- Home

- »

- Automotive & Transportation

- »

-

Automotive Wiring Harness Market Size & Share Report, 2030GVR Report cover

![Automotive Wiring Harness Market Size, Share & Trends Report]()

Automotive Wiring Harness Market Size, Share & Trends Analysis Report By Vehicle, By Component (Electric Wires, Connectors, Terminals), By Application, By Electric Vehicle, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-191-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global automotive wiring harness market was valued at USD 48,614.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030. The increasing adoption of electric vehicles coupled with consistent support by government agencies in the form of incentives to vehicle manufacturers and consumers are some of the key factors propelling the demand for automotive harnesses within the electric vehicle landscape, thus augmenting the automotive wiring harness market growth. In addition, the rising integration of advanced technologies such as vehicle-to-vehicle communication, self-healing for electric vehicles, smart battery systems, and smart braking & safety systems among others is attributed to drive the market growth.

In line with these advancements, the introduction of autonomous and semi-autonomous vehicles, which have a high dependency on components such as low-latency communication devices, sensors, cameras, and radar, will increase the demand for automotive wiring harnesses within the automotive manufacturing industry, thereby offering numerous growth opportunities to the automotive wiring harness marketers. Moreover, the increasing use of optical fiber for producing wiring harnesses is expected to create new opportunities for market players.

The rising consensus pertaining to security and safety while driving is fueling the demand for driver-assisting technologies such as adaptive cruise control, blind spot detection, adaptive front light, and lane departure warning system. Additionally, vehicle manufacturers are obliged to comply with stringent safety norms introduced by authorities worldwide and are expected to support market growth. For instance, On July 6th, 2022, European Union introduced new safety measures to reduce commute-related injuries and fatalities by applying general safety regulations.

The regulation sets the legal framework for the EU's approval of fully driverless and automated vehicles and introduces advanced driver assistance technologies for passenger and commercial vehicles. The deployment of cables or wire harnesses is anticipated to gain traction owing to its incorporation into multimedia and security systems. To enhance the driving experience, features including ambient lighting systems, cooled cup holders, voice recognition systems, heated steering wheels and seats, infotainment, and power steering functions have gained prominence. A wiring harness is necessary for the data, signal, and power transfer in electronic equipment which enables these functions. Wiring harness bundles are put in automobiles with these circuits to ensure that various features operate without interruption. Thus, the market is experiencing growth due to its application in the automotive industry.

The demand for automotive wiring harnesses is increasing owing to the connected car ecosystem, new laws, electrification, growing preference for 48V high voltage capacity, and an increase in comfort and safety features in automobiles. Throttle control, steering, and braking are essential vehicle activities that the electronic control unit (ECU) aids. Throughout the sensors, actuators, and ECU, the wiring harness facilitates the transmission of signals, power, and data. The development of electronic and electrical features in vehicles further exacerbates the need for wiring harnesses. Governments in North America, Europe, and Asia-Pacific are advocating for an increase in the integration of ADAS systems, telematics, and low-emission engines such as China VI, Euro VI, and BSIII to BSIV electronics engines. These engines increase the application sensors radar, telematics, and communication devices. Thus, the growing need for connectivity and data transmission in automobiles is anticipated to propel automotive wiring harness market growth within the forecast period.

The increasing traction of electric vehicles worldwide is also generating demand for lighter-weighing harnesses. Integrating an electric power train into a vehicle significantly increases the vehicle’s weight; furthermore, the amount of wiring harness integrated into vehicles also adds to the vehicle’s weight. These underlying factors impact vehicle performance and efficiency. However, such factors fuel the demand for aluminum-based wiring harnesses that help reduce bundle diameter, weight, and cost as compared to copper-based wiring harnesses. Additionally, the strong demand for displays, cameras, and other infotainment devices, has led to the development of technologies for transmitting camera and video signals over a single specialty cable along with lowering the weight and expense of wiring harnesses. OEMs favor optical fiber and aluminum for lightweight, efficient harnesses. Fiber optic cable is more resistant to environmental variables than copper wire. To transmit high-speed data, firms are switching to optic fiber wiring harnesses

Exposure to heat, cold, vibrations, and corrosion are major restraints affecting the growth of the automotive wiring harness market. Rapid temperature changes, such as those from extreme heat to extreme cold, and other abrupt changes in temperature might cause the wiring harness to bend occasionally. These factors may cause the wiring harness lifespan to shorten. The wiring harness-powered sensor system is impacted by corrosion. A sensor can interpret a current and voltage flow deterioration brought on by excessive corrosion as a system problem. The issue may cause safety features like airbags and anti-lock brakes to stop working. Additionally, this results in a number of issues like wire deterioration and fire dangers. Furthermore, the fluctuating prices of metals such as copper and aluminum also affect the supply chain and the automotive wiring harness prices, thus affecting the market growth.

