- Home

- »

- Medical Devices

- »

-

Bed Head Panel Market Size, Share & Growth Report, 2030GVR Report cover

![Bed Head Panel Market Size, Share & Trends Report]()

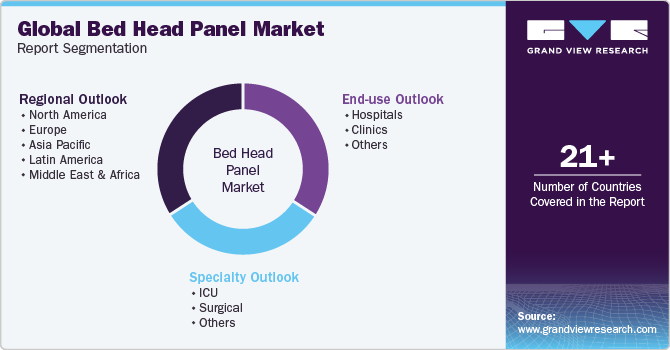

Bed Head Panel Market Size, Share & Trends Analysis Report By Specialty (ICU, Surgical), By End-use (Hospitals, Clinics), By Region (North America, Europe, Asia-Pacific, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-312-8

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Bed Head Panel Market Size & Trends

The global bed head panel market size was valued at USD 2.83 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. Increasing government initiatives, a rising geriatric population, and a high prevalence of chronic diseases are anticipated to drive the growth of the market during the forecast period. Furthermore, growing research and development activities to develop advanced bed head panel has been the area focus of manufacturers across the globe. This is further expected to lead the market during the forecast period. An increase in hospitalization rates as a result of the COVID-19 pandemic is an additional major factor driving the market.

Due to the significant outbreak of this infectious disease, there has been a global demand for modern healthcare services and infrastructure to treat infected patients that have never been seen before. Therefore, bed head panel, an important aspect of healthcare services, are in high demand worldwide due to an increase in COVID-19 patients. The pandemic also resulted in a rise in the number of patients with severe respiratory illnesses. Since then, oxygen levels in people with COVID-19 have dropped, causing breathing difficulties. As a result, bed head panels with several medical gas plug aid in delivering oxygen to persons with respiratory problems. Therefore, the number of patients requiring critical care and advanced healthcare services during pandemics has skyrocketed. This, in turn, is expected to boost the growth of the market for bed head panels.

Furthermore, major companies are working on providing innovative products and comprehensive services to increase/maintain end user confidence. For instance, in 2021, Hill-Rom quadrupled its manufacture of critical care products, such as ventilators, hospital beds, and vitals monitoring systems, to help fight the COVID-19 pandemic. Such initiatives are anticipated to spur market growth. The prevalence of chronic diseases, such as urological disorders, cancer, cardiovascular disorders, neurovascular diseases, and other chronic problems, is increasing, considerably increasing hospital admission rates. In addition, as a result of high blood pressure, obesity, and smoking, a large percentage of the population is currently in danger of developing chronic diseases. Chronic diseases are responsible for 60% of all fatalities worldwide, according to the World Health Organization (WHO). Furthermore, every year, 17.9 million people die as a result of cardiovascular disorders worldwide.

Cancer is the leading cause of death worldwide, accounting for nearly 1 in every 6 deaths. Therefore, increasing hospitalization and an increase in chronic illnesses are likely to boost bead head panel installations, resulting in market growth. The need for bed head panels in various healthcare settings is likely to increase with its rising aging population, a demographic that is more susceptible to chronic illnesses such as diabetes and other lifestyle-related disorders. In addition, adults aged 65 and up are more prone to develop diabetes, heart disease, neurological disorders, cancer, and other chronic illnesses, according to the CDC. Patients with such conditions require hospital treatment, both emergency and non-emergency.

Moreover, the global population of adults aged 60 and more is expected to exceed 2 billion by 2050. In addition, by 2050, 80% of the world's elderly will live in low- and middle-income countries. As a result, one of the significant impact-rendering factors for the market expansion is expected to be the growing elderly population. To achieve a competitive advantage, manufacturers are creating innovative products. For instance, INMED-Karczewscy, a firm located in Poland, released the latest model of the medical gas alarm panel during the MEDICA International Trade Fair 2019 in November. It detects irregularities in the gas supply and provides an audiovisual warning. It can be hung on the wall or attached to the front of other devices. Over the forecast period, such advancements are expected to promote market growth.

