- Home

- »

- Power Generation & Storage

- »

-

Battery Energy Storage Systems Market Size Report, 2027GVR Report cover

![Battery Energy Storage Systems Market Size, Share And Trends Report]()

Battery Energy Storage Systems Market Size, Share And Trends Analysis Report By Application (Telecommunication, Data Center, Medical, Industrial, Marine), By Battery Type, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-642-4

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Energy & Power

Report Overview

The global battery energy storage systems market size was valued at USD 3.4 billion in 2019 and is projected to witness a compound annual growth rate (CAGR) of 27.2% over the forecast period. Rising demand for reliable and continuous power supply from end-use sectors such as industrial, telecom, data centers, marine, and medical are expected to strengthen the market over the forecast period.

Battery energy storage systems help the electricity suppliers to save excess power for later use, thereby improving the grid flexibility and reliability in terms of power generation, transmission, and distribution. Moreover, demand for uninterrupted power is expected to grow exponentially owing to continuous population growth, infrastructure development, and rapid industrialization over the coming years.

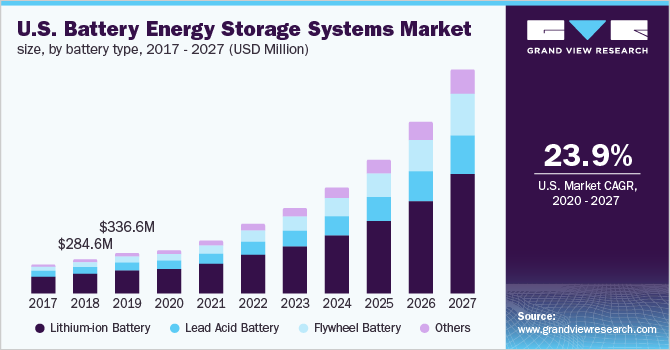

In the U.S., the market is projected to witness prominent growth on account of an increasing number of battery energy storage system manufacturers across the country. For instance, U.S. based electric services company NextEra Energy has integrated a 10-MW capacity battery storage with a large scale solar power plant, providing clean energy through a solar-plus-storage facility.

The cost of lithium ion batteries has decreased by 80.0% between 2010 to 2019 reaching approximately $200/kWh for small installations and is predicted to reach $96/kWh within the next seven years. Lithium-ion batteries offer the best option today in terms of cost, performance, calendar and cycle life, and technology maturity.

While lead-acid batteries have a high Manufacturing Readiness Level (MRL) and Technology Readiness Level (TRL), their cycle life is limited, leading to a life of fewer than 3 years assuming one cycle per day. Flywheel batteries are comparatively new technology and advancements are being made to compete with other battery technologies. However, with further reduced cost and technological up-gradation, flywheel battery storage is anticipated to grow in the coming future.

Battery Energy Storage Systems Market Trends

Plummeting lithium-ion batteries costs is one the major driver for growth of the battery energy storage systems market. Lithium-ion batteries are lightweight, as lithium is one of the lightest element in the world. Also, the utilization of non-aqueous electrolytes in lithium-ion batteries aids to provide high operating voltages as compared to other products. The only restraint on the growth of the lithium-ion battery market was high cost. However, with new technologies and developments, manufacturers have brought the price down to affordable levels.

The cost of manufacturing lithium-ion batteries has accounted for more than 70% of the cost over the last decade. For instance, lithium-ion battery pack price was USD 132/kWh in 2021 which was 6% decline as compared to the last year. Lithium-ion batteries offer the best options today in terms of cost, performance, cycle life, and technology readiness. This factor helped drive its use for energy storage as compared to other available battery technologies. Research is being conducted to further increase the energy density of lithium-ion batteries and further reduce costs.

The presence of other battery energy storage technologies in the market can be a major obstacle to market growth. In addition to batteries, energy storage can also be performed in a variety of ways such as electrical, thermal, and mechanical energy. Electrical energy storage devices include capacitors and superconductors. Mechanical includes technologies such as hydropower, pumped storage, flywheel, and compressed air storage (CAES). Pumped Storage use electricity to pump water into elevated tanks, which can be used to drive hydroelectric turbines when electricity is needed. The United States has more hydroelectric pumped storage capacity than the battery storage capacity.

Flywheels can be used to store energy by accelerating the rotating mass using an electric motor and later rotate the turbine to generate electricity. To reduce loss, the mass rotates in a housing with little friction. Flywheels are ideal for performance-oriented applications that require many charge and discharge cycles.

