- Home

- »

- Next Generation Technologies

- »

-

Automated Optical Inspection Systems Market Report, 2027GVR Report cover

![Automated Optical Inspection Systems Market Size, Share & Trends Report]()

Automated Optical Inspection Systems Market Size, Share & Trends Analysis Report By Type (2D AOI, 3D AOI), By Technology (Inline, Offline), By Industry, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-751-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Technology

Report Overview

The global automated optical inspection systems market size was valued at USD 587.2 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 18.7% from 2020 to 2027. Automated optical inspection is a technique that uses optics to capture high-quality images of the printed circuit board to identify any defects and discrepancies in the component assembly of the PCB. Probability of errors in the manufacturing and assembling of PCB components has increased due to the high speed and the high volume of production processes and the fact that the size and density of the PCBs have reduced with the miniaturization of parts has positively impacted the demand for automated optical inspection systems.

AOI systems can detect errors in real-time to ensure that the quality of the product is maintained. These systems can also offer feedback to the operator based on the production statistics and historical data, which helps in enhancing the production process, thus saving money, labor, and time. Such factors are expected to increase the adoption of AOI systems in the manufacturing industries and contribute to market growth.

Automation in the manufacturing sector and advanced features in electronic appliances, like voice assistance, touch screens, and Bluetooth and Wi-Fi connectivity, require efficiently tested printed circuit boards to ensure safe and smooth operation. As such, manual inspection techniques are time consuming and account for an increasing number of defects in the inspection of complex assemblies, like a PCB. The automated optical inspection system can be deployed at every stage in a production process for application-specific testing and detection of faults in components on the PCB. Automated optical inspection systems are equipped with high-resolution cameras and imaging systems that can detect defects and capture images at a higher speed. These systems have a faster response time of identifying and calling in a fault, which can be rectified immediately. Such advanced features facilitate the increase in the quality of components and save time and are expected to drive the market.

There are a set of regulations and standards laid down by the Institute of Printed Circuits (IPC), which must be followed by the PCB manufacturers to maintain dimensional accuracy and the quality of components assembled on a printed circuit board. For instance, IPC-2615 explains the acceptable value of dimensions and tolerances and the IPC-FC-234 standard provides guidelines for pressure-sensitive adhesive assembly for single and double-sided printed circuit boards. IPC A-610 is another standard for the acceptability of electronics assembly and is followed by OEMs and EMS companies worldwide. Automated optical inspection systems can be programmed accordingly to inspect specific component defects for abiding by these standards, which, in turn, is expected to increase the adoption of these systems.

Complexity in programming and operation of these systems is expected to pose a challenge for the market. This results in high frequency of false call rates related to fault detection, which can hamper the production. Moreover, many call rates tend to hinder the machine’s performance and provide inappropriate inspection data. However, introduction of advanced technologies, like 3D imaging and integration of artificial intelligence, in these systems is expected to reduce the number of false call rates, thereby resulting in increased adoption of the AOI system, which, in turn, will pave way for the market growth.

Type Insights

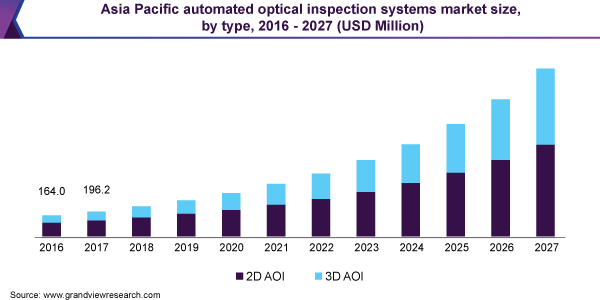

In terms of revenue, the 2D AOI segment dominated the market with a share of 62.56% in 2019. This is attributed to the lower cost and ease of programming while using the 2D AOI system. Over the years, the 2D AOI systems have undergone numerous developments related to its software interfaces and image processing technology, which has resulted in increased speed of capturing images and a significant reduction in inspection cycle times. Moreover, the camera, lighting, and the optics used in the 2D systems provide flexibility in inspection, as small and large components on a printed circuit board can be inspected simultaneously.

The 3D AOI segment is projected to expand at the highest CAGR during the forecast period. This is attributed to the functionality of the 3D system, which can provide volumetric height information of components on a printed circuit board. The 3D AOI systems are equipped with laser technology that offers better detection of co-planarity defects, which are missed while undergoing 2D inspection. Furthermore, the 3D AOI systems provide a high definition detailed image of the components on a printed circuit board, which eliminates the need for manual checking. These factors and continuous developments are expected to increase the adoption of the 3D AOI systems.

Industry Insights

In terms of revenue, IT and telecom dominated the market with a share of 34.12% in 2019. This is attributed to the extensive usage of printed circuit boards in computers in the IT industries and growing telecom networks around the globe. Telecom applications like routers, servers, satellite systems, and communication devices, broadcasting systems, telecom towers, and LED displays and indicators require high-quality electronic components, resulting in high adoption of the AOI system in this industry. Consumer electronics held the second largest market share in 2019 owing to several advanced features in home appliances and smartphones, which require high-end PCB’s to support the functioning of these devices. Asia Pacific has a high concentration of the AOI systems in the consumer electronics industry due to the significant number of electronics manufacturers present in the region.

