- Home

- »

- Next Generation Technologies

- »

-

Augmented Reality Market Size And Share Report, 2030GVR Report cover

![Augmented Reality Market Size, Share & Trends Report]()

Augmented Reality Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Display (Head-Mounted Display, Smart Glass, Head-Up Display, Handheld Devices), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-820-6

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Augmented Reality Market Size & Trends

The global augmented reality market size was valued at USD 57.26 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 39.8% from 2023 to 2030. The surge of interest among leading market players such as Google LLC, Microsoft Corporation, Apple, Inc., and others in employing augmented reality (AR) in numerous applications is creating new opportunities. Additionally, the market in media and entertainment is increasing, such as with the rising use of augmented reality in the gaming sector to give participants a view with highly effective video, graphics, and sound, which is anticipated to be a major growth factor.

Augmented reality provides interactive experiences through various sensory modalities, such as somatosensory, visual, auditory, haptic, and others. This technology has numerous applications in education, training, and entertainment. Furthermore, it is increasingly being used in industries such as logistics, healthcare, and manufacturing for monitoring, assistance, maintenance, and training.

The growing popularity of smartphones and app integration is expected to fuel the growth of the mobile augmented reality market. The increasing collaboration of market participants with 5G providers to lessen latency is expected to accelerate growth prospects. For instance, in January 2022, Telefonaktiebolaget LM Ericsson collaborated with E.E. Limited to demonstrate the potential of 5G standalone using an AR experience.

Additionally, in July 2021, Samsung Electronics Inc. collaborated with GBL Systems Corp. to deploy 5F testbeds for AR at U.S. Army military bases in order to help the U.S. Army in training and planning. To maintain augmented reality market share, big firms frequently engage in mergers and acquisitions as well as new product launches.

Since the COVID-19 outbreak, there has been an increase in the use of virtual and augmented reality technology in marketing and advertising to host virtual events, promotional events, virtual exhibitions, and online commercials. For instance, in July 2020, the OnePlus Nord smartphone was launched using the AR platform Blippar. The growing adoption of AR technology by healthcare industry incumbents is also anticipated to play a significant role in driving market growth.

Numerous augmented reality market leaders work with healthcare organizations and provide their AR tools to support AR-powered healthcare. For instance, in February 2022, Altoida Inc., a provider of augmented reality software, collaborated with the pharmaceutical company Click Therapeutics to use AR technology to understand better baseline cognition measures and how they may impact patient outcomes.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The continuous evolution of technologies like computer vision and spatial computing, coupled with substantial investments from major tech players and startups, fosters a dynamic environment. The competitive landscape, featuring established companies like Apple, Google, and Microsoft alongside numerous startups, promotes innovation as organizations strive to differentiate themselves. Cross-industry collaborations and a focus on enhancing user experiences underscore the market's commitment to advancing AR technology.

The augmented reality market is anticipated to witness a moderate to high level of merger and acquisition (M&A) activities. Owing to the rapid technological advancements and diverse applications, companies may engage in strategic mergers and acquisitions to strengthen their market positions and expand their capabilities. Established tech giants seeking to enhance their AR offerings and startups aiming for scale and market access may drive M&A activities.

The impact of regulations on competition in the augmented reality market is expectred to be moderate to high. As AR technologies become more integrated into various sectors, regulatory frameworks may play a crucial role in shaping industry dynamics. Regulations addressing privacy concerns, data security, and ethical use of AR applications can influence the development and deployment of AR solutions.

The augmented reality market growth is anticipated to face a relatively low level of competition from direct substitutes. The unique capabilities and applications of AR, such as overlaying digital information onto the real world, create a distinctive user experience that is challenging to replicate directly. While there may be alternatives, such as virtual reality (VR) or mixed reality (MR), each technology serves distinct purposes, and AR stands out for its real-world integration. However, indirect substitutes, such as advancements in smartphone capabilities or other emerging technologies, could impact the market by offering alternative ways to address similar needs.

The level of end-user concentration in the augmented reality future market is expected to be moderate to high. Applications span various industries, including augmented reality in gaming, augmented reality in healthcare, augmented reality in military, augmented reality in education, augmented reality in automotive, and more, leading to a diversified user base. While major tech companies and enterprise-focused AR solutions may cater to large-scale deployments, the widespread adoption of AR across diverse sectors contributes to a broad distribution of end-users.

