- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Recycled Plastics Market Size Report, 2019-2025GVR Report cover

![Asia Pacific Recycled Plastic Market Size, Share & Trends Report]()

Asia Pacific Recycled Plastic Market Size, Share & Trends Analysis Report By Source (Plastic Bottles, Plastic Films, Polymer Foam), By Type (PE, PET, PP, PVC, PS), By Application, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-169-6

- Number of Pages: 81

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Bulk Chemicals

Industry Insights

The Asia Pacific recycled plastic market size was estimated at USD 1.7 billion in 2018 and is expected to exhibit a CAGR of 6.4% over the forecast period. Rising environmental concerns and increasing use of recycled plastics in various applications are expected to significantly fuel market growth.

The use of recycled plastics reduces the amount of waste that goes into landfills, helps in conservation of natural resources & energy, and prevents pollution. As a result, end-use industries, such as building & construction, packaging, electrical & electronics, textiles, and automotive, are more inclined toward the adoption of recycled plastics.

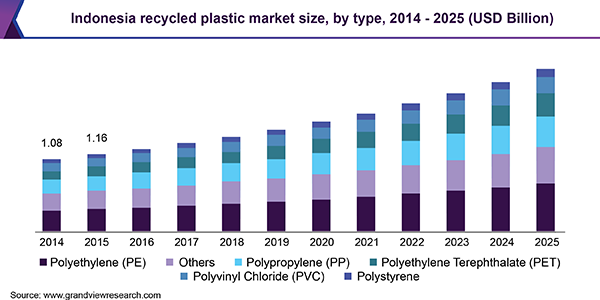

Stringent regulations for recycling plastics in China, the country that once contributed to the maximum share of plastics recycled in the world, are driving the manufacturers of recycled plastics to shift their facilities to Indonesia, thereby contributing to increased production and consumption in the country. With the growing purchasing power and disposable income in the country, automotive, building & construction, and packaging industries are anticipated to drive the product demand over the forecast period, owing to the ability of plastic to replace the conventional metal and wooden parts in vehicle. The development of residential, industrial, commercial, and public infrastructure is further aiding the market growth in the country.

However, waste collection and separation are anticipated to be among the major challenges for the market players over the forecast period. Growing use of plastics as a packaging material is one of the major issues of solid waste disposal. The management of plastics bottles and related products is tedious, and it is not entirely possible to recycle all waste in an eco-friendly manner. The separation of different types of waste is complex and requires several processes, which may further need more labor and energy.

Most of the waste collection and recycling programs face the problem of materials and waste quality, as different types of plastic wastes are discarded together. Hazardous wastes are also sometimes dumped in landfills. Contamination in landfills worsens when electronics, metals, and chemicals are mixed in the recycling system. The removal of metal and electronic wastes is difficult and deters potential buyers from purchasing recycled materials.

Source Insights

Based on source, plastic bottles was the dominant segment in 2018, in terms of both volume and revenue. Plastics bottles are the major sources of recycled products as they are used in various applications across industries for packaging strong medicines, oils, water, and carbonated drinks. Polindo Utama, KK Asia Pte Ltd., SAMKI GROUP, and Chemco Group are some of the manufacturers engaged in manufacturing recycled plastic bottles in the region.

Plastic foam is one of the prominent source segments as the foam is frequently used in packaging. Expanded polystyrene is the most common type of recycled plastic foam. Automobile and electrical manufacturers such as Panasonic Corporation; Sanyo Electric Co., Ltd.; Hitachi, Ltd.; and Honda Motor Company Ltd. are moving toward adoption of recycled plastics foam over virgin plastics.

The others segment includes flexible and rigid packaging. Rigid packaging includes expanded polystyrene packaging, crates, and containers. These products are made from different types of plastics including PET, PP, PE, and PS. Flexible packaging includes strapping. Hospitals, caterers, agriculture, and FMCG are some of the major contributors to these recyclable plastic sources.

Type Insights

On the basis of type, the market has been segmented into polyethylene, polypropylene, polyethylene terephthalate, polyvinyl chloride, polystyrene, and others. Polyethylene was the dominant type segment in 2018. The segment is estimated to maintain its dominance over the forecast period owing to the huge demand for PE in production of reusable bags, toys, agriculture films, housewares, milk bottles, shampoo bottles, containers, food packaging films, trays, and toys. In addition, properties such as excellent resistance to solvents, high tensile strength, toughness, flexibility, and relative transparency are fueling the demand for PE in the market. Polyethylene further includes high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

Polypropylene segment is anticipated to witness significant growth over the forecast period. Recycled polypropylene is majorly used in automotive industry for construction of interior parts such as battery cases, signal lights, battery cables, broom and brushes, ice scrapers, and oil funnels, among others. Properties of polypropylene such as low moisture vapor transmission, excellent optical clarity in biaxially oriented films & stretch blow molded containers, and chemical and electrical resistance are further propelling its demand in recycled plastics market. Moreover, it is also used to produce garden rakes, storage bins, shipping pallets, and trays.

