- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Banana Flour Market Size, Share & Trends Report, 2028GVR Report cover

![Banana Flour Market Size, Share & Trends Report]()

Banana Flour Market Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Processing, By Form, By End-use (Food Insustry, Beverages), By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-948-2

- Number of Pages: 184

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Consumer Goods

Report Overview

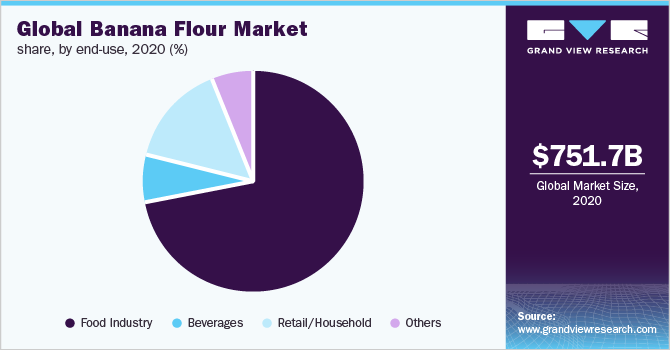

The global banana flour market size was estimated at USD 751.7 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2021 to 2028. The market growth is expected to be driven by a rising number of health-conscious consumers and an increasing preference for clean label products in daily diet. The COVID-19 pandemic highlighted the need for healthy and nutritionally rich food consumption. Banana flour is recognized as a functional ingredient because of its nutritional profile. Bananas contain prebiotic fiber, which is beneficial for gut health and reducing belly fat. Prebiotic fiber is also beneficial for digestion. The flour of bananas may support weight loss and blood sugar control, improve metabolic syndrome symptoms, promote a healthy colon, assist weight loss, and reduce cholesterol levels.

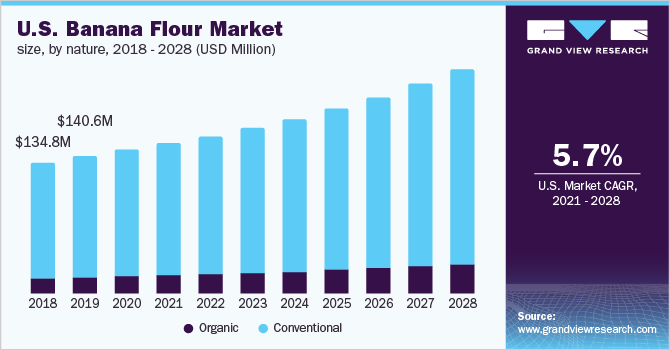

U.S. consumer interest in clean label products is driven by rising health concerns, as clean label products are considered healthier than non-clean label counterparts, as they are made with actual foods instead of cheap chemical imitations. Clean label products are about authenticity, traceability, and organic or sustainable farming. Clean-label products are increasingly being offered to customers who demand products that contain no artificial ingredients or ingredients that may be harmful. Food manufacturers are responding to the consumer demand for healthy, natural foods without harmful ingredients like artificial dyes, aspartame, bromine vegetable oil, and caramel color. Increasing demand for clean label products is expected to drive the demand for the market in the U.S.

Nature Insights

The organic banana flour segment is expected to witness a CAGR of 7.9% during the forecast period of 2021 - 2028. With consumers' increasing preference for clean eating, organic products have seen considerable growth in demand. Banana flour made with organic ingredients is becoming increasingly popular with consumers looking for chemical- and pesticide-free products. Banana flour manufacturers are also collaborating closely with suppliers or farmers to understand the quality of the bananas used to make the flour. The market demand is expected to be influenced by the demand for organic banana flour. For instance, Miski Organics offers certified organic green banana flour, which is high in antioxidants and has a positive impact on human health and well-being.

The demand for banana flour is increasing across the globe as banana plants and fruits are known for their health benefits, as they are nutritious and serve as a good source of fiber, resistant starch, vitamin A, vitamin B6, vitamin C, and potassium. Banana flour prepared with unpeeled bananas has a higher nutritional value with higher content of minerals, dietary fibers, total phenolic, and higher antioxidant activity. Thus, the increased consumer awareness regarding the importance of adequate immunity amid the outbreak of the COVID-19 has increased the demand for immunity-boosting food and supplements which, in turn, are likely to expand the size of the banana flour segment in the coming years across the world.