Electric Vehicle Insights

The battery electric vehicle (BEV) is expected to accumulate the largest market share and is projected to expand at the highest CAGR within the forecast period. The BEVs are fitted with comparatively more wires and connections than an ICE vehicle, with the integration of a more electric-based system in the vehicle for auxiliary and primary vehicle functions the vehicle. The use of high-voltage wiring harnesses is gaining prominence throughout the automotive industry, and as the sales for electric commercial and passenger vehicles throughout the world increase, the market for automotive wiring harnesses within the electric vehicle segment will experience a positive growth trajectory.

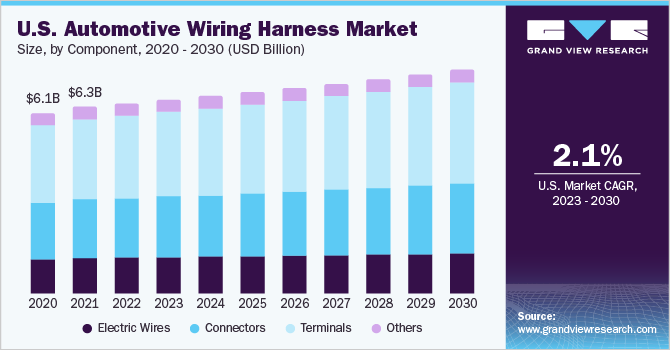

Component Insights

The terminal segment dominated the market and is anticipated to hold the majority of the market share in 2022. The growing complexity and connections of vehicle wiring structures are major factors propelling the market growth. Terminals are designed to facilitate effective and robust wiring connections between two or more wires. These terminals withstand high thermal and vibrations, thus positioning them as an essential part of the wiring harness system. The constant technological advancement in the automotive industry and the electrification of vehicles are further expected to propel market growth.

The connector segment is expected to have the highest growth rate from 2023-2030. The connectors play a crucial role in maintaining a consistent flow of power or data while the vehicle is functioning. The dependency vehicles with level 2 to level 5 autonomous functions have sensors and radar, the function of wires, and the flow of data and power becomes more important. Thus the market for connectors is expected to gain momentum during the forecast period.

Vehicle Insights

Light vehicles dominated the market and accounted for the largest revenue share of over 90% in 2022. Light vehicles such as utility vans, SUVs, or trucks are now equipped with systems such as GPS, advanced infotainment systems, smart lights, and panoramic roofs, even with sensors for temperature control and tire pressure. The integration of such technologies and equipment in light vehicles is helping in redefining comfort and functionality while traveling as consumers are now considering advanced functions and driving experience while buying a vehicle. The wiring harness in these vehicles is expected to increase in proportion while maintaining an optimum vehicle weight. Thus, the rising functions in the vehicle will positively impact the demand for wiring harnesses in light vehicles.

Light vehicles are expected to register a CAGR of 3.4% from 2023-2030. The automotive wiring harness market is expected to gain traction in the heavy vehicle segment owing to increasing traction in heavy-duty electric vehicles, and the integration of telematics, GPS, and ADAS sensors and radar by trucks and bus fleet managers is further augmenting the market growth.

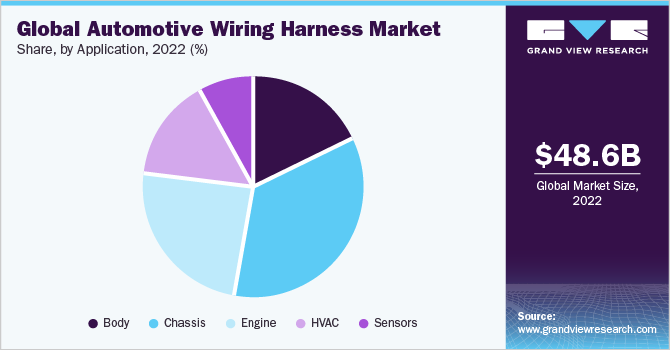

Application Insights

The chassis segment dominated the market and accounted for the largest revenue share of over 34% in 2022. The chassis harness system consists of the main, rear, and front harness, which houses wired connections to multimedia such as GPS, DVD, radio, engine, AC, and other sensors for temperature control and ADAS. The chassis holds wiring and connections for all the important components that enable the vehicles to perform their primary functions. In addition, the chassis carries the advantage of minimal risk of shorting its ability to withstand high temperatures while improving fuel efficiency and vehicle performance.

The sensors sub-segment is expected to exhibit the highest growth rate of 5.0% within the forecast period. It includes numerous sensors for systems such as illumination, battery system, speed systems, infotainment systems, and ADAS. The wiring harness is equipped with sensors required to maintain and enable an analysis of relevant data coupled with the increasing use of sensors based on the level of autonomous driving technology in vehicles is expected to determine the market.