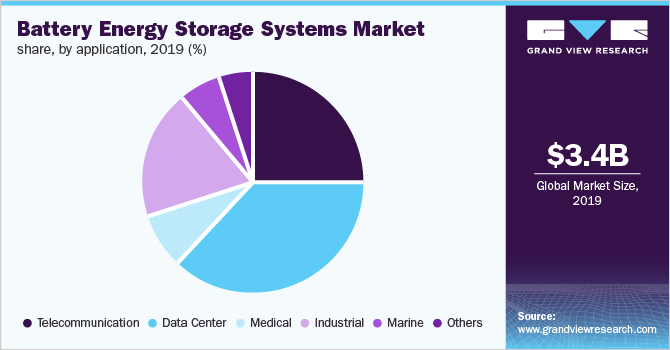

Application Insights

The data center application segment held a market share of 37.3% in 2019 and is expected to ascend with a prominent CAGR over the forecast period. Uninterruptible power supply is of utmost importance in data centers. The losses incurred due to power failure are huge. In the U.S. alone, around USD 50.0 billion are annually lost due to power failures and related problems.

Irregularities such as energy dips and spikes can adversely affect the equipment at data centers, resulting in losses. A line-interactive UPS system can also act as a filter that refines power that comes into the UPS, adjusting the output so that the internal systems receive a consistent and uninterrupted supply.

Replacement of diesel generators by highly efficient batteries in the telecom industry is expected to augment the growth of the market for battery energy storage systems. Market players in telecom industry have contracts with battery energy storage systems manufacturers, thereby facilitating continuous and cost-effective power supply. Rising number of telecom subscriptions has resulted in growth of telecom tower installations, which is expected to positively influence the battery energy storage systems market.

Others segment is expected to witness a significant CAGR of 28.0% over the forecast period. Growth of renewable energy with the deployment of numerous wind and solar energy projects over the past years is expected to augment product demand over the forecast period. In addition, there is a huge potential for growth in micro-grid development for military and disaster relief in the economy. In addition, rapid development in grid storage infrastructure and supportive government regulations are likely to have a positive impact on the growth of the market for battery energy storage systems.

Battery Type Insights

Lithium-ion batteries accounted for the largest revenue share of 55.0% of the market. Demand for lithium-ion batteries for energy storage systems is projected to subsequently increase owing to its low weight, low cost, and limited coverage area. Moreover, growing infrastructural spending from residential industrial and commercial sectors will bolster the lithium-ion battery energy storage systems market growth in the coming years.

Key Li-ion battery manufacturers include Toshiba Corporation, Panasonic Corporation, Hitachi Chemical Co., Ltd., GS Yuasa International Ltd., Samsung SDI Co., Ltd., LG Chem Power (LGCPI), and China BAK Battery Co., Ltd. Lithium-ion battery finds application in battery forklift trucks, automatic guided vehicles, wind and photovoltaic power storage, backup power source, and UPS.

Lead-acid battery occupies the second-largest revenue share in the market for a battery energy storage systems. The lead-acid batteries are relatively cheaper as compared to other batteries and are easily manufactured with relatively low technology equipment, which in turn will drive system growth in the near future. However, the emergence of alternative battery technology such as Li-ion and volatile raw material prices are expected to hamper the growth of the segment over the next seven years.

Flywheel battery technology is expected to witness the fastest growth on account of continuous uninterrupted power supply to the grid along with the instant response, frequency regulation, and quality improvement in terms of electricity. Flywheel batteries are more economical than other battery solutions. The main reasons for this are the long service life and low maintenance costs of the flywheel compared to the battery, which compensates for the higher purchase costs at the beginning of the installation.

Regional Insights

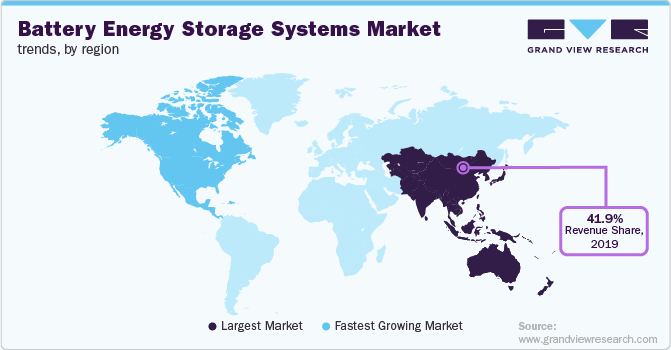

The market in Asia Pacific occupied a significant revenue share of 41.9% in 2019. Rapid population growth has led to increased power demand across developing economies. Grid operators are deploying battery energy storage systems to prevent power outages and enhance grid flexibility over a period of the next seven years.

