- Home

- »

- Pharmaceuticals

- »

-

Attention Deficit Hyperactivity Disorder Market Size Report 2030GVR Report cover

![Attention Deficit Hyperactivity Disorder Market Size, Share & Trends Report]()

Attention Deficit Hyperactivity Disorder Market Size, Share & Trends Analysis Report By Drug Type (Stimulants, Non-stimulants), By Demographics (Children, Adults), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-795-7

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global attention deficit hyperactivity disorder market size was valued at USD 13.21 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The rising prevalence of ADHD across the globe is expected to contribute to market growth. According to the ADHD Institute, the estimated prevalence of the disease ranges from 0.1% to 8.1% in children and adolescents worldwide. The mean prevalence of attention deficit hyperactivity disorder in adults aged 18 to 45 years is approximately 2.8% in Asia, Europe, North America, and MEA.

Extensive research studies conducted by organizations to evaluate the safety and efficacy of drugs in patients with attention deficit hyperactivity disorder are expected to drive market growth soon. The positive outcomes of these studies open new opportunities in the market. According to the study published by Boston Children's Hospital in 2021, alpha-2-adrenergic agonists such as guanfacine & clonidine can be effective in lowering the symptoms of disease in children. Further, it showed that these medications have minimum side effects compared to other stimulants like amphetamines (Adderall, Vyvanse) and methylphenidate (Ritalin, Concerta), which are often used as first-line treatment for attention deficit hyperactivity disorder.

Increasing initiatives undertaken by key players for the promotion of products may open new avenues for business. For instance, Eli Lilly and Company under the Lilly Cares Foundations' patient assistance program provides Strattera (Atomoxetine) free of cost for one year to eligible patients for their treatments. The eligibility of the program includes U.S.-based non-insured patients with a physician-prescribed prescription. This program may boost the prescription rate for Strattera by encouraging physicians to prescribe this product to patients.

Various factors restraining the growth of the market are short-term and long-term adverse effects such as permanent damage of blood vessels of the brain and heart, lung, liver, & kidney as well as increased blood pressure leading to heart attack, stroke, and death. According to a study published by the University of Toronto in October 2021, the incidence of heart attack and stroke increased by 40% and 30% in ADHD patients after consumption of Ritalin and other stimulant drugs during an initial 30 days period.

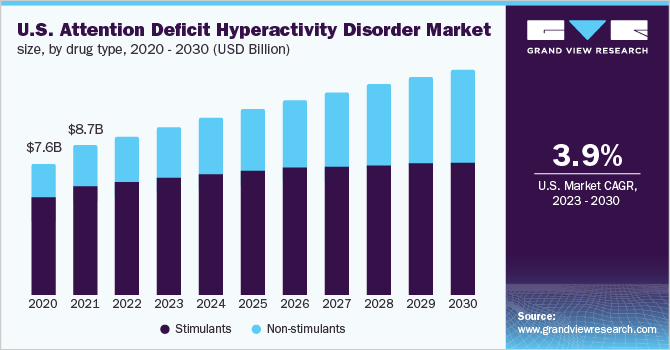

Drug Type Insights

The stimulant drug type segment dominated the attention deficit hyperactivity disorder market with a revenue share of 71.91% in 2022 owing to the approval of the extended version of stimulant drugs as the most effective treatment that works in 70% - 80% of the cases. Stimulants are the most prescribed medications to treat attention deficit hyperactivity disorder. Recently, in March 2021, the U.S. FDA approved AZSTARYS developed by Kem Pharma, Inc. for the treatment of patients with ADHD aged 6 and above. Corium, Inc. is responsible for the commercialization of AZSTARYS in the U.S.

The non-stimulant drug type segment is expected to witness significant growth during the forecast period. This growth can be attributed to the approval of novel non-stimulant drug therapies to treat patients with the condition. For instance, in April 2021, the U.S. FDA approved Qelbree developed by Supernus Pharmaceuticals, Inc. for the treatment of children and adolescent patients ages 6 to 17 years. It is the first non-controlled non-stimulant product to be included in the ADHD treatment portfolio. This approval may attract a new target population and broaden the source of revenue.