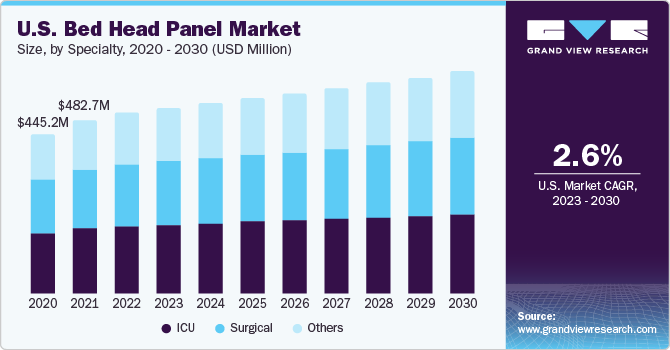

Specialty Insights

The ICU segment dominated the market and held the largest revenue share of around 40% in 2022. The increasing number of ICU admissions, owing to an increasing number of accidents, an aging population, and an increasing prevalence of life-threatening infectious diseases, are all contributing to segment growth. More than 5 million patients are hospitalized in ICUs in the U.S. each year, according to the Society of Critical Care Medicine (SCCM). Furthermore, major companies are working on providing innovative products and comprehensive services to increase/maintain end user confidence.

For instance, according to the National Center for Biotechnology Information (NCBI), in 2020, Germany saw 176,137 hospitalizations due to COVID-19 infection. More than half of these patients were male, and more than half were aged 70 years or older. Among them, 27,053 patients were treated in intensive care units (ICUs). Those who needed ICU care were generally younger and, more often, male. They also had higher rates of heart-related conditions and risk factors like obesity and diabetes. Unfortunately, the data showed that being admitted to the ICU increased the risk of in-hospital death. Factors like being male, obesity, diabetes, atrial fibrillation/flutter, and heart failure were linked to a higher likelihood of needing ICU care.

The other segment is expected to grow at the fastest CAGR of 3.7% over the forecast period. The others segments include operation theatre, children’s wards, light duty day care, ambulatory patient beds, examination/consulting room beds, long-term care, and general wards. The segment is expected to grow due to the increased number of bariatric patients, the volume of surgical procedures performed on them, and the increased prevalence of preterm newborns.

For instance, according to the American Society for Metabolic and Bariatric Surgery (ASMBS), in 2019, 256,000 persons in the U.S. received weight loss surgeries. Typically, such patients require long-term hospitalization, which increases the demand for better treatment due to bed head panels during their stay. This is projected to strengthen the segment growth rate in the coming years.

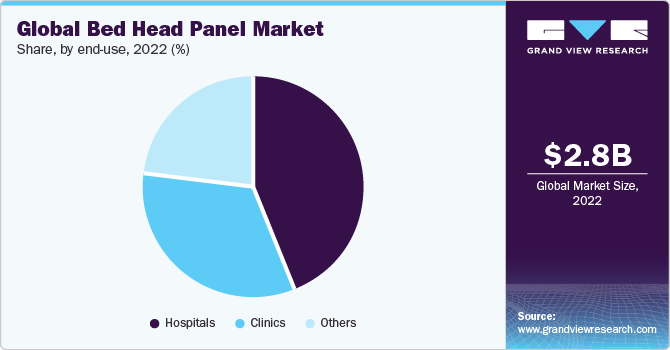

End-use Insights

The hospitals led the market and accounted for more than 40% share in terms of revenue in 2022. The increasing hospitalization rate due to infectious diseases such as COVID-19 and others, the growing number of well-furnished, well-equipped, and advanced infrastructure hospitals, the aging population, and the increasing prevalence of chronic diseases are expected to propel the segment. In addition, as the number of public hospitals that provide cost-effective treatment grows, so will the number of bed head panels installed in hospitals. Another major segment driver is a growing customer preference for adequately equipped hospitals.

For instance, according to NCBI, in 2020, around 13.2 million older adults aged 65 and above are hospitalized yearly in the U.S. They go to the hospital for various reasons, like medical issues, surgeries, injuries, and mental health conditions. The COVID-19 pandemic, which started in 2020, significantly changed how hospitals were used. Some places had more people getting sick from COVID-19 and needing hospital care. Older adults, especially those in nursing homes, are more at risk from COVID-19 because of their age, health vulnerabilities, and living closely with others.

The other segment is anticipated to witness the fastest CAGR of 3.6% over the forecast period. Senior homes, emergency care, and nursing institutions are some of the other end use segments. Emergency care is rapidly gaining popularity in many nations, including the U.S. and Europe. These facilities provide effective patient care while maintaining a safe environment and providing a wide range of services. Similarly, compared to hospitals, emergency care facilities provide various benefits to patients, including faster procedure times and same-day discharge. These services can perform more than half of all outpatient procedures, including brain injuries, strokes, and other conditions. Patients can benefit from significant cost reductions as these facilities are less expensive than hospitals. Other segments have been quickly increasing as a result of these factors.

For instance, according to the survey conducted by National Hospital Ambulatory Medical Care, in 2020, a lot of people went to the emergency department - around 131.3 million times. Many visits were because of injuries. For every 100 people, there were about 40.5 visits. Quite a few visits led to the patient being admitted to the hospital or even to a critical care unit. About half of the visits had patients seen by a doctor in less than 15 minutes. And some visits ended with the patient being admitted to the hospital, while a small number were transferred to another hospital for special care.