Processing Insights

The spray drying segment dominated the market and accounted for 41.7% of the global revenue share in 2020, as the spray drying process is widely used in banana flour production. During spray drying, the feeding flow of the particulate fluids is prayed into hot air to produce dried particles. This method features the fastest drying speed. The spray drying process has been adopted as a method of producing powders because of its ability to produce a reliable, consistent product with precise quality specifications. It provides both shelf stability and ease of use in products such as drinks that are ready for consumption in households or be used in any product requiring fruit solids, including desserts, yogurts, infant formulations, pharmaceuticals, etc. All these factors are expected to drive the sun-dried banana flour products over the forecast period.

Form Insights

The unripe banana flour segment dominated the market and accounted for 76.5% of the global revenue share in 2020. The banana (Musa sp.) is one of the world's most widely grown tropical fruits. Bananas are grown in over 1000 different kinds around the world. Bananas, both green and yellow, are high in a variety of nutrients. Unripe bananas are high in potassium, vitamin B6, and vitamin C, among other minerals. They are virtually entirely made up of carbohydrates, with very little protein and fat. Stage 1 of banana maturation is typically employed in the creation of green banana products because it contains high antioxidant chemicals, high starch, and low sugar content.

These properties are necessary for promoting health benefits, which could lead to the classification of banana flour as a functional food. Green bananas can help to keep your gut bacteria healthy. It can also make short-chain fatty acids, which are important for digestion. These driving factors are expected to drive the unripe segment's expansion in the market over the next few years. The ripen banana flour segment is expected to witness the highest CAGR over the forecast period owing to the increasing use of flour in the manufacturing of food products for infants.

Distribution Channel Insights

The direct sales segment dominated the market and accounted for 82.8% of the global revenue share in 2020. Banana flour has found various applications in the food industry, beverages, pet food and feed industry, nutraceuticals, pharmaceuticals, and other end-use industries. Banana flour is becoming a gluten-free alternative to food and beverage manufacturers across the globe. Banana flour is emerging as a key ingredient in bakery, sweet, and dessert products. Food and beverage manufacturers use flour as an ingredient in the products they produce. End-users purchase it in bulk quantities for use in many foods and beverages. This made direct sales a significant segment of the market.

However, the indirect sales segment is expected to grow at a significant rate over the forecast period due to the increased use of banana flour in households for making different dishes and recipes. Indirect sales include retail sales of banana flour through hypermarkets, supermarkets, grocery stores, and other retail channels such as multi-level marketing (MLM), convenience stores, and pharmacies. In contrast, direct sales segments are expected to remain dominant due to end-users bulk consumption of banana flour.

End-use Insights

The food industry segment dominated the banana flour market and accounted for 72.1% of the global revenue share in 2020. Banana flour has found various applications in the food industry with it being used as a gluten-free alternative to wheat flour. Banana flour is actively used in the bakery industry to make natural gluten-free and nut-free products for health-conscious consumers. Green banana flour is now used to make pasta-based meals healthier and more nutritious. Bread, as the most commonly consumed bakery product around the world, provides a great opportunity to use banana flour to strengthen bread and enhance its nutritional benefits. Banana flour can be used as a supplement daily by simply adding it to smoothies, yogurt, or other products to enjoy its nutritional benefits.

The retail/household segment is expected to witness the highest CAGR over the forecast period. Banana flour is becoming a nutritionally rich and healthy alternative to other grain flours such as wheat, barley, maize, rice, etc. Consumers in Africa, Latin America, and Asia traditionally consume banana flour using the traditional sun drying process. Consumers are using banana flour in their recipes owing to its health benefits. According to NuBana, its green banana flour is low in sugar and high in RS2-resistant starch, which can help individuals better regulate their blood glucose levels while also providing an interesting spectrum of digestive benefits, making it a potent new gut health component.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of around 35.9% in 2020. Countries such as India, China, Phillippines, Indonesia, etc are the leading producer of bananas in the world. Additionally, Asia Pacific is one of the most populous regions with the largest food and beverage consumer base. As bananas are traditionally consumed fruit in the Asia Pacific, the trend has been changing over the past decade with the increasing importance and health benefits of banana flour. Banana manufacturers in the region are more inclined to make banana products since bananas are becoming a healthier substitute for processed and raw foods. Gluten intolerance is also one of the -growing concerns among consumers around the world and in Asia.

