominated the overall regional market with a revenue share of 22.21% in 2020 owing to the high consumption of innovator brands in this country. Moreover, the presence of high patient disposable income and healthcare expenditure is expected to drive market growth during the forecast period. The presence of domestic players offering products at low rates than international players is also expected to drive the market. The local presence of major device manufacturers, such as Tuttnauer and Ningbo Scientz Biotechnology Co., Ltd, and outsourcing players, such as Synergy Health and Matachana Group is another key parameter supporting the market growth.

However, India is expected to register the highest CAGR of 12.3% from 2021 to 2028. India, being a developing country, offers new investment opportunities to the global market players. Increasing patient pool and developing healthcare infrastructure are driving the demand for advanced medical devices in the country. The government of India has been actively investing in the improvement of healthcare services to offer safer healthcare facilities to people. Moreover, with the rising awareness regarding various preventive measures to control the spread of deadly diseases, the market in India is estimated to have a substantial CAGR over the forecast period.

Key Companies & Market Share Insights

Some of the key players that dominated the market in 2020 include Steris plc, Getinge AB, Advanced Sterilization Products, The Ruhof Corporation, Sterigenics International LLC, Biotrol, Sklar Surgical Instruments, Oro Clean Chemie AG, Metrex Research, LLC, and Cantel Medical Corporation. The companies stress R&D activities to develop technologically advanced products for strengthening their product portfolio as well as gaining a competitive edge. For instance, in April 2020, the U.S. FDA approved the use of Steris V-PRO 1 Plus, maX2, and maX low-temperature sterilization systems for decontamination of around 750,000 N95 respirators and similar masks each day in hospitals used for treating the COVID-19 patients. This may increase the goodwill of the company.

The leading players are adopting strategies such as mergers and acquisitions and collaborations targeting to fortify their product portfolio, manufacturing capacities, and provide competitive diversity. For instance, in April 2019, Fortive Corporation acquired Johnson & Johnson's Advanced Sterilization Products business (a division of Ethicon, Inc.) for a total value of around USD 2.8 billion. Thus, infection prevention-related product portfolio would be marketed under Fortive. Similarly, in February 2020, Nordion, Inc. and Westinghouse Electric Company signed a contract to develop advanced isotope production technology which would allow Cobalt-60 to be produced in Pressurized Water Reactors. Through this alliance, both the companies will bolster the supply of Cobalt-60. This product plays an important role in reducing pathogens in food and other products as well as decontamination of medical devices. Some of the prominent players operating in the Asia Pacific medical device cleaning market are:

-

Steris plc.

-

GetingeAB

-

Advanced Sterilization Device Types

-

The Ruhof Corporation

-

Sklar Surgical Instruments

-

Sterigenics International LLC

-

Biotrol

-

Metrex Research, LLC

-

Oro Clean Chemie AG

-

Cantel Medical Corporation

Asia Pacific Medical Device Cleaning Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.87 billion

Revenue forecast in 2028

USD 8.12 billion

Growth Rate

CAGR of 11.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, technique, EPA classification, country

Country scope

China; India; Japan; Indonesia; South Korea; Thailand; Malaysia; Singapore; Australia; Philippines

Key companies profiled

Steris Plc; Getinge AB; Advanced Sterilization Device Types; Ruhof Corporation; Sklar Surgical Instruments; Sterigenics International; Biotrol; Metrex Research; Oro Clean Chemie AG; Cantel Medical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this report, Grand View Research has segmented the Asia Pacific medical device cleaning market report based on device type, technique, EPA classification, and country:

-

Device Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Non-critical

-

Semi-critical

-

Critical

-

-

Technique Outlook (Revenue, USD Million, 2016 - 2028)

-

Cleaning

-

Detergents

-

Buffers

-

Chelators

-

Enzymes

-

Others

-

-

Disinfection

-

Chemical

-

Alcohol

-

Chlorine and Chlorine Compounds

-

Aldehydes

-

Phenolics

-

-

Metal

-

Ultraviolet

-

Others

-

-

Sterilization

-

Heat sterilization

-

Ethylene Dioxide (ETO)

-

Others

-

-

-

EPA Classification Outlook (Revenue, USD Million, 2016 - 2028)

-

High Level

-

Intermediate Level

-

Low Level

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

Asia Pacific

-

Japan

-

China

-

Indonesia

-

South Korea

-

Thailand

-

Malaysia

-

Singapore

-

Australia

-

Philippines

-

-

Frequently Asked Questions About This Report

b. Among the three techniques for reprocessing medical devices, the disinfection segment captured the largest revenue share of 57.40% in 2020 in the APAC medical devices cleaning market.

b. The intermediate level segment held the largest revenue share of 52.35% in 2020 in the APAC medical devices cleaning market.

b. China dominated the overall APAC medical devices cleaning market with a revenue share of 22.21% in 2020 owing to the high consumption of innovator brands in this country.

b. The APAC medical devices cleaning market size was estimated at USD 3.22 billion in 2020 and is expected to reach USD 3.87 billion in 2021

b. The APAC medical devices cleaning market is expected to grow at a compound annual growth rate of 11.2% from 20201 to 2028 to reach USD 8.12 million by 2028

b. The semi-critical device type segment dominated the APAC medical devices cleaning market with a revenue share of 46.26% in 2020.

b. Some of the key players operating in the APAC medical devices cleaning market include Steris plc, Getinge AB, Advanced Sterilization Products, The Ruhof Corporation, Sterigenics International LLC, Biotrol, Sklar Surgical Instruments, Oro Clean Chemie AG, Metrex Research, LLC, and Cantel Medical Corporation.

b. Key factors that are driving the APAC medical devices cleaning market growth include the rising prevalence of surgical site infections, the introduction of technologically advanced products, and growing government initiatives for spreading awareness about hygiene and cleanliness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."