Demographics Segment Insights

The adults segment dominated the attention deficit hyperactivity disorder (ADHD) market with a revenue share of 58.80% in 2022. Adults above 18 years of age suffering from ADHD have difficulty functioning in an academic environment, social & occupational environment. Currently, Ritalin, Focalin, Concerta, Daytrana, Quillivant XR, Aptensio SR, Evekeo, Elvanse, and Vyvanse are available brands of stimulant and non-stimulant drugs in the market to treat adult patients with ADHD.

The children segment is expected to grow at a high growth rate during the forecast period due to the rising prevalence of the disease. According to the ADHD Australia Report 2021, it affects over 800,000 Australian population accounting for 281,200 children aged 0 to 19 years and 533,300 adults aged 20 years and above. Approximately 2 of 3 children suffering from ADHD had at least other conditions such as anxiety, depression, mental, and emotional or behavioral disorder. Thus, an increasing number of children cases with ADHD is anticipated to drive segment growth.

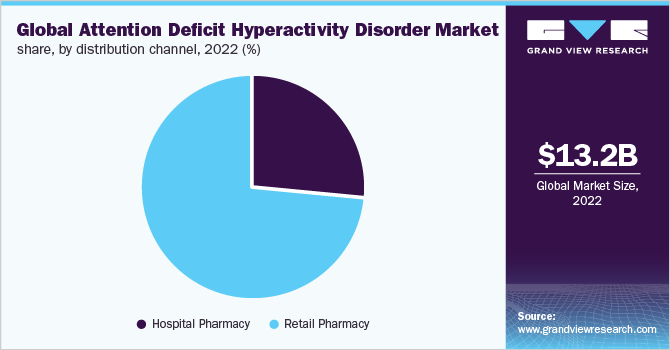

Distribution Channel Segment Insights

The retail pharmacy segment dominated the attention deficit hyperactivity disorder market with a revenue share of 73.76% in 2022 and is anticipated to witness the fastest growth over the forecast period. This dominance can be attributed to the fact that most ADHD patients are treated in outpatient settings. Additionally, increase in focus on patient care initiatives, such as Greenway Medical Technologies, to provide personal Electronic Health Records (EHRs) to customers to keep track of medication history and basic care. Other factors boosting market growth are increasing healthcare expenditure, growing awareness of the disorder, and a rising volume of prescriptions for ADHD drugs.

The hospital pharmacy segment is expected to witness significant growth over the forecast period. Hospital pharmacists as medication experts can assist patients with ADHD and their parents with appropriate medication selection. Thus, the availability of multiple treatment options and the launch of new therapeutic products for better and more effective treatment with minimum side effects contribute the market growth. Based on an article published in 2022, around 388,000 (2.4%) children ages 2 to 5 years and 2.4 million (9.6%) ages 6 to 11 years have been diagnosed with ADHD. Thus, the growing aging population with ADHD acts as a major driver for the market.

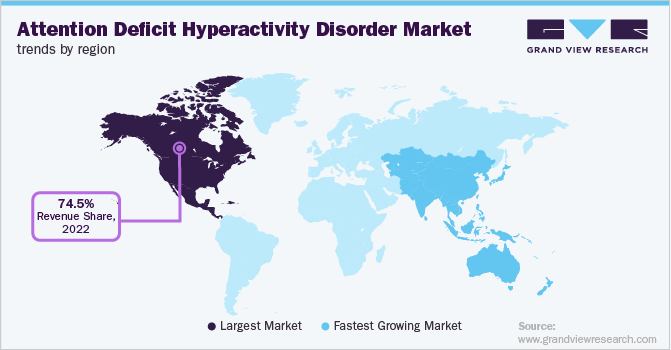

Regional Insights

North America dominated the attention deficit hyperactivity disorder market in terms of the revenue share of 74.53% in 2022, owing to the launch and rapid uptake of multiple ADHD drugs. Increasing awareness about current treatment therapies, favorable reimbursement policies, and improved patient affordability are expected to drive market growth. According to the Centre for ADHD Awareness Canada (CADDAC), more than 1.5 million people are affected with ADHD in Canada.

