- Home

- »

- Biotechnology

- »

-

Biological Data Visualization Market Size & Share Report, 2030GVR Report cover

![Biological Data Visualization Market Size, Share & Trends Report]()

Biological Data Visualization Market Size, Share & Trends Analysis Report By Technique (Microscopy, Sequencing), By Application (Systems Biology), By Platform, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-504-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

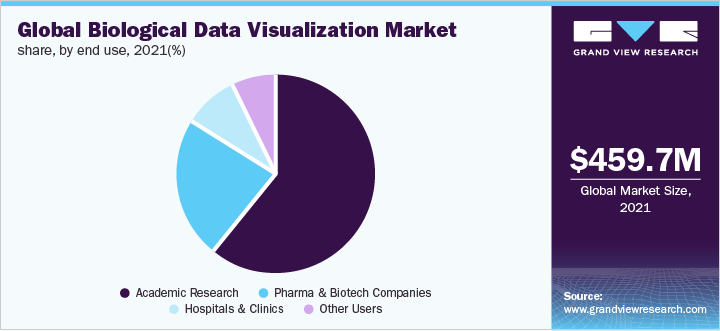

The global biological data visualization market size was valued at USD 459.7 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.0% from 2022 to 2030. The advent of Artificial Intelligence (AI) in the analysis of biological information along with the growing requirement for rapid decision-making through bioinformatics is likely to become a major determinant of growth in the biological data visualization market. For instance, in September 2022, NVIDIA Corporation is developing a framework that enables researchers in the life sciences and healthcare industry to take benefit from rapidly growing datasets of chemical and biological. Similarly, researchers from Harvard and the Broad Institute of MIT collaborated with NVIDIA to design and develop next-generation DNA language models through the framework. These models are expected to combine into a cloud platform developed by Microsoft, Verily, and Broad Institute that will allow researchers in biomedical to access, share and analyze information at any scale. Such initiatives is likely to support the growth of biological data visualization market.

Over the years, biological information generation has grown exponentially. This large volume of biological data is known as big data, which transforms case-based studies into large-scale, data-driven research experiments. For instance, the European Bioinformatics Institute stated in September 2022 that the volume of data management scaled up from 40 petabytes to 250 petabytes in six years. The rapid enhancement is due to development in various areas of biomedical and biological research, such as proteomics, genomics, and transcriptomics.

The COVID-19 pandemic demonstrated the importance of bio-manufacturing and biotechnology in developing and manufacturing vaccines, therapeutics, and diagnostics. The U.S. is one of the countries to identify the need of investing in scientific capabilities. The objective to boost investments in biotechnology and bio-manufacturing is to establish a strong biological information ecosystem, including biologic data visualization. Since, it is anticipated to advance innovation in biomanufacturing and biotechnology, while keeping privacy, security, and responsible conduct of research in check.

Similarly, in September 2022, the U.S. government announced an investment of USD 14 million in developing capabilities for analyzing biological data through AI. An additional USD 20 million is allotted to build a data infrastructure that eases the process of data sharing in cancer research. Hence, funds inflow in the biological data visualization market is anticipated to boost the participation of private players too.

However, the translation of the obtained sequenced data into conclusive biological insights is an important step in information analysis, which can be carried out by the use of efficient data management tools. The decreasing cost of sequencing and an increasing number of sequence reads generated have resulted in the high demand for computational resources & knowledge necessary to handle sequencing information. The requirement for proper and scalable storage to increase data accessibility for research is increasing with the reduction in the costs of sequencing.

Technique Insights

The sequencing segment is projected to have a considerable market share of 36.0% in 2021. Genomic analysis is expected to witness significant growth in the near future, due to the expansion of Next-generation Sequencing (NGS) technologies. The introduction of novel NGS platforms by companies, such as Illumina, Inc. and Thermo Fisher Scientific, Inc, as well as the declining cost of sequencing, facilitates the generation of a large amount of genomic information that requires biological data visualization tools to be analyzed.