The automobile industry is expected to expand at the highest CAGR of 23.1% during the forecast period. Rising demand for high performing and durable electronic components to enhance the safety in vehicles is driving the segment. Furthermore, with the advent of technologies like anti-lock braking systems (ABS) and advanced driver assistance systems (ADAS), electric vehicles and autonomous vehicles have increased the requirement of high-end electronics components in the automobile sector. Germany, France, and Japan are the leading markets to adopt the AOI systems in the automobile sector due to presence of major vehicle manufacturers in these countries.

Technology Insights

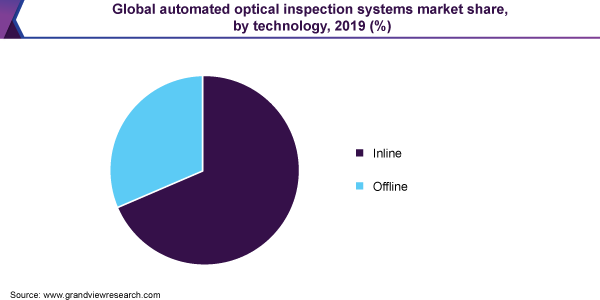

In terms of revenue, inline dominated the market with a share of 68.53% in 2019. This is attributed to these systems’ ability to inspect a high volume of manufactured printed circuit boards at a faster rate. Inline AOI system can be utilized at each stage of the production line, which facilitates a thorough inspection of the printed circuit board components for its specification and defects. The inline system can scan both sides of the printed circuit boards while reducing human intervention for flipping the boards.

Inline AOI systems can scan a large volume of printed circuit boards at a faster rate, which is suitable for the electronic and automotive industries involved in the high volume of production. Therefore, most of the manufacturing companies install multiple inline AOI systems on the production lines to speed up the inspection process. For instance, BuS Elektronik GmbH & Co. KG, an EMS service provider, based in Reisa, Germany, has deployed multiple automated optical inspection systems for the inspection of electronic components to be delivered to different sectors, like electronics, medical, and automotive. Deployment of the inline AOI systems ensures an efficient inspection process without interruption of production, which is expected to increase the adoption of these systems.

Regional Insights

Asia Pacific dominated the market for automated optical inspection systems with a share of 48.1% in 2019. This is attributed to the presence of a significant number of electronics and printed circuit board manufacturers in the region. Besides, the low cost of labor has been one of the prime factors for compelling major electronics manufacturers to undertake the production activities in this region. Furthermore, rising disposable income has increased the demand for consumer electronics and automobiles in countries, like China and India, thus driving the need for high-quality electronic components and contributing to the growth of this market.

North America held the second largest market share in 2019 owing to rising innovation and technological advancements across all the manufacturing sectors in the region. The market in this region is also driven by growing demand for smaller, slimmer, and faster electronic products and smartphones. The AOI market in Europe is expected to witness steady growth due to significant presence of automobile manufacturers in this region. Auto manufacturers in countries like Germany and France are focused on enhancing the vehicles’ safety systems, which has contributed to the rise in demand for high-quality electronic components, thus increasing the demand for AOI systems in this region.

Key Companies & Market Share Insights

The market is highly consolidated and companies in this market are focused on expanding their plants and enhancing their product portfolios by introducing new technologies in the automated optical inspection systems. For instance, in May 2018, Koh Young Technologies, Inc. established a new R&D facility in Suwon, South Korea.

Similarly, several market players are engaged in forming strategic partnerships and making investments to sustain their market position. For instance, in July 2019, Saki Corporation announced a strategic alliance with Cogiscan, Inc., which is a track, trace, and control (TTC) solution provider for the electronics manufacturing industry. This alliance is expected to help Saki Corporation to expand the manufacturing software capabilities of its automated optical inspection (AOI), x-ray inspection (AXI), and solder paste inspection (SPI) software by incorporating TTC solutions of Cogiscan Inc. Some of the prominent players in the global automated optical inspection systems market include:

-

CyberOptics

-

Daiichi Jitsugyo Asia Pte. Ltd.

-

GOPEL electronic GmbH

-

KOH YOUNG TECHNOLOGY Inc.

-

MIRTEC CO., LTD.

-

Nordson Corporation

-

OMRON Corporation

-

Saki Corporation

-

Test Research, Inc.

-

Viscom AG

Recent Development

-

In May 2022, Saki Corporation launched the 3Di series of next-generation in-line 3D automated optical inspection (3D AOI) systems that offer great speed and precision. It has improved quality control, boosted output, and is ideal for the highest level of high-density PCB technology quality inspection.

Automated Optical Inspection Systems Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 689.4 million

Revenue forecast in 2027

USD 2,290.4 million

Growth Rate

CAGR of 18.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Taiwan; Brazil; Mexico

Key companies profiled

CyberOptics; Daiichi Jitsugyo Asia Pte. Ltd.; GOPEL electronic GmbH; KOH YOUNG TECHNOLOGY Inc; MIRTEC CO., LTD.; Nordson Corporation; OMRON Corporation; Saki Corporation; Test Research, Inc.; Viscom AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThe report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global automated optical inspection systems market report based on type, technology, industry, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

2D AOI

-

3D AOI

-

-

Technology Outlook (Revenue, USD Million, 2016 - 2027)

-

Inline

-

Offline

-

-

Industry Outlook (Revenue, USD Million, 2016 - 2027)

-

IT & Telecom

-

Consumer Electronics

-

Automotive

-

Industrial Electronics

-

Aerospace & Defence

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."