- Home

- »

- Next Generation Technologies

- »

-

Banking Encryption Software Market Size Report, 2022-2030GVR Report cover

![Banking Encryption Software Market Size, Share & Trends Report]()

Banking Encryption Software Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Function (Cloud Encryption, Folder Encryption), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-964-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global banking encryption software market size was valued at USD 1.73 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.0% from 2022 to 2030. Several advantages are offered by this software, such as smooth data transaction services and high security. The growing need for payment security solutions in the banking sector to provide a more secure service to its customers is driving the growth. Moreover, the emergence of digital payment platforms and increased utilization of digital payment methods are creating a positive outlook for the industry. The prevalence of online payment platforms is intertwined with the threat of cyberattacks, which will provide further opportunities for the market.

Additionally, the integration of artificial intelligence (AI) in banking encryption software is anticipated to increase the efficiency and effectiveness of the software. At the same time, it also aids in catering to the rising demand for data security of customers as well as businesses. This thereby is expected to result in the rapid deployment of artificial intelligence-enabled encryption software across the banking and finance industry.

In addition, a surge in the implementation of data privacy laws, such as the Payment Card Industry Data Security Standards (PCI DSS) for the banking sector to protect sensitive data from fraud and theft creates the demand for banking encryption software. Although the banking sector is highly regulated by authorities it is the prime target of cybercriminals. The banking sector is a house of a large volume of data such as personal information, social security numbers, and payment card details. This thereby creates the need for the banking industry to deploy security measures to protect such data, which is expected to create lucrative growth opportunities.

The banks are required to uphold the integrity of data throughout its life cycle. Consequently, it is also crucial for banks to implement the proper threat detection and response procedures as per their requirements. The data integrity can thereby be maintained by enforcing a variety of security policies, including data masking and encryption software by banks. Hence, it is expected to boost the demand for banking encryption software across the banking, finance, and insurance (BFSI) sector.

However, the lack of awareness and implementation concerns associated with software in developing countries is expected to restrain the growth of the market over the forecast period. Although, the rapid growth in IT infrastructure and technological developments across the globe are expected to counter such challenges. Moreover, the regulatory frameworks that require banks to improve their data security are expected to drive market growth. For instance, in May 2022, U.S. President Joe Biden administered a new set of cybersecurity rules for the financial sector.

COVID-19 Impact Analysis

The COVID-19 pandemic is expected to play an emphasized part in propelling the growth of the banking encryption software market. Since the outbreak, the global payment industry has evolved rapidly owing to the rise in the use of digital payment methods among people as well as digital transformation worldwide. In line with this, the need for providing digital financial services to customers has increased among the banks, which thereby has created growth opportunities. Thus, creating the need for implementing encryption software to secure customers’ data such as debit/credit numbers, and date of birth.

Component Insights

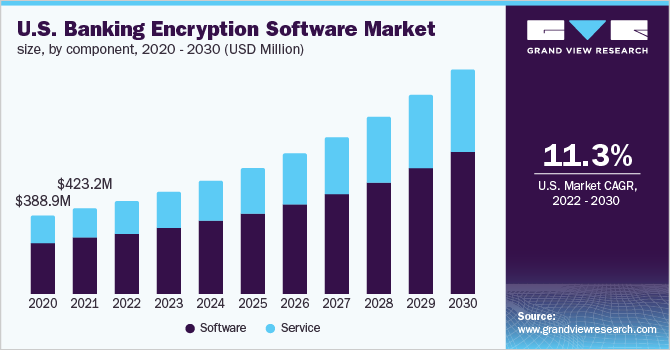

The software segment accounted for the largest revenue share of more than 65.0% in 2021. The software provides the infrastructure for deploying, creating, and managing financial products. Additionally, account holders' personal information, including names, addresses, and dates of birth, is stored and secured using the software. The segment is expected to grow as banks increasingly use encryption software to provide secure money transfer services to their customers.

The service segment is anticipated to witness the fastest growth over the forecast period. It includes professional services, managed services, training & development, among others. Professional services help banks smoothly integrate encryption software with their existing systems. Managed services are used for offering deep infrastructure support and maintenance to the banks.

Deployment Insights

The on-premise segment held the largest revenue share of more than 62.0% in 2021. Institutions worldwide are making efforts for gaining authority over their software and control over the data. As a result, they are demanding on-premise deployment as it enables them to have control over their data and its security. At the same time, even if the connection to the internet is interrupted the employees can gain access to the data with on-premise solutions.

The cloud segment is anticipated to witness the fastest growth over the forecast period. Since there are many management and security options available with cloud deployment, it can be deployed by practically any type of business. Banking companies can benefit from improved levels of fault tolerance, data protection, and disaster recovery with cloud deployment, where the service provider manages the technology. Additionally, cloud deployment provides high levels of redundancy and backup at a lesser cost.

Enterprise Size Insights

The large enterprise's segment held the largest revenue share of more than 61.0% in 2021. The large enterprises comparably have to handle a lot of data owing to their large customer base is the key attribute responsible for the segment’s dominance. Unlike SMEs, they have huge funds to implement software to enhance security and protect customers’ interests. As a result, they can easily adopt modern security solutions to enhance their standards.

The small & medium enterprises segment is anticipated to register the fastest growth over the projection period. The rising incidents of cyber-attacks and frauds on SMEs are expected to increase the demand for comprehensive security solutions. This security solution helps the banks in preventing revenue loss due to the theft of sensitive information. Thus, the growing number of small & medium banks is expected to drive the segment growth.