Asia Pacific is expected to witness a growth rate of 6.2% over the forecast period. The growth of the region is attributed to the presence of key players in the market and strategic initiatives undertaken by them to develop and commercialize new products to treat patients. For instance, in February 2022, Siemens Healthcare GmbH and HMI Group entered into a partnership to support the development of a center of excellence to improve diagnosis, treatment, and care in Southeast Asia. This partnership boosts the research and development of novel ADHD drugs in Asia Pacific region.

Key Companies & Market Share Insights

Market players are engaging in new product development, merger and acquisitions, and licensing agreements to gain market share. For instance, in 2021, KemPharma, Inc. announced the launch of AZSTRAYS, a once-daily tablet to treat patients with ADHD. Additionally, in December 2020, Tris Pharma, Inc. and Neuraxpharm Group signed an agreement for the commercialization and distribution of Tris’s Quillivant XR & Quillichew ER used for the treatment of ADHD in Europe. Under this agreement, Neuraxpharm received an exclusive right to commercialize Tris’s product in Europe. Some of the prominent players in the global attention deficit hyperactivity disorder market include:

-

Eli Lilly and Company.

-

Pfizer Inc.

-

Johnson & Johnson Services Inc.

-

Lupin

-

Novartis AG

-

Takeda Pharmaceutical Company Limited

-

Mallinckrodt Inc.

-

Purdue Pharma LP

-

NEOS Therapeutics Inc.

-

Supernus Pharmaceutical, Inc.

Attention Deficit Hyperactivity Disorder Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.97 billion

Revenue forecast in 2030

USD 18.69 billion

Growth Rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Drug type, demographics, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Novartis AG, Eli Lilly and Company, Johnson & Johnson Services, Inc., Lupin, Takeda Pharmaceutical Company Limited, Mallinckrodt plc., Pfizer, Inc., Purdue Pharma L.P., NEOS Therapeutics Inc., Supernus Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

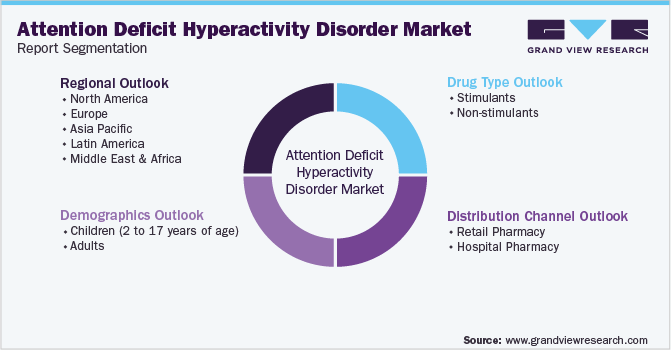

Global Attention Deficit Hyperactivity Disorder Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global attention deficit hyperactivity disorder market report based on drug type, demographics, distribution channel, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stimulants

-

Amphetamine

-

Methylphenidate

-

Lisdexamfetamine

-

Dexmethylphenidate

-

-

Non-stimulants

-

Atomoxetine

-

Guanfacine

-

Clonidine

-

Others

-

-

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Children (2 to 17 years of age)

-

Adults

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacy

-

Hospital Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global attention deficit hyperactivity disorder market size was valued at USD 13.21 billion in 2022 and is anticipated to reach USD 13.97 billion in 2023.

b. The global attention deficit hyperactivity disorder market is expected to witness a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 18.69 billion by 2030.

b. Based on drug type, the stimulant segment accounted for a share of 71.91% in 2022 due to high prescription and usage rate of stimulant drugs due to good efficacy and immediate result.

b. Some of the key players in the attention deficit hyperactivity disorder market are Novartis AG, Eli Lilly and Company, Johnson & Johnson Services, Inc., Lupin, Takeda Pharmaceutical Company Limited, Mallinckrodt plc., Pfizer, Inc., Purdue Pharma L.P., NEOS Therapeutics Inc., Supernus Pharmaceuticals Inc.

b. The major factors driving the market growth are the increasing prevalence of ADHD and increasing awareness about ADHD among physicians and patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."