Growing penetration of renewable energy along with rising demand for distributed power generation across several Asia Pacific economies are further expected to intensify the regional market growth. Surplus renewable energy is stored in the battery systems and is used later for local power generation and grid power supply in times of peak demand.

In addition, countries in the Asia-Pacific region such as China, Japan, India, South Korea, Australia, and others are showcasing rapid population growth and urbanization, which tends to increase the electricity demand. Hence, uninterrupted power supply demand is increasing which augments the growth of battery energy storage market in the region during the forecast period.

China emerged as the largest country in the Asia-Pacific region in terms of deployment of battery energy storage in 2019. China battery energy storage market will grow in size due to lower technology costs and increased technological advancement. The unit price of lithium batteries has halved in recent years as compared to industry benchmarks and will continue to follow the trend in future. In addition, manufacturing economies of scale, combined with innovative business cases, will drive industry growth.

North America occupies the second-largest share in the market for battery energy storage systems, with the U.S. being the major contributor to regional growth. Owing to the growing number of utilities and corporations, energy storage has been cornerstone of all energy planning in the U.S., and safety of these energy storage systems is among the top priorities of industry leaders. The explosion at an Arizona Public Service facility propelled the need for standardized safety regulations for storage technology of energy storage system integration and monitoring.

The New York Fire Department (NYFD), issued regulations for the deployment of stationary energy storage systems in New York City (NYC). It will be the first municipality in a dense urban area to examine, study, and determine how energy storage can be placed and used in a city. These regulations will eventually influence the market for battery energy storage systems and provide insight into the direction of the industry over the coming years.

North American countries such as U.S. and Canada have advanced energy markets consisting of well-developed schemes for power generation, capacity, transmission, auxiliary services, as well as pollutant emissions trading permits and renewable energy credits. Hence, U.S. and Canada are a major contributor for the revenue generation of battery energy storage market in North America.

Key Companies & Market Share Insights

Key companies are indulging in organic and inorganic growth strategies to enhance their foothold in the market through diversification of their product offerings. Some of the prominent players in the battery energy storage systems market include:

-

ABB

-

LG Chem Ltd.

-

Panasonic Corporation

-

Samsung SDI

-

BYD Company Limited

-

Contemporary Amperex Technology Co. Limited

-

Exide Technologies

-

General Electric

-

Enersys

-

Nissan

-

AES Energy Storage

-

Hoppecke Batteries Inc.

-

Tesla

Battery Energy Storage Systems Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.7 billion

Revenue forecast in 2027

USD 23.4 billion

Growth Rate

CAGR of 27.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, battery type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; U.K.; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

ABB; LG Chem Ltd.; Panasonic Corporation; Samsung SDI; BYD Company Limited; Contemporary Amperex Technology Co. Limited; Exide Technologies; General Electric; Enersys; Nissan; AES Energy Storage; Hoppecke Batteries Inc.; Tesla

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

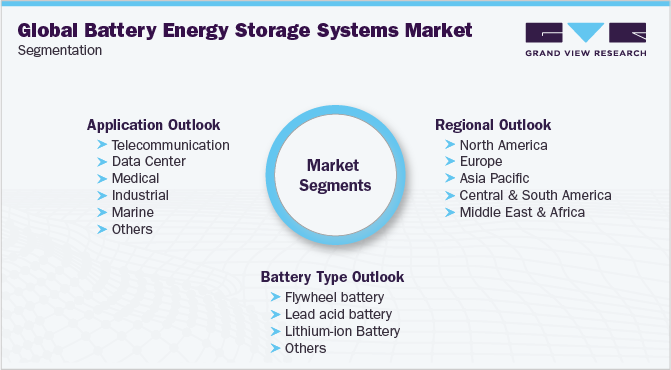

Global Battery Energy Storage Systems Market SegmentationThis report forecasts revenue growth at global, regional, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global battery energy storage systems market on the basis of application, battery type, and region.

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Telecommunication

-

Data Center

-

Medical

-

Industrial

-

Marine

-

Others

-

-

Battery Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Flywheel battery

-

Lead acid battery

-

Lithium-ion Battery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

France

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."