- Home

- »

- Digital Media

- »

-

Asia Pacific Video Streaming Market Size, Share Report, 2030GVR Report cover

![Asia Pacific Video Streaming Market Size, Share & Trends Report]()

Asia Pacific Video Streaming Market Size, Share & Trends Analysis Report By Streaming, By Solution, By Platform, By Service, By Revenue Model, By Deployment, By User, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-394-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The Asia Pacific video streaming market size was estimated at USD 22.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.5% from 2023 to 2030. Increased adoption of novel technologies such as blockchain and artificial intelligence to improve video streaming is expected to boost the market’s growth prospects over the forecast period. Furthermore, the growing adoption of cloud-based video streaming solutions for increasing video content reach is directly influencing the market’s growth. This trend is observed in numerous countries of the Asia Pacific region.

Cost reduction and innovations in the delivery of video services are also projected to play a marginal role in fueling the market’s growth over the forecast period. To address the lack of digital connectivity in the industry, market leaders are focusing on improving coverage in areas lacking basic infrastructure. Resultantly, developing countries in the Asia Pacific region are expected to experience rapid adoption of video services on mobile computing devices.

High-speed internet technologies provide easy access to any form of video content on different networking platforms. Social media platforms such as Facebook, FaceTime, Google Hangout, Instagram, and Reddit provide easy access to videos and real-time entertainment services. The rising user base of these platforms also serves as a driver for video streaming services and is likely to work well in favor of the Asia Pacific video streaming market in the next few years. These trends have also led to a notable rise in the production of on-demand content services and are expected to drive the growth of the regional video streaming market.

The growing use of smartphones with high-speed internet technologies such as 4G, and LTE has led to the increased consumption of digital data. A study by GSMA Intelligence suggests that mobile subscribers in the region are projected to increase by 400 million between 2022 and 2030, reaching a total of 2.11 billion. Furthermore, the Asia Pacific region is expected to achieve approximately 1.4 billion 5G connections by the close of 2030. This growth is attributed to the decreasing cost of 5G devices, the swift expansion of network coverage in numerous countries, and the collaborative efforts of governments to seamlessly integrate mobile-enabled technologies.

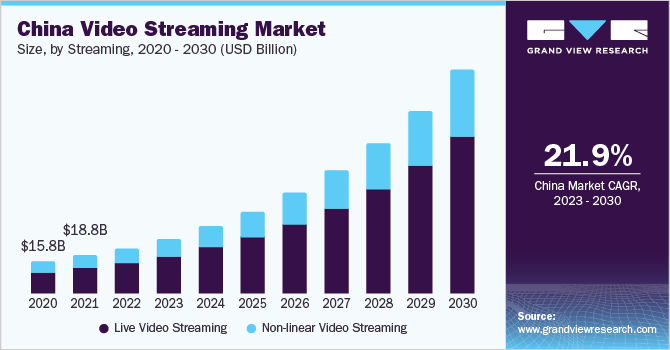

Streaming Insights

The live video streaming segment dominates the market, with a revenue share of 63.6% in 2022. Live video allows creators and brands to engage with their audience in real-time, fostering a sense of immediacy and connection that on-demand content might not offer to the same extent. This factor is anticipated to bode well for the growth of the segment. Live streaming is often used to cover events, conferences, sports matches, and other time-sensitive occurrences, offering audiences a way to virtually attend and experience these events as they happen.

The non-linear video streaming segment is expected to grow at a CAGR of 21.6% from 2023 to 2030. The several advantages associated with non-linear video streaming solutions and services, such as the flexibility of watching the video anytime, video recording capability, and convenience of series linking, are expected to drive the demand for non-linear video streaming over the forecast period. Furthermore, leading streaming service providers in Asia are trying to establish their foothold in countries such as India through economic plans and offers.

Solution Insights

The OTT segment dominates the market, with a revenue share of 44.5% in 2022. OTT stands for Over the Top, a service platform that delivers film and TV content through the internet, without requiring the users to subscribe to a traditional cable service or Pay TV services. Pay-TV, also known as subscription television or premium television, is a subscription-based television service that delivers content through analog or digital cable. The factor propelling the market's growth is the rising number of subscribers of the service in the region. The OTT segment is also estimated to expand at a faster pace as compared to other segments over the forecast period.

The OTT segment delivers film and TV content through the Internet without needing a traditional cable or Pay TV service subscription. Video streaming OTT services are gaining popularity in various end-use industries such as education, healthcare, and gaming. For instance, the rising subscribers of Netflix and OTT service providers such as subscription-based digital content providers such as Spotify and YouTube have also contributed significantly to the growth of audio and video streaming services in the region. Furthermore, the increasing demand for improved automation of business processes and the wide availability of broadband infrastructure is expected to drive the growth of the OTT segment over the forecast period.

