- Home

- »

- Alcohol & Tobacco

- »

-

Beer Kegs Market Size, Share, Industry Research Report, 2019-2025GVR Report cover

![Beer Kegs Market Size, Share & Trends Report]()

Beer Kegs Market Size, Share & Trends Analysis Report By Raw Material (Steel, Plastic), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-411-6

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

The global beer kegs market size was valued at USD 45.2 billion in 2018. Shifting consumer preference toward premium beer and flavored varieties is a key factor driving the global market. The rising trend of on-premise sales is also expected to fuel market growth.

The market is driven by increasing consumption of beer among young consumers. An analysis conducted by Gallup, Inc., previously known as the American Institute of Public Opinion, about alcohol consumption habits of Americans showed that close to 70.0% of men between the age of 18 and 29 preferred beer over other alcoholic beverages. This trend has continued over the years and has served as a key factor driving the market.

A rising inclination for flavored alcoholic beverages is a trend that is likely to benefit the market. This, along with growing demand for premium products such as craft and draught variants, is fueled by an evolving consumer lifestyle and increased per capita income. Kegs help in maintaining the authentic quality and flavor of alcoholic beverages over long durations. Draught beer is mostly served through kegs to maintain its pressure, and therefore, the product witnesses greater demand from on-trade sales.

Sustainability is a crucial factor that companies have been focusing on in the overall packaging industry, resulting in the growing usage of recyclable and environment-friendly materials. As a result, steel kegs are preferred over other product variants. Companies have shown tendencies of investing in recycling programs in keeping with changing industry policies and norms to counter environmental problems.

For instance, in January 2018, Mitsubishi Chemical Corporation, KHS GmbH, and Petainer collaborated to develop one-way PET beer kegs for the Japanese market. Similarly, in December 2018, Firstmile.com teamed up with one circle BV and KeyKeg to create a circular program to recycle plastic kegs.

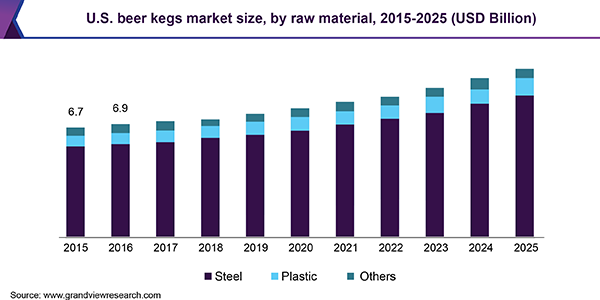

Raw Material Insights

Steel as a raw material held the dominant share of 84.7% in the beer kegs market owing to its largescale production in the industry, higher durability, and favorable recycling properties. Steel kegs are used for transportation and storage as it helps in blocking gases and ultraviolet rays, thereby preserving the quality and flavor of beer with optimal hygienic conditions throughout the supply chain. This trend plays a prominent role for manufacturers of real ale or live beer in England and Eastern Europe.

Plastic kegs are expected to register the highest CAGR of 4.6% from 2019 to 2025. High cost associated with manufacturing and recycling metal kegs has compelled manufacturers to invest in PET plastic kegs. These are supplied as ready-to-fill or preforms that can be blown into a PET container whenever required at the site. They are made available in different sizes of 15, 20, 30, and 40 liters, depending on the requirement. Moreover, plastic kegs are easy to recycle as well as minimizes the transportation cost owing to lower weight compared to metal kegs.

