- Home

- »

- Clothing, Footwear & Accessories

- »

-

Athleisure Market Size, Share & Trend Analysis Report, 2030GVR Report cover

![Athleisure Market Size, Share & Trends Report]()

Athleisure Market Size, Share & Trends Analysis Report By Type (Mass Athleisure, Premium Athleisure), By Product, By End-user, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-350-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Athleisure Market Size & Trends

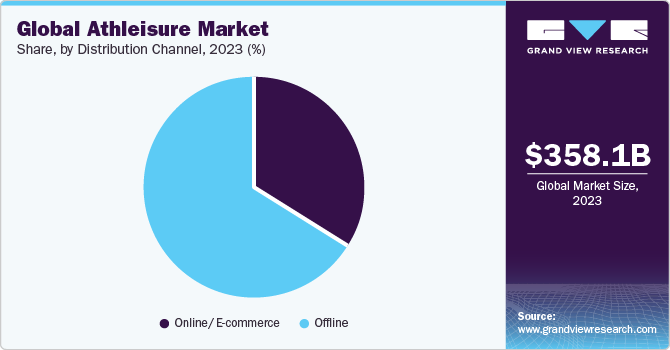

The global athleisure market size was valued at USD 358.08 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. Increased passion for sports and outdoor recreational activities among the country’s young population is predicted to fuel demand for athleisure gear. One of the primary aspects driving this trend is a rise in fitness & health consciousness, which is generating the demand for comfortable and fashionable clothes.

The COVID-19 pandemic has drastically altered the yoga landscape around the world. Yoga studios, gyms, health clubs, and other locations where in-person group yoga lessons were held were shut down or temporarily closed as a result of the lockdown measures. However, the shift from in-person sessions to online platforms supported the market growth.

Furthermore, several businesses concentrate on specific activewear product categories and prioritize customer satisfaction. Several businesses also offer tailored gear that is best suited to different types of customers, as well as professional advice to help customers choose the right product. Sustainability, a long-standing fashion trend, has made its way into the athleisure sector.

Consumers continue to find and invest in new items made of sustainable, durable, and high-quality materials, according to Forbes, and many firms are attempting to bridge the gap between fashion and innovative-functional designs. Gap, which owns both Old Navy and Athleta, is far from the only shop reaping the benefits of athleisure, which is more properly described as a category of clothes that can be worn for both sports activities and casual wear.

During the pandemic, customers were drawn to loungewear like leggings, pajama sets, and other comforting alternatives. The Old Navy store reshuffled its store layout to accommodate this trend, placing those items right at the door. Major companies are introducing new goods with stretchy fabric that can be worn on a run or to the supermarket to gain a higher market share.

Kohl’s unveiled its own activewear brand, FLX, in early 2021, while Target debuted All in Motion, a new workout label, earlier in 2020. People between the age group of 16 and 30 years are the most active athleisure consumers. As fitness is becoming more essential, a slightly older age group also forms a part of the target consumer base. The women’s athleisure products, in particular, have witnessed the most rapid growth.

Market Concentration & Characteristics

Integrating technology into athleisure wear is a rising trend. Smart fabrics with moisture-wicking properties, temperature regulation, and anti-bacterial features enhance performance and comfort. Additionally, some brands are incorporating sensors and wearable technology to track fitness metrics and provide real-time feedback to users.

Mergers and acquisitions are prevalent in the athleisure industry as companies seek to strengthen their market positions, expand their product portfolios, and gain access to new technologies and distribution channels.

For instance, in January 2024, U.S.-based Platinum Equity revealed its acquisition of Augusta Sportswear Brands (ASB) and Founder Sport Group (FSG). These companies serve as suppliers for team uniforms, off-field performance wear, and fan apparel in the youth and recreational sports markets.

Regulations in the athleisure market play a crucial role in ensuring product safety, quality, and compliance with standards across various industries. Athleisure brands need to adhere to trademark and intellectual property laws to protect their brand identity and designs. This includes registering trademarks for logos and brand names, as well as ensuring that designs do not infringe on existing patents or copyrights.

The potential threat of substitutes could drive athleisure brands to focus on innovation and differentiation. This creates a need to invest in unique designs, advanced technologies, or sustainable practices to set themselves apart and retain consumer loyalty. A shift in consumer demand towards substitutes may necessitate adjustments in the athleisure supply chain.