Component Insights

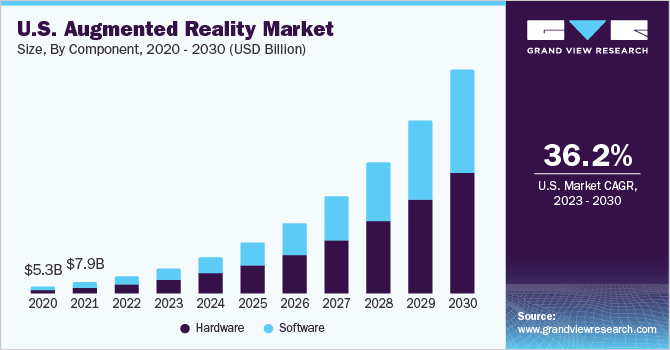

The augmented reality hardware segment dominated the market in 2022 with a share of nearly 60%. This is attributed to the growing acceptance of augmented reality technology worldwide and its compatibility with older hardware devices. For instance, in May 2021, Meta opened its first hardware store in California to give its customers a first-hand experience with its hardware products, such as AR glasses and goggles.

Augmented reality technology is constantly evolving in sync with the widening adoption of technology in consumer applications. As a result, demand for augmented reality chipsets has risen. The rapid growth of AR chipsets is driving industry leaders such as NXP and Qualcomm Technologies, Inc. to develop innovative AR-powered chipsets to fulfill end-users changing needs. In January 2022, Qualcomm Technologies, Inc. collaborated with Microsoft Corporation to develop unique chips for AR glasses that will be compatible with Metaverse apps.

The augmented reality software segment is expected to register a CAGR of around 41.0% during the forecast period with the rising demand for various displays and smartphones. Moreover, companies are focusing on upgrading smartphones, tablets, and computers by integrating AR software with new features and indulging in strategic collaborations to simplify, automate and support large-scale AR deployments. In 2022, HTC launched HTC Desire 22 Pro, its first Metaverse smartphone. It is embedded with the company’s Viverse application that enables users to create their virtual space and buy NFTs from the marketplace in the virtual world.

Display Insights

The head-mounted display segment held a sizeable revenue share in 2022. This is attributed to the rising need for head-mounted displays in commercial and industrial applications. The widespread availability of lightweight head-mounted displays is anticipated to be fueled by the developments in OLED technology and the expanding use cases for AR technology in industrial and enterprise applications.

The smart glasses segment is anticipated to record the highest CAGR from 2023 to 2030 as they are being widely adopted across various industries. Smart glasses are commonly used in industries such as construction, oil & gas as well as automotive due to their structural properties. For instance, the HMT-1 smart glasses by RealWear, Inc. are highly robust, insensitive to dust and dirt, waterproof with an IP of 66, and fully functional in extreme cold or heat (from -20°C to 50 °C), which makes them suitable for the industrial environment.

Report Coverage & Deliverables Application Insights

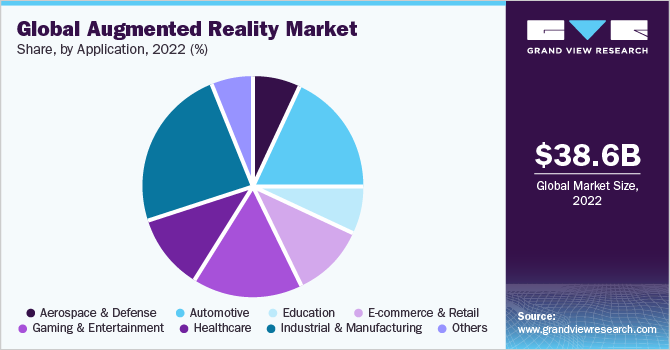

The industrial & manufacturing segment held a notable revenue share in 2022 and is expected to grow significantly over the coming years. The use of augmented reality technology by the market leaders in a variety of sectors and industry verticals enables them to identify any errors or flaws quickly, ensure that all processes are ongoing, and facilitate efficient operations to reduce the amount of downtime associated with manufacturing is driving the growth of the segment.

The augmented reality healthcare segment is expected to record a CAGR of over 44.0% from 2023 to 2030. AR technology is increasingly being implemented in medical training, surgical visualization, and vein visualization. As a result, several market players are taking profound steps in this direction. In January 2022, AMA Corporation Plc strengthened its partnership with Vuzix Corporation, a leading supplier of smart glasses and AR technology and products. This partnership is anticipated to accelerate the digital transformation of their joint healthcare and industrial customer base.

Regional Insights

North America accounted for the largest revenue share of nearly 35.0% in 2022 and is estimated to record a significant growth rate during the forecast period as the region is home to several leading technology companies, such as Google LLC, and Microsoft, among others. Besides, the regional countries are considered the early adopters of advanced technologies.