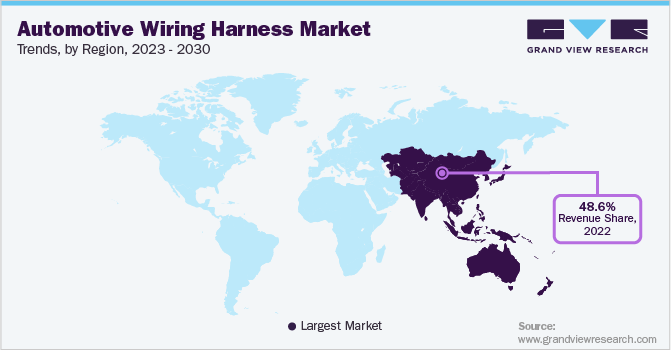

Regional Insights

Asia Pacific region dominated the automotive wiring harness market and accounted for the largest revenue share of 48.6% in 2022. Asia Pacific region is home to some of the major automobile markets, such as China and India. Economics such as China, India, and South Korea ranks among the top 5 car-producing countries in the world, and the application of automotive wiring harness in the region is expected to be high, thus positively impacting the market. The region also has a high population density and disposable income. Many manufacturers have a strong presence in the Asian market and are launching many technological advance vehicles in the region. Furthermore, the presence of automobile manufacturing units concentrated in India, Thailand, China, South Korea, and Japan, coupled with increasing demand for passenger & commercial vehicles in the region, is bound to spur the demand for automotive wiring harnesses in the region.

The European region is expected to experience a healthy growth rate over the forecast period, the region is expected to see a rise in the demand for high-voltage harness wires as the region witnessed a consistent rise in electric vehicle sales. The sales of EV vehicles are further propelling owing to subsidies provided by the EU and respective governments of European countries. The EV sales are anticipated to positively affect the wiring harness sales.

Key Companies & Market Share Insights

The major market layers competing in the industry include Sumitomo Electric Industries, Ltd., Yazaki Corporation, Aptiv PLC, Lear Corporation, Furukawa Electric Co., Ltd., and Leoni AG. The companies are resorting to strategies such as technological advancement such development of optical wires, integration of sensors and wiring harnesses, and development of alternative metal wires. Furthermore, the OEMs are optimizing production costs by sourcing relatively cheaper labor from highly populated countries with skilled workforces.

Manufacturers are expanding their production facilities to stay in the competition and cope with the rising demand for wiring harnesses in the automotive landscape. For instance, Harness manufacturer Leoni AG has inaugurated its production plant in Cuauhtémoc, Mexico to produce automotive wiring harnesses and systems. The company established the plant to cope with the rising demand for electric vehicles in the North American region. Some of the prominent players in the global automotive wiring harness market include:

-

Delphi Technologies PLC (Aptiv PLC)

-

Furukawa Electric Co., Ltd.

-

Kromberg & Schubert GmbH Cable & Wire

-

LEONI AG

-

Lear Corporation

-

PKC Group

-

Sumitomo Electric Industries, Ltd.

-

Spark Minda, Ashok Minda Group

-

China Auto Electronics Group Limited (THB Group)

-

Yazaki Corporation

Automotive Wiring Harness Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 50,097.4 million

Revenue forecast in 2030

USD 63.0 billion

Growth rate

CAGR of 3.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, electric vehicle, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa.

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Delphi Technologies PLC (Aptiv PLC); Sumitomo Electric Industries, Ltd.; Yazaki Corporation; Leoni AG; Lear Corporation; Furukawa Electric Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Wiring Harness Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive wiring harness market report based on component, application, electric vehicle, vehicle, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Wires

-

Connectors

-

Terminals

- Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Body

-

Chassis

-

Engine

-

HVAC

-

Sensors

-

-

Electric Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Vehicles

-

Heavy Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

- Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global automotive wiring harness market size was estimated at USD 48,614.7 million in 2022 and is expected to reach USD 50,097.4 million in 2023.

b. The global automotive wiring harness market is expected to grow at a compound annual growth rate of 3.3% from 2018 to 2030 to reach USD 63.0 billion by 2030.

b. Terminal components dominated the automotive wiring harness market with a share of 41.52% in 2022. This is attributable to rising adoption of advanced vehicle technologies such as self-driving vehicles and connected vehicles that require more connections as compared to conventional variants.

b. Some key players operating in the automotive wiring harness market include Aptiv PLC, Sumitomo Electric Industries, Ltd., Yazaki Corporation, Leoni AG, Lear Corporation, and Furukawa Electric Co., Ltd.

b. Key factors that are driving the market growth include increasing use of electronic devices and components in vehicles to provide enhanced safety features.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."