Type Insights

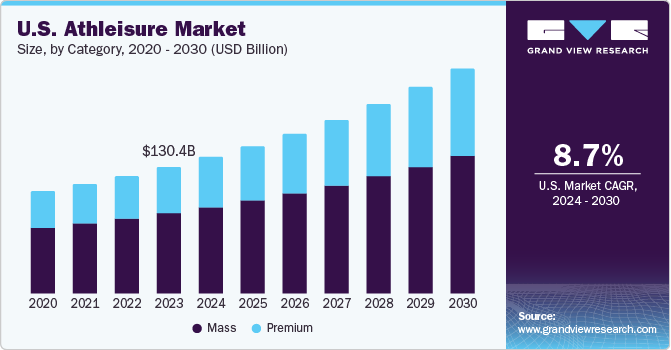

The mass athleisure market held the share of over 63% in the global athleisure market in 2023. Athletic-casual clothing is becoming more widely accepted for use in a range of social settings. Sports-inspired materials like spandex, Lycra, and other synthetic fibers are used in many of the garments that are today considered work-appropriate. More individuals are shopping online and purchasing products to pick up in person around the world, and both trends are anticipated to continue. Pandemic-induced lockdowns have also resulted in an increase in first-time e-commerce shoppers: 14% of U.S. customers and 17% of Chinese consumers purchased apparel online for the first time due to the pandemic-induced restrictions.

Premium athleisure market is estimated to grow at a CAGR of 9.7% from 2024 to 2030. Wellness has progressed from a niche lifestyle choice to a new status symbol and expression of personal beliefs that transcends many industries, from luxury travel to high-end beauty and fitness. Luxury fashion has been heavily affected by streetwear athleisure trends, which are motivated by current affluent consumers’ need to mix comfort and style. To tap into the booming athletic sector, luxury labels are launching new sporting items ranging from sneakers to leggings and gym accessories as luxury fashion options that are both comfortable and stylish are high in demand.

Product Insights

Shirts dominated the global market with the highest revenue share of around 31% in 2023. There is an increased demand for athleisure shirts as they integrate comfort and fashion. Product launches by leading brands such as Lululemon and Athleta in the segment have been contributing to its growth. This has encouraged many retailers to launch their own product lines to cater to the growing consumer demand. For instance, in January 2020, Target announced the launch of its own athleisure and activewear products, including shirts, shorts, and tracks made using sustainably typed materials. The shirts in this collection are available in a range of striking and bright prints.

The yoga apparel segment is projected to register the fastest growth rate of 11.0% from 2024 to 2030. The growing popularity of yoga, especially in developed countries such as the U.S., Canada, and the U.K., is expected to be the key factor driving the market. Increasing cases of lifestyle diseases and rising awareness about the health benefits of yoga are also boosting the demand for yoga athleisure and activewear. The growing prevalence of yoga as a mind-body fitness activity, particularly over the past few years, has led to an increasing number of yoga enthusiasts all over the world. According to The Good Body, as of December 2020, the number of yoga enthusiasts in the U.S. was around 36 million & 300 million globally.

Form Insights

Women’s athleisure held a revenue share of over 40% in 2023. The influx of regional and domestic brands solely dedicated to women’s clothing has been driving this segment. Some of the prominent regional players catering to this segment are No KA’OI, P.E. Nation, Lululemon, Sweaty Betty, Perfect Moment, and Olympia Activewear. Moreover, increasing participation of women in sports and fitness is likely to proliferate the segment growth.

According to the Sasakawa Sports Foundation (SSF), 72.4% of the total population in Japan participates in sports at least once a year. Moreover, close to 70% of the total women population in the country participate in sports at least once a year.

The children’s athleisure market is projected to grow at a CAGR of 10.1% from 2024 to 2030. The increasing participation of children in sports has significantly boosted the sales of sportswear and athleisure worldwide. Growing awareness about the harmful effects of obesity and the growing need to promote confidence in children has driven parents to keep their children engaged in various sports.

According to a report by The Aspen Institute, the percentage of children aged 6 to 12 years who engaged in team sports at least one day during a year increased from 55.5% in 2013 to 56.3% in 2018. Thus, it will drive the market for children's athleisure during the forecast period.

Distribution Channel Insights

Sales of athleisure through offline channels dominated the market with the highest revenue share of over 65% in 2023. Several stores also offer customized apparel best suited to varied customers and provide professional guidance to ensure customers choose the right products.

For instance, athleisure wear brand Lululemon’s Chicago store is not only a shopping outlet but also a 20,000 square feet flagship store that includes multiple fitness spaces and a café that offers breakfast bowls, smoothies, and more. These retail stores attract a large footfall of customers and are usually located in the center of the city area.

The online distribution channel segment is projected to register the fastest growth rate of 9.9% from 2024 to 2030. Moreover, celebrity collaborations can aid a brand’s discoverability, as celebrities frequently share products on social media channels, such as Instagram, which is a major platform for shops. Influencer marketing increased by 198% last year, and more than 70% of firms use Instagram influencers in their marketing initiatives. The fashion business is undergoing seismic shifts as a result of digital innovation, rapid globalization, and changes in consumer buying habits.

Regional Insights

North America dominated the athleisure market with the highest revenue share of over 30% in 2023. The North America athleisure market is driven by the increasing demand for stylish and comfortable sportswear. This trend is driven by the rising participation in outdoor and fitness activities such as camping, sports, and yoga in the region.

