- Home

- »

- Advanced Interior Materials

- »

-

Bare Die Shipping & Handling And Processing & Storage Market Report, 2025GVR Report cover

![Bare Die Shipping & Handling And Processing & Storage Market Size, Share & Trends Report]()

Bare Die Shipping & Handling And Processing & Storage Market Size, Share & Trends Analysis Report By Product (Shipping Tubes, Trays, Carrier Tapes), By End-Use, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-674-5

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Advanced Materials

Industry Insights

The global bare die shipping & handling and processing & storage market size was valued at USD 770.3 million in 2016. The increasing demand for integrated circuits (ICs) in automotive, communications, and industrial & medical applications is expected to drive the demand for bare die carrier products as the bare die is used for manufacturing ICs.

The high cost of bare die and increased vulnerability to atmospheric conditions has created a need for reliable carrier products. The utilization of HDPE, PTFE, and other materials with high corrosion, thermal, and chemical resistance has increased the reliability of bare die manufacturers on carrier products, which is expected to drive market growth.

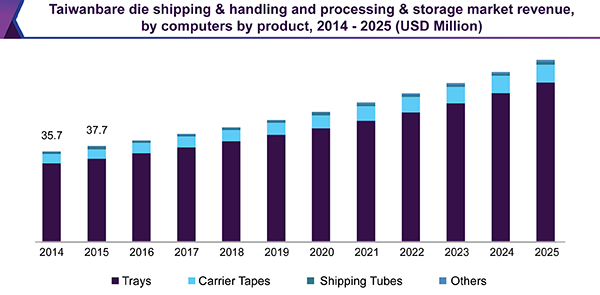

The demand for the silicon chip is high in computers on account of the growing demand for ICs in the manufacturing of the system. As the complexity of the designs of the computers is increasing demand for all-in-one PCs, the dependency on the improved ICs is growing significantly, leading to the demand for bare dies and its carrier products in computer systems.

The international market is characterized by IC chip manufacturers, who import large quantities of shipping tubes, carrier tapes, and IC trays from global players. The global distribution market is characterized by global players supplying products to major bare die manufacturers through authorized dealers.

There are several legal factors governing the market concerning Patents Act and regulations governing the manufacturing sector including the Clean Water Act, Clean Air Act. In addition, manufacturers of bare die shipping tubes, carrier tapes, and trays are required to abide by the laws regulating the health & safety of labor.

Plastic Pollution is one of the major concerns as plastics are non-degradable and pollute the environment. As a result, the bare die manufacturers are searching for an alternative to carrier products to reduce the environmental footprint and substitute plastic carrier products, which is expected to restrain bare die shipping & handling and processing & storage market growth over the forecast period.

Product Insights

Trays are expected to grow at a CAGR of 7.1% in terms of revenue share from 2017 to 2025. Optimum security and safety coupled with a lower margin of breakage are expected to be the key reason for the increasing demand for trays. In addition, the low cost of the trays is expected to be a complementing factor for the growing demand for the product in the industry.

Bare die stacked into waffle packs/chip trays is traditionally a popular method of storing bare die products. The demand for waffle packs is expected to grow as the product aids in a bulk shipment and offers high protection to the silicon chips. In addition, the lightweight waffle packs enable ease in the handling of the bare dies, which is expected to have a positive impact on its demand.

Carrier tapes are expected to witness faster growth as compared to its counterpart as the tight tolerance of carrier tapes as well as the specially designed corner protect features reduces the rotation of the component in the pocket and provides better protection to the component. In addition, low prices of the tapes are expected to have a positive impact on product growth.

End-Use, by Product Insights

The rising penetration of the silicon chips in the automotive application is expected to have a positive impact on the carrier products in the automotive industry over the forecast period. The growing complexity of automotive electronics and the need for more than one integrated circuit is expected to drive the demand for carrier products in the automotive industry.

The demand for carrier tapes and trays in industrial & medical applications is expected to grow on account of the increasing demand for ICs in complex medical devices and industrial machinery. The need for improved medical electronics is expected to drive the demand for high-performance ICs, leading to the demand for the bare die and its carrier products in the industry.

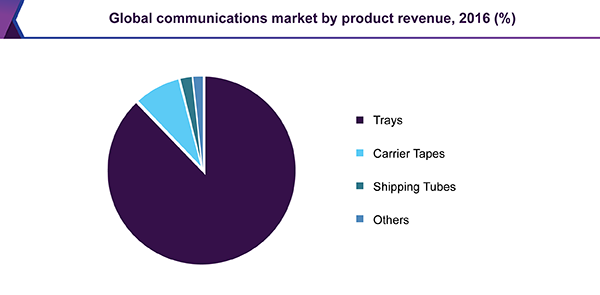

The communications industry accounted for 32.5% of the overall market revenue in 2016. The growing demand for ICs and bare die in the communication systems and devices is expected to drive the market growth over the forecast period. In addition, the growing demand for communication systems and devices is expected to drive market growth for carrier products.

Regional Insights

The demand for shipping & handling and processing & storage products in North America is mainly driven by the high demand in the U.S. The Silicon Valley is the major consumer of bare dies as a large number of IC manufacturers are located in the region. Also, the increasing manufacturing of electronics in the country is expected to drive the carrier product demand.

The advent of the Internet of Things (IoT) is expected to boost the growth of the semiconductor industry not just in France, but also across the world and is aided by the development in the areas of consumer electronics, automotive applications, energy-related applications, and other industrial applications.

The majority of the IC manufacturers outsource the die fabrication process to foundries. The presence of a large number of semiconductor foundries such as TSMC, UMC, and Micron, in Taiwan, is the sole factor contributing to high semiconductor fabrication in the country and driving the demand for the silicon chip carrier products.

Bare Die Shipping & Handling And Processing & Storage Market Share Insights

The companies in the industry are highly competitive and compete on the basis of prices and regional expansion. Established players such as Entegris compete in terms of innovation and new product development. The companies provide high-performance shipping products with customized solutions in terms of services.

Taiwan is expected to remain the dominant market for the manufacturing of silicon chips. The countries such as Brazil and Israel have expressed their inclination towards the installation of chip manufacturing plants which is expected to complement the demand for carriers and shipping & handling products on a large scale over the forecast period.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in million units; revenue in USD million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America

Country scope

U.S., Germany, France, China, South Korea, Japan, Taiwan, Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global bare die shipping & handling and processing & storage market on the basis of product, end-use, by product and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2014 - 2025)

-

Shipping Tubes

-

Trays

-

Waffle packs

-

Metal trays

-

Gel packs

-

-

Carrier Tapes

-

Others

-

-

End-Use, by Product Outlook (Volume, Million Units; Revenue, USD Million, 2014 - 2025)

-

Communications

-

Shipping Tubes

-

Trays

-

Carrier Tapes

-

Others

-

-

Computers

-

Shipping Tubes

-

Trays

-

Carrier Tapes

-

Others

-

-

Consumer Electronics

-

Shipping Tubes

-

Trays

-

Carrier Tapes

-

Others

-

-

Automotive

-

Shipping Tubes

-

Trays

-

Carrier Tapes

-

Others

-

-

Industrial & Medical

-

Shipping Tubes

-

Trays

-

Carrier Tapes

- Others

-

-

Defense

-

Shipping Tubes

-

Trays

-

Carrier Tapes

-

Others

-

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

South Korea

-

Japan

-

Taiwan

-

-

Central & South America

-

Brazil

-

- Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."