North America is expected to generate the highest revenue during the forecast period. Immersive technologies are becoming more popular in the region due to continued investment. Likewise, the U.S. government is significant in improving the adoption of immersive technology in order to enhance the region's augmented reality industry share. For instance, in 2019, the United States Defense Advanced Research Projects Agency agreed to participate in IMT Atlantique. It engaged the firm to create smart contactless lenses for the United States military.

Asia Pacific is expected to record a CAGR of above 40.0% from 2023 to 2030 with increasing usage of internet-based platforms across various regional countries, including Japan and Australia. Besides, the continued rollout of high-speed 5G networks in the Asia Pacific is favoring the widespread adoption of AR technology and AR-based solutions across the region. The increasing adoption of AR technology in the manufacturing and healthcare industries, along with investments by large technology providers in India, is contributing to the growth of the market augmented reality market in the Asia Pacific region.

The Asia Market is expected to proliferate during the forecast period. The burgeoning logistics, manufacturing, gaming, and automotive industries are expected to fuel regional market growth. Due to the low-cost hardware manufacturers, China is expected to dominate the market. India is also expected to offer market growth opportunities due to the rising customer demand. For instance, in June 2021, Libestream Technologies increased its investment in Japan to support the APAC region's growing customer base.

Key Companies & Market Share Insights

The key players operating in the augmented reality market are investing aggressively in research and development to deliver innovative AR solutions. They are forming strategic alliances as a part of their efforts for technological advancements to gain a competitive edge in the market. For instance, in May 2022, Magic Leap, Inc. announced a strategic partnership with a digital company, Globant, to accentuate the adoption of enterprise AR. The collaboration is aimed at expanding enterprise AR applications.

Google LLC offers several products and applications based on its augmented reality technology platform, such as Google Glass, Google Goggles, Google Cardboard, Google AR apps for mapping and games, and Project Tango. In April 2021, Google LLC launched the WebXR collection to offer viewers a superior immersive experience. The Web XR platform includes Sodar, Measure UP, Floom, and Picturescape, creating an altogether immersive platform for Android users.

Samsung expanded its product portfolio by including the wearable technology market with virtual reality, Samsung Gear VR Innovator Edition. Samsung Electronics Co., Ltd. has a global market presence with a vast sales and distribution network, multiple manufacturing units, and R&D centers. In December 2021, Samsung Electronics Co. Ltd partnered with Microsoft to collaboratively work on an advanced AR/MR project that includes HoloLens. The new project is expected to unveil the next generation HoloLens by 2024.

Key Augmented Reality Companies:

- Apple, Inc.

- Blippar Limited

- Google LLC

- Lenovo Group

- Magic Leap, Incorporated

- Meta

- Microsoft Corporation

- PTC Inc.

- Snap, Inc.

- Sony Corporation

- TeamViewer AG

- Vuzix Corporation

- Wikitude GmbH

- Xiaomi Corporation

- Zappar Limited

Recent Developments

-

In January 2024, Apple Inc. revealed the launch date of its anticipated Vision Pro headset, set to be available for purchase on February 2nd in the U.S. This cutting-edge device is equipped with the advanced R1 chip, designed to expedite the processing of information from its sensors. Additionally, the company addressed the weight of the headset by incorporating an external battery, ensuring a runtime of up to 2 hours.

-

In July 2023, Apple, Inc. launched a new immersive Deep Field AR app for students. The Deep Field iPad app uses Apple Pencil to experiment with vibrant colors, textures, and shapes and draw their own flora and fauna.

-

In June 2023, Apple Inc. launched Apple Vision Pro, integrated with visionOS, the world’s first spatial operating system that lets users interact with digital content with an ultra-high-resolution display system.

-

In February 2023, Xiaomi Corporation unveiled a prototype of augmented reality glasses. The device boasts a "retina-level display," enabling users to perceive virtual objects with the same clarity as they would physically object.

Global Augmented Reality Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 57.26 billion

Revenue forecast in 2030

USD 597.54 billion

Growth rate

CAGR of 39.8% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, display, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

Microsoft; Google LLC; Apple, Inc.; Sony Corporation; Blippar Limited; Xiaomi Corporation; Lenovo Group; Meta; PTC Inc.; Snap, Inc.; TeamViewer AG; Zappar Limited; Magic Leap, Incorporated; Vuzix Corporation; Wikitude GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Augmented Reality Market Report Segmentation

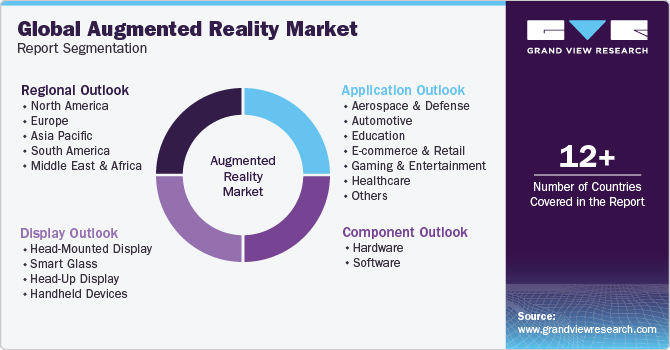

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global augmented reality market report based on the component, display, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