U.S. Athleisure Market

The athleisure market in the U.S. has witnessed an increase in demand of the athleisure products owing to rise in sports activities participation. As triathlon is one of the trending sports in the country, significant increase in sports participation is anticipated to drive the demand for sportswear over the forecast period, thereby favoring the market for athleisure.

The Asia-Pacific athleisure market is projected to grow at a CAGR of 10.3% from 2024 to 2030. Booming textile markets in countries such as China, India, Japan, Indonesia, Vietnam, and Bangladesh have resulted in the abundant availability of textiles and fabrics for athleisure wear, thereby boosting the adoption of athleisure wear in the region. The increasing focus on health and fitness, rising disposable income of consumers, and the expansion of international players in the region are also acting as major drivers for market growth.

India Athleisure Market

The athleisure wear market in India is characterized by the presence of several manufacturers, with local players dominating the market and offering athleisure products made from good quality fabrics such as recycled nylon and organic cotton. Thus, large product availability with greater options provided by small players is expected to drive market growth at a CAGR of over 11.0% from 2024 to 2030.

China Athleisure Market

The athleisure market in China is known to be the major textile producer as well as exporter, and is, therefore, one of the largest production hubs for sportswear, active wear, and athleisure wear. The presence of several manufacturers producing these apparels has resulted in the availability of a variety of product options for consumers in the country. The China athleisure market is projected to grow at a CAGR of 10.7% from 2024 to 2030.

Singapore Athleisure Market

The athleisure market in Singapore is projected to grow at a CAGR of around 11.0% during the forecast period. Owing to the country’s tropical climate, breathable fabrics, moisture-wicking technology, and UV protection features may become significant selling points for athleisure brands in the country.

Australia & New Zealand Athleisure Market

The athleisure market in Australia & New Zealand, owing to the country's diverse climate and the popularity of outdoor activities, such as hiking, running, and beach sports, contribute to the demand for comfortable and breathable activewear. Additionally, as people become more health-conscious, there is an increased focus on fitness and wellness.

Key Athleisure Company Insights

The global athleisure market is a highly competitive market owing to the presence of high concentration of international and players in the market. The key players in the market are adopting market strategies such as celebrity endorsements, new product launches, expansion of distribution channels, and mergers and acquisitions, in order to acquire a large customer base.

Key Athleisure Companies:

The following are the leading companies in the athleisure market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these athleisure companies are analyzed to map the supply network.

- Hanes Brands, Inc.

- Adidas AG

- Vuori

- PANGAIA

- Under Armour, Inc.

- Outerknown

- EILEEN FISHER

- Patagonia, Inc.

- Wear Pact, LLC

- Lululemon Athletica

Recent Developments

-

In May 2022, Under Armour announced the launch of the D2C platform, UnderArmour.com in India. The company aims to distribute its products and services through Underdog Athletics, its local distributor and master franchise in the country. The company is considering capitalizing on the success of its direct-to-consumer (DTC) business

-

In March 2022, Abercrombie & Fitch Co. announced the launch of a new activewear sub-brand called YPB. YPB is an acronym for “Your Personal Best” and is intended to inspire customers to achieve their full potential in various activities, such as running, stretching, lifting, and daily living. Through the launch, the company aims to expand its reach to millennials

-

In July 2022, Third Wind Performance, a company that specializes in athleisure clothing, expanded its range by offering six color options in leggings and sports bras, and five color options in Third Wind Definition shirts for both men and women

-

In February 2021, Puma SE launched five new lines of running products including Liberate, Velocity, Deviate, Deviate Elite and Eternity. The Deviate features two layers of lightweight NITRO combined with the carbon fiber innoplate

Athleisure Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 388.30 Billion

Revenue forecast in 2030

USD 662.56 Billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Singapore, Australia & New Zealand, Brazil, South Africa, UAE

Key companies profiled

Vuori; PANGAIA; Outerknown; lululemon athletica; HanesBrands Inc.; EILEEN FISHER; Patagonia, Inc.; Adidas AG; Wear Pact, LLC; Under Armor, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Athleisure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global athleisure market report based on type, product, end-user, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass

-

Premium

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Yoga Apparels

-

Tops

-

Pants

-

Shorts

-

Unitards

-

Capris

-

Others

-

-

Shirts

-

Leggings

-

Shorts

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global athleisure market size was estimated at USD 330.97 billion in 2022 and is expected to reach USD 358.08 billion in 2023.

b. The global athleisure market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 662.56 billion by 2030.

b. North America dominated the athleisure market with a share of 33.52% in 2022. This is attributable to the growing apparel & textile sector and the rising frequency of fashion events, most notably in the U.S. and Canada.

b. Some key players operating in the athleisure market include Lululemon Athletica, Inc.; Adidas AG; TPUMA SE; Nike, Inc.; HUMAN PERFORMANCE ENGINEERING; and Under Armour, Inc.

b. Key factors that are driving the athleisure market growth include increased passion for sports and outdoor recreational activities among the country's young population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."