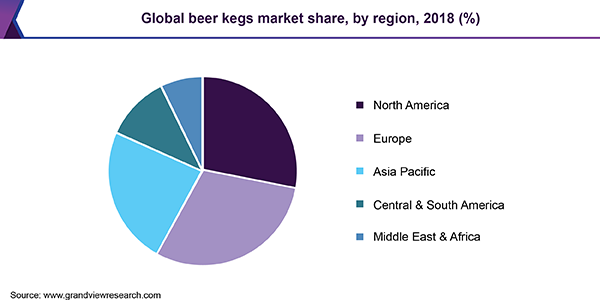

Regional Insights

The global production and consumption volume is increasing at a steady pace. Europe dominated the global market, accounting for a 29.9% share in 2018. Increasing the consumption of beer and cider is the main driving factor in this region. Moreover, the growing popularity of beer and secondary cask fermentation has resulted in the increased promotion of steel barrel kegs of different capacities. Also, growing preference for craft and localized beer produced by micro-breweries has ramped up the demand for kegs. These micro-breweries produce craft beers such as Zaganu, Hophead, Ground Zero, Klausen Burger, and Hop Hooligans, which are quite renowned in Europe and focus on quality and flavor. The market in Eastern Europe and Russia is primarily driven by the significance of draft beer. Moreover, the limited distribution of beer kegs in this region by exclusive partners hints at a lucrative opportunity for distributors.

Asia Pacific is expected to witness the highest CAGR of 5.1% from 2019 to 2025. Increasing consumption of beer in countries such as China and India has greatly contributed to product sales. Shifting cultural trends toward consumption of draft beer is another factor boosting the market growth in these and other developing countries. Moreover, the surge in the establishment of breweries, bars, and pubs has also widened the scope for beer kegs in the market. Another factor driving the market is the rising number of leading companies investing in sustainable packaging solutions and producing environment-friendly kegs. For instance, the unique DLC kegs produced by Petainer are some of the most eco-friendly variants introduced in Japan.

Key Companies & Market Share Insights

The global market is highly competitive. Top players operating in the market include American Keg Company, LLC; NDL Keg Inc.; Shinhan Industrial Co, Ltd; Ningbo BestFriends Beverage Containers Co. Ltd; Blefa GmbH; Schaefer Container Systems; Petainer UK Holdings Ltd; Ardagh Group S.A.; Julius Kleemann GmbH & Co KG; and The Metal Drum Company. Market players are resorting to mergers and acquisitions to increase product offerings and strengthen their position in the industry. Moreover, companies are focusing on expanding their production capacity and adopting innovative technologies owing to meet consumer demand.

Beer Kegs Market Report Scope

Report Attribute

Details

The market size value in 2020

USD 48.41 billion

The revenue forecast in 2025

USD 62.06 billion

Growth Rate

CAGR of 4.6% from 2019 to 2025

The base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; India; Brazil

Key companies profiled

American Keg Company, LLC; NDL Keg Inc.; Shinhan Industrial Co, Ltd; Ningbo BestFriends Beverage Containers Co. Ltd; Blefa GmbH; Schaefer Container Systems; Petainer UK Holdings Ltd; Ardagh Group S.A.; Julius Kleemann GmbH & Co KG; The Metal Drum Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global beer kegs market report based on raw material and region:

-

Raw Material Outlook (Revenue, USD Billion, 2015 - 2025)

-

Steel

-

Plastic

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global beer kegs market size was estimated at USD 46.67 billion in 2019 and is expected to reach USD 48.41 billion in 2020.

b. The global beer kegs market is expected to grow at a compound annual growth rate of 4.6% from 2019 to 2025 to reach USD 62.06 billion by 2025.

b. Europe dominated the beer kegs market with a share of 29.8% in 2019. This is attributed to growing preference for craft and localized beer produced by micro-breweries.

b. Some key players operating in the beer kegs market include American Keg Company, LLC; NDL Keg Inc.; Shinhan Industrial Co, Ltd; Ningbo BestFriends Beverage Containers Co. Ltd; Blefa GmbH; Schaefer Container Systems; Petainer UK Holdings Ltd; Ardagh Group S.A.; Julius Kleemann GmbH & Co KG; and The Metal Drum Company.

b. Key factors that are driving the market growth include shifting consumer preference toward premium beer and flavored varieties and increasing consumption of beer among young consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."