Display Outlook (Revenue, USD Billion, 2018 - 2030)

-

Head-Mounted Display

-

Smart Glass

-

Cinema Display Glasses

-

XR Glasses

-

-

Head-Up Display

-

Handheld Devices

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Education

-

E-learning

-

Educational Games and Simulations

-

-

E-commerce & Retail

-

Hypermarket

-

Supermarket

-

Malls and Shopping Centers

-

-

Gaming & Entertainment

-

Video Games

-

Live Events and Concerts

-

Amusement Parks

-

-

Healthcare

-

Hospitals

-

Clinics

-

Medical Training and Education

-

-

Industrial & Manufacturing

-

Energy & Utilities

-

Construction and Engineering

-

Mining

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Rest of Asia Pacific

-

-

South America

-

Brazil

-

Argentina

-

Rest of South America

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Rest of Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global augmented reality market size was estimated at USD 38.56 billion in 2022 and is expected to reach USD 57.26 billion by 2023.

b. The global augmented reality market is expected to grow at a compound annual growth rate of 39.8% from 2023 to 2030 to reach USD 597.54 billion by 2030.

b. The head-mounted display (HMD) & smart glass dominated the AR market with a share of around 60.0% in 2022. This is attributable to the rise in R&D expenditure for developing HMDs with advanced AR features.

b. Some key players operating in the augmented reality market include Total Immersion; Magic Leap, Inc.; Sony Corporation; Vuzix; Microsoft; Google LLC; Apple Inc., and Meta.

b. The growing demand for remote assistance and coaction from industries working in optimization and workflow management also bodes well for the growth of the AR market.

Table of Contents

Chapter 1. Augmented Reality Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Augmented Reality Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot (1/2)

2.3. Segment Snapshot (2/2)

2.4. Competitive Landscape Snapshot

Chapter 3. Augmented Reality Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.4. Industry Analysis Tools

3.4.1. Porter’s Analysis

3.4.2. Macroeconomic Analysis

3.5. Key Company Analysis, 2022

3.6. Key Player Positioning Matrix, 2022

3.7. Augmented Reality- Covid-19 Impact Analysis

Chapter 4. Component Estimates and Trend Analysis

4.1. Component Movement Analysis & Market Share, 2022 & 2030

4.2. Augmented Reality Market Estimates & Forecast, By Component (USD Billion)

4.2.1. Hardware

4.2.2. Software

Chapter 5. Display Estimates & Trend Analysis

5.1. Display Movement Analysis & Market Share, 2022 & 2030

5.2. Augmented Reality Market Estimates & Forecast, By Display (USD Billion)

5.2.1. Head Mounted Display

5.2.2. Smart Glasses

5.2.2.1 Cinema Display Glasses

5.2.2.2 XR Glasses

5.2.3. Head-Up Display

5.2.4. Handheld Devices

Chapter 6. Application Estimates & Trend Analysis

6.1. Application Movement Analysis & Market Share, 2022 & 2030

6.2. Augmented Reality Market Estimates & Forecast, By Application (USD Billion)

6.2.1. Aerospace & Defense

6.2.2. Automotive

6.2.3. Education

6.2.3.1. E-learning

6.2.3.1.1. Up to K-12

6.2.3.1.2. Universities and Educational Institutes

6.2.3.1.3. Higher Education

6.2.3.2. Educational Games and Simulations

6.2.4. E-Commerce & Retail

6.2.4.1. Hypermarket

6.2.4.2. Supermarket

6.2.4.3. Malls and Shopping Centers

6.2.5. Gaming & Entertainment

6.2.5.1. Video Games

6.2.5.2. Live Events and Concerts

6.2.5.3. Amusement Parks

6.2.6. Healthcare

6.2.6.1. Hospitals

6.2.6.2. Clinics

6.2.6.3. Medical Training and Education

6.2.7. Industrial & Manufacturing

6.2.7.1. Energy & Utilities

6.2.7.2. Construction & Engineering

6.2.7.3. Mining

6.2.7.4. Others

6.2.8. Others

Chapter 9. Regional Estimates & Trend Analysis

9.1. Augmented Reality Market: Regional Outlook

9.2. North America

9.2.1. North America augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.2.2. U.S.

9.2.2.1. U.S. augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.2.3. Canada

9.2.3.1. Canada augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.2.4. Mexico

9.2.4.1. Mexico augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Europe augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.3.2. UK.