Platform Insights

The smartphones & tablets segment dominates the market, with a revenue share of 31.9% in 2022. The factor attributed to the segment growth is the substantial growth in the number of subscribers that use smartphones & tablets as a platform for streaming videos. The fact that India and China have the world’s largest smartphone and internet user base also favors the smartphones & tablets segment. Moreover, as mobile internet connectivity improves, users can seamlessly stream high-quality content on their devices, further promoting the dominance of this segment.

The gaming consoles segment is expected to grow with the fastest CAGR of 22.5% from 2023 to 2030. Gaming consoles are increasingly being integrated with streaming services, allowing users to access video content directly from their consoles. This convergence of gaming and streaming can attract a broader user base and drive growth in the gaming consoles segment. Moreover, modern gaming consoles often serve as all-in-one entertainment hubs, offering access to video streaming platforms alongside gaming experiences. This can make consoles more appealing to a wider audience, including those who primarily seek streaming content.

Service Insights

The training & support segment dominates the market, with a revenue share of 38.2% in 2022, and is estimated to remain the leading segment over the forecast period. This can be attributed to Asia Pacific being one of the top outsourcing destinations for several industries. Also, industries such as IT, telecom, BFSI, and healthcare have witnessed a steady rise in countries such as India, China, and Japan over the years. The resultant rise in the number of employees in these industries and the need for effective training programs will likely drive the segment.

Enterprises face multiple challenges while training employees and employ a variety of mediums to make training programs more engaging and effective. For this, organizations use live-streaming videos in their corporate training programs. Live-streaming content lends authenticity and enables more effective interaction with the audience, thus helping retain their attention and facilitating an enhanced training experience. Thus, the growing use of videos for corporate training is boosting the growth of the use of video streaming in the training & support service segment.

Revenue Model Insights

The subscription segment dominated the market, with a revenue share of 45.8% in 2022.The subscription segment, often called Subscription Video on Demand (SVOD), was a significant and growing player in the Asia Pacific video streaming market. SVOD services like Netflix, Amazon Prime Video, Disney+, and local platforms offered users access to a wide range of content for a recurring subscription fee. These services gained popularity due to their convenience, extensive content libraries, and the ability to stream on-demand across various devices. Many consumers in the APAC region were opting for SVOD platforms over traditional Pay TV due to the flexibility and personalized viewing experience they offered.

There is a growing demand for connected devices and consumer electronics that support digital media and high-speed internet technologies, allowing consumers to access video content anywhere across the globe. An access fee or a subscription is often required for online video streaming. For example, Netflix offers various subscription programs for streaming videos online. The subscription model offers access to a wide range of video content, including exclusive series. Therefore, the rising number of subscription-based services in the region is expected to lead to growth opportunities for the segment.

Deployment Insights

The cloud segment held the largest revenue share of 61.7% in 2022 and is estimated to remain dominant over the forecast period as well. The cloud segment is expected to witness steady growth owing to the benefit of convenience offered in watching videos and the growing need for original content. With the rising number of internet users in the Asia Pacific region, governments of different countries are collaborating with international organizations such as the International Telecommunication Union (ITU) and Global System for Mobile Communications (GSMA) to improve internet connectivity and increase the use of cloud-based applications, including video streaming. Such initiatives are expected to contribute positively to the cloud segment.

Certain enterprises and organizations with specific security and compliance requirements might still opt for on-premises solutions to have more control over their infrastructure and data. Even within the on-premises segment, CDNs could have played a role in optimizing content delivery. These networks help reduce latency and improve the streaming experience for viewers. While cloud-based streaming has been gaining momentum, some companies might choose hybrid solutions that combine on-premises infrastructure with cloud capabilities. This approach can provide a balance between control and scalability.

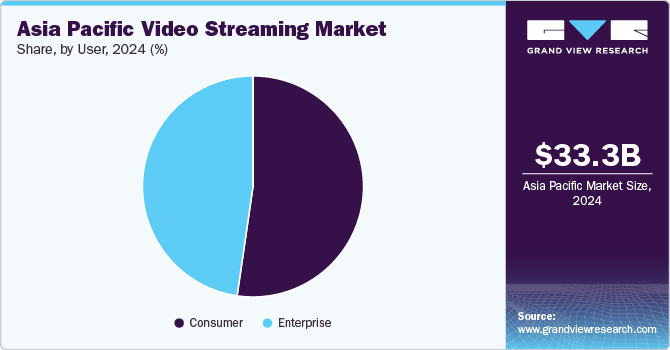

User Insights

The consumer segment dominates the market, with a revenue share of 52.6% in 2022. The consumer segment, which refers to individual viewers or households, was indeed a dominant force in the APAC video streaming market. The rise of consumer-focused streaming platforms and services, both global and local, contributed to this dominance. Platforms like Netflix, Amazon Prime Video, Disney+, and various regional players catered to consumers’ preferences by offering a wide range of content choices, convenience, and personalized viewing experiences.