Furthermore, the introduction of workflow management systems solutions such as Galaxy and Chipster drive demand for technological advancements in information storage and management. Demand for technologically advanced infrastructure to monitor the flow of data analysis process from information generation to preliminary analysis to higher-level analysis has increased. Constantly undergoing developments in information analysis tools for obtaining effective results is anticipated to drive the market over the forecast period.

The magnetic resonance imaging segment is estimated to have the fastest CAGR in the market. Several MRI-based tools, such as BrainVoyager, have been developed for the extraction, analysis, and visualization of brain models from MRI data. Similarly, software tools, such as Cardiac Image Modeller developed by the University of Auckland, New Zealand, are specific for cardiac image processing and analysis.

Similarly, in September 2022, Qynapse Inc. collaborated with researchers from the University of Miami Miller School of Medicine to study the impact of the SARS-Cov-2 virus on vascular contributions to dementia and cognitive impairment through AI. The subjects’ MRI, neuropsychological, clinical, and biological data is likely to be collected. Hence, the integration of MRI techniques and AI for information analysis is expected to support the growth of the biological data visualization market.

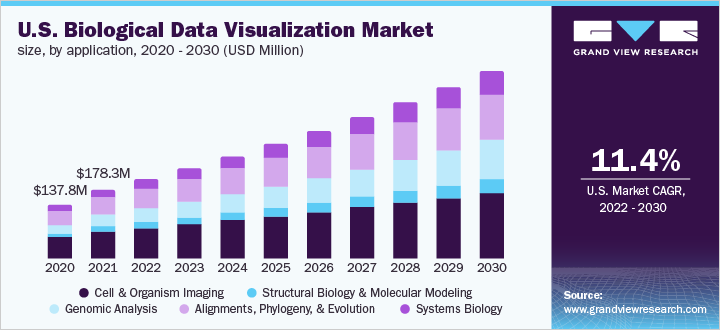

Application Insights

The application of visualization software for the visualization of cell and organism images accounted for a substantial revenue share of 38.8% in 2021. The advanced microscopy technology and workflows rapidly deliver millions of images at cellular and sub-cellular levels. In addition, when the cells are labeled with dyes or antibodies facilitates the detection of proteins even at a single-cell level. With these advancements, cellular phenotypes can be also quantified. The generation of 3D microscopic images further drives segment growth.

Genomic analysis is projected to witness the fastest growth during the forecasted period. The study of genomes has become digital to a larger extent by the emergence of sequencing technology and its ability to determine genomic sequences at nucleotide resolution. The recent innovations in sequencing technology provide a unique capacity for information generation. Improvements in technology are expected to influence market growth in the near future. For instance, in October 2021, a group of researchers developed CoolBox, a toolkit for visual analysis of genomics information. The toolkit is user-friendly and compatible with the Python ecosystem. CoolBox is anticipated to enable researchers to produce visualization plots and assess the information in a flexible way.

Platform Insights

The windows segment accounted for a significant revenue share of 60.1% in 2021. Windows is an extensively used operating system among all other operating systems. Currently, around 90% of computers and laptops possess Microsoft Windows 10 globally. This operating system is widely available globally and has longer life as compared to other platforms. It has the largest software library in the world. The main advantage of using Windows is that it is a highly compatible operating system with all kinds of software used for information visualization.

Although Linux is an open source operating system when compared to MAC OS and Windows. This operating system can be easily used by users, thus increasing its usability. However, as compared to Windows, this operating system possesses a complex version structure. Due to the open-source nature of Linux, numerous Linux-based operating systems, known as distros, are introduced, which impose difficulty in choosing the appropriate version.

End-use Insights

Academic research dominated the market and accounted for the largest revenue share of 60.6% in 2021. Additionally, funds provided by the government for promoting research in academic institutes, which use NGS platforms, further increase the usage of information analysis tools. For instance, in November 2019, the National Institutes of Health (NIH) provided funding of USD 29.5 million to academic centers for a new human genome reference program. The Washington University, the European Bioinformatics Institute, and the University of California received USD 12.5 million to establish a reference center for the human genome.