Function Insights

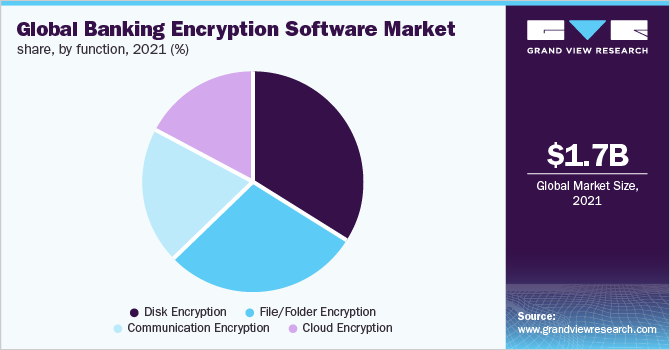

The disk encryption segment dominated with a revenue share of over 33.0% in 2021. The capability of disk encryption to encrypt the tiniest bit of data that is stored in the disk volume creates its demand across the banking sector. In addition, the market for this category is expanding because encrypted disks are secure, even if they are lost or stolen, only authorized users can access their information. Moreover, it is comparably easier to implement across the institute hence it is preferred over other functions.

The cloud encryption segment is anticipated to grow at the fastest CAGR over the forecast period. Cloud encryption enables secure remote work and real-time data security. The data is converted into ciphertext with the help of an encryption algorithm. In addition, cloud encryption serves as proactive protection against data breaches and cyberattacks. It enables businesses and their clients to benefit from the advantages of cloud collaboration services without unduly risking their customers' data.

Regional Insights

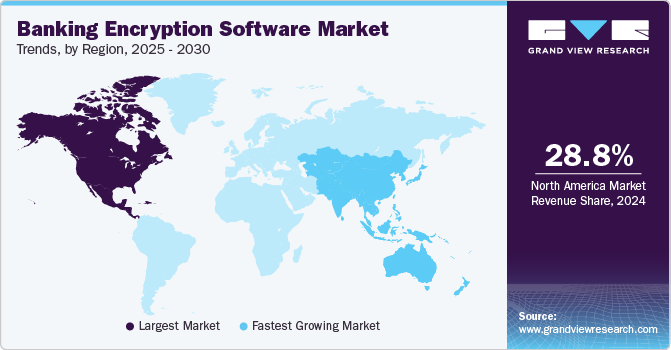

North America held the largest revenue share of over 28.0% in 2021. The dominance is attributable to the improved regulatory norms in countries such as Canada and the U.S. that requires banks to improve data privacy. Public and private banks have also expanded their demand for cryptographic software to safeguard privacy. Additionally, the rise in cyberattacks & the threat to the information that affects business is expected to drive the regional market growth.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth of the regional market can be attributed to the growing awareness in countries, such as China, and India about the benefits offered by banking encryption software. The demand for secure, all-encompassing, and dependable security systems among banking service providers is fueling the industry’s expansion. In addition, rising government privacy regulations and the use of mobile payment technology are two more key growth drivers.

Key Companies & Market Share Insights

The market can be characterized by the presence of several prominent market players such as Intel Corporation, and IBM Corporation. Industry incumbents are pursuing various strategies, such as new product launches, geographic expansion, strategic partnerships, and mergers & acquisitions among others, as part of the efforts to enhance their offerings. For instance, in June 2021, a supplier of commercial systems, Duality Technologies, and Intel collaborated. This partnership sought to enhance Fully Homomorphic Encryption on the newest 3rd Gen Intel Xeon Processors, enhancing performance for collaborative, AI, and data science applications that protect user privacy.

Market players are investing aggressively in research & development activities to enhance their product offerings. For instance, in Apr 2021, the first cloud platform designed specifically for financial services was unveiled by IBM as IBM Cloud for Financial Services. With built-in standards that are followed by the entire ecosystem, this platform is also designed to help financial institutions, their partners, and FinTechs reduce risk while innovating rapidly. It was made in collaboration with the Bank of America, specifically aimed at secure computing by taking a comprehensive approach to data security that includes containers, databases, and encryption for complete data privacy assurance. Some prominent players in the global banking encryption software market include:

-

Broadcom

-

ESET North America

-

IBM Corporation

-

Intel Corporation

-

McAfee, LLC

-

Microsoft

-

Sophos Ltd.

-

Thales Group

-

Trend Micro Incorporated

-

WinMagic

Banking Encryption Software Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.90 billion

Revenue forecast in 2030

USD 5.03 billion

Growth rate

CAGR of 13.0% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, function, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Broadcom; ESET North America; IBM Corporation; Intel Corporation; McAfee, LLC; Microsoft; Sophos Ltd.; Thales Group; Trend Micro Incorporated; WinMagic

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Banking Encryption Software Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global banking encryption software market report based on component, deployment, enterprise size, function, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Function Outlook (Revenue, USD Million, 2017 - 2030)

-

Disk Encryption

-

Communication Encryption

-

File/Folder Encryption

-

Cloud Encryption

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global banking encryption software market size was estimated at USD 1.73 million in 2021 and is expected to reach USD 1.90 billion in 2022

b. The global banking encryption software market is expected to grow at a compound annual growth rate of 13.0% from 2022 to 2030 to reach USD 5.03 billion by 2030

b. North America dominated the banking encryption software market with a share of 28.77% in 2021. The dominance is attributable to the improved regulatory norms in countries such as Canada and the U.S. that requires banks to improve data privacy.

b. Some key players operating in the banking encryption software market include Broadcom; ESET North America; IBM Corporation; Intel Corporation; McAfee, LLC; Microsoft; Sophos Ltd.; Thales Group; Trend Micro Incorporated; WinMagic

b. Key factors that are driving the banking encryption software market growth include increasing demand for security solutions among banks and growing emphasis on digitalization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."