9.3.2.1. UK augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.3.3. Germany

9.3.3.1. Germany augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.3.4. France

9.3.4.1. France augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.3.5. Italy

9.3.5.1. Italy augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Asia Pacific augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.4.2. India

9.4.2.1. India augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.4.3. China

9.4.3.1. China augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.4.4. Japan

9.4.4.1. Japan augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.4.5. South Korea

9.4.5.1. South Korea augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.5. South America

9.5.1. South America augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.5.2. Brazil

9.5.2.1. Brazil augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.5.3. Argentina

9.5.3.1. Argentina augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.6. Middle East and Africa (MEA)

9.6.1. MEA augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.6.2. UAE

9.6.2.1. UAE augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

9.6.3. South Africa

9.6.3.1. South Africa augmented reality market estimates & forecasts, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Augmented Reality Market - Key Hardware Companies

10.1.1. Vuzix

10.1.2. Meta

10.1.3. RealWear, Inc.

10.1.4. Alphabet Inc. (Google LLC)

10.1.5. Nreal Technology Limited

10.1.6. Magic Leap, Inc.

10.1.7. Lenovo Group

10.1.8. Tilt Five, Inc.

10.1.9. Snap, Inc.

10.1.10. Apple, Inc.

10.1.11. Seiko Epson Corporation (Epson America Inc.)

10.1.12. Rokid, Inc.

10.1.13. Shenzhen INMO Technology Co., Ltd.

10.1.14. Xiaomi Corporation

10.1.15. MAD Gaze

10.1.16. OPPO Private Limited (Parent company - BBK Electronics Corporation)

10.1.17. Viture, Inc.

10.1.18. DreamWorld, Inc.

10.1.19. Goertek, Inc.

10.1.20. Microsoft Corporation

10.1.21. Qualcomm Technologies, Inc.

10.1.22. Sony Group Corporation

10.1.23. Samsung Electronics Co., Ltd.

10.2. Augmented Reality Market - Key Software Companies

10.2.1. TeamViewer AG

10.2.2. PTC Inc.

10.2.3. Librestream Technologies

10.2.4. OverIT S.p.A.

10.2.5. AMA Corporation Plc

10.2.6 CareAR Holdings (Parent Company - Xerox Holding Corporation)

10.2.7. RE'FLEKT GmbH

10.2.8. Help Lightning, Inc.

10.2.9. Taqtile, Inc.

10.2.10. Atheer, Inc.

10.2.11. Scope Technologies US Inc.

10.2.12. Blippar Group Limited

10.2.13. Wikitude GmbH (Parent Company - Qualcomm Technologies, Inc.)

10.2.14. Zappar Ltd.

10.3. Recent Development & Impact, By Key Market Participants

10.4. Company Categorization

10.5. Participant’s Overview

10.6. Financial Performance

10.7. Product Benchmarking

10.8. Company Heat Map Analysis

10.9. Company Market Share Analysis, 2022

10.10. Strategy Mapping

10.10.1. Expansion

10.10.2. Mergers & acquisition

10.10.3. Collaborations

10.10.4. New product launches

List of Tables

Table 1 Augmented Reality Market Revenue Estimates and Forecast, By Component, 2018 - 2030 (USD Billion)

Table 2 Augmented Reality Market Revenue Estimates and Forecast, By Display, 2018 - 2030 (USD Billion)

Table 3 Augmented Reality Market Revenue Estimates and Forecast, By Application, 2018 - 2030 (USD Billion)

Table 4 Recent Developments & Impact Analysis, By Key Market Participants

Table 5 Key Company Categorization

Table 6 Company Heat Map Analysis

Table 7 Key Companies Undergoing Expansions

Table 8 Key Companies Involved In Mergers and Acquisitions

Table 9 Key Companies Undergoing Collaborations

Table 10 Key Companies Launching New Products

Table 11 Key Companies Undertaking R&D Activities

List of Figures

Fig. 1 Augmented Reality Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot (1/2)

Fig. 8 Segment Snapshot (2/2)

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Augmented Reality Market Value, 2022 (USD Billion)

Fig. 11 Augmented Reality- Industry Value Chain Analysis

Fig. 12 Augmented Reality Market Dynamics

Fig. 13 Key Market Driver Impact

Fig. 14 Key Market Restraint Impact

Fig. 15 Augmented Reality Market: PORTER’s Five Forces Analysis

Fig. 16 Augmented Reality Market: Macroeconomic Analysis

Fig. 17 Augmented reality market, by component, key takeaways

Fig. 18 Component movement analysis & market share, 2022 & 2030 (USD Billion)