The enterprise segment is expected to grow with the fastest CAGR of 22.9% from 2023 to 2030. The segment growth factor is that businesses increasingly use video streaming platforms for employee training, communication, and collaboration. As businesses realize the effectiveness of video for conveying information and conducting remote training sessions, the demand for enterprise-focused video streaming solutions may rise. Moreover, the rise of remote work and virtual events has led to a surge in demand for webinars, conferences, and virtual meetings. Enterprises may rely on video streaming platforms to host and broadcast such events to a wider audience.

Country Insights

China dominated the market, with a revenue share of 27.3% in 2022, owing to the country's high subscriber base of video streaming platforms.Companies like Tencent Video, iQiyi Inc., and Youku Tudou were some of the major players in China's video streaming industry, offering a wide range of content, including movies, TV shows, original programming, and more. These platforms were not only catering to domestic audiences but were also venturing into international markets. India and South Korea are expected to emerge as the leading countries in terms ofthecountry's high subscriber base of video streaming platforms in the region.

Liberalization of the telecom sector, the subsequent flow of substantial investment from mobile operators, and the competitive costs of several video streaming services are projected to drive market growth in the Asia Pacific region. Companies such as Tencent, Baidu, and Alibaba, which are some of the leading market players in the television industry in China, are investing millions to create new content. However, Chinese content is in the early stages of global distribution. Therefore, the high cost of content creation could hamper the overall growth of the video streaming market.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is on developing new products and collaboration among the key players due to the changing requirements of the armed forces worldwide. For instance, In November 2022, CDNetworks established strategic partnerships with multiple Asia-based OTT platforms. This collaboration enabled seamless live streaming and video-on-demand services for the World Cup 2022, effectively catering to the streaming needs of millions of CDNetworks' B2B clientele. Some prominent players in the Asia Pacific video streaming market include:

-

Akamai Technologies

-

Amazon.com Inc.

-

Baidu Inc.

-

Brightcove Inc.

-

Comcast Corporation

-

Google LLC

-

Hulu

-

Kaltura Inc.

-

Netflix Inc.

-

Roku

-

Tencent Holdings Limited

-

Youtube

Asia Pacific Video Streaming Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.31 billion

Revenue forecast in 2030

USD 112.89 billion

Growth rate

CAGR of 22.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Market revenue in USD billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Streaming, solution, platform, service, revenue model, deployment, user, country

Country scope

China; Japan; India; South Korea; Australia

Regional scope

Asia Pacific

Key companies profiled

Akamai Technologies; Amazon.com Inc.; Baidu Inc.; Brightcove Inc.; Comcast Corporation; Google LLC; Hulu; Kaltura Inc.; Netflix Inc.; Roku; Tencent Holdings Limited; Youtube

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Video Streaming Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific video streaming market report based on streaming, solution, service, platform, revenue model, deployment, user, and country:

-

Streaming Outlook (Revenue, USD Billion, 2017 - 2030)

-

Live Video Streaming

-

Non-linear Video Streaming

-

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Internet Protocol TV

-

Over the Top (OTT)

-

Pay-TV

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gaming Consoles

-

Laptops & Desktops

-

Smartphones & Tablets

-

Smart TV

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consulting

-

Managed Services

-

Training & Support

-

-

Revenue Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Advertising

-

Rental

-

Subscription

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprise

-

Commercial

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific video streaming market size was estimated at USD 22.57 billion in 2022 and is expected to reach USD 27.31 billion in 2023.

b. The Asian Pacific video streaming market is expected to grow at a compound annual growth rate of 22.5% from 2023 to 2030 to reach USD 112.89 billion by 2030.

b. China dominated the Asia Pacific video streaming market with a share of 27.3% in 2022. This is attributable to the country's high subscriber base of video streaming platforms.

b. Some key players operating in the Asia Pacific video streaming market include Amazon Web Services, Inc.; Baidu Inc., Google Inc.; Microsoft Corporation; Netflix, Inc.; Tencent; iQIYI, Inc., among others.

b. Key factors that are driving the Asia Pacific video streaming market growth include the growing adoption of cloud-based video streaming solutions, and the increasing use of smartphones with high-speed internet technologies such as 3G, 4G, and LTE.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."