Furthermore, the pharmaceutical and biotechnological companies segment is projected to be the end-user with the fastest growth rate. The ongoing partnerships among research entities with companies for the development of visualization tools and incorporation of these tools are expected to drive revenue generation considerably. For instance, in January 2022, BGI Americas Corporation announced to collaborate with Gencove to offer comprehensive sequencing solutions to customers. The partnership includes sequencing service by BGI through DNBSEQ sequencing technology with an analysis platform by Gencove. The purpose of this partnership is to offer genomic information to the players in personalized medicines and bio-sustainability.

Regional Insights

North America dominated the biological data visualization market with the highest share of 44.1% in 2021. Its market growth can be attributed to the developed bioinformatics framework, the increase in the adoption of several computational methods, and the widespread application of advanced sequencing technologies. A large number of academic and research organizations are involved in investigating various molecular biology approaches by applying bioinformatics tools, which is expected to propel the use of information visualization tools over the coming years.

The growth of the market in the Asia Pacific is also driven by the development of public and private organizations that focus on bioinformatics, computational technologies, and big data. HKUST Big Data Institute is one such example that provides a strong leadership role in Data Science and Big Data research in Hong Kong as well as across the world by conducting educational programs and research projects in Data Science and Big Data. For instance, in September 2022, HKUST announced to collaborate with the Applied Science and Technology Research Institute (ASTRI) for research and promote the sharing of technology including big data analysis and AI, in the area of pharmaceutical R&D, Fintech, and traditional Chinese medicine (TCM) service systems.

Key Companies & Market Share Insights

Several initiatives are being undertaken by market players to cater to the rising demand for visualizing tools in biomedical applications. Some of the strategic initiatives are product developments, mergers & acquisitions, funding, and mutually beneficial partnerships by key players to boost their business.

For instance, in January 2021, Terra and Verily collaborated with Microsoft to increase the next generation of the company’s platform for life science and health research. The partnership will offer access to Microsoft’s data, cloud, AI technology, and global network of over 168,000 life science and health partners. Some of the prominent players in the global biological data visualization market include:

-

Thermo Fisher Scientific, Inc.

-

3M

-

Tableau Software, LLC,

-

QIAGEN

-

ZEISS International

-

Oxford Instruments

-

Olympus Corporation

-

General Electric Company

-

Agilent Technologies Inc.

-

Clarivate

Biological Data Visualization Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 528.6 million

Revenue forecast in 2030

USD 1.3 billion

Growth rate

CAGR of 12.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, application, platform, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico, Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Thermo Fisher Scientific, Inc.; 3M; Tableau Software, LLC; QIAGEN; ZEISS International; Oxford Instruments; Olympus Corporation; General Electric Company; Agilent Technologies Inc.; Clarivate

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Data Visualization Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global biologic data visualization on the basis of technique, application, platform, end-use, and region:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Microscopy

-

Magnetic resonance imaging

-

Sequencing

-

X-ray Crystallography

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell And Organism Imaging

-

Structural Biology And Molecular Modeling

-

Genomic Analysis

-

Alignments, phylogeny, And Evolution

-

Systems Biology

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Windows

-

Mac OS

-

Linux

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Pharma & Biotech Companies

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global biological data visualization market size was estimated at USD 459.7 million in 2021 and is expected to reach USD 528.6 million in 2022.

b. The global biological data visualization market is expected to grow at a compound annual growth rate of 12.0% from 2022 to 2030 to reach USD 1.3 billion by 2030.

b. North America dominated the biological data visualization market with a share of 44.06% in 2021. This is attributable to the growth of capital-intensive biotechnology sectors, such as personalized medicine, and the development of high-throughput sequencing techniques in this region.

b. Some key players operating in the biological data visualization market include Thermo Fisher Scientific Inc.; QIAGEN; Becton-Dickinson and Company; Agilent Technologies, Inc.; 3M; Carl Zeiss AG; Oxford Instruments; Olympus Corporation; GE Healthcare; Clarivate Analytics; arivis AG; Scientific Volume Imaging B.V.; Media Cybernetics, Inc.; Molecular Devices, LLC; and Danaher.

b. Key factors that are driving the market growth include the rapid growth of biological data, the incorporation of artificial intelligence in the analysis of biological data, and the growing demand for faster decision-making.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."