Regional Insights

Europe dominates the bed head panel market in terms of revenue, accounting for a share of over 35% in 2022. Europe is one of the most developed regions globally, with advanced technologies and well-established infrastructure. Market growth in this region can be attributed to an increase in the number of road accidents and surgical procedures, the presence of various key players, and the introduction of technologically advanced products. For instance, according to the European Commission, road deaths increased by 3% in the European Union in 2022 compared to the previous year. This rise was partly due to the recovery of traffic levels after the pandemic. It's important to note that many of the improvements made during the COVID-19 period (including a 17% decrease from 2019 to 2020) have not been reversed.

Compared to 2019, the number of deaths in 2022 decreased by 10%. However, the progress has varied significantly among different Member States. Countries like Lithuania and Poland saw the most significant decreases, over 30%, while Denmark also experienced a 23% reduction. On the other hand, countries like Ireland, Spain, France, Italy, the Netherlands, and Sweden have seen stable or increased road deaths over the past three years.

Asia Pacific is expected to be the fastest-growing segment, with a CAGR of 12.9% over the forecast period. Key factors driving the market for bed head panels are the presence of a large patient pool and the growing need for technologically advanced and cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market. Moreover, the increase in the number of clinical trials and high R&D investments by global players to enter untapped markets in the Asia Pacific owing to low-cost services are high-impact-rendering drivers of the market for bed head panels. In addition, an increase in the number of hospitalization and advancements in the clinical development framework of developing economies are a few other factors aiding market growth in the region.

For instance, according to the World Health Organization (WHO), before the COVID-19 pandemic, spending on healthcare per person was going up in many countries in the Asia-Pacific region. In lower-income countries, healthcare spending increased by 65% from 2010 to 2019, while in middle-income countries, it went up by 76% during the same time. Even in wealthier countries, healthcare spending increased by 33%. However, there were still big differences in how much each person spent on healthcare in 2019. For example, in Bangladesh, it was around 105 international dollars, while in Australia, it was 5,294. This means that some countries spend a lot more on healthcare than others. The healthcare sector was growing faster than the economy in this region, which means more of the money made in these countries was being used for healthcare. China had the fastest growth in healthcare spending and its economy compared to other countries in the region.

Key Companies & Market Share Insights

Key players in the market are focusing on adopting growth strategies, such as mergers and acquisitions, developing existing devices, promotional events, and technological advancements. For instance, in December 2021, Hill-Rom was acquired by Baxter International, Inc., a global leader in medical technology. The merger brings together two leading medical technology firms with the similar goal of improving patient care and transforming healthcare globally. The firm intends to expand historical Welch Allyn and Hill-Rom products into new foreign markets, bringing the aggregate portfolio of products and services to more patients and providers worldwide, which is expected to increase bed head panel demand in the near future.

Key Bed Head Panel Companies:

- Precision UK

- Baxter

- NOVAIR MEDICAL

- AmcareMed Medical Gas System

- Amico Group of Companies

- Drägerwerk AG & Co. KGaA

- BioLume, Inc.

- BeaconMedaes

- Silbermann

- INMED PHARMACEUTICALS INC.

Bed Head Panel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.92 billion

Revenue forecast in 2030

USD 3.62 billion

Growth rate

CAGR of 3.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

specialty, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Precision UK; Baxter; NOVAIR MEDICAL; AmcareMed Medical Gas System; Amico Group of Companies; Drägerwerk AG & Co. KGaA; BioLume, Inc.; BeaconMedaes; Silbermann; INMED PHARMACEUTICALS INC.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Bed Head Panel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bed head panel marketbased on specialty, end-use, and region:

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

ICU

-

Surgical

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bed head panel market size was estimated at USD 2.83 billion in 2022 and is expected to reach USD 2.92 billion in 2023.

b. The global bed head panel market is expected to grow at a compound annual growth rate of 3.15% from 2023 to 2030 to reach USD 3.62 billion by 2030.

b. Europe dominated the bed head panel market with the highest share of 37.73% in 2022. This is attributable to the rising prevalence of various disorders, increasing government initiatives for investments in health care, and growing demand for quality health care in this region.

b. Some of the key players operating in the bed head panel market include Precision UK Ltd., Baxter, Novair Medical, Amcaremed Medical, Amico Group of Companies, Drägerwerk AG & Co. KGaA, BIOLUME, BeaconMedaes, Silbermann, and INMED among other players.

b. Key factors driving the bed head panel market growth include an increasing number of patients undergoing surgeries, increasing incidence of chronic medical illnesses, the impact of COVID-19, and growing cases of traumatic injuries due to accidents.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."