Application Insights

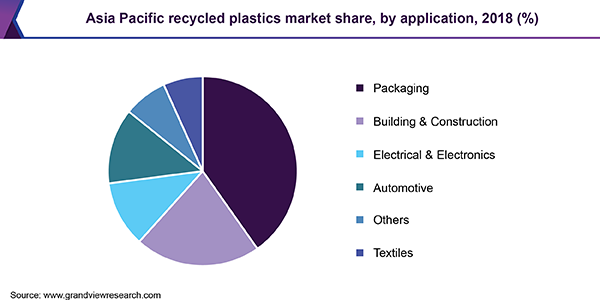

Based on application, the market is segmented into packaging, building & construction, electrical & electronics, textiles, and others. Packaging was estimated as the largest application segment in 2018 and is projected to maintain its dominance over the forecast period. Recycled plastics are extensively used in packaging applications such as food and non-food containers, beverage bottles, personal care products, household care products, and film & sheets. PET, PP, PE, and PS are some of the major recycled plastics used for packaging. Inclination of consumers toward sustainable packaging and increasing landfill issue in the region are compelling manufacturers to adopt recycled plastics for packaging.

Electrical & electronics segment is one of the key contributors to the growth of Asia Pacific recycled plastics market. Several products such as mobile phones, laptop, video game consoles, cameras, camcorders, and computers are made from recycled plastics.

Increasing initiatives from manufacturers toward reducing carbon footprint are expected to significantly drive the market growth. For instance, in January 2019, Samsung Electronics, one of the leading electronics manufacturers, announced its plan to replace virgin plastics with recycled & bio-based plastics and paper for packaging. Further, the company also aims to use 500 thousand tons of recycled plastics and collect 7.5 million tons of discarded products by 2030. Building & construction is anticipated to be one of the prominent application segments. Recycled products, such as composite lumber, roofing tiles, insulation, rocks, and fences, among others, are widely used in building & construction industry owing to rising environmental concerns among consumers.

Country Insights

Rest of Asia Pacific was the largest segment occupying over 32.7% of the revenue share in 2018, followed by China and India. India is projected to account for a significant share of the overall market, during the forecast period on account of ascending product demand from the key application industries such as packaging, automotive, and construction. For instance, according to The Organisation Internationale des Constructeurs d'Automobiles (OICA), the automobile production in India reached 5.1 million units in 2018, up from 4.7 million units in 2017. Thus, the growing production of automobiles in the country is anticipated to generate huge demand for the product over the next seven years. In addition, rising environmental concerns among consumers coupled with the government policies such as “Swachh Bharat mission” are anticipated to fuel the product demand in the country during the forecast period.

Asia Pacific Recycled Plastic Market Share Insights

The market is fragmented in nature with presence of various small-sized and medium-sized players such as Plastipak Holdings, The Shakti Plastic Industries, Imerys S.A., Green Line Polymers, SUEZ, and Veolia.

Companies operating in the market lay high emphasis on expanding their operational footprints in developing economies as an attempt to drive their revenues. Market players are expanding their services in emerging countries such as India, China, Japan, and South-East Asian countries where the construction, automotive, electrical & electronics, and packaging industries are growing significantly, owing to an increase in disposable income and purchasing power. Thus, growing application industries in Asia Pacific region are expected to provide new expansion opportunities to the key players over the forecast period.

Developments in the field of electric vehicles, wherein recycled products are likely to have a high potential, in terms of replacing the conventional metal parts in order to lower the automotive weight and thereby improve the efficiency and performance, are anticipated to offer growth opportunities to key players. In addition, the regional players have knowledge about local competition and product demand, which gives them a competitive edge over other players. Therefore, key players are focusing on strengthening their positions in the emerging countries through different geographical expansion strategies.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million & CAGR from 2019 to 2025

Country scope

China, India, Indonesia, Thailand, Vietnam, Philippines, Rest of Asia Pacific

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the Report

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Asia Pacific recycled plastic market report on the basis of source, type, application, and country:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polystyrene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Building & Construction

-

Packaging

-

Electrical & Electronics

-

Textiles

-

Automotive

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

China

-

India

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

Rest of Asia Pacific

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."