- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Elastomers Market Size & Trends Report, 2030GVR Report cover

![Automotive Elastomers Market Size, Share & Trends Report]()

Automotive Elastomers Market Size, Share & Trends Analysis Report By Type (Thermoset, Thermoplastic), By Application (Tire, Interior, Exterior, Under The Hood), By Vehicle Type, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-951-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2019 - 2020

- Industry: Bulk Chemicals

Report Overview

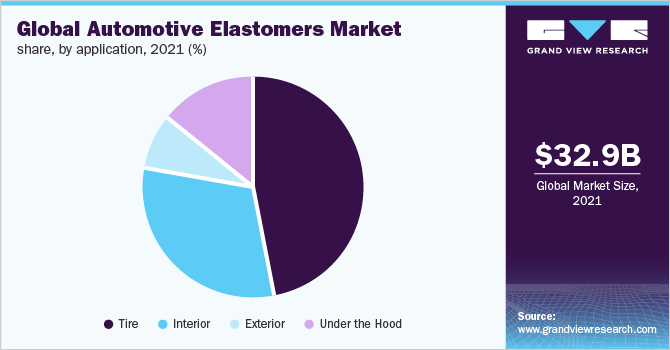

The global automotive elastomers market size was valued at USD 32.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2022 to 2030. The market is anticipated to be driven by the increasing demand for new vehicles and rising consumer disposable income. Moreover, the government's strict standards and policies to reduce pollution, increase vehicle efficiency, and ensure passenger safety have resulted in the widespread use of and demand for automotive elastomers. Rising awareness regarding various benefits of automotive elastomers like emissions reduction, noise reduction, performance improvement, and safety improvement is anticipated to boost the demand for several types of automotive elastomers.

The COVID-19 pandemic had a negative impact on the market. The pandemic forced governments to seal global borders and temporarily shut industries and markets in 2020. The closure of manufacturing plants in the regions has resulted in a significant loss of business and revenue for the regions under lockdown and fluctuation in raw material prices and supplies. The disruption in global supply chains negatively impacted the sales of products, delivery schedules, and manufacturing, which led to a notable drop in automotive sales, thereby leading to a reduction of automotive elastomer demand as it is dependent on the demand and sales of the automotive industry. However, the market is expected to recover quickly and reach pre-COVID levels over the forecast period.

The ongoing R&D and technological developments in the field of automotive elastomers and the widespread adoption of and need for elastomers in the automotive sector are expected to drive the market in the coming future. Additionally, an increasing need for lightweight, durable, flexible, high abrasion resistance and better low-temperature performance material is one of the factors driving the demand for automotive elastomers. The fluctuation of crude oil prices and their market substitutes impact the cost of automotive elastomer manufacturing, either directly or indirectly.

The capital cost of automotive elastomer manufacturing is high, and companies outsource manufacturing to nations with cheap labor and raw materials, such as India and China. Furthermore, the presence of a huge, domestic market in the Asia Pacific and the Middle East has posed a threat to major international firms because of the low-cost technology, the availability of raw materials at low prices, and cheap labor, resulting in a price disparity in the global market. In April 2022, Motherson announced the closing of the acquisition of Marelli, a car components manufacturer. The acquisition will lead the group to become India's largest vehicle component producer and rank among the world's top ten.

Type Insights

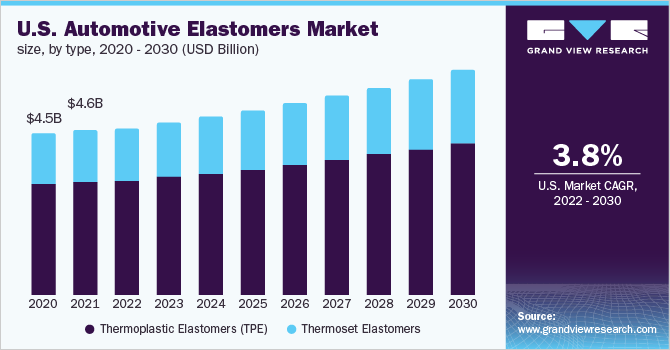

The thermoset elastomers segment accounted for the largest revenue share of over 65.0% in 2021 and is expected to continue to dominate the market over the forecast period. This can be attributed to the increasing demand for and use of natural and synthetic rubber in the automotive industry. In addition, tires are made using natural and synthetic elastomers, which provide durability and flexibility on the road, further driving the segment. In terms of type, the market has been segmented into thermoset and thermoplastic elastomers.

The Thermoplastic Elastomers (TPE) segment is expected to expand at a revenue-based CAGR of 5.7% over the forecast period. This can be attributed to thermoplastic properties such as compression resistance, high tear resistance, thermoplastic process-ability, high tensile strength, shock absorption, and slip resistance. The automotive industry is one of the biggest consumers of TPEs owing to the resistance to high temperatures, abrasion, and chemical resistance. These products are excellent for bumper stops, vibration dampeners, shock-absorbing seals, and other weather-stripping elements. In December 2019, Sirmax SpA established a thermoplastic elastomer compounding factory in Poland with a yearly capacity of 30 kilotons of TPE to expand its position in Northern and Eastern Europe.

Vehicle Type Insights

The passenger cars segment accounted for the largest revenue share of over 55.0% in 2021 and is anticipated to continue to dominate the market over the forecast period. This can be attributed to the increasing usage of automotive elastomers in passenger cars due to the materials’ properties, substitutability with several metals used in vehicles, and better customer experience.

The light commercial vehicles are expected to expand at a revenue-based CAGR of 5.0% over the forecast period. This can be attributed to the increasing use and adoption of automotive elastomer compounds in light commercial vehicles because they contain cross-linking compounds that improve aging and cyclic loading resistance.