Fig. 19 Augmented reality market, by display, key takeaways

Fig. 20 Display movement analysis & market share, 2022 & 2030 (USD Billion)

Fig. 21 Augmented reality market, by application, key takeaways

Fig. 22 Application movement analysis & market share, 2022 & 2030 (USD Billion)

Fig. 23 Regional market size estimates & forecasts, 2022 & 2030 (USD Billion)

Fig. 24 Regional movement analysis & market share, 2022 & 2030 (USD Billion)

Fig. 25 Key Company Categorization

Fig. 26 Company Market Share Analysis, 2022

Fig. 27 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Augmented Reality Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Hardware

- Software

- Augmented Reality Display Outlook (Revenue, USD Billion, 2018 - 2030)

- HMD (Head Mounted Display)

- Smart Glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld Devices

- Augmented Reality Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Aerospace & Defense

- Automotive

- Education

- E-learning

- Educational Games and Simulations

- E-Commerce & Retail

- Hypermarket

- Supermarket

- Malls and Shopping Centers

- Gaming & Entertainment

- Video Games

- Live Events and Concerts

- Amusement Parks

- Healthcare

- Hospitals

- Clinics

- Medical Training and Education

- Industrial & Manufacturing

- Energy & Utilities

- Construction and Engineering

- Mining

- Others

- Others

- Augmented Reality Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America augmented reality market, by component

- Hardware

- Software

- North America augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- North America augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- U.S.

- U.S. augmented reality market, by component

- Hardware

- Software

- U.S. augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- U.S. augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- U.S. augmented reality market, by component

- Canada

- Canada augmented reality market, by component

- Hardware

- Software

- Canada augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Canada augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Canada augmented reality market, by component

- Mexico

- Mexico augmented reality market, by component

- Hardware

- Software

- Mexico augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Mexico augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Mexico augmented reality market, by component

- North America augmented reality market, by component

- Europe

- Europe augmented reality market, by component

- Hardware

- Software

- Europe augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Europe augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Germany

- Germany augmented reality market, by component

- Hardware

- Software

- Germany augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Germany augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Germany augmented reality market, by component

- UK

- UK augmented reality market, by component

- Hardware

- Software

- UK augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- UK augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- UK augmented reality market, by component

- France

- France augmented reality market, by component

- Hardware

- Software

- France augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- France augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- France augmented reality market, by component

- Rest of Europe

- Rest of Europe augmented reality market, by component

- Hardware

- Software

- Rest of Europe augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Rest of Europe augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Rest of Europe augmented reality market, by component

- Europe augmented reality market, by component

- Asia-Pacific

- Asia-Pacific augmented reality market, by component

- Hardware

- Software

- Asia-Pacific augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Asia-Pacific augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- China

- China augmented reality market, by component

- Hardware

- Software

- China augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- China augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- China augmented reality market, by component

- India

- India augmented reality market, by component

- Hardware

- Software

- India augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- India augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- India augmented reality market, by component

- Japan

- Japan augmented reality market, by component

- Hardware

- Software

- Japan augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Japan augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Japan augmented reality market, by component

- South Korea

- South Korea augmented reality market, by component

- Hardware

- Software

- South Korea augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- South Korea augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- South Korea augmented reality market, by component

- Rest of Asia Pacific

- Rest of Asia Pacifica augmented reality market, by component

- Hardware

- Software

- Rest of Asia Pacific augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Rest of Asia Pacific augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Rest of Asia Pacifica augmented reality market, by component

- Asia-Pacific augmented reality market, by component

- South America

- South America augmented reality market, by component

- Hardware

- Software

- South America augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- South America augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Brazil

- Brazil augmented reality market, by component

- Hardware

- Software

- Brazil augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Brazil augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Brazil augmented reality market, by component

- Rest of South America

- Rest of South America augmented reality market, by component

- Hardware

- Software

- Rest of South America augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- Rest of South America augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- Rest of South America augmented reality market, by component

- South America augmented reality market, by component

- MEA

- MEA augmented reality market, by component

- Hardware

- Software

- MEA augmented reality market, by display

- HMD (Head Mounted Display)

- Smart glass

- Cinema Display Glasses

- XR Glasses

- HUD (Head-Up Display)