Wheat and wheat-containing foods are abundant in the global food supply and are commonly associated with gluten. Gluten intolerance is caused by several factors, including non-celiac gluten sensitivity, celiac disease, and wheat allergy. As such, banana flour is becoming a healthy and gluten-free alternative to the traditional grain flour commonly consumed in the region. As a result, these factors are expected to fuel banana flour demand over the forecast period. In the Middle East and Africa, the market is expected to witness a significant CAGR over the forecast period.

Key Companies & Market Share Insights

Market players operating in the market are increasingly investing in research and development activities to develop the highest-quality banana flour at competitive prices. In addition, the manufacturers are likely to establish their partnerships with e-commerce portals to ensure a continuous supply to buyers. Key players are focused on the merger and acquisition of small and medium-size banana flour manufacturers and suppliers to increase their regional presence and product availability.

Recent Developments:

-

In October 2021, the ICAR-National Research Centre for Banana (NRCB) in Trichy signed a memorandum of understanding (MoU) with Cake Bee, one of India's top bakeries. Foam mat drying, a low-cost innovative method developed by the ICAR, might be a viable alternative for making cost-effective banana powders from ripe or market rejected bananas.

-

As per the article published in November 2017, The International Agriculture Group (IAG), a start-up ingredient technology business, was developing a novel ingredient with a high quantity of prebiotic dietary fiber resistant starch. NuBana N200 Green Banana Flour includes at least 65 percent RS2 resistant starch, which has been demonstrated to provide a wide range of health advantages depending on how much is ingested daily.

Some of the prominent players in the banana flour market include:

-

Pereg Gourmet Spices

-

Dr. Food Banatone

-

Seawind Foods

-

Woodland Foods

-

Divine Foods

-

APKA Industries

-

Miski Organics

-

Saipro Biotech Private Limited

-

LiveKuna

-

Diana Foods

-

Synergy Food Industries

Banana Flour Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 792.5 million

Revenue forecast in 2028

USD 1,269.6 million

Growth Rate

CAGR of 6.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, processing, form, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; Argentina; GCC; South Africa

Key companies profiled

Pereg Gourmet Spices, Dr. Food Banatone, Seawind Foods, Woodland Foods, Divine Foods, APKA Industries, Miski Organics,

Saipro Biotech Private Limited, LiveKuna, Diana Foods, Synergy Food Industries

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global banana flour market report based on nature, processing, form, end-use, distribution channel, and region:

-

Nature Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Organic

-

Conventional

-

-

Processing Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Freeze Dried

-

Spray/Drum Dried

-

Sun Dried

-

Others

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Ripen

-

Unripen

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Food Industry

-

Beverages

-

Retail/Household

-

Others

-

-

Distribution Channel Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Direct Sales

-

Indirect Sales

-

Supermarkets & Hypermarkets

-

Grocery Stores

-

Online Retail

- Others

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

- Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the banana flour market include Pereg Gourmet Spices, Dr. Food Banatone, Seawind Foods, Woodland Foods, Divine Foods, APKA Industries, Miski Organics, Saipro Biotech Private Limited, LiveKuna, Diana Foods, Synergy Food Industries, among others.

b. The key factors that are driving the banana flour market including rising number of health conscious consumer and increasing preference for clean label products in daily diet.

b. The global banana flour market size was estimated at USD 751.7 Million in 2020 and is expected to reach USD 792.5 Million in 2022.

b. The banana flour market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2021 to 2028 to reach USD 1,269.6 Million by 2028.

b. Asia Pacific dominated the market and accounted for 35.9% share of global revenue in 2020, on account of several factors, including increasing health conscious population, changing food habits and rising spending power of consumer on health and wellness across the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."