Application Insights

The tire segment accounted for the largest revenue share of over 45.0% in 2021 and is expected to retain its position in the market over the forecast period. This can be attributed to the usage of elastomers in tire manufacturing, which improves performance significantly. The chemical system in tire rubber benefits from intermediates that give reliable seals, flexibility, and durability.

The interior segment is expected to expand at a revenue-based CAGR of 5.5% from 2022 to 2030. The use of automotive elastomers in car interiors is growing owing to their advantages such as lightweight, flexibility, safety, aesthetics, cost-effectiveness, agility, low emissions, and moldability. In June 2022, Continental created Benova Eco Protect, a new premium surface material. It improves the sustainability, durability, and comfort of vehicle interiors.

Regional Insights

Asia Pacific accounted for the largest revenue share of over 50.0% in 2021 and is anticipated to retain its position over the forecast period. Factors such as the presence of major market vendors, the availability of raw materials and labor at a lower price, and the high adoption of advanced technologies are the key factors driving the market in the region. Leading vehicle-producing countries in the Asian region include India, China, Japan, and South Korea.

North America is anticipated to expand at a revenue-based CAGR of 4.1% over the forecast period. The market growth in the region can be attributed to technological developments in the country, significant disposable incomes, demand for new vehicles, and strict environmental regulations in the region.

Key Companies & Market Share Insights

The market has a fragmented competitive landscape as it features various global and regional market players. Leading industry players are adopting strategies such as partnerships, collaborations, acquisitions & mergers, and agreements to survive the highly competitive environment and expand their business footprints. Moreover, automotive elastomer providers are spending extensively on research and development activities to develop advanced products and integrate new technologies and features into their offerings.

For instance, in December 2021, Pexco LLC declared that it acquired Performance Elastomers Corporation. Through this deal, Pexco is looking forward to expanding its thermoplastic and silicone elastomer products and expanding its abilities to incorporate other high-performance polymer solutions to provide even higher value to its customers. Some prominent players in the global automotive elastomers market include:

-

Dow

-

LANXESS

-

DuPont

-

ExxonMobil Corporation

-

BASF SE

-

SABIC

-

Huntsman International LLC

-

Continental AG

-

INEOS

-

Mitsui Chemicals, Inc.

Automotive Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 33.8 billion

Revenue forecast in 2030

USD 51.3 billion

Growth Rate

CAGR of 5.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; U.K.; France; China; India; Japan; South Korea; Brazil

Key companies profiled

BASF SE; Exxon Mobil Corporation; DuPont; Dow; Huntsman International LLC; LANXESS; SABIC; Covestro AG; Continental AG; INEOS; Mitsui Chemicals, Inc.; Versalis S.p.A; Kraton Corporation; KRAIBURG TPE; China Petroleum & Chemical Corporation (SINOPEC CORP.)

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts volume and revenue growth at the global, regional, and country levels. It provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global automotive elastomers market report based on type, application, vehicle type, and region:

-

Type Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

-

Thermoset Elastomers

-

Natural Rubber (NR)

-

Synthetic Rubber (SR)

-

Styrene-Butadiene Rubber (SBR)

-

Butyl Rubber (IIR)

-

Poly Butadiene Rubber (BR)

-

Neoprene Rubber / Polychloroprene Rubber (CR)

-

Nitrile Butadiene Rubber (NBR)

-

Acrylic Rubber (ACM)

-

Ethylene Propylene Diene Monomer (EPDM)

-

Polyisoprene Rubber (IR)

-

Silicone (Q) Elastomers

-

Fluoroelastomers

-

-

Thermoplastic Elastomers (TEP)

-

Styrene Block Copolymer (SBC)

-

Thermoplastic Polyurethane (TPU)

-

Thermoplastic Polyolefins (TPO)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyester Elastomers (TPC)

-

Polyether Block Amide (PEBA)

-

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

-

Tire

-

Interior

-

Hoses and Seals

-

Door Panels

-

Airbags

-

Conveyors and Transmission belts

-

Dash Boards

-

Seating

-

Instrument & Soft Touch Panels

-

Window and Door Trim

-

Anti-Slip Mats

-

-

Exterior

-

Front End Body Panel

-

Breaks & Suspensions

-

Bumper Fascia

-

Rocker Panel

-

Roof Molds & Window Shields

-

-

Under the Hood

-

Battery Casing

-

Hoses and nozzles

-

Others

-

-

-

Vehicle Type Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Medium and Heavy Commercial Vehicles

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive elastomers market size was estimated at USD 32.9 billion in 2021 and is expected to reach USD 33.8 billion in 2022.

b. The global automotive elastomers market is expected to grow at a compound annual growth rate of 5.4% from 2022 to 2030 to reach USD 51.3 billion by 2030.

b. Passenger cars segment dominated the automotive elastomers market with a share of 55.0% in 2021. This is attributable to increasing usage of automotive elastomers in passenger cars due to the materials’ properties, substitutability with several metals used in vehicles, and to give a better customer experience.

b. Some key players operating in the automotive elastomers market include BASF SE, Exxon Mobil Corporation, DuPont, Dow, Huntsman International LLC, LANXESS, SABIC, Covestro AG, Continental AG, INEOS, Mitsui Chemicals, Inc., Versalis S.p.A, Kraton Corporation, KRAIBURG TPE, and China Petroleum & Chemical Corporation (SINOPEC CORP.)

b. Key factors that are driving the market growth include government's strict standards and policies to reduce pollution, increase vehicle efficiency, and ensure passenger safety have resulted in the widespread use and demand of automotive elastomers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."