- Handheld devices

- MEA augmented reality market, by application

- Aerospace & Defense

- Automotive

- Education

- E-Commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

- MEA augmented reality market, by component

- North America

Augmented Reality Market Dynamics

Drivers: Surge in AR Smartphone Application

Development in AR-based smartphone applications holds key contribution in the requirement of Augmented Reality (AR) headsets among customers. These AR apps provide creative and immersive content such as videos, photos, and graphs better than the raw camera and 2D content. Thus, to view and comprehend the content and contextual data included in the apps, AR headsets such as smart glasses and head-on displays are needed. The industry has perceived robust traction as there exist over 2000 augmented reality applications on the app store. The growth in AR apps is owing to the popularity of 3D graphical immersive objects. In addition, the advancement of AR apps resulted in the development of SDKs. Enterprises such as Apple, Inc. and Google, Inc. introduced their ARKit and ARCore SDKs to help develop numerous AR apps. Presently, over 13 million AR apps have been developed and downloaded from the release of ARKit. Furthermore, companies such as Adobe and Simile are also striving towards developing innovative tools to create 3D content to offer an immersive user experience.

Drivers: Continued Growth in Demand for Remote Assistance and Collaboration

Growing innovation and technological advancements have increased the adoption of sophisticated hardware, software, and services to improve business processes. Further, the transformation towards consumer-oriented business models to offer efficient real-time consumer services has raised the need to provide services at touchpoints. Therefore, providing technical support or installation and assembly services in remote areas focuses on a need for remote assistance. As a result, the need for collaborative and remote assistance emerged among the peers to devise effective solutions whenever required in any of the remote places. For instance, live video streaming, image annotations, and voice communication were used to collaborate with remote users. However, the communication medium does not reflect high output and productivity as it delivers limited real-time visibility. Thus, in comparison to these techniques, AR headsets and AR technology impart 3D superimposed objects, which can help repair complex issues.

Restraint: Privacy and Security Issues Associated with Augmented Reality

Privacy and security concerns are critical factors restraining the AR market growth. As augmented reality technology is extensively adopted, much data will be recorded and collected about individuals and their surroundings. This may create various security and privacy issues related to the right to access the data, its secure storage, and data ownership. Copyright concerns are also coming into play. The considerable value of augmented reality technology comes from its ability to contextualize information through the overlay of images, text, and other artifacts—possibly infringing on a copyright owner’s rights to alteration or reproduction. Moreover, top AR-based mobile apps require that the end-users Global Positioning System (GPS) be active to function efficiently. Access to such information may give rise to challenges associated with privacy needs. For AR technology, regulatory bodies will likely need a comprehensive review of several current guidelines. Some of the policies that will likely need review and potential reconsideration are intellectual property rights, privacy regulations, property laws, and copyright. Thus, privacy and security issues associated with augmented reality is expected to hamper the market growth.

What Does This Report Include?

This section will provide insights into the contents included in this augmented reality market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Augmented reality market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Augmented reality market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the augmented reality market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for augmented reality market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of augmented reality market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Augmented Reality Market Categorization:

The augmented reality market was categorized into four segments, namely component (Hardware, Software), display (Head-Mounted Display, Smart Glass, Head-Up Display), application (Aerospace & Defense, Automotive, Education, E-commerce & Retail, Gaming & Entertainment, Healthcare, Industrial & Manufacturing), and regions (North America, Europe, Asia Pacific, South America, Middle East & Africa).

Segment Market Methodology:

The augmented reality market was segmented into component, display, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The augmented reality market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into fiveteen countries, namely, the U.S.; Canada; Mexico; the UK; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Argentina; UAE; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Augmented reality market companies & financials:

The augmented reality market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Vuzix Corporation - Vuzix Corporation manufactures and sells computer displays, wearable display technology, and AR-VR. The company offers products such as Vuzix Blade, Vuzix M Series, Vuzix Labs Smart Swim, and other accessories. The company provides smart glass for various industries, such as manufacturing, warehouse logistics, telemedicine, and field services. Vuzix Corporation offers smart wearable products to develop and deploy AR applications. AR smart glass enables the user to see the graphics & images, and other real-world information. The company has adopted a strategy to sustain its market position, gain a worldwide presence, and innovation in AR smart glasses.

-

Meta Platforms, Inc. - Meta Platforms, Inc., formerly Facebook, Inc., is a global technology company based in California, U.S. The company owns renowned brands such as Instagram, Facebook, and WhatsApp. Meta is among the world's most valuable businesses and is regarded as one of the Big Five American IT companies, along with Apple, Alphabet, Microsoft, and Amazon. It has also acquired Kustomer, Presize, Mapillary, Giphy, and Oculus and has a 9.99% stake in Jio Platforms. Meta was founded in 2004 in Massachusetts, U.S. and now is headquartered in California with 71,970 employees. In 2021, the parent organization of Facebook revised its name to Meta Platforms, Inc., to center its focus on creating the metaverse. The metaverse directs to the integrated ecosystem that connects the company's services and products.

-

RealWear, Inc. - RealWear, Inc., a global wearable technology company based in Vancouver, Washington. The company was founded in 2016 and has provided wearable technology and services equipped with AR & VR to over 40 fortune 100 companies, such as Microsoft Corporation. The company provides solutions such as remote expert guidance, document navigation, visual assistance, digital workflow, and industrial IoT data in several industries, such as oil & gas, automotive, energy & utilities, manufacturing, audit and inspection, and field services, to name some.

-

Alphabet Inc. (Google LLC) - Alphabet Inc., an internet and computer software solution provider headquartered in the U.S. The multinational company specializes in internet-related services and products such as Google Cloud Platform & G Suite (Gmail, Drive, Docs, and Calendar), Google Play, and YouTube. Search and others. The company's most prominent technologies and services include cloud computing, search, online advertisement technologies, and Industrial IoT and software services. The company was established in 1998 and is a wholly owned subsidiary of Alphabet, Inc. Google operates its business from 70 offices in over 40 countries across the globe. The company provides several products and services, including Application Programming Interfaces (APIs), enterprise products, productivity tools, search engines, social networking, mobile devices, and advertisement services.

-

Nreal Technology Limited - Nreal Technology Limited, a Chinese company developing mixed reality products and services. The company was formed in 2017 and has a presence in China, Japan, and South Korea. Nreal Technology was recognized for launching the first AR glasses for consumers in 2019, which connected to the mobile content ecosystem and featured revolutionary design. The company has established a partnership with over ten carriers worldwide and has raised over USD 240 million from reputed investors, such as Alibaba, China Growth Capital, etc. The company has several initiatives, such as Meson x Nreal- MR shopping experience, LG U+ x Nrealcommercialization in South Korea, and xcommons x Nreal-fashion & digital integration with AR. Global conglomerates such as Verizon, Vodafone, Sony, Oppo, Microsoft, One Plus, Intel, and NVIDIA, among others, are Nreal's international partners.

-

Magic Leap, Inc. - Magic Leap, Inc., a wearable augmented reality platform pioneer that amplifies enterprise productivity. The company launched Magic Leap One, a head-mounted VR display, which places 3D computer-generated imagery over real-world things by involving technologies suited to computer vision and applications in augmented reality. Magic Leap was founded in 2010 and had an extended list of investors, including Alibaba Group, Google, and recently AT&T, which made Magic leap available in the U.S.

-

Lenovo Group - Lenovo Group, a Chinese company majoring business in technology and innovation. The company has been known for its gadgets and PCs since its inception. The company has a global footprint in over 60 countries serving customers in more than 160 countries. The company works in several segments, such as PC & Tablets, phones, servers & storage, smart devices, and services & solutions. Lenovo is also investing in local domestic manufacturing, R&D, and other high-value operations in addition to sales and distribution in each of the major markets.

-

Tilt Five, Inc. - Tilt Five, Inc., an American AR video game hardware and software making company. The company was founded in 2017 and has provided wearable technology and games equipped with AR & VR since inception. Tilt Five, Inc. brings about a cutting-edge gaming experience with augmented reality and delivers it to AR developers and gamers worldwide. The platform brings games in a 3D stereoscopic hologram for enhanced experience. Tilt Five, Inc. has partnered with big players in the market such as- UploadVR, Twitter, Youtube, Figmin XR among others.

-

Snap, Inc. - Snap, Inc., an American social media and camera company founded in 2011 in Santa Monica, California. The organization maintains and develops technology services and products, namely Bitmoji, Snapchat, and Spectacles. The corporation was named Snapchat Inc. initially, but it rebranded to Snap, Inc. in 2016, to fit the Spectacles product under the company name. Spectacles are smart glasses to record videos for Snapchat. The phrase "spectacles" is usually used to address eyeglasses and sunglasses. The spectacles by Snap, Inc. have an inbuilt camera lens that can sync with a smartphone and record short video segments to upload to the user's online account.

-

Apple, Inc. - Apple, Inc. is an American technology company focused on procuring software, electronics, and online services. The company was founded in April 1976 in Cupertino, California, USA. It is one of the Big 5 American information technology companies and is available worldwide in all countries. The company offers a wide range of products and services such as phones, desktops, iPads, iPods, clothing, home and utilities, Mac, iOS, Air pods, battery chargers, Electronics accessories, mac OS, software, iTunes, Cloud, location opening, apple music, apple books., etc. The company also serves into immersive technology, i.e., augmented reality (AR). Apple, Inc. offers several AR enabled application on their app store to experience the technology.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Augmented Reality Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Augmented Reality Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."